In-Flight Entertainment and Connectivity (IFEC) Market

Global In-Flight Entertainment and Connectivity (IFEC) Market Size, Share & Trends Analysis Report by Type (In-Flight Entertainment and In-Flight Connectivity), by Class (Economy Class, Business Class, and First Class) and Forecasts, 2019 – 2025 Update Available - Forecast 2025-2031

IFEC is the entertainment provided during the flight to the passengers onboard. Passenger’s surging demand for continuous entertainment and connectivity while in the air is boosting the growth of the global IFEC market. Moreover, continuous access to business applications, internet, and calling facilities required by passengers traveling in business class, further drive the demand for IFEC across a range of aircraft; thereby expanding the market size. The global IFEC market is still in its infancy; however, is expected to boom in the near future. Various services offered by airlines across the globe are differentiated on the basis of categories of in-flight entertainment into wireless in-flight entertainment, embedded in-flight entertainment, and immersive in-flight entertainment. Furthermore, in recent times, significant inclination towards the usage of personal electronic devices (such as smartphones, tablets, laptops) on board along with the emergence of bringing your own device (BYOD) trend has boosted the demand for content streaming services. Thereby, leading to the market growth of IFEC across the globe.

Segmental Outlook

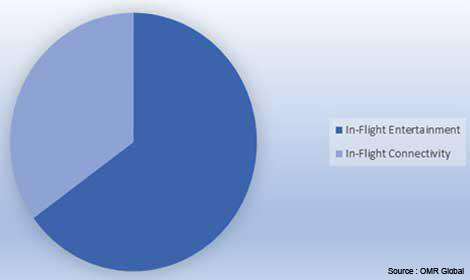

The global IFEC market is segmented on the basis of type, class, and region. On the basis of type, the market is divided into in-flight entertainment and in-flight connectivity. In-flight entertainment segment is expected to dominate the market in 2018 and is expected to continue this trend over the forecast period. The growth of the segment is attributed to the surge in demand for continuous entertainment, such as video streaming, by the passengers onboard. Whereas, on the basis of class, the market is segmented into economy class, business class, and first-class.

Global IFEC Market Share by Type, 2018 (%)

Video and TV Watching is the Most Preferred Activities on Long Haul Flights

In the recent past, In-flight entertainment has been primarily dominated by the consumption of media content. Airlines enable passengers to watch movies and series stored in the plane which are being provided through the individualized In-flight entertainment system. According to a study carried by International Air Transport Association (IATA) in 2015, watching movies or TV is the top activity during long haul flights shared by nearly 74% of passengers and the second most frequent activity during short-haul flight.

Wide Adoption of Personal Devices is Changing Onboard Media Consumption

There has been an increasing penetration of personal devices such as smartphones that have changed the mode of media consumption. As per IATA in 2017, 51% of passengers prefer using their own devices onboard for accessing access entertainment options for media and other content consumption. Onboard entertainment systems are slow and unfriendly if it is used for something else than video streaming. Whereas, mobile devices are much more intuitive and powerful and are more adapted to each passenger habits. This phenomenon could be a game-changer for airlines companies that need to adapt their entertainment offering. It also means that there will not be any requirement for individual seat screens in the near future, which in turn will reduce the weight of the flight and hence will save fuel. It serves as an opportunity for airline companies by proving more customized entertainment experience. Some of the companies have already adopted this solution. For instance, in January 2017, American Airlines announced that the 100 Boeing 735 Max recently ordered, would not feature seat-back video screens.

Different Levels of Connectivity and Offerings

The connectivity offerings available in the market differ in terms of scope. Several service components can be proposed that include simple broadband access, content and services portal access from passenger’s own device, and ability to pass phone calls or sending text messages. The airlines do not provide these services directly and are provided by in-flight entertainment service providers such as Panasonic Avionics Corp. These providers then buy satellite capacity to satellite operators. Some of the types of inflight services often available include -

Access to content and services portal from a passenger's own device such as smartphones and tablets via Wi-Fi. These services are usually provided free of cost. The services are generally hosted onboard the aircraft. In addition, it sometimes includes live TV channels access.

The ability to use cellular service, mainly SMS, at international roaming rates, using a mobile phone of the passenger and SIM card of the operator.

Full internet access as a part of the plan. The price is based on the flight duration and passenger’s class; for instance, some companies may provide the service free to business class, while, as a paid service for economy class.

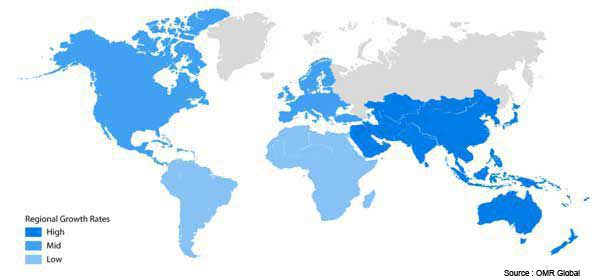

Regional Outlook

Geographically, the global IFEC market is analyzed into North America, Europe, Asia-Pacific, and Rest of the World. North America and Europe are expected to contribute majorly in the global IFEC market in 2018 due to the well-established airline industry and dense flight networks spread across the regions. Furthermore, most of the major airlines are located in these regions which are adopting advanced pioneer technologies to offer onboard entertainment and connectivity to their passengers.

