Industrial Fasteners Market

Global Industrial Fasteners Market Size, Share & Trends Analysis Report by Product Type (Threaded, Non-threaded, and Specialty), by Material (Metal and Non-metal), and by End-user (Automotive, Aerospace, Construction, Consumer Appliance and Furniture, and Industrial and Consumer Machinery) Forecast Period (2021-2027) Update Available - Forecast 2025-2031

Global industrial fasteners market is growing at a CAGR of 4.3% during the forecast period. A fastener can be defined as a hardware device that mechanically joins or affixes two or more objects together. Industrial fasteners are used to create non-permanent joints and can made with metals such as iron, copper, steel, titanium, and other mellitic alloys as well as non-metals like plastic and its variants. These fasteners are used in several end-user industries such as automotive, aerospace, construction, machine manufacturing, and consumer appliances, and furniture.

The increasing dominance of innovations in manufacturing, construction, need for increasing number of machines, the growing demand for consumer appliances and forging machines across all geographies have enabled the industry to focus on improvement in productivity and product innovation. The competitive nature of the automotive, aerospace, IT, and defense industries has led to these sectors demanding high-quality, value-added outputs through efficient designs and strong fastening abilities. The growth of the industrial fasteners market can also be gauged by the order book of the manufacturing and machine tools industry, which is expected to present double-digit growth in coming years.

The rapidly spreading COVID-19 pandemic in early 2020 has greatly affected the global manufacturing and industrial outlook. The momentum for new orders and expansion of manufacturing capabilities has reduced globally, both in terms of production and stimulation of new and replacement demand in all sectors. The stringent government policies and regulations from the local and national governments greatly restricted the movement of supplies, activities at production facilities, and logistics of finished goods from manufacturers to consumers. Such situations became highly challenging for OEM and MRO clients, which together comprise the largest base for industrial applications.

Segmental Outlook

The global industrial fasteners market is segmented based on product type, material, and end-user. Based on product type, the industrial fasteners market is segmented into threaded, non-threaded, and specialty. Based on material, the industrial fasteners market is segmented into metal and non-metal. On the basis of end-user, the market is classified into automotive, aerospace, construction, consumer appliance and furniture, and industrial and consumer machinery. The construction segment is the one of the largest in terms of expected revenue addition to the industrial fasteners market through 2026. Rising construction activities in residential, commercia, and civic infrastructure sectors bode well for the industrial fasteners market.

Industry 4.0 and Smart Manufacturing

The advancements in production technologies, enhancements in product features, and high focus on integrated services are molding the core of manufacturing organizations in recent years, and this trend is expected to continue during the forecast period. The advent of Industry 4.0 is driving the sales of all fastener types, and the rise in smart manufacturing is expected to drive the demand for specialty fasteners and fasteners made with innovative materials.

Regional Outlook

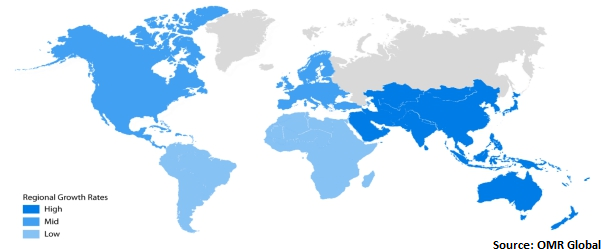

The global hand tools market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific is leading the market in 2020 in terms of growth rate. Airbus predicted that MRO solutions are expected to increase at an average annual rate of 4.50% in the Asia-Pacific region compared to the global rate of 3.70% in 2020. This substantial development in the aviation sector is expected to boost the fasteners market in the growing economies of the Asia-Pacific region. Further, the investments being channeled into expansion have been rapid, especially in Europe and the APAC region. Europe is also set for revision in contracts due to UK-Brexit, which is likely to change the operating landscape of manufacturing and construction.

