Indian Infertility Diagnosis and Treatment Market

Indian Infertility Diagnosis and Treatment Market Size, Share & Trends Analysis Report by Female Infertility Diagnosis (Ovulation Testing, Hysterosalpingography, Hysteroscopy, Imaging Testing, Ovarian Reserve Testing, Hormonal Level Testing, Genetic Testing, and Others), by Male Infertility Diagnosis (Semen Analysis, Genetic Testing, Testicular Biopsy, Hormone Testing, and Others), and by Infertility Treatment (Drugs and Medicine, Surgical Interventions, Assisted Reproductive Technology (ART), and Others) Forecast Period (2024-2031)

- Based on female infertility diagnosis, the market is segmented into ovulation testing, hysterosalpingography, hysteroscopy, imaging testing, ovarian reserve testing, hormonal level testing, genetic testing, and others (thyroid function tests).

- Based on male infertility diagnosis, the market is segmented into semen analysis, genetic testing, testicular biopsy, hormone testing, and others (imaging techniques, and anti-sperm antibody testing).

- Based on infertility treatment, the market is segmented into drugs and medicine, surgical interventions, assisted reproductive technology (ART), and others (advanced reproductive technologies, and surrogacy).

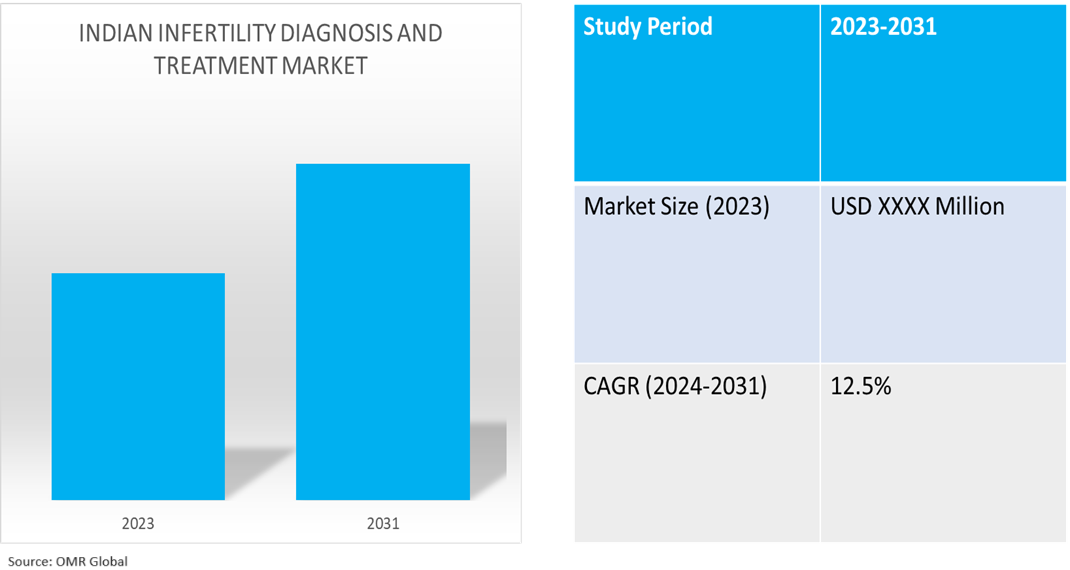

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Key companies operating in the global Indian infertility diagnosis and treatment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Dr. Reddy’s Laboratories, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Lupin, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sun Pharmaceutical Industries Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Indian Female Infertility Diagnosis Market by Diagnosis Type

