Indian Motorcycle Sharing Service Market

Indian motorcycle sharing service Market Size, Share & Trends Analysis Report By Service (Bike Taxi, and Dock-Less), and by Propulsion Type (Hybrid, Electric Vehicles, and ICE) Forecast Period (2025-2035)

Industry Overview

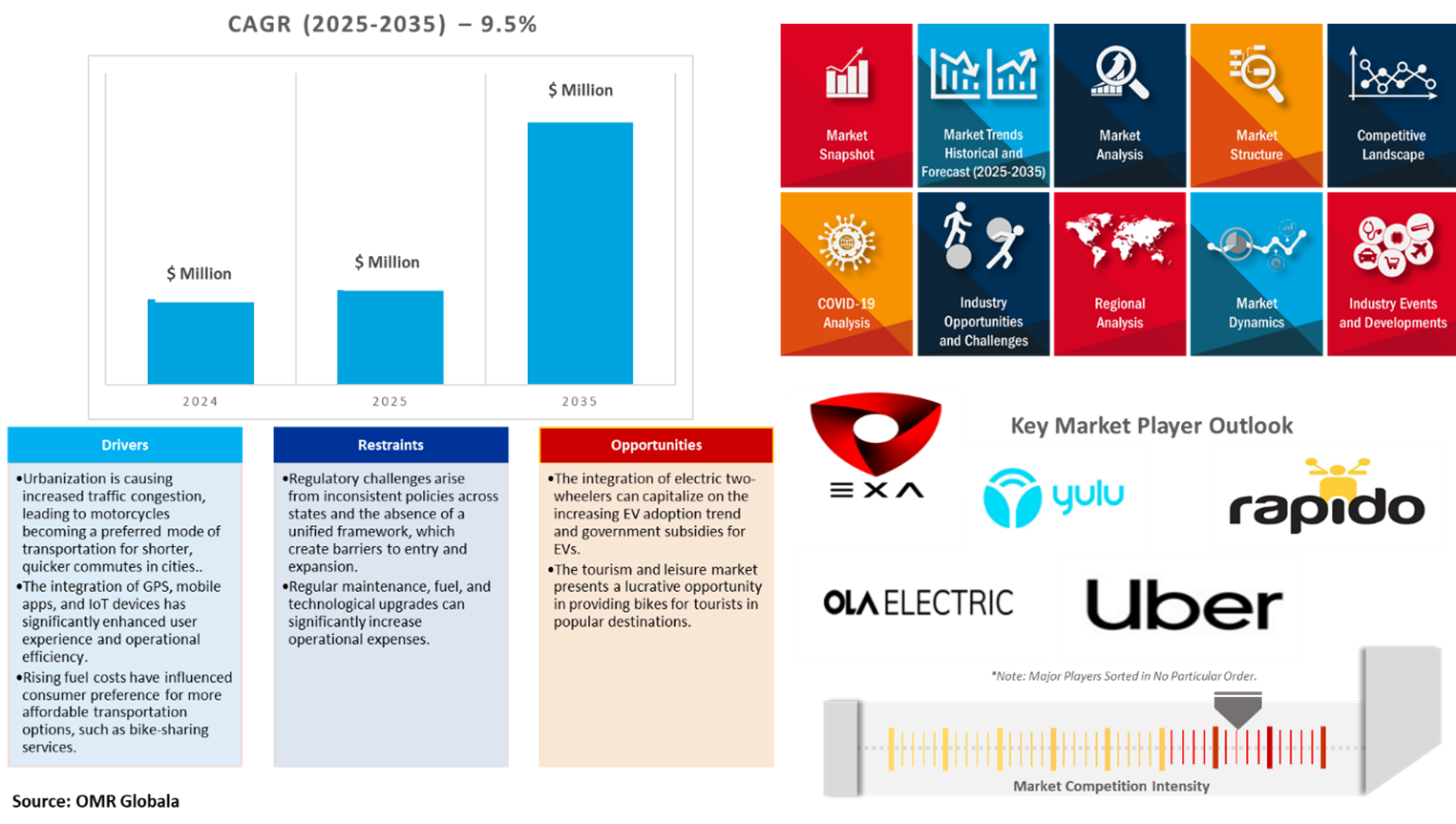

Indian motorcycle-sharing service market was valued at $72 million in 2024 and is anticipated to grow at a CAGR of 9.5% during the forecast period (2025-2035). Rapid urbanization in the country led to heavy traffic congestion, and two-wheeler-sharing services must be used for efficient travel. The services are economical alternatives to traditional modes and bridge a gap in public transportation networks. Technological advancement, environmental concerns, and huge investments in two-wheeler-sharing startups have facilitated market expansions and service improvements that attract more users.

Market Dynamics

Technological Advancements

The integration of GPS, mobile apps, and digital payment systems has utterly transformed the motorcycle rental process, allowing it to become more accessible and faster. In August 2024, Indian Motorcycle launched the 2024 Roadmaster Elite in India, which features an air-cooled V-2 ThunderStroke 116 CU-IN engine, 7-inch Display RIDE COMMAND, and inter-city travel Bluetooth integration.

