Industrial Metrology Equipment Market

Global Industrial Metrology Equipment Market Size, Share & Trends Analysis Report By Equipment (Coordinate Measuring Machine, Optical Digitizer and Scanner, X-Ray and Computed Tomography, Automated Optical Inspection, 2D Equipment, and Gauges), By Application (Reverse Engineering, Quality & Inspection, Mapping & Modelling, Equipment Calibration), By End-User Industry (Automotive & Transportation, Aerospace, Machinery, Biomechanics / Medical, Electrical & Electronics, Others), Forecast Period 2020-2026 Update Available - Forecast 2025-2035

The industrial metrology equipment market is anticipated to grow at a CAGR of 9.3% during the forecast period. Industrial metrology equipment aids in capturing quality data for measurement, positioning, and inspection. Thereafter, the assessment of data with the latest technology and software provides manufacturers with the necessary information about the design and engineering processes and hence enables the achievement of higher levels of productivity and efficiency in production processes. The continuous innovation towards more real-time feedback in metrology with the integration of the latest technologies such as Al and computer assistance is providing growth opportunities to the market. Moreover, the development of various 3D measurement solutions such as portable CMM, robot-mounted optical CMM scanners, and cloud-based software application platforms is also providing significant expansion opportunities to the industrial metrology equipment market. A negative impact on end-user industries is witnessed due to the COVID-19 pandemic in 2020, which will create an adverse effect on the industrial metrology market during the forecast period.

Segmental Outlook

The global industrial metrology equipment market is segmented based on the equipment, application, and end-user industry. Based on the equipment, the market is sub-segmented into coordinate measuring machines, optical digitizer and scanner, x-ray and computed tomography, automated optical inspection, 2D equipment, and Gauges. Further, based on the application the market is sub-segmented into reverse engineering, quality & inspection, mapping & modeling, and equipment calibration. Additionally, the end-user industry segment contains automotive & transportation, aerospace, biomechanics / medical, electrical & electronics, and others.

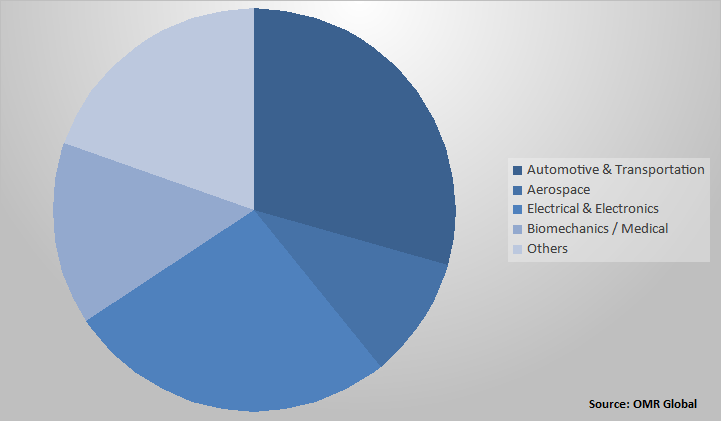

The automotive segment will hold considerable market shares

The automotive segment is anticipated to have a considerable market share in the industrial metrology equipment market during the forecast period owing to the rising automation in the automotive industries across the globe. The industrial metrology equipment used in the automotive industry aids in significantly reducing design-to-production time hence, the adoption of such equipment is high in the automotive industry. The recent trend of the move from off-line quality inspection to near-line or in-line measurement techniques which in turn enable higher sampling rates and faster inspection times is also fueling the adoption of industrial metrology equipment used in automotive.

