Industrial Control System Market

Global Industrial Control System Market Size, Share & Trends Analysis Report by System (Supervisory Control and Data Acquisition System (SCADA), Distributed Control System (DCS), Programmable Logic Controller (PLC), Machine Execution System (MES), Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), Human Machine Interface (HMI), and Others) By Vertical (Automotive, Energy and Utility, Medical & Life Science, Food and Beverage, Others) Forecast Period (2020-2026) Update Available - Forecast 2025-2035

The industrial control system market is projected to grow at a considerable CAGR of around 8% during the forecast period (2020-2026). The rising demand for automation in the different industrial sectors such as automotive, energy and utility, medical & lifescience, food and beverage, and others for overall cost reduction is a major factor to drive the growth of the global industrial control system market. Industrial control systems are playing an imperative role in the proper functioning of industries. The growing adoption of emerging advanced technologies such as AI and IoT and their twining with a different type of sensor used in industries are the key factors promoting the growth of the global industrial control systems industry.

Moreover, a huge investment in industry 4.0 and smart factories is further anticipated to drive the market growth. With the rise in the investment focal point of manufacturers has been increased on dropping the operational and maintenance costs, rolling need for industrial control systems. Here, with the integration of Industry 4.0-ready solutions and IoT, the data can be made available that can assist both ends of the supply chain since information is a more flexible way. Industrial IoT (IIoT) is a sub-application area of IoT that can be used in combination with control systems in various industries such as oil and gas, transportation, automotive, manufacturing, and chemical among others. The ongoing technological advancement in equipment manufacturing is anticipated to offer considerable opportunities to the growth of the global market. However, due to the lack of a skilled workforce and limited awareness regarding industrial security solutions are limiting the growth of the market.

Segmental Outlook

The global industrial control system market is classified on the basis of system, and vertical. Based on system, the market is segmented into Supervisory Control and Data Acquisition System (SCADA), Distributed Control System (DCS), Programmable Logic Controller (PLC), Machine Execution System (MES), Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), Human Machine Interface (HMI), and others. Based on vertical, the market is segmented into automotive, energy and utility, medical & lifescience, food and beverage, and others.

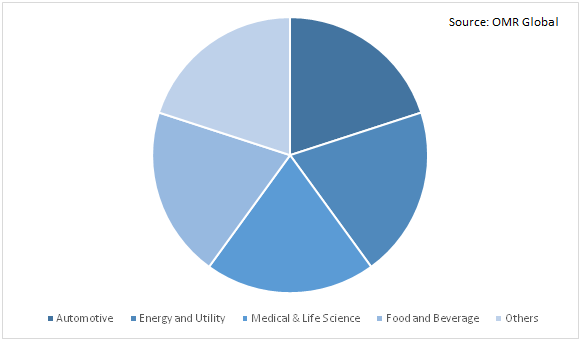

Automotive will be considerable segment based on vertical

The automotive industry requires huge automation to support consistency in repetitive tasks. The automotive projects include assembly, paint, body, welding, stamping, and press of automotive parts. The integration of automotive systems with the plant floor connects people with technology to make more timely decisions. Moreover, the use of the industrial control system to meet the manufacturing challenges in the automotive industry is a major contributor to the high market share of this segment.

Global Industrial Control System Market Share by Vertical, 2019 (%)

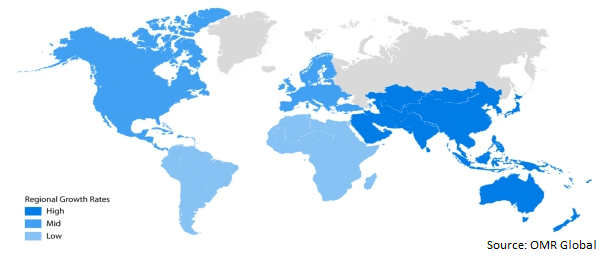

Regional Outlook

The global industrial control system market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to hold considerable market share during the forecast period. The considerable presence of various end-user verticals of an industrial control system along with well established IT infrastructure is a key factor contributing towards the high market share of North America in the market. Moreover, supporting government policies, rising demand for automation in industries, availability of competitively priced natural gases are promoting the industries of the region to build plants, expand, automate, and control their facilities. Therefore, the growth of the industrial control system in the North American region is anticipated to hold considerable share during the forecast period.