Urbanization and Traffic

India's urbanization is driving a surge in demand for eco-friendly transportation solutions, including motorcycle-sharing services, that reduce personal vehicle usage and last-mile connectivity. Furthermore, motorcycle-sharing services' region expansion, offering flexible, on-demand mobility solutions, contributing to sustainable urban transport systems. India is the largest manufacturer of E2W and E3W globally and the government is promoting its usage through subsidy, tax benefit, and charging infrastructure. In the Indian automobile market, the two-wheeler sector dominates over 70% of the registered vehicles and over 50% of the petrol transactions.

Market Segmentation

- Based on service, the market is segmented into bike taxi and dock-less.

- Based on propulsion type, the market is segmented into hybrid, electric vehicles, and ICE.

Bike Taxi Segment to Hold a Considerable Market Share

The rise of ride-hailing platforms such as Uber and Ola have seen the rise of bike taxis in India with integrated payment systems and app-based booking options for passengers. For instance, in December 2024, Uber introduced an exclusive women-only bike taxi service in Bengaluru and planned to expand pan-India to other major cities. It additionally integrated real-time trip sharing, phone number anonymization, RideCheck, and a dedicated 24x7 safety helpline for the passengers.

Similarly, in November 2024, Delhi Metro introduced a bike taxi service that can be accessed on the Momentum 2.0 mobile application with two variants from 12 stations for female passengers Sheryds and all passengers Rydr.

Electric Vehicles Segment To Hold a Considerable Market Share

Technological advancements in electric vehicles have made the feasibility of EV-based sharing services more feasible by increasing battery life, reducing charging time, and improving vehicle designs. According to the World Bank Organisation, in October 2024, the Government of India, under its Faster Adoption and Manufacturing of Electric Vehicles initiative, is promoting electric and hybrid vehicles and, in October 2024. Under FAME I and II, approximately 371,000 electric vehicles have been incentivized with a total amount of around Rs. 634 Crore ($79.6 million) till July 2021, and 427 installation of charging stations. FAME II has already earmarked Rs. 1000 Crores ($125.6 million) towards the development of the country's charging infrastructure. Under the policy, the nation aims to have 70% of commercial vehicles, 30% of private cars, 40% of buses, and 80% of two and three-wheelers fully electrified by 2030.

Market Players Outlook

The major company serving the Indian motorcycle-sharing service market include Roppen Transportation Services Pvt. Ltd., Ola Electric Mobility Pvt Ltd., Uber Technologies Inc., Yulu Bikes Pvt Ltd., Exa Mobility India Pvt. Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In February 2025, Rapido announced plans to introduce an all-women "Pink" bike service in Karnataka by the end of the year. The mobility unicorn aims to create 25,000 job opportunities for women "captains" in the city.

The Report Covers-

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Indian motorcycle-sharing service market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Indian Motorcycle Sharing Service Market Sales Analysis – Service| Propulsion Type | ($ Million)

• Indian Motorcycle Sharing Service Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Indian Motorcycle Sharing Service Industry Trends

2.2.2. Market Recommendations

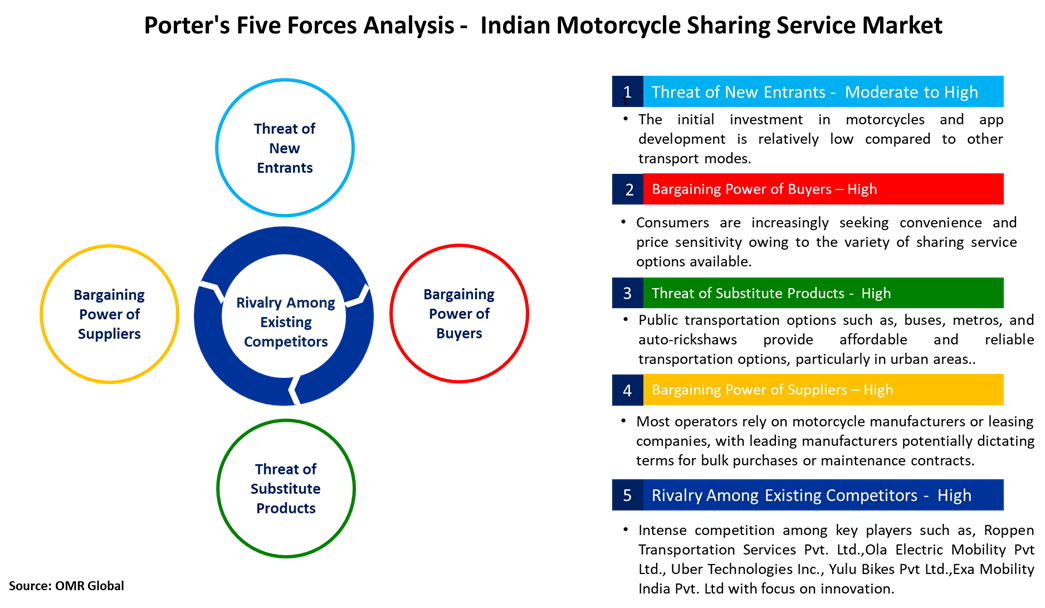

2.3. Porter's Five Forces Analysis for the Indian Motorcycle-Sharing Service Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Indian Motorcycle Sharing Service Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Indian Motorcycle Sharing Service Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Indian Motorcycle-Sharing Service Market Revenue and Share by Manufacturers

