Industrial Electrical Heating Element Market

Industrial Electrical Heating Element Market & Trends Analysis Report byProduct (Immersion Heaters, Tubular Heaters, and Circulation Heaters) and by Application (Oil and Gas, Building Construction, Food Industry and Pharmaceuticals Industry) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Industrial electrical heating element market is anticipated to grow at a CAGR of 3.5% during the forecast period.The surge in demand for electrical heating equipment is a primary factor contributing to the growth of the global market. The demand is increased owing to the various advantages associated with it including temperature-controlled processes and clean heating.Additionally,it is a noise-free device that is easy to operate and economical in terms of installation and running.

Another factor propelling the market growth includesthe rising demand for electrical heating equipment among various industries along with the contribution of major player such as Leminar Air Conditioning Co., Rheem, and Tempco Electric Heater Corp., that adopted numerous tactical moves which include collaboration, partnership, and expansion to stay competitve in the global is expected to drive the market growth during the forecast period. For instance, in August 2022, Leminar Air Conditioning Co. signed a distribution agreement with Rheem. The partnership fortifies the three-decades-long collaboration between the two companies expanding its portfolio of cooling solutions to include efficient water and air heating offerings. Moreover, the partnership has enabled both companies to continue to jointly cater to the needs of the UAE market and bring a more extensive selection of futuristic air and water turnkey solutions to the region through Rheem’s wide range of products in both sectors.

Segmental Outlook

The global industrial electrical heating element market is segmented based on product and application. Based on the product, the market is sub-segmented into immersion heaters, tubular heaters, and circulation heaters. Based on application, the market is sub-segmented into oil and gas, building construction, food industry and the pharmaceutical industry.Among the application, the building construction segment is expected to grow at a significant rate, owing to the rising number of various construction projects across the globe.However,the pharmaceutical industry is expected to holda favorableshare of the market owing to the wider application of heaters in hospitals, and clinics for storing medicinal drugs, and other medical instruments.

Among the product, the tubular heaters sub-segment is anticipatedto grow at a significant CAGR in the global industrial electrical heating element market. The growing demand for tubular heaters from end-use sectors, such as commercial, industrial and scientific is driving the demand for tubular heaters. Moreover, the growing trend of greenhouse plants to save the environment has increased the demand for heating devices as well as the latest technological advancements in heaters, especially in tabular categories such as U-shape, and S tabular heaters driving the segment growth. For instance, according to the US Environmental Protection Agency (EPA), nearly 27% of greenhouse gas emissions in generated by the transportation sector in 2020, and 24% is generated by the burning of fossil fuels for energy. Hence, owing to the reduction in greenhouse gas emissions and increasing application of tubular heaters in various industries, boost the segment growth during the forecast period.

Regional Outlooks

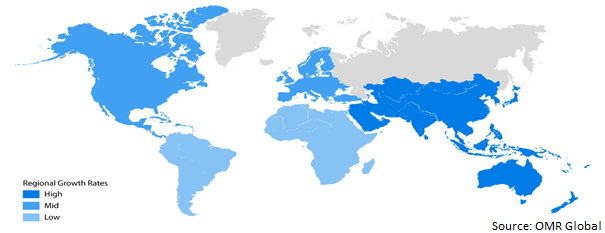

The global industrial electrical heating element market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America).

The European region is anticipated to have progressive growth during the forecast period. Factors attributing regional growth are the growing demand for efficient engineering equipment across the region and the adoption of technology in heating processes in electrical heating elements are the key demand drivers for the market. In October 2022, Panasonic announced to launch of three new versions of its air-to-water (A2W) Aquarea heat pumps, which use R290 natural refrigerant, in Europe in May 2023. A2W Aquarea is developed based on energy-saving technology refined with its Eco Cute and air conditioners.

Global Industrial Electrical Heating Element Market Growth, by Region 2022-2028

The Asia-Pacific Region is Anticipated to Grow at a Considerable CAGR in the Global Industrial Electrical Heating Element

The Asia-Pacific region is expected to witnessed a singnificant market share and likely to maintain its dominance throughout the forecast period.

. The growth of the market is primarily attributed to the growing use of industrial electrical elements in food, pharmaceutical, semiconductor, and other industries. Moreover,China has a large number of distributors and manufacturers of industrial elements compared to other regions, which in turn drives the market growth. According to th Observatory of Economic ComplexityWorld (OEC), in 2020, China is the top exporter of electric heaters with an export worth $24.7 billion in electric heaters, followed by Germany, and Italy. Moreover, as per China's General Administration of Customs in September 2022, the country's exports of electric blankets and electric heaters has reached to 97% and 23% year-on-year, respectively, in the first seven months in 2022.

Market Players Outlook

The major companies serving the global industrial electrical heating element market include Chromalox, Durexindustries, Freek GmbH, Headway Electric Heat products Co.,Ltd., Heatact Super Conductive Heat - Tech Co., Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance,inFebruary 2020, NIBE Industrier AB acquired Nathan Holding B.V. Following the acquisition, it is expected that NIBE will be able to strengthen its position as a leading provider of heating and cooling solutions in Europe.

The Report Covers

- Market value data analysisof 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial electrical heating element market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. ByRegion

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Industrial Electrical Heating Element Market by Product

4.1.1. Immersion Heaters

4.1.2. Tubular Heaters

4.1.3. Circulation Heaters

4.2. Global Industrial Electrical Heating Element Market by Application

4.2.1. Oil and Gas

4.2.2. Building Construction

4.2.3. Pharmaceuticals Industry

4.2.4. Food Industry

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Chromalox

6.2. Durexindustries

6.3. Freek Gmbh

6.4. Headway Electric Heat PRODUCTts Co.,Ltd.

6.5. Heatact Super Conductive Heat - Tech Co., Ltd.

6.6. Hotset GmbH

6.7. Minco

6.8. Nibe

6.9. Omega Heater

6.10. Tempco Electric Heater Corp.

6.11. Thermowatt S.p.A

6.12. Tutco Heating Solutions Group

6.13. Zhenjiang Dongfang Electric Heating Technology Co.,Ltd.

6.14. Zoppas Industries

1. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL IMMERSION HEATERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL TUBULAR HEATERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL CIRCULATION HEATERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT IN OIL AND GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT IN BUILDING CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT IN PHARMACEUTICALS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT IN FOOD INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. NORTH AMERICANINDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

12. NORTH AMERICAN INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. EUROPEAN INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

15. EUROPEAN INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. REST OF THE WORLD INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

21. REST OF THE WORLD INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SHARE BYPRODUCT, 2021 VS 2028 (%)

2. GLOBAL IMMERSION HEATERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL TUBUALR HEATERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBALCIRCUALTION HEATERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

6. GLOBALINDUSTRIAL ELECTRICAL HEATING ELEMENT IN OIL AND GAS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT IN BUILDING CONSTRUCTION MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBALINDUSTRIAL ELECTRICAL HEATING ELEMENT IN PHARMACEUTICALS INDUSTRY MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL INDUSTRIAL ELECTRICAL HEATING ELEMENT IN FOOD INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)GLOBALINDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. US INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

12. UK INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALYINDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIAIN DUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

21. SOUTH KOREA INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF ASIA-PACIFIC INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD INDUSTRIAL ELECTRICAL HEATING ELEMENT MARKET SIZE, 2021-2028 ($ MILLION)