Industrial Lubricants Market

Industrial Lubricants Market Size, Share & Trends Analysis Report by Base Oil Type (Mineral Oil and Bio-based Oil), by Product Type (Hydraulic Oil, Compressor Oil, Metalworking Fluid, Gear Oil, Turbine Oil, Marine Oil, Grease, and Others), and by End-Use Industry (Construction, Metal & Mining Production, Cement Production, Power Generation, Automotive (Vehicle Manufacturing), Chemical, Oil & Gas, Food Processing and Others), Forecast Period (2024-2031)

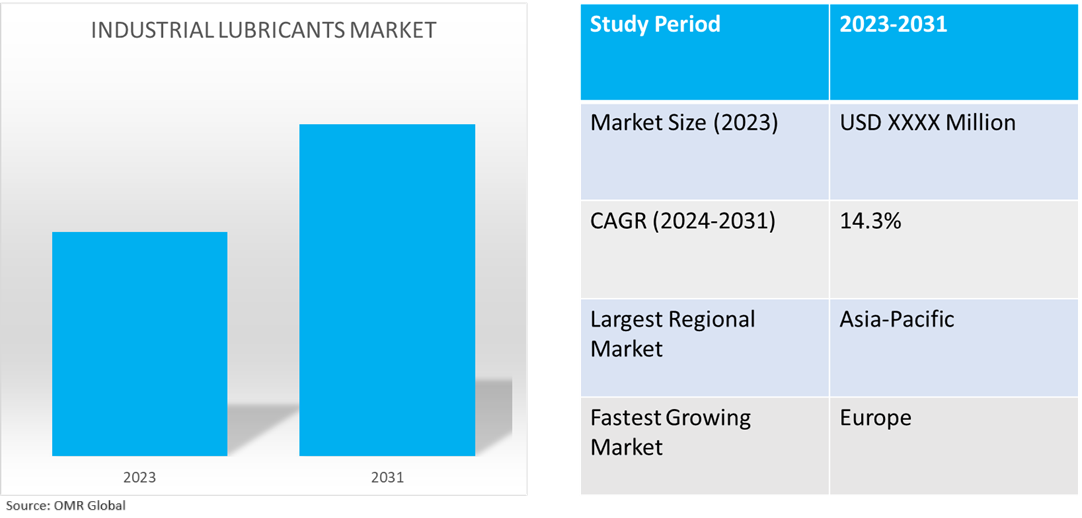

Industrial lubricants market is anticipated to grow at a significant CAGR of 14.3% during the forecast period (2024-2031). The market growth is attributed to the increasing demand for lubricants in various industries such as automotive, industrial machinery, and aerospace to ensure the smooth operation and maintenance of machinery and equipment across different sectors globally. According to the World Metrics Report 2024, the revenue of automotive lubricants in Germany is projected to be approximately $1.8 billion in 2025. It is expected that in 2022, the value of bio-lubricants in the US reach about $2.4 billion.

Market Dynamics

Increasing Adoption of Innovative Lubricating Technologies

Key drivers propelling the growth of the industrial lubricants market include the development of innovative lubricating technologies, stringent laws encouraging the use of environmentally friendly products, an increase in demand for energy-efficient lubricants, and the expansion of manufacturing activities. Many power plants have adopted condition-based maintenance strategies for lubricants, moving away from traditional schedule-based replacements. The simultaneous goals of reducing lubricant consumption and enhancing plant availability can be aligned.

Growing Demand for Biodegradable Lubricants and Sustainability

Globally, there is a tendency toward sustainability that involves several industries, including lubricants. The growing emphasis on developing and application of biodegradable lubricants. The goal of these eco-friendly substitutes is to lessen lubricant disposal's negative environmental effects. By implementing resource-efficient lubricating techniques, manufacturers and end users can also aim to reduce their carbon footprint. Reduce waste, this can entail implementing closed-loop lubricating systems or recycling spent lubricants. Businesses may investigate methods to increase the lifespan of lubricants by utilizing creative recycling and re-refining techniques. This move to a circular economy model is in line with larger international initiatives to cut waste and encourage resource efficiency.

Market Segmentation

- Based on the base oil type, the market is segmented into mineral oil and bio-based oil.