Global Industrial Fasteners Market Growth, by Region 2021-2027

Market Players Outlook

The global fasteners market is highly fragmented with no major vendors taking up a significant share in the market. The number of fastener manufacturers is also considerable in almost all manufacturing countries. For instance, Japan has over 3,000 manufacturers with the capacity of manufacturing fasteners worth $9 billion annually. The market is characterized by vendors that are application-specific, product-specific, or multiple-service vendors at any point in time. Some of the major market players include A&G Fasteners, ARaymond, Berkshire Hathaway Inc., Boltfast, Caparo Group, Ever Hardware Industrial Limited, Gruppo Fontana S.r.l., Howmet Aerospace Inc., Kamax Group, NIFCO INC., and Stanley Black & Decker, Inc.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hand tools market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Berkshire Hathaway Inc.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Gruppo Fontana S.r.l.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Illinois Tool Works Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. NIFCO INC.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. Stanley Black & Decker, Inc.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Industrial Fasteners Market by Product Type

5.1.1. Threaded

5.1.2. Non-threaded

5.1.3. Specialty

5.2. Global Industrial Fasteners Market by Material

5.2.1. Metal

5.2.2. Non-metal

5.3. Global Industrial Fasteners Market by End-user

5.3.1. Automotive

5.3.2. Aerospace

5.3.3. Construction

5.3.4. Consumer Appliance and Furniture

5.3.5. Industrial and Consumer Machinery

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. A.Agrati S.p.A.con Unico Socio

7.2. A&G Fasteners

7.3. Aoyama Seisakusho Co., Ltd.

7.4. ARaymond

7.5. B&B Specialties, Inc.

7.6. Berkshire Hathaway Inc.

7.7. Boltfast

7.8. Bulten AB (publ)

7.9. Caparo Group

7.10. CBC FASTENERS PTY (LTD).

7.11. Deepak Fasteners Limited

7.12. EJOT

7.13. Ever Hardware Industrial Limited

7.14. Federal Screw Works

7.15. FUCHS Schraubenwerk GmbH

7.16. Gem-Year Industrial Co., Ltd.

7.17. Gruppo Fontana S.r.l.

7.18. Hilti Corporation

7.19. Howmet Aerospace Inc.

7.20. Illinois Tool Works Inc.

7.21. Kamax Group

7.22. LISI, LLC.

7.23. MacLean-Fogg

7.24. NIFCO INC.

7.25. Stanley Black & Decker, Inc.

7.26. The 3M Company

7.27. Wilhelm Böllhoff GmbH & Co. KG

1. GLOBAL INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

2. GLOBAL THREADED MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL NON-THREADED MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SPECIALTY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

6. GLOBAL METAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL NON-METAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

9. GLOBAL AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL CONSUMER APPLIANCE AND FURNITURE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL INDUSTRIAL AND CONSUMER MACHINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. NORTH AMERICA INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

16. NORTH AMERICAN INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

17. NORTH AMERICAN INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

18. EUROPE INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. EUROPE INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

20. EUROPE INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

21. EUROPE INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

26. REST OF THE WORLD INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

27. REST OF THE WORLD INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

28. REST OF THE WORLD INDUSTRIAL FASTENERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. GLOBAL INDUSTRIAL FASTENERS MARKET SHARE BY PRODUCT TYPE, 2020 VS 2027 (%)

2. GLOBAL INDUSTRIAL FASTENERS MARKET SHARE BY MATERIAL, 2020 VS 2027 (%)

3. GLOBAL INDUSTRIAL FASTENERS MARKET SHARE BY END-USER, 2020 VS 2027 (%)

4. GLOBAL INDUSTRIAL FASTENERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. THE US INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

6. CANADA INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

7. UK INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

8. FRANCE INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

9. GERMANY INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

10. ITALY INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

11. SPAIN INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

12. ROE INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

13. CHINA INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

14. INDIA INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

15. JAPAN INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

16. REST OF ASIA-PACIFIC INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)

17. REST OF THE WORLD INDUSTRIAL FASTENERS MARKET SIZE, 2020-2027 ($ MILLION)