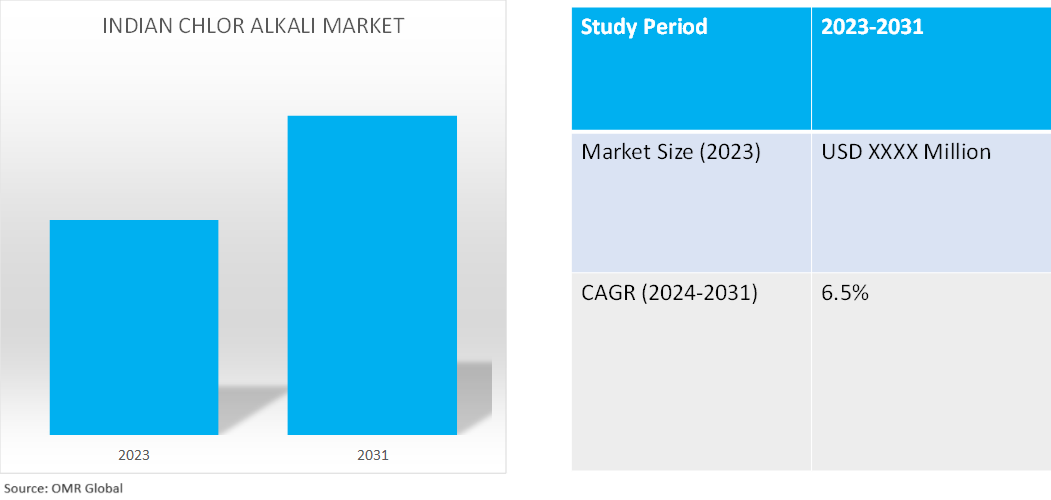

Indian Chlor Alkali Market

Indian Chlor Alkali Market Size, Share & Trends Analysis Report by Product (Caustic Soda, Chlorine and Soda Ash), and by End-Users (Glass, Chemical, Pulp & Paper, Textile, and Others) Forecast Period (2024-2031)

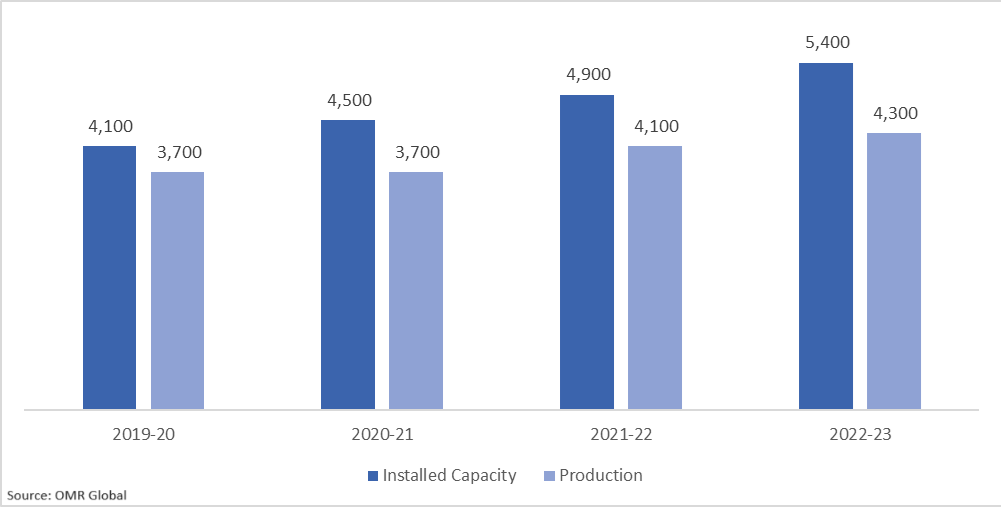

Indian chlor alkali market is anticipated to grow at a significant CAGR of 13.7% during the forecast period (2024-2031). The Indian chlor alkali market growth is attributed to the growing demand for products containing chlor alkali across several industries such as pulp & paper, textiles, soaps and detergents, petroleum products, aluminum metal, chemical processes, and bleach manufacturing driving the growth of the market. According to the Alkali Manufacturers Association of India, caustic soda installed capacity as of 31st March 2023 was 55.65 Lakh MTPA, and the production during the year 2022-23 was 44.73 Lakh metric tons (MT). Capacity utilization was 80.0% during 2022-23.

Market Dynamics

Increasing Adoption of Greener Production Technologies

Membrane cell technology subjugates the technology used in the manufacturing of chlor alkali. The mercury cell process is still used in a lot of production plants, nevertheless. Owing to the extreme toxicity of mercury, policymakers have been forced to impose strict environmental laws on procedures involving the element. Consequently, producers are shifting from mercury cell technologies to more environmentally friendly ones like membrane cells. Owing to growing environmental concerns, several Indian plants have recently changed their technologies.

