Industrial Couplings Market

Industrial Couplings Market Size, Share & Trends Analysis Report by Type (Flexible Coupling, Rigid Coupling), End-user Industry (Automotive, Healthcare, Aerospace and Defense, Oil and Gas, Metal and Mining, Other), Forecast Period (2022-2030) Update Available - Forecast 2025-2035

Industrial couplings market is anticipated to grow at a considerable CAGR of 4.5% during the forecast period. The rising industrialization and adoption of the Industry 4.0 revolution across the globe have created the demand for an industrial coupling market. The high demand for industrial coupling from the end-user industry is a key factor driving the growth of the global industrial couplings market. To meet the growing demand for industrial couplings key players are expanding their production facilities. For instance, in July 2023, R+W, a global brand of precision couplings for motion control and automation systems, opened a new US-based manufacturing facility with expanded machining capabilities and assembly operations for its precision couplings and line shafts. The company relocated into the 30,000-square-foot facility in West Chicago, IL in late 2022, and is currently ramping up to produce the majority of its precision bellows couplings, elastomer couplings, and line shafts for the North American market.

Segmental Outlook

The global industrial couplings market is segmented based on type and end-user industry. Based on type, the market is segmented into flexible coupling and rigid coupling. Based on the end-user industry, the market is segmented into automotive, healthcare, aerospace and defense, oil and gas, metal, and mining.

Automotive Sector Held Considerable Share Based on Industrial Coupling Market

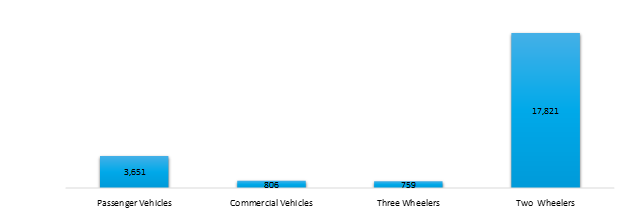

The automotive industry held a considerable share of the industrial coupling market in 2022. The high demand for numerous tools for testing and connecting a vehicle to a trough in the automotive industry has driven the growth of this market segment. Furthermore, the rising adoption of electric vehicles globally is creating more opportunities for industrial couplings.

Regional Outlook

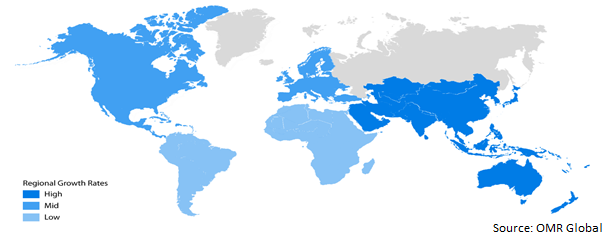

The global industrial couplings market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, Asia-Pacific is estimated to be the fastest-growing region owing to the growing industrialization in emerging economies such as India & China. Government initiatives, such as the 'Make in India' and ‘Made in China’ programs, have further strengthened the place of the region in the industrial coupling market. The growing automobile industry is further driving the demand for the industrial coupling market.?

Indian Auto-Production 2021-2022 (in ’000)

Source: International Organization of Motor Vehicle Manufacturers

Apart from these, Japan has been a pioneer in transforming into an automated industrial economy. The country is working hard in the field of adopting industrial version 5.0, which is expected to create high demand for the industrial coupling market across the region. In July 2022, Gilat Satellite Networks Ltd. received an order of $7.0 million from a Tier-1 mobile network carrier in the Asia-Pacific region for a 4G cellular backhaul network expansion. Such ongoing developments in the 5G infrastructure across the region are further contributing to the regional market growth.

Global Industrial Couplings Market Growth, by Region 2023-2030

The North American region held a Considerable Share in the Global Industrial Couplings Market

North America held a considerable share in the global industrial couplings market. In North America, the US held a major market share in the regional market. High demand for industrial couplings along with the presence of active key players is driving the growth of the industrial coupling market. For instance, in January 2022, OilQuickUSA, an Exodus Global company, and OilQuick AB, the manufacturer of the OilQuick Automatic Quick Coupler System, announced a joint venture to manufacture automatic coupling systems in the US. The new company will be named OilQuick Americas, LLC “OQA” and will service both the North and South American markets. OQA is investing millions of dollars in state-of-the-art manufacturing machinery at its Superior, Wisconsin location. This joint venture will increase the company’s manufacturing capacity to meet the exponential growth in demand for industrial couplings.

