Industrial 4.0 Market

Global Industrial 4.0 Market Size, Share & Trends Analysis Report by Technology Type (Industrial Robotics, IIoT, AI and ML, Blockchain, Extended Reality, Digital Twin, and 3D Printing), by End User Industry (Manufacturing, Automotive, Oil and Gas, Energy and Utilities, Electronics and Foundry, Food and Beverage, Aerospace and Defence) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global industrial 4.0 market is anticipated to grow at a significant CAGR of 19.6% during the forecast period. Adoption of Artificial Intelligence (AI) and Internet of Things (IoT) in manufacturing sector, rising internet penetration, advancements in digital technologies are the prominent factors extended the market growth and new growth opportunities for Industrial 4.0. In addition, new product developments by prominent players is developing new revenue and business models to sustain in the industry and to fulfil growing market demands. For instance, Henkel’s Laundry & Home Care business unit successfully developed a unique cloud-based data platform, called Digital Backbone, that connects more than 30 production sites and ten distribution centers across the globe in real-time. The platform helps to enhance the growing customer and consumer expectations of service and sustainability while achieving double-digit cost and inventory reductions.

Impact of COVID-19 Pandemic on Global Industrial 4.0 Market

The COVID-19 pandemic had impacted most of the industries in the market. The spread of the virus led most governments across the globe to impose a lockdown that strictly restricted the uses of the vehicle and shut down most the transportation, and other services for a while. All this led to a increase in the demand, and production activities in the industrial 4.0 market. The adoption of Industrial 4.0 and improve resilience to future pandemics. This is because in a pandemic technologies, like automation and robotics, help decrease human dependence and allow the human workforce to safeguard against these threats. It also enhances productivity, hence, preventing the shutdown of plants in a crisis.

Segmental Outlook

The global industrial 4.0 market is segmented on the basis of technology type and end-user. On the basis of technology type, the market is segmented into industrial robotics, IIot, ai and ml, blockchain, extended reality, digital twin, and 3d printing. By end-user, the market is segmented into manufacturing, automotive, oil & gas, energy and utilities, electronics and foundry, food and beverages, and aerospace and defense. The manufacturing industry has seen significant growth in the global Industrial 4.0 market owing to the higher adoption of digital transformation across the globe. For instance, in February 2021, Schneider Electric partnered with Nexans to bring Industrial 4.0 to amplify sustainability and operations through a digital transformation program. Digitization in factories improves predictive maintenance, reduces carbon emissions, and improves the efficiency of production lines.

The Industrial Robotics Segment Anticipated to Hold the Prominent Share in the Global Industrial 4.0 Market

The industrial robotics segment is estimated to dominate the market with a prominent share of the market during the forecast period. Industrial robots are used in almost all industries from automotive to healthcare due to the benefits offered by it such as it used to track, monitor, and maintain various equipment within the smart factor unit.. According to the World Robotics 2020, Embedded vision contributes to transforming Industrial 4.0 by empowering robots with cutting-edge vision-enabled functionalities. India will have a total of 6,000 industrial robots. As per the World Robotics 2020, Industrial Robots Report published by the IFR (International Federation of Robotics), 2.7 million robots were operating in factories worldwide in 2019, and installations of co-bots (collaborative robots) grew by 11% in 2019.

Regional Outlooks

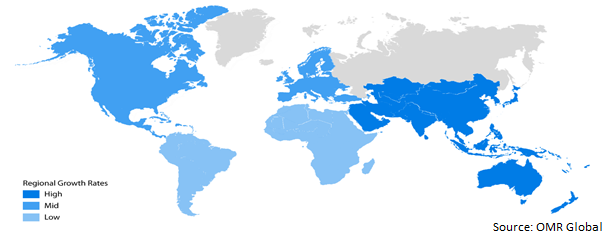

The global industrial 4.0 market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The Asia-Pacific is estimated to grow significantly while Europe going to show notable growth in the market during the forecast period. The market growth in the region is attributed to the significant development in the construction, automotive, steel and other manufacturing industry in the region.

Global Industrial 4.0 Market Growth, by Region 2022-2028

The Europe Region Estimated to Show Notable Growth in the Global Industrial 4.0 Market

The Europe region is projected to show notable growth in the market during the forecast period. Low production cost in European countries enables market players to set up manufacturing facilities by forming partnerships in this region. The improved operational efficiency and productivity, rising R&D investment, and significant technological advancements in Internet of Things (IoT) are the other prominent factor for the market growth.