- Based on the product type, the market is segmented into hydraulic oil, compressor oil, metalworking fluid, gear oil, turbine oil, marine oil, grease, and others (gun oil).

- Based on the end-use industry, the market is segmented into construction, metal & mining production, cement production, power generation, automotive (vehicle manufacturing), chemical, oil & gas, food processing, and others (textile).

Bio-based Oil is Projected to Hold the Largest Segment

The bio-based oil segment is expected to hold the largest share of the market. The primary factors supporting the growth include increasing demands of ecological sustainability, emerging patterns, and technological advancements all influence the modern industrial landscape. The industry that produces bio-based lubricants is one that greatly benefits from these features. Comparing bio-lubricants to conventional mineral oil-based lubricants, there are some clear advantages. Their superior lubricity, higher flash points, and reduced volatility contribute to increased safety and efficiency across a range of applications. Furthermore, governments and businesses are becoming more aware of their ecologically friendly qualities, which encourages market choice and regulatory support. For instance, in February 2024, KRATON introduced the Innovative SYLVASOLV™ Biobased Oils product line to deliver superior performance and environmental advantages across many industries, including agrochemicals, adhesives, and lubricants.

Hydraulic Oil Segment to Hold a Considerable Market Share

The hydraulic oil segment is expected to hold a considerable share of the market. Hydraulic fluid is used in so many different industries, it is the most popular product category in the industrial lubricants industry. Hydraulic oil keeps moving components lubricated, promotes effective power transfer, and keeps hydraulic machinery running smoothly. The demand for hydraulic fluid is mostly driven by the growing use of hydraulic equipment in heavy machinery and automobiles. Furthermore, to preserve peak performance and prolong equipment longevity, high-performance hydraulic oils are growing essential as hydraulic technology develops. For instance, in May 2022, Volvo Construction Equipment introduced the latest addition to its hydraulic oil lineup. Volvo Hydraulic Oil 98611 HO103. The new oil is approved and compatible with all Volvo machines across all markets and in crawler excavators extending the drain interval from 2,000 hours to 3,000 hours.

Regional Outlook

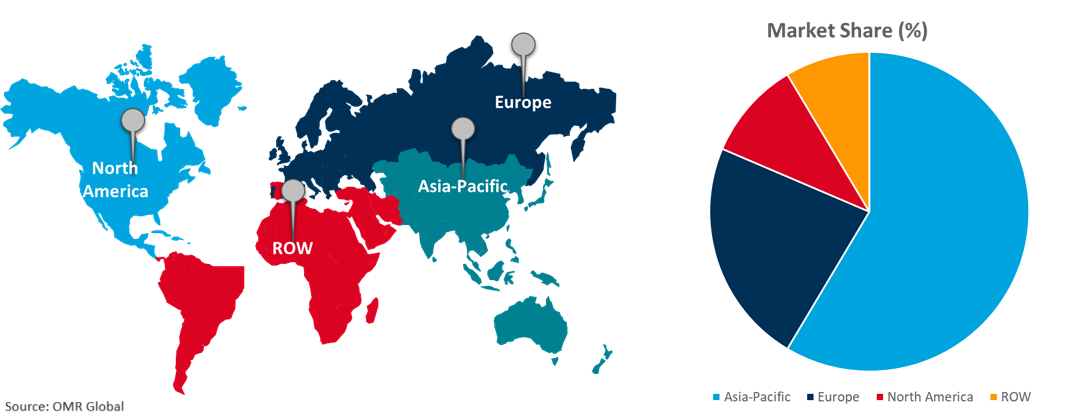

The global industrial lubricants market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand in End-Use Industry in Europe

- The regional growth is attributed to the increased industrial lubricant demand in power generation, automotive (vehicle manufacturing), chemical, and oil & gas industries. According to the United Kingdom Lubricants Association Ltd., in August 2022, the UK was the second largest market for petrochemical lubricants in Europe with a 15.0% market share, second to Germany and ahead of Italy, France, and Spain. The market volume is around 600,000 metric tons a year and is equally split between automotive and industrial applications. The market is comprised of large multinationals that make up around 60.0% of the market volume, and many small and medium-sized enterprises that make up the remaining 40.0%.