4.2. Indian Motorcycle-Sharing Service Product Comparison Analysis

• Top Market Player Ranking Matrix

4.3. Key Company Analysis

4.3.1. Ola Electric Mobility Pvt Ltd.

4.3.1.1. Overview

4.3.1.2. Product Portfolio

4.3.1.3. Financial Analysis (Subject to Data Availability)

4.3.1.4. SWOT Analysis

4.3.1.5. Business Strategy

4.3.2. Roppen Transportation Services Pvt. Ltd.

4.3.2.1. Overview

4.3.2.2. Product Portfolio

4.3.2.3. Financial Analysis (Subject to Data Availability)

4.3.2.4. SWOT Analysis

4.3.2.5. Business Strategy

4.3.3. Uber Technologies, Inc.

4.3.3.1. Overview

4.3.3.2. Product Portfolio

4.3.3.3. Financial Analysis (Subject to Data Availability)

4.3.3.4. SWOT Analysis

4.3.3.5. Business Strategy

4.4. Key Strategy Analysis

5. Indian Motorcycle Sharing Service Market by Service

5.1. Bike Taxi

5.2. Dock-Less

6. Indian Motorcycle Sharing Service Market by Propulsion Type

6.1. Hybrid

6.2. Electric Vehicles

6.3. Internal Combustion Engine (ICE)

7. Company Profiles

7.1. Exa Mobility India Pvt. Ltd.

7.1.1. Quick Facts

7.1.2. Company Overview

7.1.3. Product Portfolio

7.1.4. Business Strategies

7.2. ONN Bikes

7.2.1. Quick Facts

7.2.2. Company Overview

7.2.3. Product Portfolio

7.2.4. Business Strategies

7.3. RenTrip

7.3.1. Quick Facts

7.3.2. Company Overview

7.3.3. Product Portfolio

7.3.4. Business Strategies

7.4. Roundtrip Services Pvt Ltd

7.4.1. Quick Facts

7.4.2. Company Overview

7.4.3. Product Portfolio

7.4.4. Business Strategies

7.5. Riderly

7.5.1. Quick Facts

7.5.2. Company Overview

7.5.3. Product Portfolio

7.5.4. Business Strategies

7.6. Roppen Transportation Services Pvt. Ltd.

7.6.1. Quick Facts

7.6.2. Company Overview

7.6.3. Product Portfolio

7.6.4. Business Strategies

7.7. Wheelbros

7.7.1. Quick Facts

7.7.2. Company Overview

7.7.3. Product Portfolio

7.7.4. Business Strategies

7.8. Yulu Bikes Pvt Ltd

7.8.1. Quick Facts

7.8.2. Company Overview

7.8.3. Product Portfolio

7.8.4. Business Strategies

7.9. Ola Electric Mobility Pvt Ltd.

7.9.1. Quick Facts

7.9.2. Company Overview

7.9.3. Product Portfolio

7.9.4. Business Strategies

7.10. Uber Technologies Inc.

7.10.1. Quick Facts

7.10.2. Company Overview

7.10.3. Product Portfolio

7.10.4. Business Strategies

1. Indian Motorcycle Sharing Service Market Research And Analysis By Service, 2024-2035 ($ Million)

2. Indian Bike Taxi Motorcycle Sharing Service Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Indian Dock-Less Motorcycle Sharing Service Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Indian Motorcycle Sharing Service Market Research And Analysis By Propulsion Type, 2024-2035 ($ Million)

5. Indian Hybrid Motorcycle Sharing Service Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Indian Electric Vehicles Motorcycle Sharing Service Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Indian ICE Motorcycle Sharing Service Market Research And Analysis By Region, 2024-2035 ($ Million)

1. Indian Motorcycle Sharing Service Market Share By Service, 2024 Vs 2035 (%)

1. Indian Bike Taxi Motorcycle Sharing Service Market Share By Region, 2024 Vs 2035 (%)

2. Indian Dock-Less Motorcycle Sharing Service Market Share By Region, 2024 Vs 2035 (%)

3. Indian Motorcycle Sharing Service Market Share By Propulsion Type, 2024 Vs 2035 (%)

4. Indian Hybrid Motorcycle Sharing Service Market Share By Region, 2024 Vs 2035 (%)

5. Indian Electric Vehicles Motorcycle Sharing Service Market Share By Region, 2024 Vs 2035 (%)

6. Indian ICE Motorcycle Sharing Service Market Share By Region, 2024 Vs 2035 (%)