Global Industrial Control System Market Growth, by Region 2020-2026

Asia-Pacific is anticipated to exhibit considerable CAGR during the forecast period 2020-2026

The growth of the industrial control systems in the region is backed by the growing need for automation in the industries, a high rate of production along with the increased demand for high-quality products. In Asia-Pacific, emerging countries such as India and China majorly contribute to the growth of the industrial control system market, as there are focussing in industrial sectors. According to the India Brand Equity Foundation (IBEF), the food processing industry of India accounts for a total of 32% of India’s total food market. The food processing sector in India is ranked fifth in terms of export, manufacturing, and consumption. The Indian food market was valued at $1.3 billion in 2016 and is growing at a CAGR of 20%. The growing demand for industrial control systems in the food and beverage industry is anticipated to drive the market growth in the region

Market Players Outlook

The major players that contribute to the growth of the global industrial control system market include IBM Corp., Microsoft Corp., Honeywell International Inc., Cisco Systems, Juniper Networks Inc., Kaspersky Lab, Lockheed Martin, Microsoft Corp., Mitsubishi Electric Corp., Omron Corp., Rockwell Automation Inc., and Schneider Electric SE among others. In order to remain competitive, the players operating in the market adopt various strategies such as mergers and acquisitions, partnerships,collaborations, product launch, and geographical expansion. For instance, in April 2019, IBM collaborated with Sund & Bælt to design and develop an AI-powered IoT solution and extend the IBM Maximo portfolio.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial control system market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Honeywell International Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. ABB Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Siemens AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Omron Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Schneider Electric SE

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Industrial Control System Market by System

5.1.1. Supervisory Control and Data Acquisition System (SCADA)

5.1.2. Distributed Control System (DCS)

5.1.3. Programmable Logic Controller (PLC)

5.1.4. Machine Execution System (MES)

5.1.5. Product Lifecycle Management (PLM)

5.1.6. Enterprise Resource Planning (ERP)

5.1.7. Human Machine Interface (HMI)

5.1.8. Others

5.2. Global Industrial Control System Market by Vertical

5.2.1. Automotive

5.2.2. Energy and Utility

5.2.3. Medical & LifeScience

5.2.4. Food and Beverage

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB, Ltd.

7.2. Advantech Co., Ltd.

7.3. Bachmann electronic GmbH

7.4. Emerson Electric Co.

7.5. Fortinet, Inc.

7.6. General Electric Co.

7.7. GLC Controls Inc.

7.8. Honeywell International Inc.

7.9. ICONICS, Inc.

7.10. Lockheed Martin

7.11. Microsoft Corp.

7.12. Mitsubishi Electric Corp.

7.13. Omron Corp.

7.14. RACO Manufacturing & Engineering Co., Inc.

7.15. Rockwell Automation Inc.

7.16. Schneider Electric SE

7.17. Siemens AG

7.18. Symantec Corp.

7.19. Trihedral Engineering Ltd.

7.20. Yokogawa Electric Corp.

1. GLOBAL INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

2. GLOBAL SUPERVISORY CONTROL AND DATA ACQUISITION SYSTEM (SCADA) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL DISTRIBUTED CONTROL SYSTEM (DCS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL PROGRAMMABLE LOGIC CONTROLLER (PLC) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL MACHINE EXECUTION SYSTEM (MES) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PRODUCT LIFECYCLE MANAGEMENT (PLM) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ENTERPRISE RESOURCE PLANNING (ERP) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

11. GLOBAL AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL ENERGY AND UTILITY MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

13. GLOBAL MEDICAL & LIFESCIENCE MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

14. GLOBAL FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

15. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

16. NORTH AMERICA INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

18. NORTH AMERICAN INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

19. EUROPEAN INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. EUROPEAN INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

21. EUROPEAN INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

25. REST OF THE WORLD INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

26. REST OF THE WORLD INDUSTRIAL CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

1. GLOBAL INDUSTRIAL CONTROL SYSTEM MARKET SHARE BY SYSTEM, 2019 VS 2026 (%)

2. GLOBAL INDUSTRIAL CONTROL SYSTEM MARKET SHARE BY VERTICAL, 2019 VS 2026 (%)

3. GLOBAL INDUSTRIAL CONTROL SYSTEM MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

6. UK INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD INDUSTRIAL CONTROL SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)