Industrial Dust Collector Market

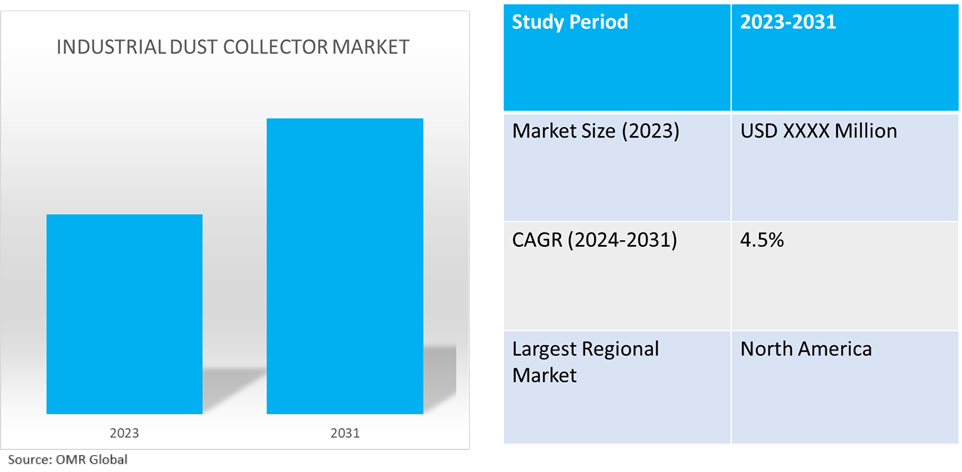

Industrial Dust Collector Market Size, Share & Trends Analysis Report by Type (Baghouse Dust Collector, Cartridge Dust Collector, Electrostatic Precipitator (ESP), Inertial Separators, and Wet Scrubbers), and by End-user (Cement, Chemical Processing, Food Processing, Pharmaceuticals, Power Generation, Steel, Manufacturing, and Mining) Forecast Period (2024-2031)

Industrial dust collector market is anticipated to grow at a CAGR of 4.5% during the forecast period (2024-2031). An industrial dust collector is a type of air pollution control equipment used in factories, plants, warehouses, and other industrial or commercial settings to meet environmental and workplace safety requirements. Rapid industrialization and urbanization in developing economies drive the demand for industrial dust collectors globally.

Market Dynamics

Increasing Manufacturing Industries

The growth of manufacturing industries has led to a surge in the demand for industrial dust collectors. These collectors help protect workers from dust exposure, ensuring a healthier work environment and reducing health risks. They also safeguard product quality, preventing contamination and reducing product recalls. Uncontrolled dust can cause machinery breakdowns and production delays, affecting operational efficiency. Additionally, they help manufacturers comply with environmental regulations by capturing dust before it enters the atmosphere, contributing to cleaner air and a more sustainable environment. As manufacturing continues to thrive, the industrial dust collector market is expected to grow significantly.

Growing Demand for Clean Air in Workplaces

The increasing awareness of the health risks of airborne dust in industrial settings is driving the need for industrial dust collectors. These devices not only reduce health risks but also improve worker morale and productivity. Regulatory bodies worldwide are enacting stricter air quality standards, and dust collectors help companies comply with these standards. Investing in clean air demonstrates a commitment to worker health and safety, attracting and retaining top talent. Dust-laden air can also negatively impact production processes, leading to increased wear and tear and potential malfunctions. Industrial dust collectors contribute to a safer, healthier, and more productive industrial environment. For instance, in May 2023, LIGNA Nederman launched the unique Nederman SAVE solution and showcased a smarter approach to dust collection systems that helps pave the way for a safer, more efficient, and more profitable future. It helps to improve energy efficiency, reduce health and safety risks, ensure compliance with regulations, and boost productivity.

Market Segmentation

- Based on type, the market is segmented into baghouse dust collectors, cartridge dust collectors, ESP, inertial separators, and wet scrubbers.

- Based on end-users, the market is segmented into cement, chemical processing, food processing, pharmaceuticals, power generation, steel, manufacturing, and mining.

Industrial Biotechnology is Projected to Emerge as the Largest Segment

The baghouse dust collector segment is expected to hold the largest share of the market due to the versatility and cost-effectiveness of solutions for handling a wide range of dust and airborne particles. They can be integrated into various industrial processes, including woodworking, chemical production, cement manufacturing, and power generation. Baghouses offer a one-stop solution for various dust collection needs, with lower initial investment and manageable maintenance costs. They also capture high filtration efficiency, trapping airborne particles, reducing emissions, and contributing to a cleaner environment. Baghouse systems offer customization based on the specific type of dust being targeted, and their core functionality is straightforward, making operation and maintenance easier.

Energy Driven Segment to Hold a Considerable Market Share

Cement plants are increasingly implementing environmental regulations to combat dust pollution, which poses health risks to workers and reduces visibility within the factory. Industrial dust collectors help cement plants comply with these regulations by capturing a significant portion of dust particles before they escape into the atmosphere. This helps cement plants comply with environmental regulations and contributes to cleaner air. Dust is not only a health and environmental concern but also a financial one, as uncontrolled dust can lead to increased wear and tear on machinery, impacting production efficiency and increasing maintenance costs. Additionally, some captured dust can be reintroduced back into the production process, reducing the need for raw materials and improving resource efficiency. Thus, dust collectors are essential investments for cement plants to safeguard worker's health, and the environment, and improve production efficiency.

