Industrial Nitrogen Market

Industrial Nitrogen Market Size, Share & Trends Analysis Report, By Form (Liquid Nitrogen and Compressed Nitrogen), By End-User (Food & Beverage, Petrochemicals, Metal Manufacturing & Fabrication, Oil & Gas, Pharmaceutical & Healthcare, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2031

industrial nitrogen market is expected to grow at a CAGR of 7.6% during the forecast period. The growing demand for industrial nitrogen from end-user industries including food & beverage, petrochemicals, metal manufacturing & fabrication, and oil & gas among others is a key factor driving the growth of the global industrial nitrogen market. The rise in demand for industrial nitrogen in the chemical industry is anticipated to offer lucrative opportunities to the global industrial nitrogen market. The constant advancements made in cryogenic fraction distillation technology are further contributing to the market growth. However, the dearth of universal directives about applications of industrial nitrogen is anticipated to hinder the growth of the global industrial nitrogen market during the forecast period.

Segmental Outlook

The global industrial nitrogen market is segmented by form and end-user. The market segmentation based on the form includes liquid nitrogen and compressed nitrogen. Among form, liquid nitrogen is anticipated to exhibit significant CAGR during the forecast period. Increased incidence of brain and spinal cord tumors among adults and the subsequent rise in product demand for use in applications such as MRI machines is a major contributing factor to the growth of this market segment. Based on the end-user, the market is classified into food & beverage, petrochemicals, metal manufacturing & fabrication, oil & gas, pharmaceutical & healthcare, and others.

Food & Beverage Held Considerable Share in the Global Industrial Nitrogen Market

Based on end-user, the food & beverage segment held a considerable share in the global industrial nitrogen market. Nitrogen is commonly utilized in multiple steps of food and beverage manufacturing, packaging, and storage. The use of nitrogen in food packaging and processing aims to preserve the shelf life of processed food/drinks. This works by removing food oxidants, preventing rancidity, and preserving flavor. The requirements of food-grade nitrogen gas requirements usually fall between 98-99.5% purity.

Electronics is expected to emerge as a major end-user industry for industrial nitrogen. The considerable increase in spending on laptops, gaming consoles, and other electronics during the COVID-19 pandemic has driven the market demand. As the nitrogen gas soldering of electronic parts is considered an efficient process that ensures high-quality finishes, the surging product demand will promote industrial nitrogen supply during the forecast period.

Regional Outlook

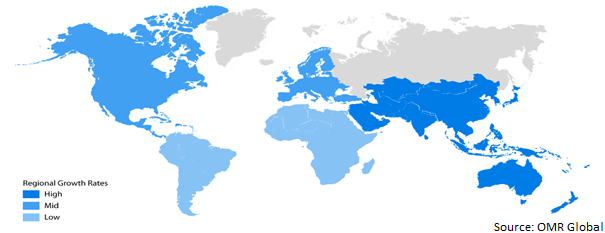

The global industrial nitrogen market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Europe is anticipated to exhibit the highest CAGR in the global industrial nitrogen market. The factor that is propelling the growth of the market in the region includes the growing demand for industrial nitrogen from several end-user industries including healthcare, food & beverage, and oil & gas, among others.

Global Industrial Nitrogen Market Growth, by Region 2022-2028

Asia-Pacific Held Potential Share in the Global Industrial Nitrogen Market

Asia-Pacific held a considerable share in the global industrial nitrogen market. Rapid industrialization, various advancements in the healthcare sector and pharmaceutical industries that are the key consumers of industrial nitrogen are one of the key factors contributing to the growth of the regional market. The high demand for fertilizers containing ammonia found in Agrarian countries, such as India and China, to enhance soil fertility within the region is further contributing to the regional market growth. According to the India Brand Equity Federation (IBEF), India's food and beverage industry currently stands at $40.3 billion and has reached $66.3 billion in 2018, registering a growth of 18.0%. With a huge agriculture sector, abundant livestock, and cost competitiveness, India is fast emerging as a sourcing hub for processed food. The growing food and beverage industry of India and China is creating a significant opportunity for market growth in the region.