Global IFEC Market Growth, 2019-2025

Asia-Pacific to Grow at a Much Faster Rate Over the Forecast Period

Asia-Pacific is expected to register the fastest growth in the IFEC market during the forecast period. The region comprises of industrial-based economies such as China, South Korea, India, and Japan which reflects a profitable market for the aviation industry. This is demonstrating substantial potential for the region to emerge as a promising market for personal electronic devices. Furthermore, the emergence of new players in the airline industry of the region has made it important for operators to upgrade their IFEC solutions and stay competitive in the industry.

Market Players Outlook

Growing Competition Between Airlines Favor Wider Adoption

Though the major proportion of the passenger desire to have onboard entertainment and connectivity, higher cost related to the services hampers the adoption of such services. Moreover, cutting down the cost associated with the connectivity and entertainment option will lead to increased competition between airlines. In the recent scenario, the majority of the airlines provide Wi-Fi service as a premium, while a rare amount of them offers such services at free of cost. The global IFEC market is influenced by the presence of a number of market players that are offering in-flight entertainment and in-flight connectivity solutions to various airlines. Some of the major market players include AirFi.aero, BAE Systems PLC, Honeywell International Inc., Panasonic Avionics Corp., Thales Group, Inmarsat PLC, and Cobham PLC, among others. According to Inmarsat PLC, the number of connected aircraft is expected to grow to 15,000 in 2020 from 6,000 in 2016.

Recent Developments

- In June 2019, AirFi has announced three deals with airlines in Asia-Pacific to supply wireless in-flight entertainment services. Vietnam-based Bamboo Airways will deploy AirFi’s IFE solution onboard its fleet of eight Airbus A319s and A320s. This enabled the company to expand its global footprint and strengthen its customer base in Asia-Pacific.

- In October 2016, Thales Group developed new security and encoding technologies for its 4K in-flight entertainment systems that will be launched on the Boeing 777X fleet in 2020. Through this, the Emirates passengers will be able to stream premium ultra-high definition (UHD) content from Hollywood Studios.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global IFEC market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BAE Systems PLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. Swot Analysis

3.3.1.4. Recent Developments

3.3.2. Cobham PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. Swot Analysis

3.3.2.4. Recent Developments

3.3.3. Panasonic Avionics Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. Swot Analysis

3.3.3.4. Recent Developments

3.3.4. Thales SA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. Swot Analysis

3.3.4.4. Recent Developments

3.3.5. Honeywell International Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. Swot Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global IFEC Market by Type

5.1.1. In-Flight Entertainment

5.1.2. In-Flight Connectivity

5.2. Global IFEC Market by Class

5.2.1. Economy Class

5.2.2. Business Class

5.2.3. First Class

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AeroMobile Communications Ltd.

7.2. AirFi.aero

7.3. Astronics Corp.

7.4. BAE Systems PLC

7.5. Burrana Inc.

7.6. Cobham PLC

7.7. Deutsche Telekom AG

7.8. Eutelsat SA

7.9. Gilat Satellite Networks Ltd.

7.10. Global Eagle Entertainment, Inc.

7.11. Gogo Business Aviation Services LLC

7.12. Honeywell International Inc.

7.13. Inmarsat PLC

7.14. Iridium Communications Inc.

7.15. Lufthansa Systems GmbH & Co. KG

7.16. Panasonic Avionics Corp.

7.17. Safran Group

7.18. SITA Group

7.19. SmartSky Networks, LLC

7.20. Thales Group

7.21. ViaSat, Inc.

1. GLOBAL IFEC MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL IN-FLIGHT ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL IN-FLIGHT CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL IFEC MARKET RESEARCH AND ANALYSIS BY CLASS, 2018-2025 ($ MILLION)

5. GLOBAL IFEC FOR ECONOMY CLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL IFEC FOR BUSINESS CLASS AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL IFEC FOR FIRST CLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL IFEC MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN IFEC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN IFEC MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

11. NORTH AMERICAN IFEC MARKET RESEARCH AND ANALYSIS BY CLASS, 2018-2025 ($ MILLION)

12. EUROPEAN IFEC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. EUROPEAN IFEC MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

14. EUROPEAN IFEC MARKET RESEARCH AND ANALYSIS BY CLASS, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC IFEC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC IFEC MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC IFEC MARKET RESEARCH AND ANALYSIS BY CLASS, 2018-2025 ($ MILLION)

18. REST OF THE WORLD IFEC MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. REST OF THE WORLD IFEC MARKET RESEARCH AND ANALYSIS BY CLASS, 2018-2025 ($ MILLION)

1. GLOBAL IFEC MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL IFEC MARKET SHARE BY CLASS, 2018 VS 2025 (%)

3. GLOBAL IFEC MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US IFEC MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA IFEC MARKET SIZE, 2018-2025 ($ MILLION)

6. UK IFEC MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE IFEC MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY IFEC MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY IFEC MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN IFEC MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE IFEC MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA IFEC MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN IFEC MARKET SIZE, 2018-2025 ($ MILLION)

14. INDIA IFEC MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC IFEC MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD IFEC MARKET SIZE, 2018-2025 ($ MILLION)