Indoor Farming Market

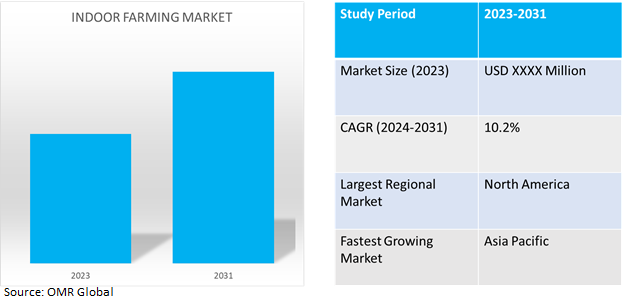

Indoor Farming Market Size, Share & Trends Analysis Report by Growing System (Aeroponics, Hydroponics, Aquaponics, Soil-Based, and Hybrid), and by Crop Type (Fruits and Vegetables, Herbs and Microgreens, Flowers and Ornamentals, and Others), and by Facility (Indoor Vertical Farms, Container Farms, Indoor Deep Water Culture Systems, and Greenhouses) Forecast Period (2024-2031)

Indoor farming market is anticipated to grow at a moderate CAGR of 10.2% during the forecast period (2024-2031). The market growth is attributed to the rising demand o fresh food attributing to the rising population globally. The other factors contributing significantly towards industry growth include the rising preferences for sustainable and locally sourced food options. Also the continuous technological advancements in indoor farming practices, including LED lights, sensors, and automation (such as robotic arms and conveyor belts) are driving the market growth.For instance, in May 2021, Bowery Farming, secured $300.0 million, in its Series C equity round of funding. The company will utilize the amount in expanding its network smart indoor farms across the US.

Market Dynamics

Rising Water and Land Scarcity for Farming

Globally countries are facing water scarcity in different timeframes due to increased urbanization and industrialization. Also, there is rapid land degradation due to land pollution making land infertile for farming. For instance, according to the Food And Agriculture Organization of the United Nations, by 2025, 1800 million people are expected to be living in countries or regions with ‘absolute’ water scarcity (<500 m3 per year per capita), and two-thirds of the world population could be under ‘stress’ conditions (between 500 and 1000 m3 per year per capita). The situation will be exacerbated as rapidly growing urban areas place heavy pressure on neighboring water resources.

Increasing food demand due to Rising Population

With the global population increasing, demand for crops is rising. The food availability is also affected by the changes in consumption patterns, climate impact on conventional agriculture, and more. In such conditions, indoor farming becomes an ideal alternative to adopt and increase crop yield through controlled processes. For instance, as per the World Economic Forum, by 2050, the world will feed two billion more people, an increase of a quarter from the current global population. The demand for food will be 56.0% greater than it was in 2010. Also, for highly populous countries, the disparity of food security and demand remains more astounding.

Segmental Outlook

Our in-depth analysis of the global indoor farming market includes the following segmentsgrowing system, crop type, and facility.

- Based on the growing system, the market is sub-segmented into aeroponics, hydroponics, aquaponics, soil-based, and hybrid.

- Based on crop type, the market is sub-segmented into fruits and vegetables, herbs and microgreens, flowers and ornamentals, and others (cannabis, and grains).

- Based on facility, the market is sub-segmented into indoor vertical farms, container farms, indoor deep water culture systems, and greenhouses.

Hydroponics Segment is Projected to Demonstrate the Highest Growth

The hydroponic farming systems are estimated to demonstrate highest growth, as they offer better water, space efficiency as compared to other alternatives. Also, they are more economical in comparison to other systems. It also provides the option of recycling and reusing water, making it one of the most efficient growing systems.

Fruits And Vegetables are the Most Grown Crop Type

Fruits and vegetables are the most grown crop type for indoor farming, specifically those that consume less space and are better cultivated in controlled environments such as leafy greens, and mushrooms. The crop type is also grown widely due to its huge and all-year demand.

Greenhouses are the Dominant Facility Type

Greenhouse-based indoor farming is widely adopted by farmers due to their cost-effectiveness, extensive supply potential, less energy consumption, diverse crop portfolio, and crop security. It is also preferred as the government provides support for greenhouse farming initiatives. For instance, NHB (National Horticulture Board) grants a 50.0% subsidy on 112 lakh (11.2 million) maximum project ceiling per beneficiary and GAIC (Gujarat Agro Industries Corporation) grants a greenhouse farming subsidy in Gujarat of 6.0% up to 4 lakhs (400 thousands) on interest on loans.

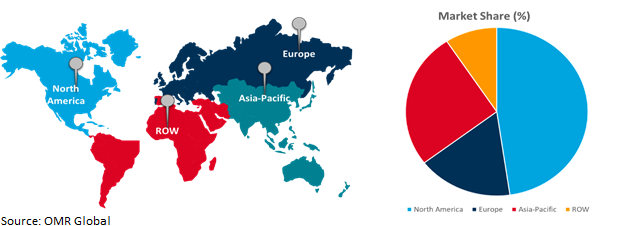

Regional Outlook

The global indoor farming market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Indoor Farming Market

North America holds the highest share of the global indoor farming market share. The key factors contributing to the regional market growth are the supportive regulatory environment, strong technological ecosystem, and rise of vertical and indoor farming startups in the region. Also, North America has heavily invested in indoor farming initiatives, technology, and projects. For instance, in March 2023, NIFA (National Institute of Food and Agriculture) announced funding of more than $9.4 million for 12 projects through urban, indoor, and other emerging agricultural production research, education, and extension initiatives. This initiative provides grants for research, education, and extension work to solve key problems of urban, indoor, and emerging agricultural systems.