Market Players Outlook

The major companies serving the global industrial couplings market include Altra Industrial Motion Corp., Baker Hughes Company, Emerson Electric Co., Siemens AG, and Baldor Electric (ABB Ltd.) among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2022, the US Tsubaki Power Transmission, LLC acquired ATR Sales Inc. (ATR) based out of Santa Ana, CA. ATR has been manufacturing and providing ATRA-FLEX premium flexible couplings to the power transmission industry for more than 36 years. The Made in USA ATRA-FLEX premium flexible couplings provide customers with increased productivity and profitability by offering high-quality solutions for rotating equipment. This acquisition was made to expand the company’s product portfolio.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial couplings market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Altra Industrial Motion Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Baldor Electric (ABB Ltd.)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Baker Hughes Company

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Emerson Electric Co.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Industrial Couplings Market by Type

4.1.1. Flexible Coupling

4.1.2. Rigid Coupling

4.2. Global Industrial Couplings Market by End-User

4.2.1. Automotive

4.2.2. Healthcare

4.2.3. Aerospace & Defense

4.2.4. Oil and Gas

4.2.5. Metal and Mining

4.2.6. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Baldor Electric (ABB Ltd)

6.2. Colossus

6.3. Daido Precision Industries Ltd.

6.4. Dandong Colossus Group Co. Ltd.

6.5. Dhara Industries

6.6. Elegant Engineering Corp.

6.7. Emerson Electric Co.

6.8. Industrial Clutch Parts Ltd.

6.9. John Crane Ltd.

6.10. KK Foundry

6.11. KTR Systems

6.12. Nishi Enterprise

6.13. Premium Energy Transmission Ltd.

6.14. Rexnord Corp.

6.15. Sedan Engineering Enterprises

6.16. Shri Umiya Industries

6.17. Tsubakimoto Chain

6.18. Summit Tools Corp.

6.19. SuperMech Industries

6.20. Utkur Iron & Steel Industries

6.21. Wiperdrive Industries

1. GLOBAL INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL RIGID INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL FLEXIBLE INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

5. GLOBAL INDUSTRIAL COUPLINGSFOR AUTOMOTIVEMARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBALINDUSTRIAL COUPLINGSFORHEALTHCAREMARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL INDUSTRIAL COUPLINGSFORAEROSPACE & DEFENSEMARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBALINDUSTRIAL COUPLINGSFOROIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL INDUSTRIAL COUPLINGS FOR METAL & MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. NORTH AMERICAN INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. NORTH AMERICAN INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

14. NORTH AMERICAN INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

15. EUROPEAN INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. EUROPEAN INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

17. EUROPEAN INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

20. ASIA-PACIFIC INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

21. REST OF THE WORLD INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. REST OF THE WORLD INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

23. REST OF THE WORLD INDUSTRIAL COUPLINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL INDUSTRIAL COUPLINGS MARKET SHARE BY TYPE, 2022 VS 2030(%)

2. GLOBAL INDUSTRIAL COUPLINGS MARKET SHARE BY END-USER, 2022 VS 2030(%)

3. GLOBAL FLEXIBLE INDUSTRIAL COUPLINGS MARKET SHARE BY REGION, 2022 VS 2030(%)

4. GLOBAL RIGID INDUSTRIAL COUPLINGS MARKET SHARE BY REGION, 2022 VS 2030(%)

5. GLOBAL INDUSTRIAL COUPLINGS FOR AUTOMOTIVEMARKET SHARE BY REGION, 2022 VS 2030(%)

6. GLOBALINDUSTRIAL COUPLINGS FOR HEALTHCARE MARKET SHARE BY REGION, 2022 VS 2030(%)

7. GLOBAL INDUSTRIAL COUPLINGS FOR AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2022 VS 2030(%)

8. GLOBAL INDUSTRIAL COUPLINGS FOR OIL & GASMARKET SHARE BY REGION, 2022 VS 2030(%)

9. GLOBAL INDUSTRIAL COUPLINGS FOR METAL & MINING MARKET SHARE BY REGION, 2022 VS 2030(%)

10. GLOBALINDUSTRIAL COUPLINGS FOR OTHER END-USER MARKET SHARE BY REGION, 2022 VS 2030(%)

11. GLOBAL INDUSTRIAL COUPLINGS MARKET SHARE BY REGION, 2022 VS 2030(%)

12. US INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

13. CANADA INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

14. UK INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

15. FRANCE INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

16. GERMANY INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

17. ITALY INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

18. SPAIN INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

19. REST OF EUROPE INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

20. INDIA INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

21. CHINA INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

22. JAPAN INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

23. SOUTH KOREA INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF ASIA-PACIFIC INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

25. LATIN AMERICAINDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)

26. MIDDLE EAST AND AFRICA INDUSTRIAL COUPLINGS MARKET SIZE, 2022-2030 ($ MILLION)