In-Vehicle Networking Market

Global In-Vehicle Networking Market Size, Share & Trends Analysis Report by Connectivity Standard (Ethernet, Controller Area Network (CAN), FlexRay, Local Interconnect Network (LIN), and Others) and by Vehicle Type (Passenger Cars and Commercial Vehicles) and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global in-vehicle networking market is growing at a significant CAGR of around 6.6% during the forecast period (2020-2026). The market is driven by the rising disposable income, growing demand for advanced safety and comfort, and increase in the use of electronics in vehicles since few years. In addition, the growing demand for autonomous cars and connected cars, and hybrid and electric vehicles is further offering growth to the in-vehicle networking market across the globe. For instance, the government of some of the developed and emerging economies are taking steps towards reducing the CO2 emission in vehicles. For instance, Norway is planning to phase out conventional cars by 2025, followed by France and UK in 2040 and 2050 respectively. Moreover, in October 2017, Germany’s Bundesrat passed a resolution to ban IC engine-based vehicles by 2030. Such initiatives spur the demand for in-vehicle networking in hybrid and electric vehicles. However, the high cost of in-vehicle networking systems and fluctuation in oil prices will affect the market growth during the forecast period.

Segmental Outlook

The in-vehicle networking market is classified on the basis of connectivity standard and vehicle type. Based on connectivity standard, the market is segmented into ethernet, controller area network (CAN), FlexRay, local interconnect network (LIN), and others. Based on vehicle type, the market is bifurcated into passenger cars and commercial vehicles.

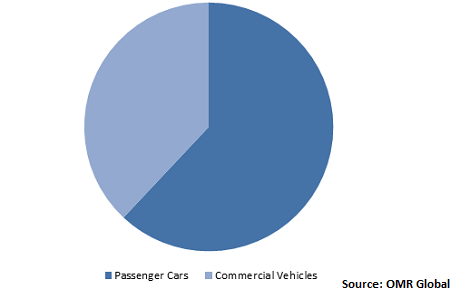

Global In-Vehicle Networking Market Share by Vehicle Type, 2019 (%)

Global in-vehicle networking market is driven by passenger cars

The passenger cars contribute a significant share in the global in-vehicle networking market. The passenger car segment comprises hatchback, SUV, sedan, sports car, van, and so others depending on their design and purpose. Some of the major global automotive manufacturers include Toyota, Volkswagen, Daimler, BMW, Honda, General Motors, Hyundai, Tata, Suzuki, Tesla, Ford, Nissan, Fiat Chrysler and so on. As per the International Organization of Motor Vehicle Manufacturers, in 2018 more than 70% of the vehicles sold (except two-wheelers) were passenger cars and less than 30% were commercial vehicles. The rise in the disposable income of the buyer, a wide available price range with a wide variety of models is some of the other major factors for the growth of the market. In addition, the market players are continuously employing smart technologies such as AI and IoT in the luxury cars, which in turn, drives the market for in-vehicle networking in passenger cars segment.

Regional Outlook

The global in-vehicle networking market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global in-vehicle networking market. The US plays the critical role in geographic contribution of North America in global in-vehicle networking market. High expenditure on vehicle electronics is a chief factor for the growth of the market in the region. The presence of major market players including Texas Instruments, Inc., and so on are also leveraging the introduction of new products in the region. Along with these electronics companies, the region has some of the technologically advanced automobile companies, such as Tesla Inc., which are significantly working in the connected cars market. These factors are expected to act potentially and will offer growth to the in-vehicle networking market during the forecast period.