Global Indoor Farming Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing Indoor Farming Market

- Asia-Pacific region is home to around 50.0% of the world population creating huge food demand for the region which is expected to increase in the future.

- Asia-Pacific countries are increasingly investing in farming technology and supporting infrastructure, including schemes, subsidies, and collaboration with private players to increase their crop production capabilities.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global indoor farming market include Argus Control Systems Ltd., Certhon Build B.V., Richel Group, Bowery Farming Inc., and New AeroFarms, Inc. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in August 2021, Cargill partnered with vertical farming company AeroFarms for a research focused on cocoa production, by entering a multi-year research agreement aimed at improving cocoa bean yields and developing more climate-resilient farming practices.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global indoor farming market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Indoor farming Market by Growing System

4.1.1. Aeroponics

4.1.2. Hydroponics

4.1.3. Aquaponics

4.1.4. Soil-based

4.1.5. Hybrid

4.2. Global Indoor farming Market by Crop type

4.2.1. Fruits and Vegetables

4.2.2. Herbs and Microgreens

4.2.3. Flowers and Ornamentals

4.2.4. Others (Cannabis, and Grains)

4.3. Global Indoor farming Market by Facility

4.3.1. Indoor vertical farms

4.3.2. Container Farms

4.3.3. Indoor deep water culture systems

4.3.4. Greenhouses

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Argus Control Systems Ltd.

6.2. Bowery Farming Inc.

6.3. Certhon Build B.V.

6.4. CubicFarm Systems Corp.

6.5. Freight Farms, Inc.

6.6. Gotham Greens Holdings, PBC

6.7. Hydrodynamics International, Inc.

6.8. Infarm Technologies Ltd.

6.9. Intelligent Growth Solutions Ltd.

6.10. Jewish Family Service of Colorado

6.11. Metropolis Farms Inc.

6.12. Netafim Ltd.

6.13. New AeroFarms, Inc.

6.14. Plenty Unlimited Inc.

6.15. Priva Holding B.V

6.16. Richel Group

6.17. Sky Greens

6.18. Spread Co., Ltd.

6.19. Surna

6.20. Urban Crop Solutions BV

1. GLOBAL INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY GROWING SYSTEM, 2023-2031 ($ MILLION)

2. GLOBAL AEROPONICS INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL HYDROPONICS INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AQUAPONICS INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SOIL-BASED INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL HYBRID INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

8. GLOBAL INDOOR FARMING FOR FRUITS AND VEGETABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL INDOOR FARMING FOR HERBS AND MICROGREENS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL INDOOR FARMING FOR FLOWERS AND ORNAMENTALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL INDOOR FARMING FOR OTHER CROPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY FACILITY, 2023-2031 ($ MILLION)

13. GLOBAL VERTICAL FARMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CONTAINER FARMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL DEEP WATER CULTURE SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL GREENHOUSES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY GROWING SYSTEM, 2023-2031 ($ MILLION)

20. NORTH AMERICAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

21. NORTH AMERICAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY FACILITY, 2023-2031 ($ MILLION)

23. EUROPEAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY GROWING SYSTEM, 2023-2031 ($ MILLION)

25. EUROPEAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

26. EUROPEAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

27. EUROPEAN INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY FACILITY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY GROWING SYSTEM, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY FACILITY, 2023-2031 ($ MILLION)

33. REST OF THE WORLD INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY GROWING SYSTEM, 2023-2031 ($ MILLION)

35. REST OF THE WORLD INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

36. REST OF THE WORLD INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

37. REST OF THE WORLD INDOOR FARMING MARKET RESEARCH AND ANALYSIS BY FACILITY, 2023-2031 ($ MILLION)

1. GLOBAL INDOOR FARMING MARKET SHARE BY GROWING SYSTEM, 2023 VS 2031 (%)

2. GLOBAL AEROPONICS INDOOR FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL HYDROPONICS INDOOR FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AQUAPONICS INDOOR FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SOIL-BASED INDOOR FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL HYBRID INDOOR FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL INDOOR FARMING MARKET SHARE BY CROP TYPE, 2023 VS 2031 (%)

8. GLOBAL INDOOR FOR FRUITS AND VEGETABLES FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL INDOOR FOR HERBS AND MICROGREENS FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL INDOOR FOR FLOWERS AND ORNAMENTALS FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL INDOOR FOR OTHER CROPS FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL INDOOR FARMING MARKET SHARE BY FACILITY, 2023 VS 2031 (%)

13. GLOBAL INDOOR VERTICAL FARMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CONTAINER FARMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL INDOOR DEEP WATER CULTURE SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL GREENHOUSES MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL OTHER FACILITIES INDOOR FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL INDOOR FARMING MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

21. UK INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)

33. THE MIDDLE EAST AND AFRICA INDOOR FARMING MARKET SIZE, 2023-2031 ($ MILLION)