Global Industrial Metrology Equipment Market Share by End-User Industry, 2019 (%)

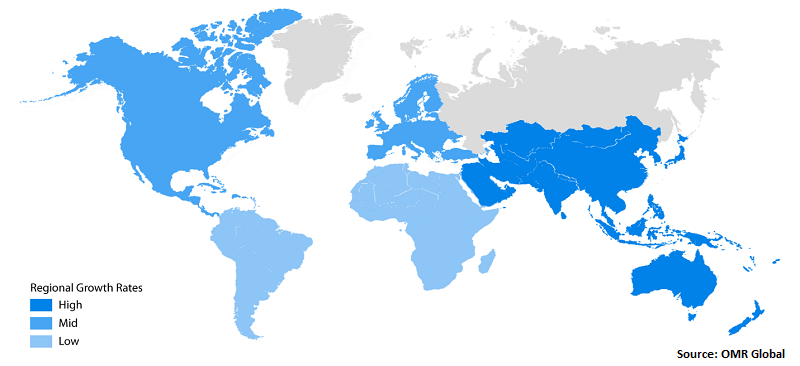

Regional Outlooks

The global industrial metrology equipment market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to be one of the leading regions in the industrial metrology equipment market. North America is home to a number of end-use industries that will significantly impact the growth of the industrial metrology equipment market. In addition to this, the high penetration of technologically advanced industrial processes will also influence the growth of metrology equipment adoption in North America. Furthermore, Europe is also expected to have a substantial market for industrial metrology equipment owing to the presence of a large base of key end-user industries in the region.

Global Industrial Metrology Equipment Market Growth, by Region 2020-2026

Asia-Pacific will have considerable shares in the global Industrial Metrology Equipment market

The Asia Pacific is estimated to hold considerable shares in the global industrial metrology equipment market during the forecast period. The presence large base of end-user industries in the countries such as China, Japan, India, and ASEAN will provide various expansion opportunities to the industrial metrology equipment market in Asia-Pacific. Additionally, the continuous technological advancements coupled with the extensive government support to the industries are also fueling the growth of the industrial metrology equipment market across the region.

Market Players Outlook

The key players of the Industrial Metrology Equipment market include Carl Zeiss AG, FARO Technologies, Inc., Hexagon AB, Jenoptik AG, Nikon Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers, and acquisitions, collaborations, funding to the start-ups, and new product launches to stay competitive in the market.

Recent Activity

- In November 2020, Nikon Corp. released the NEXIV CNC Video Measuring System model range called “NEXIV VMZ-S3020”, which is the first lineup of the “NEXIV VMZ-S” series. This is most suitable for measuring semiconductor and electronic components as well as the associated tooling.

- In October 2020, Nikon Corp., as part of a large volume non-contact measuring system APDIS (Accurate Precision Distance Scanning) series released four products that are APDIS MV430, APDIS MV450, APDIS MV430E, and APDIS MV450E. These can measure the 3D coordinates of an object in a non-contact manner on a large scale with an accuracy of tens of micrometers. These can be deployed and installed in various places including production lines, robot arms, and large machine tools which will contribute to improved productivity in automobile and other manufacturing plants.

- In February 2020, KLA Corp. introduced the Archer 750 imaging-based overlay metrology system and the SpectraShape 11k optical critical dimension ("CD") metrology system for integrated circuit (IC) manufacturing. The new metrology systems are intended to assist IC manufacturers to maintain strict control of the complex processes required to bring high-performance memory and logic chips to market, for applications such as 5G, AI, data centers, and edge computing.

- In June 2018, Jenoptik AG invested $13 million in a new production facility for industrial metrology in Villingen-Schwenningen, Germany. The facility is expected to be ready by the end of 2020 with a modern laboratory, testing and production areas, and the space for services and customer support.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Industrial Metrology Equipment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Carl Zeiss AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. FARO Technologies, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Hexagon AB

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Jenoptik AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Nikon corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Industrial Metrology Equipment Market by Equipment

5.1.1. Coordinate Measuring Machine (CMM)

5.1.2. Optical Digitizer and Scanner

5.1.3. X-Ray and Computed Tomography

5.1.4. Automated Optical Inspection

5.1.5. 2D Equipment

5.1.6. Gauges

5.2. Global Industrial Metrology Equipment Market by Application

5.2.1. Reverse Engineering

5.2.2. Quality & Inspection

5.2.3. Mapping & Modelling

5.2.4. Equipment Calibration

5.3. Global Industrial Metrology Equipment Market by End-User Industry

5.3.1. Automotive & Transportation

5.3.2. Aerospace

5.3.3. Machinery

5.3.4. Biomechanics / Medical

5.3.5. Electrical &Electronics

5.3.6. Others (Energy, Military & Defense, Marine, Plastics)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accretech (Tokyo Seimitsu Co., LTD)