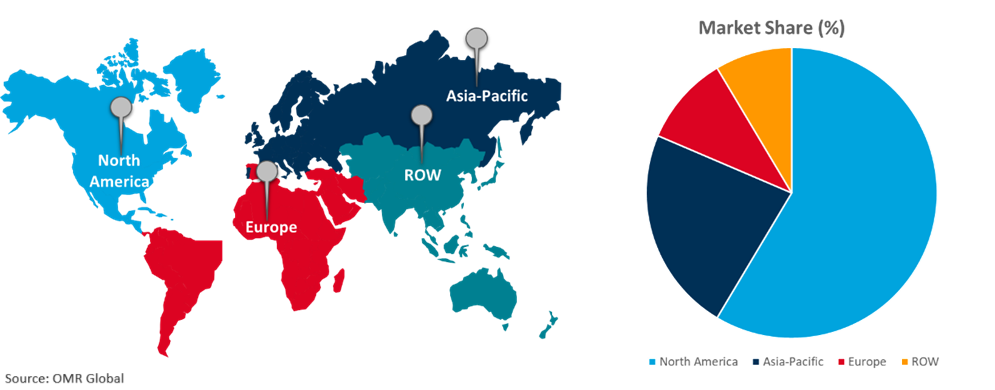

Regional Outlook

The global industrial dust collector market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in the industrial dust collector market

- The increasing investments in the infrastructure sector in India by governments are significantly impacting the steel and cement industry, which, in turn, drives the market.

- China is one of the major regional markets due to the presence of end-use industries and the largest steel manufacturer globally.

Global Industrial Dust Collector Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to well-established environmental regulations governing air quality and emissions standards. State and federal authorities such as the Environmental Protection Agency (EPA) enforce regulations to reduce airborne pollutants, including particulate matter. Industrial dust collectors are in high demand as a result of businesses trying to minimize emissions and stay out of trouble with the law. Numerous sectors, such as manufacturing, mining, construction, and chemical processing, are based in North America. Dust collection systems are necessary to regulate dust and other airborne pollutants produced during production operations, and this need is fueled by the region's industrial activity’s ongoing growth and expansion.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global industrial dust collector market include CECO Environmental Corp., Donaldson Group, FLSmidth Cement A/S, Parker Hannifin Corporation, and Nederman, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in November 2022, Camfil Air Pollution Control, a global manufacturer of industrial dust and mist collection systems, announced plans to build a groundbreaking innovative manufacturing and office building.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial dust collector market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. B y Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Thermax, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Donaldson Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. FLSmidth Cement A/S

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Industrial Dust Collector Market by Type

4.1.1. Baghouse Dust Collector

4.1.2. Cartridge Dust Collector

4.1.3. Electrostatic Precipitator (ESP)

4.1.4. Inertial Separators

4.1.5. Wet Scrubbers

4.2. Global Industrial Dust Collector Market by End-User

4.2.1. Cement

4.2.2. Chemical Processing

4.2.3. Food Processing

4.2.4. Pharmaceuticals

4.2.5. Power Generation

4.2.6. Steel

4.2.7. Manufacturing

4.2.8. Mining

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AAF International

6.2. Airflow Systems

6.3. Baghouse America

6.4. Camfil APC

6.5. CECO Environmental Corporation

6.6. Clarcor Industrial Air

6.7. Dynavac India Pvt. Ltd.

6.8. Hamun Aria Industrial Development Group

6.9. Imperial Systems, Inc.

6.10. Keller USA Inc.

6.11. Nederman Holding AB

6.12. Noes Air Filtration

6.13. Parker Hannifin Corporation

6.14. Schenck Process Europe GmbH

6.15. SLY, LLC.

6.16. Teldust A/S

1. GLOBAL INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL INDUSTRIAL BAGHOUSE DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL INDUSTRIAL CARTRIDGE DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL INDUSTRIAL ESP DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL INDUSTRIAL INERTIAL SEPARATORS DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL INDUSTRIAL WET SCRUBBERS DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

8. GLOBAL INDUSTRIAL DUST COLLECTOR FOR CEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL INDUSTRIAL DUST COLLECTOR FOR CHEMICAL PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL INDUSTRIAL DUST COLLECTOR FOR FOOD PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL INDUSTRIAL DUST COLLECTOR FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL INDUSTRIAL DUST COLLECTOR FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL INDUSTRIAL DUST COLLECTOR FOR STEEL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL INDUSTRIAL DUST COLLECTOR FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL INDUSTRIAL DUST COLLECTOR FOR MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. EUROPEAN INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. EUROPEAN INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

26. REST OF THE WORLD INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD INDUSTRIAL DUST COLLECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL INDUSTRIAL DUST COLLECTOR MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL INDUSTRIAL BAGHOUSE DUST COLLECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL INDUSTRIAL CARTRIDGE DUST COLLECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL INDUSTRIAL ESP DUST COLLECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL INDUSTRIAL INERTIAL SEPARATORS DUST COLLECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL INDUSTRIAL WET SCRUBBERS DUST COLLECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL INDUSTRIAL DUST COLLECTOR MARKET SHARE BY END-USER, 2023 VS 2031 (%)

8. GLOBAL INDUSTRIAL DUST COLLECTOR FOR CEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL INDUSTRIAL DUST COLLECTOR FOR CHEMICAL PROCESSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL INDUSTRIAL DUST COLLECTOR FOR FOOD PROCESSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL INDUSTRIAL DUST COLLECTOR FOR PHARMACEUTICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL INDUSTRIAL DUST COLLECTOR FOR POWER GENERATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL INDUSTRIAL DUST COLLECTOR FOR STEEL MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL INDUSTRIAL DUST COLLECTOR FOR MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL INDUSTRIAL DUST COLLECTOR FOR MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL INDUSTRIAL DUST COLLECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

19. UK INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA INDUSTRIAL DUST COLLECTOR MARKET SIZE, 2023-2031 ($ MILLION)