Growing Expansion of the Water Treatment Industry

The demand for chlor alkali products is increasing as a result of the water treatment industry's significant expansion. This is mainly because the production of sodium hypochlorite in water treatment facilities depends on chlor alkali, an essential component. This disinfectant is commonly used to treat wastewater and drinking water. Considering its well-known and dependable disinfecting abilities, sodium hypochlorite is a necessary component for ensuring the security and quality of water. In addition, rising industrialization and population growth have raised water pollution levels, which is driving up demand for water treatment products. Moreover, a variety of goods, including paper, textiles, detergents, and plastics, are made using chlor alkali. Thus, the growing market for chlor alkali will also be aided by the rising demand for these goods.

Market Segmentation

- Based on the product, the market is segmented into caustic soda, chlorine, and soda ash.

- Based on the end-users, the market is segmented into glass, chemicals, pulp & paper, textiles, and others.

Caustic Soda is Projected to Hold the Largest Segment

The primary factors supporting the growth include caustic soda use is expected to rise in tandem with the growing use of aluminum in the automotive sector. As a result of the organic chemistry industry's widespread use of caustic soda. In the textile sector, textile is the second-fastest-growing category utilized for mercerization, dyeing, and scouring. One of the earliest industrial applications of caustic soda was in the soap and detergent industry. The use of caustic in detergent and soap applications has been hindered by the robust availability of substitutes. Roughly, half of the Indian demand for caustic soda came from pulp and paper, inorganics, water treatment, and other industries.

Caustic Soda Installed Capacity and Production 2019-2023

Source: Alkali Manufacturers Association of India

Glass Segment to Hold a Considerable Market Share

The factors supporting the market growth include the growing demand for glass in the building and automotive industries are expanding, for soda ash used in glass applications. A necessary ingredient in the production of glass is soda ash. Melting calcium compounds, metallic oxides, coloring additives, and silica soda ash make Glass, which makes up around 15.0% of the glass's overall weight. There are many kinds of glass available, including vacuum flasks, laboratory glassware, fiberglass, hollow wares and containers made of glass, safety glass, figured and wired glass, float glass, and sheet glass. Glass goods have extensive usage in several industries, including construction, automotive, packaging, domestic, and laboratory settings.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the chlor alkali market include Aditya Birla Chemicals (India) Ltd., Chemfab Alkalis Ltd., DCM Shriram Ltd., Gujarat Alkalies and Chemicals Ltd. (GACL), and Tata Chemicals Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In February 2023, Gujarat Alkalies and Chemicals Ltd. in line with its growth plans, expanded the caustic soda lye plant from 785 Maximum Tolerable Period of Disruption (MTPD) to 1310 MTPD of its Dahej Complex. As a part of the caustic soda expansion, a new 700 MTPD Caustic Evaporation Unit (CEU) was also commissioned to cater to the requirement of caustic soda lye production (48.0% w/w).

- In April 2022, Grasim Industries Ltd. commissioned its Chlor-Alkali manufacturing facility in Andhra Pradesh at Balabhadrapuram village in Biccavolu Mandal of East Godavari district. The company had invested ?2,700 crore in the caustic soda unit and agreed to employ 75.0% locals. Grasim Industries would provide direct employment to 1,300 and indirectly employ 1,150 people.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the chlor alkali market. Based on the availability of data, information related to new organic and inorganic chemicals, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Olin Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. The Dow Chemical Company

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Aditya Birla Chemicals Company

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. TATA Chemicals Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Tosoh Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Indian Chlor Alkali Market by Product

5.1.1. Chlorine

5.1.2. Caustic Soda

5.1.3. Soda Ash

5.2. Indian Chlor Alkali Market by Application

5.2.1. Paper & Pulp

5.2.2. Water Treatment

5.2.3. Organic Chemicals

5.2.4. Inorganic Chemicals

5.2.5. Alumina

5.2.6. Textiles

5.2.7. Others

6. Company Profiles

6.1. AkzoNoble

6.2. Axiall Corp.

6.3. Formosa Plastic Corp.

6.4. Nirma Ltd.

6.5. Occidental petroleum Corp. (OXY)

6.6. Olin Corp.

6.7. Tosoh Corp.

6.8. Ineos Corp.

6.9. The Dow Chemicals Company

6.10. Aditya Birla Chemical Company

6.11. DCM Shriram Ltd.

6.12. Lords Chloro Alkali Ltd.

6.13. TATA Chemicals Ltd.

6.14. Gujarat Alkali

6.15. DCW Ltd.

1. INDIAN CHLOR ALKALI MARKET RESEARCH AND ANALYSIS BY PRODUCT 2018-2025 ($ MILLION)

2. CHLORINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. CAUSTIC SODA MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. SODA ASH MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. INDIAN CHLOR ALKALI MARKET RESEARCH AND ANALYSIS BY APPLICATION 2018-2025 ($ MILLION)

6. PAPER & PULP MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. ORGANIC CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. INORGANIC CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. ALUMINA MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. TEXTILE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

1. INDIAN CHLOR ALKALI MARKET SHARE BYPRODUCT, 2018 VS 2025 (%)

2. INDIAN CHLOR ALKALI MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. INDIAN CHLOR ALKALI MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. INDIA CONTENT DELIVERY NETWORK MARKET SIZE, 2018-2025 ($ MILLION)