In-Vehicle Ethernet System Market

Global In-Vehicle Ethernet System Market Size, Share & Trends Analysis Report by Vehicle Type (Passenger Cars, Commercial Vehicles, and Farming & Off-Highway Vehicles) by Applications (Advanced Driver Assistance Systems (ADAS), Infotainment, On-Board Diagnostic, and Others) Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global in-vehicle ethernet system is projected to grow at a significant CAGR during the forecast period. In-vehicle ethernet is used to connect components within a car using a wired network. It is designed to meet the needs of the automotive industry, including meeting electrical requirements (EMI/RFI emissions and susceptibility), bandwidth requirements, latency requirements, synchronization, and network management requirements. The primary factors that drive the growth of the global in-vehicle ethernet system market include the acceptance of technological innovations in vehicles. The manufacturers have also enhanced the attractiveness as well as features of the vehicles by adding automotive ethernet to provide control systems, entertainment components, navigation systems, smartphone connections, driver safety systems, and Internet access facilities.

Segmental Outlook

The global in-vehicle ethernet system market is segmented on the basis of vehicle type and applications. Based on the vehicle type, the market is segmented as passenger cars, commercial vehicles, and farming & off-highway vehicles. Whereas, based on the applications, the market is segmented as advanced driver assistance systems (ADAS), infotainment, on-board diagnostic, and others. Ethernet is widely used by the automotive industry as the preferred interface for On-Board-Diagnostics (OBD) in the next generation of cars. Moreover, with the introduction of power over Ethernet (PoE), the PoE tends to surge the demand for automotive Ethernet over the forecast period.

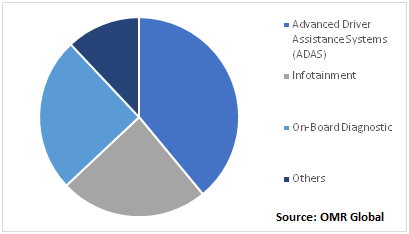

Global In-Vehicle Ethernet System Market by Application, 2018 (%)

Advanced Driver Assistance Systems (ADAS) to Hold the Significant Share

Amongst the applications of the global in-vehicle ethernet market, advanced driver assistance systems (ADAS) are expected to hold the most significant share in the market. The segmental growth is attributed to the continuous rise in the level of vehicle automation, as well as technological advancement, which in turn, has created the demand for self-driving cars over the last few years. ADAS technologies such as night vision, roadside recognition, and drowsiness monitoring system, have also accelerated the adoption of ADAS which in turn enhances the segmental growth of the market during the forecast period.

Regional Outlook

The global in-vehicle ethernet system market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The European region is expected to hold a significant share in the global market during the forecast period. This is attributed to the presence of the key automotive manufacturers in the region. Further, the strict laws and regulations regarding the safety of the passenger as well as the driver are also projected to provide growth opportunities to the market. In addition, due to the growing disposable income resulting in improved and enhanced purchasing power of the middle-class group, the Asia-Pacific region is projected to register a significant growth rate in the market during the forecast period.

Global In-Vehicle Ethernet System Market, by Region 2018 (%)

Image

Asia-Pacific is projected to grow at a significant rate during the forecast period. The major economies contributing to the regional growth of the market include China, Japan, and India. The economy of China is growing significantly, and the disposable income of middle-class consumers is also increasing. This reflects positively on the increasing demand for vehicles.

Market Players Outlook

Some of the prominent players operating in the global in-vehicle ethernet system market include Robert Bosch GmbH, Toshiba America Electronic Components, Inc., NXP Semiconductors NV, Broadcom Inc., Continental AG, Microchip Technology Inc., Renesas Electronics Corp., Vector Informatik GmbH,and others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global in-vehicle ethernet system market.

For instance, in January 2018, NXP Semiconductors N.V., supplier of automotive semiconductor solutions, has announced the expansion of Ethernet product portfolio with TJA1102 PHY transceiver and SJA1105x Ethernet switch. Together, these products will help automakers deliver high-speed Ethernet networks with the small electronic footprints required for highly connected and increasingly autonomous vehicles.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global in-vehicle ethernet system market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Robert Bosch GmbH

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. NXP Semiconductors NV

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Broadcom Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Continental AG

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global In-Vehicle Ethernet System Market by Vehicle Type

5.1.1. Passenger Cars

5.1.2. Commercial Vehicles

5.1.3. Farming & Off-Highway Vehicles

5.2. Global In-Vehicle Ethernet System Market by Applications

5.2.1. Advanced Driver Assistance Systems (ADAS)

5.2.2. Infotainment

5.2.3. On-Board Diagnostic

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ACTIA Group

7.2. B&R Industrial Automation GmbH

7.3. Broadcom Inc.

7.4. Cadence Design Systems Inc.

7.5. Continental AG

7.6. DASAN Network, Inc.

7.7. Harman International Industries, Corp.

7.8. Keysight Technologies, Inc.

7.9. Marvell Semiconductor, Inc.

7.10. Mentor Graphics, a Siemens AG company

7.11. Microchip Technology Inc.

7.12. Molex, LLC

7.13. NXP Semiconductors NV

7.14. Renesas Electronics Corp.

7.15. Robert Bosch GmbH

7.16. Ruetz System Solutions GmbH

7.17. System-on-Chip Engineering S.L.

7.18. Toshiba America Electronic Components, Inc.

7.19. Vector Informatik GmbH

7.20. Visteon Corp.

1. GLOBAL IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

2. GLOBAL IN-VEHICLE ETHERNET SYSTEM IN PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL -VEHICLE ETHERNET SYSTEM IN COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL-VEHICLE ETHERNET SYSTEM INFARMING & OFF-HIGHWAY VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

6. GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL INFOTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL ON-BOARD DIAGNOSTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. EUROPEAN IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. REST OF THE WORLD IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD IN-VEHICLE ETHERNET SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL IN-VEHICLE ETHERNET SYSTEM MARKET SHARE BY VEHICLE TYPE, 2018 VS 2025 (%)

2. GLOBAL IN-VEHICLE ETHERNET SYSTEM MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL IN-VEHICLE ETHERNET SYSTEM MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

6. UK IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD IN-VEHICLE ETHERNET SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)