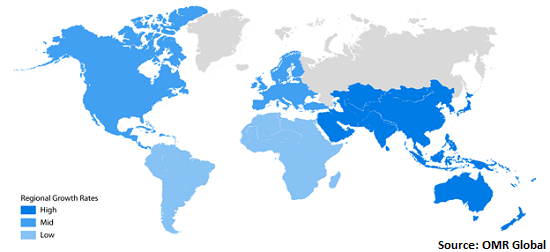

Global In-Vehicle Networking Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global in-vehicle networking market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. The region is considered as a hub for automotive production and sales, especially China. China is the largest consumer of the automobile with a share of around 30% globally in 2018. The Chinese Central Government expects that China automotive output will touch 30 million units by 2020 and 35 million units by 2025. In addition, the presence of a large customer base coupled with the favorable government incentives and subsidies to promote the adoption of EV are some factors that are motivating the market growth. Economies such as China, India, Japan, and South Korea are fueling the industry growth of the regional market. Additionally, initiatives such as EV30@30 are also driving the rapid adoption of EVs across the major economies of Asia-Pacific.

Market Players Outlook

The key players in the in-vehicle networking market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global in-vehicle networking market include NXP Semiconductors N.V., Infineon Technologies AG, Texas Instruments Inc., Renesas Electronics Corp., Microchip Technology Inc., and Marvell Semiconductor, Inc. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market. For instance, in February 2020, Marvell Semiconductor, Inc. launched second generation 88Q1110/88Q1111 100BASE-T1 automotive Ethernet PHY with the lowest power consumption in the industry. This Ethernet PHY works as a platform for the secure connection between the multiple endpoints which are required to transfer all the data in connected cars.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global in-vehicle networking market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. NXP Semiconductors N.V.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Infineon Technologies AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Texas Instruments Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Renesas Electronics Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Microchip Technology Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global In-Vehicle Networking Market by Connectivity Standard

5.1.1. Ethernet

5.1.2. Controller Area Network (CAN)

5.1.3. FlexRay

5.1.4. Local Interconnect Network (LIN)

5.1.5. Others (MOST and Radio Frequency (RF))

5.2. Global In-Vehicle Networking Market by Vehicle Type

5.2.1. Passenger Cars

5.2.2. Commercial Vehicles

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Cisco Systems Inc.

7.2. Continental AG

7.3. ElectRay Technologies Pvt. Ltd.

7.4. Elmos Semiconductor AG

7.5. Embitel Technologies India Pvt. Ltd.

7.6. Harman International Industries, Inc.

7.7. Infineon Technologies AG

7.8. Marvell Semiconductor, Inc.

7.9. Melexis NV

7.10. Microchip Technology Inc.

7.11. NXP Semiconductors N.V.

7.12. ON Semiconductor Corp.

7.13. Renesas Electronics Corp.

7.14. Sierra Wireless, Inc.

7.15. Spirent Communications PLC

7.16. STMicroelectronics International N.V.

7.17. Texas Instruments Inc.

7.18. Toshiba Corp.

7.19. Visteon Corp.

7.20. Xilinx, Inc.

1. GLOBAL IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY STANDARD, 2019-2026 ($ MILLION)

2. GLOBAL ETHERNETS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CONTROLLER AREA NETWORK (CAN) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL FLEXRAY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL LOCAL INTERCONNECT NETWORK (LIN) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER STANDARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

8. GLOBAL IN-VEHICLE NETWORKING FOR PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL IN-VEHICLE NETWORKING FOR COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY STANDARD, 2019-2026 ($ MILLION)

13. NORTH AMERICAN IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

14. EUROPEAN IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY STANDARD, 2019-2026 ($ MILLION)

16. EUROPEAN IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY STANDARD, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY STANDARD, 2019-2026 ($ MILLION)

21. REST OF THE WORLD IN-VEHICLE NETWORKING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

1. GLOBAL IN-VEHICLE NETWORKING MARKET SHARE BY CONNECTIVITY STANDARD, 2019 VS 2026 (%)

2. GLOBAL IN-VEHICLE NETWORKING MARKET SHARE BY VEHICLE TYPE, 2019 VS 2026 (%)

3. GLOBAL IN-VEHICLE NETWORKING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

6. UK IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD IN-VEHICLE NETWORKING MARKET SIZE, 2019-2026 ($ MILLION)