- According to the European Commission, in October 2023, the demand for lubricant in the EU electric and fuel cell fleet will be 10.0% of that of a conventional fleet predicting the use of engine oils in the EU. It is assumed that the waste oil generation from the automotive sector currently represents approximately 40.0% of the lubricating oils market. According to the referred study, the EU-27 total waste oil generation will be between 1.7 and 2 million tons in 2050.

Global Industrial Lubricants Market Growth by Region 2024-2031

Asia Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to numerous prominent Industrial Lubricants companies and providers such as China Petroleum & Chemical Corp. (SINOPEC), Indian Oil Corp. Ltd., and Valvoline Cummins Pvt. Ltd., in the region. The regional growth is mainly attributed to the increasing industrialization and urbanization, especially in China and India, which enhance end-use industries including construction, agriculture, and automobile production. Furthermore, the region's industrial lubricant consumption is predicted to rise significantly as further expenditures in infrastructure and automobile manufacturing. According to the Asian Lubricants Industry Association, Asia's share of the global lubricant market translates to an annual consumption of 19–23 billion liters, considering that this amount is worth an estimated $60.0–80.0 billion. The strategic move empowers to establish business coverage and footprint in the lubricants market, allowing partners and customers to provide the services and solutions. For instance, in November 2023, IMCD China entered the lubricants market with the acquisition of Guangzhou RBD Chemical Co., Ltd. RBD focuses mainly on lubricant additives and represents global suppliers. It is based in Guangzhou, China, and generated a revenue of approximately CNY 75.0 million ($11.1 million) in 2022. It has 12 employees.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the industrial lubricants market include BP p.l.c., Chevron Corp., Exxon Mobil Corp., Shell plc, and TotalEnergies SE, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In February 2024, TotalEnergies Lubrifiants and Bericap collaborated to launch a new closure made from recycled plastic. The two key players have joined forces to design a new closure using recycled material. TotalEnergies and Bericap are launching a closure for 20-liter lubricant packaging incorporating 50.0% post-consumer recycled plastic (PCR), in compliance with DIN 60 standards for lubricants.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the industrial lubricants market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BP p.l.c.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Chevron Corporation

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Exxon Mobil Corporation

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Shell Group of Companies

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. TotalEnergies SE

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Industrial Lubricants Market by Base Oil Type

4.1.1. Mineral Oil

4.1.2. Bio-based Oil

4.2. Global Industrial Lubricants Market by Product Type

4.2.1. Hydraulic Oil

4.2.2. Compressor Oil

4.2.3. Metalworking Fluid

4.2.4. Gear Oil

4.2.5. Turbine Oil

4.2.6. Marine Oil

4.2.7. Grease

4.2.8. Others (Gun Oil)

4.3. Global Industrial Lubricants Market by End-Use Industry

4.3.1. Construction

4.3.2. Metal & Mining Production

4.3.3. Cement Production

4.3.4. Power Generation

4.3.5. Automotive (Vehicle Manufacturing)

4.3.6. Chemical

4.3.7. Oil & Gas

4.3.8. Food Processing

4.3.9. Others (Textile)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ADDINOL Lube Oil GmbH

6.2. AMSOIL INC.

6.3. Calumet Branded Products, LLC

6.4. China Petroleum & Chemical Corp. (SINOPEC)

6.5. ENEOS Group

6.6. Enilive S.p.A.

6.7. FUCHS SE

6.8. Idemitsu Kosan Co., Ltd.

6.9. Indian Oil Corporation Ltd.

6.10. KLÜBER LUBRICATION INDIA Pvt. Ltd.

6.11. The Lubrizol Corporation

6.12. Morris Lubricants Online

6.13. MOTUL S.A.

6.14. Petróleo Brasileiro S.A.

6.15. PETRONAS Lubricants International

6.16. Phillips 66 Company

6.17. PJSC LUKOIL

6.18. Quaker Chemical Corp.

6.19. The Dow Chemical Company

6.20. Valvoline Cummins Pvt. Ltd.

1. GLOBAL INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY BASE OIL TYPE, 2023-2031 ($ MILLION)

2. GLOBAL INDUSTRIAL MINERAL LUBRICANTS OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL INDUSTRIAL BIO-BASED LUBRICANTS OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

