Indian Infertility Diagnosis and Therapeutics Market

Indian Infertility Diagnosis and Therapeutics Market Size, Share & Trends Analysis Report, By Diagnosis (Male Infertility {Semen Analysis, Genetic Testing, Testicular Biopsy, Hormonal Tests and Others} Female Infertility {Ovulation Testing, Hysterosalpingography, Imaging Tests, Ovarian Reserve Testing, Hormone Testing and Others), By Treatment and Forecast, 2019-2025 Update Available - Forecast 2025-2035

Indian infertility diagnosis and therapeutics market has witnessed CAGR of 5.8% owing to a significant prevalence of infertility and the government financial incentives for treatment of infertility. For instance, according to the World Health Organization (WHO) estimate, the overall prevalence of primary infertility in India ranges between 3.9% to 16.8%. The prevalence of infertility varies from state to state such as 3.7% in Uttar Pradesh, Himachal Pradesh and Maharashtra, to 5% in Andhra Pradesh, and 15% in Kashmir. Moreover, prevalence varies in the same region across tribes and caste.

The major causes of infertility in the country include unhealthy lifestyle factors and significant adoption of contraception methods. Due to the growing concern of infertility, the government has made necessary provisions in insurance coverage. For instance, in August 2018, the Insurance Regulatory and Development Authority of India (IRDAI) asked for the removal of procedures, such as infertility, stem cell, dental, and psychiatric treatment from the list of ’optional cover’ for health insurance. This may enable to increase the reach of infertility treatment among Indian people. As a result, such government initiatives may encourage the demand for infertility diagnostic tests and treatment alternatives in India, which in turn, would provide significant growth opportunity for the market.

Furthermore, the high cost of in-vitro fertilization (IVF) treatment and social stigma associated with infertility treatment is restricting the growth of the market in India. For instance, the cost of IVF treatment ranges from $2,100 to $2,800 per cycle of treatment. The major cause of the high cost of IVF treatment in the country includes the significant cost of maintaining a high-quality embryo lab and the consumables used for IVF. Therefore, some patients refrain to opt for infertility treatment in the country.

Segment Outlook

Indian infertility diagnosis and therapeutics market are segmented on the basis of diagnosis and treatment. Based on the diagnosis, the market is classified on the basis of male and female infertility. Male infertility is further classified into semen analysis, genetic testing, testicular biopsy, hormonal tests and others. Female infertility is further classified into ovulation testing, hysterosalpingography, imaging tests, ovarian reserve testing, hormone testing and others. Based on treatment, the market is further classified into male and female infertility. The male infertility treatment is further sub-segmented into drugs, ART therapy and surgery. The female infertility treatment is further sub-segmented into drugs, ART therapy, surgery and intrauterine insemination (IUI).

Indian Infertility Diagnosis and Therapeutics Market: By Treatment

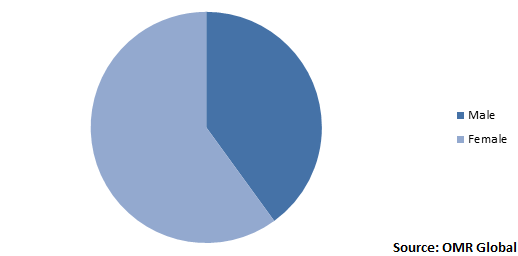

Female infertility treatment is anticipated to hold the largest share in the country owing to the rising use of contraception methods among women and significant prevalence of PCOS (polycystic ovary syndrome) in India. For instance, as data published by National Health Portal of India in February 2016, in South India and Maharashtra, the prevalence of PCOS was reported to be 9.13% and 22.5%, respectively. Women with PCOS may struggle to become pregnant and at considerable risk of developing complications during pregnancy. This, in turn, may contribute to the higher infertility rates among women and thereby driving the demand for female infertility diagnosis and treatment in the country.

The assisted reproductive technique (ART) is the most commonly used method of reproductive assistance in females, which involves retrieval of female mature eggs from and fertilize them with the male sperm in a dish in a lab. Later, the process involves transferring the embryo into the uterus through the cervix. IVF is the most commonly used ART technology as it increases the chances of pregnancy. The demand for IVF procedures is anticipated to rise significantly owing to the introduction of financial coverage for infertility treatment in India.

Indian Infertility Diagnosis and Therapeutics Market Share by Treatment, 2018 (%)

Competitive Landscape

Some crucial players in the market include Merck KGaA, Abbott Laboratories, Inc., Cipla Ltd., Torrent Pharmaceuticals Ltd. and Medical Electronic Systems. These companies are working to increase the accessibility of their fertility technologies in India. For instance, in February 2019, Merck introduced two devices, namely Geri and Gavi, as well as Gems, a complete culture medium suite in India. These devices will be made available in collaboration with Genea Biomedx, to IVF clinics and hospitals. This new technology offers an environment that allows reducing external stresses on the embryos of patients undergoing infertility treatment. With the rising number of IVF clinics and hospitals in the country, the adoption of this technology may enable clinicians to provide effective IVF outcomes to the patients.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Key companies operating in the Indian infertility diagnosis and therapeutics market. Based on the availability of data, information related to pipeline products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Merck KGaA

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Cipla Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Torrent Pharmaceuticals Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Medical Electronic Systems

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Indian Infertility Diagnosis and Therapeutics Market by Diagnosis

5.1.1. Male Infertility

5.1.1.1. Semen Analysis

5.1.1.2. Genetic Testing

5.1.1.3. Testicular Biopsy

5.1.1.4. Hormonal Tests

5.1.1.5. Others (Anti-sperm Antibodies Test and Ultrasound)

5.1.2. Female Infertility

5.1.2.1. Ovulation Testing

5.1.2.2. Hysterosalpingography

5.1.2.3. Imaging Tests

5.1.2.4. Ovarian Reserve Testing

5.1.2.5. Hormone Testing

5.1.2.6. Others (Genetic Testing and Hysteroscopy)

5.2. Indian Infertility Diagnosis and Therapeutics Market by Treatment

5.2.1. Male Infertility

5.2.1.1. Drugs

5.2.1.2. ART Therapy

5.2.1.3. Surgery

5.2.2. Female Infertility

5.2.2.1. Drugs

5.2.2.2. Surgery

5.2.2.3. ART Therapy

5.2.2.4. Intrauterine insemination (IUI)

6. Company Profiles

6.1. Abbott Laboratories, Inc.

6.2. Bayer AG

6.3. Bristol-Myers Squibb Co.

6.4. Cadila Pharmaceuticals Ltd.

6.5. Centogene AG

6.6. Cipla Ltd.

6.7. Cook Medical, Inc.

6.8. Cordex Pharma, Inc.

6.9. Eli Lilly and Co.

6.10. Endo Pharmaceuticals, Inc.

6.11. GlaxoSmithKline PLC

6.12. Intas Pharmaceuticals Ltd.

6.13. Lupin Pharmaceuticals, Inc.

6.14. Medical Electronic Systems

6.15. Merck KGaA

6.16. Mylan N.V.

6.17. PerkinElmer, Inc.

6.18. Pfizer, Inc.

6.19. Sanofi S.A.

6.20. Sun Pharmaceutical Industries Ltd.

6.21. Torrent Pharmaceuticals Ltd.

- INDIAN INFERTILITY DIAGNOSIS MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

- INDIAN INFERTILITY THERAPEUTICS MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

- INDIAN INFERTILITY DIAGNOSIS MARKET SHARE, 2018 VS 2025 (%)

- INDIAN INFERTILITY THERAPEUTICS MARKET SHARE, 2018 VS 2025 (%)