7.2. Applied Materials, Inc.

7.3. Automated Precision, Inc. (API)

7.4. Bruker Corp.

7.5. Carl Zeiss AG

7.6. Carmar Accuracy Co., Ltd.

7.7. Creaform Inc.

7.8. FARO Technologies, Inc.

7.9. General Electric Co.

7.10. Hexagon AB

7.11. InnovMetric Software Inc.

7.12. Innovalia Metrology

7.13. Jenoptik AG

7.14. Keyence Corp.

7.15. KLA Corp.

7.16. L S Starrett Co.

7.17. Metrologic Group (Advanced Theodolite Technology, Inc.)

7.18. Mitutoyo Corp.

7.19. Nikon Corp.

7.20. Olympus Corp.

7.21. Perceptron, Inc. (Atlas Copco AB)

7.22. Pollen Technology SAS

7.23. Prolink Software Corp.

7.24. Renishaw plc

7.25. The Sempre Group Ltd.

7.26. TriMet Metroloy

7.27. Yokogawa Electric Corp.

1. GLOBAL INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

2. GLOBAL COORDINATE MEASURING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL OPTICAL DIGITIZER AND SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL MEASURING INSTRUMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL X-RAY AND COMPUTED TOMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL AUTOMATED OPTICAL INSPECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL 2D EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL GAUGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

10. GLOBAL REVERSE ENGINEERING INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL QUALITY & INSPECTION INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL MAPPING & MODELLING INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL EQUIPMENT CALIBRATION INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

15. GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL AEROSPACE INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL ELECTRICAL & ELECTRONICS INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL BIOMECHANICS / MEDICAL INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

19. GLOBAL OTHERS INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

20. GLOBAL INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

21. NORTH AMERICAN INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. NORTH AMERICAN INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

23. NORTH AMERICAN INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. NORTH AMERICAN INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

25. EUROPEAN INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

26. EUROPEAN INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

27. EUROPEAN INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

28. EUROPEAN INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

29. ASIA-PACIFIC INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

33. REST OF THE WORLD INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

34. REST OF THE WORLD INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

35. REST OF THE WORLD INDUSTRIAL METROLOGY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY EQUIPMENT, 2019 VS 2026 (%)

2. GLOBAL INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY END-USER INDUSTRY, 2019 VS 2026 (%)

4. GLOBAL INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. GLOBAL COORDINATE MEASURING MACHINE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

6. GLOBAL OPTICAL DIGITIZER AND SCANNER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

7. GLOBAL X-RAY AND COMPUTED TOMOGRAPHY INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

8. GLOBAL AUTOMATED OPTICAL INSPECTION INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

9. GLOBAL 2D EQUIPMENT INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

10. GLOBAL GAUGES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

11. GLOBAL REVERSE ENGINEERING INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

12. GLOBAL QUALITY & INSPECTION INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

13. GLOBAL MAPPING & MODELLING INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

14. GLOBAL EQUIPMENT CALIBRATION INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

15. GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

16. GLOBAL AEROSPACE INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

17. GLOBAL MACHINERY INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

18. GLOBAL BIOMECHANICS / MEDICAL INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

19. GLOBAL ELECTRICAL & ELECTRONICS INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

20. GLOBAL OTHERS END USER INDUSTRY INDUSTRIAL METROLOGY EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

21. US INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

22. CANADA INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

23. UK INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

24. FRANCE INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

25. GERMANY INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

26. ITALY INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

27. SPAIN INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

28. REST OF EUROPE INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

29. INDIA INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

30. CHINA INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

31. JAPAN INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

32. REST OF ASIA-PACIFIC INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

33. REST OF THE WORLD INDUSTRIAL METROLOGY EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)