5. GLOBAL INDUSTRIAL HYDRAULIC LUBRICANTS OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL INDUSTRIAL COMPRESSOR LUBRICANTS OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INDUSTRIAL METALWORKING FLUID LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL INDUSTRIAL GEAR LUBRICANTS OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL INDUSTRIAL TURBINE LUBRICANTS OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL INDUSTRIAL MARINE LUBRICANTS OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL INDUSTRIAL GREASE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL OTHER INDUSTRIAL LUBRICANTS PRODUCT TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

14. GLOBAL INDUSTRIAL LUBRICANTS FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL INDUSTRIAL LUBRICANTS FOR METAL & MINING PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL INDUSTRIAL LUBRICANTS FOR CEMENT PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL INDUSTRIAL LUBRICANTS FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL INDUSTRIAL LUBRICANTS FOR AUTOMOTIVE (VEHICLE MANUFACTURING) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL INDUSTRIAL LUBRICANTS FOR CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL INDUSTRIAL LUBRICANTS FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL INDUSTRIAL LUBRICANTS FOR FOOD PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL INDUSTRIAL LUBRICANTS FOR OTHER END-USE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBAL INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. NORTH AMERICAN INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. NORTH AMERICAN INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY BASE OIL TYPE, 2023-2031 ($ MILLION)

26. NORTH AMERICAN INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

27. NORTH AMERICAN INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

28. EUROPEAN INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. EUROPEAN INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY BASE OIL TYPE, 2023-2031 ($ MILLION)

30. EUROPEAN INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

31. EUROPEAN INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY BASE OIL TYPE, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

36. REST OF THE WORLD INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

37. REST OF THE WORLD INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY BASE OIL TYPE, 2023-2031 ($ MILLION)

38. REST OF THE WORLD INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

39. REST OF THE WORLD INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL INDUSTRIAL LUBRICANTS MARKET SHARE BY BASE OIL TYPE, 2023 VS 2031 (%)

2. GLOBAL INDUSTRIAL MINERAL LUBRICANTS OIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL INDUSTRIAL BIO-BASED LUBRICANTS OIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL INDUSTRIAL LUBRICANTS MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

5. GLOBAL INDUSTRIAL HYDRAULIC LUBRICANTS OIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL INDUSTRIAL COMPRESSOR LUBRICANTS OIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL INDUSTRIAL METALWORKING FLUID LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL INDUSTRIAL GEAR LUBRICANTS OIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL INDUSTRIAL TURBINE LUBRICANTS OIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL INDUSTRIAL MARINE LUBRICANTS OIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL INDUSTRIAL GREASE LUBRICANTS OIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL OTHER INDUSTRIAL LUBRICANTS PRODUCT TYPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL INDUSTRIAL LUBRICANTS MARKET SHARE BY END-USE INDUSTRY, 2023 VS 2031 (%)

14. GLOBAL INDUSTRIAL LUBRICANTS FOR CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL INDUSTRIAL LUBRICANTS FOR METAL & MINING PRODUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL INDUSTRIAL LUBRICANTS FOR CEMENT PRODUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL INDUSTRIAL LUBRICANTS FOR POWER GENERATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL INDUSTRIAL LUBRICANTS FOR AUTOMOTIVE (VEHICLE MANUFACTURING) MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL INDUSTRIAL LUBRICANTS FOR CHEMICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL INDUSTRIAL LUBRICANTS FOR OIL & GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL INDUSTRIAL LUBRICANTS FOR FOOD PROCESSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL INDUSTRIAL LUBRICANTS FOR OTHER END-USE INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. GLOBAL INDUSTRIAL LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

24. US INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

25. CANADA INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

26. UK INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

27. FRANCE INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

28. GERMANY INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

29. ITALY INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

30. SPAIN INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF EUROPE INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

32. INDIA INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

33. CHINA INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

34. JAPAN INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

35. SOUTH KOREA INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

36. REST OF ASIA-PACIFIC INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

37. REST OF THE WORLD INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

38. LATIN AMERICA INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

39. MIDDLE EAST AND AFRICA INDUSTRIAL LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)