4.1.1. Ovulation Testing

4.1.2. Hysterosalpingography

4.1.3. Hysteroscopy

4.1.4. Imaging Testing

4.1.5. Ovarian Reserve Testing

4.1.6. Hormonal Level Testing

4.1.7. Genetic Testing

4.1.8. Others (Thyroid Function Tests)

4.2. Indian Male Infertility Diagnosis Market by Diagnosis Type

4.2.1. Semen Analysis

4.2.2. Genetic Testing

4.2.3. Testicular Biopsy

4.2.4. Hormone Testing

4.2.5. Others (Imaging Techniques, and Antisperm Antibody Testing)

4.3. Indian Infertility Diagnosis and Treatment Market by Infertility Treatment

4.3.1. Drugs And Medicine

4.3.2. Surgical Interventions

4.3.3. Assisted Reproductive Technology (ART)

4.3.4. Others (Advanced Reproductive Technologies, and Surrogacy)

5. Company Profiles

5.1. Adorefem app

5.2. Alkem Laboratories Ltd

5.3. Biocon Ltd.

5.4. BSVL

5.5. Cadila Pharmaceuticals Ltd.

5.6. Cipla Ltd.

5.7. Crysta IVF

5.8. Dr. D Pharma

5.9. Dr. Reddy’s Laboratories Ltd.

5.10. Emcure Pharmaceuticals

5.11. Intas Pharmaceuticals Ltd.

5.12. Maksun Biotech Pvt. Ltd.

5.13. Mestra pharma Pvt Ltd.

5.14. Nova IVF Fertility Private Limited

5.15. Pfizer Ltd.

5.16. Serum Institute of India Pvt. Ltd.

5.17. Torrent Pharmaceuticals Ltd.

5.18. Wockhardt Ltd.

5.19. Zauba Technologies Pvt. Ltd.

1. Indian Female Infertility Diagnosis Market Research And Analysis By Diagnosis Type, 2023-2031 ($ Million)

2. Indian Male Infertility Diagnosis Market Research And Analysis By Diagnosis Type, 2023-2031 ($ Million)

3. Indian Infertility Treatment Market Research And Analysis By Treatment Type, 2023-2031 ($ Million)

4. Dr. Reddy’s Laboratories, Ltd Financial Analysis, 2022 VS 2023 ($ Million)

5. Lupin, Ltd. Financial Analysis, 2022 VS 2023 ($ Million)

6. Sun Pharmaceutical Industries Ltd. Financial Analysis, 2022 VS 2023 ($ Million)

1. Indian Female Infertility Diagnosis Market Share By Diagnosis Type, 2023 Vs 2031 (%)

2. Indian Male Infertility Diagnosis Market Share By Diagnosis Type, 2023 Vs 2031 (%)

3. Indian Infertility Treatment Market Share By Treatment Type, 2023 Vs 2031 (%)

4. Indian Ovulation Testing For Female Infertility Diagnosis Market Size, 2023-2031 ($ Million)

5. Indian Hysterosalpingography For Female Infertility Diagnosis Market Size, 2023-2031 ($ Million)

6. Indian Hysteroscopy For Female Infertility Diagnosis Market Size, 2023-2031 ($ Million)

7. Indian Imaging Testing For Female Infertility Diagnosis Market Size, 2023-2031 ($ Million)

8. Indian Ovarian Reserve Testing For Female Infertility Diagnosis Market Size, 2023-2031 ($ Million)

9. Indian Hormonal Level Testing For Female Infertility Diagnosis Market Size, 2023-2031 ($ Million)

10. Indian Genetic Testing For Female Infertility Diagnosis Market Size, 2023-2031 ($ Million)

11. Indian Other Female Infertility Diagnosis Market Size, 2023-2031 ($ Million)

12. Indian Infertility Diagnosis and Treatment Market Research And Analysis By Male Infertility Diagnosis, 2023-2031 ($ Million)

13. Indian Semen Analysis For Male Infertility Diagnosis Market Size, 2023-2031 ($ Million)

14. Indian Genetic Testing For Male Infertility Diagnosis Market Size, 2023-2031 ($ Million)

15. Indian Testicular Biopsy For Male Infertility Diagnosis Market Size, 2023-2031 ($ Million)

16. Indian Hormone Testing For Male Infertility Diagnosis Market Size, 2023-2031 ($ Million)

17. Indian Others Male Infertility Diagnosis Market Size, 2023-2031 ($ Million)

18. Indian Infertility Diagnosis and Treatment Market Research And Analysis By Infertility Treatment, 2023-2031 ($ Million)

19. Indian Drugs And Medicine For Infertility Treatment Market Size, 2023-2031 ($ Million)

20. Indian Surgical Interventions For Infertility Treatment Market Size, 2023-2031 ($ Million)

21. Indian Assisted Reproductive Technology (ART) For Infertility Treatment Market Size, 2023-2031 ($ Million)

22. Indian Other Infertility Treatment Market Size, 2023-2031 ($ Million)