Market Players Outlook

The major companies serving the global industrial 4.0 market are ABB Ltd., Siemens AG, Schneider Electric, Swisslog Holding AG, Rockwell Automation Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2021, ABB Ltd., launched GoFa to help workers with ergonomically and repetitive tasks. Through the launch of GoFa, the company supports the upsurge demand of robots in the industry handling heavier payloads for the enhancement of flexibility and productivity.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial 4.0 market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Industrial 4.0 Market

• Recovery Scenario of Global Industrial 4.0 Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. ABB Ltd.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Siemens AG

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Schneider Electric

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Swisslog Holding AG

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Rockwell Automation Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Industrial 4.0 Market by Technology Type

4.1.1. Industrial Robotics

4.1.2. Industrial IoT

4.1.3. AI and ML

4.1.4. Blockchain

4.1.5. Extended Reality

4.1.6. Digital Twin

4.1.7. 3-D Printing

4.2. Global Industrial 4.0 Market by End-User

4.2.1. Manufacturing

4.2.2. Automotive

4.2.3. Oil and Gas

4.2.4. Energy and Utilities

4.2.5. Electronics and Foundry

4.2.6. Food and Beverage

4.2.7. Aerospace and Defence

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Accenture Plc

6.2. Atos SE

6.3. ATS International B.V.

6.4. Autodesk Inc.

6.5. Bosch.IO GmbH

6.6. CENIT AG

6.7. Cisco Systems, Inc.

6.8. Dassault Systèmes

6.9. Emerson Electric Co.

6.10. FANUC Corp.

6.11. Fraunhofer IAO

6.12. General Electric Company

6.13. Honeywell International Inc.

6.14. Huawei Technologies Co., Ltd.

6.15. IBM Corporation

6.16. Infosys Ltd.

6.17. Intel Corp.

6.18. Johnson Controls International Plc

6.19. Keyence Corp.

6.20. Microsoft Corp.

6.21. Mitsubishi Electric Corp.

6.22. OMRON Corp.

6.23. Oracle Corp.

6.24. PTC, Inc.

6.25. SAP SE

6.26. Telefonaktiebolaget L. M. Ericsson

6.27. Wipro Limited

6.28. WITTENSTEIN SE

6.29. YASKAWA Electric Corp.

6.30. Yaskawa Motoman

6.31. Yokogawa Electric Corp.

1. GLOBAL INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL INDUSTRIAL ROBOTICS IN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL INDUSTRIAL IOT IN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL AL AND ML IN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL BLOCKCHAIN IN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL EXTENDED REALITY IN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL DIGITAL TWIN IN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL 3-D PRINTING IN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

10. GLOBAL MANUFACTURING INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL AUTOMOTIVE INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL OIL & GAS INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL ENERGY AND UTILITIES INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL ELECTRONICS ANF FOUNDRY INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL FOOD AND BEVERAGE INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL AEROSPACE AND DEFENCE INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. NORTH AMERICAN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. EUROPEAN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. EUROPEAN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

23. EUROPEAN INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

27. REST OF THE WORLD INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD INDUSTRIAL 4.0 MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL INDUSTRIAL 4.0 MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL INDUSTRIAL 4.0 MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL INDUSTRIAL 4.0 MARKET, 2022-2028 (%)

4. GLOBAL INDUSTRIAL 4.0 MARKET SHARE BY TECHNOLOGY TYPE, 2021 VS 2028 (%)

5. GLOBAL INDUSTRIAL ROBOTICS IN INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL IIOT IN INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL AI AND ML IN INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL BLOCKCHAIN IN INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL EXTENDED REALITY IN INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL DIGITAL TWIN IN INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL 3-D PRINTING IN INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL INDUSTRIAL 4.0 MARKET SHARE BY END-USER, 2021 VS 2028 (%)

13. GLOBAL MANUFACTURING INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL AUTOMOTIVE INDUSTRY INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL OIL & GAS INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL ENERGY AND UTILITIES INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL ELECTRONICS AND FOUNDRY INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL FOOD AND BEVERAGE INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL AEROSPACE AND DEFENCE INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL INDUSTRIAL 4.0 MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. US INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

22. CANADA INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

23. UK INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

24. FRANCE INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

25. GERMANY INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

26. ITALY INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

27. SPAIN INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF EUROPE INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

29. INDIA INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

30. CHINA INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

31. JAPAN INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

32. SOUTH KOREA INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

33. REST OF ASIA-PACIFIC INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)

34. REST OF THE WORLD INDUSTRIAL 4.0 MARKET SIZE, 2021-2028 ($ MILLION)