Market Players Outlook

The major companies operating in the global industrial nitrogen market include Air Products and Chemicals, Air Liquide S.A., and Linde plc, among others. The companies are focusing on production capacity expansions, mergers and acquisitions, and finding a new market or innovation in their core competency to expand individual market share. For instance, in June 2022, Air Products signed a long-term supply agreement with the state-owned Indian Oil Corp. Ltd. (IOCL) to build an industrial gas complex. The industrial gas complex will include the latest generation multi-feed hydrogen production facility supplying 70,000 normal cubic metres per hour (Nm3/hr) of hydrogen as well as steam, and a high-efficiency air separation unit producing 4,000 Nm3/hr of nitrogen,

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial nitrogen market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Industrial Nitrogen Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Industrial Nitrogen Market, By Form

4.1.1. Liquid Nitrogen

4.1.2. Compressed Nitrogen

4.2. Global Industrial Nitrogen Market, By End-User

4.2.1. Food & Beverage

4.2.2. Petrochemicals

4.2.3. Metal Manufacturing & Fabrication

4.2.4. Oil & Gas

4.2.5. Pharmaceutical & Healthcare

4.2.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Air Liquide

6.2. Air Products and Chemicals

6.3. Aspen Air Corp.

6.4. Bhuruka Gases Ltd.

6.5. Bombay Oxygen Corp. Ltd.

6.6. Canair Nitrogen Inc.

6.7. Cross Country Infrastructure Services Inc.

6.8. Cryotec

6.9. Ellenbarrie Industrial Gases

6.10. Emirates Industrial Gases Co. LLC

6.11. Gulf Cryo

6.12. Linde plc

6.13. Messer Group

6.14. Nexair Inc.

6.15. Praxair Inc.

6.16. Southern Industrial Gas Berhad

6.17. Sudanese Liquid Air Company

6.18. Taiyo Nippon Sanso

6.19. Universal Industrial Gases

6.20. Yingde Gases Group Company

1. GLOBAL INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

2. GLOBAL LIQUID NITROGEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL COMPRESSED NITROGEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

5. GLOBAL INDUSTRIAL NITROGEN IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL INDUSTRIAL NITROGEN IN PETROCHEMICALS MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL INDUSTRIAL NITROGEN IN METAL MANUFACTURING & FABRICATION MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL INDUSTRIAL NITROGEN IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL INDUSTRIAL NITROGEN IN PHARMACEUTICAL & HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL INDUSTRIAL NITROGEN IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. NORTH AMERICAN INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

14. NORTH AMERICAN SMART SYRNGE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

15. EUROPEAN INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

17. EUROPEAN INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. REST OF THE WORLD INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. REST OF THE WORLD INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

23. REST OF THE WORLD INDUSTRIAL NITROGEN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL INDUSTRIAL NITROGEN MARKET SHARE BY FORM, 2021 VS 2028(%)

2. GLOBAL INDUSTRIAL NITROGEN MARKET SHARE BY END-USER, 2021 VS 2028(%)

3. GLOBAL INDUSTRIAL NITROGEN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028(%)

4. GLOBAL LIQUID NITROGEN MARKET SHARE BY REGION, 2021 VS 2028(%)

5. GLOBAL COMPRESSED NITROGEN MARKET SHARE BY REGION, 2021 VS 2028(%)

6. GLOBAL INDUSTRIAL NITROGEN IN FOOD & BEVERAGE MARKET SHARE BY REGION, 2021 VS 2028(%)

7. GLOBAL INDUSTRIAL NITROGEN IN PETROCHEMICALS MARKET SHARE BY REGION, 2021 VS 2028(%)

8. GLOBAL INDUSTRIAL NITROGEN IN METAL MANUFACTURING & FABRICATION MARKET SHARE BY REGION, 2021 VS 2028(%)

9. GLOBAL INDUSTRIAL NITROGEN IN OIL & GAS MARKET SHARE BY REGION, 2021 VS 2028(%)

10. GLOBAL INDUSTRIAL NITROGEN IN PHARMACEUTICAL & HEALTHCARE MARKET SHARE BY REGION, 2021 VS 2028(%)

11. GLOBAL INDUSTRIAL NITROGEN IN OTHER END-USERS MARKET SHARE BY REGION, 2021 VS 2028(%)

12. GLOBAL INDUSTRIAL NITROGEN MARKET SHARE BY REGION, 2021 VS 2028(%)

13. US INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

15. UK INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD INDUSTRIAL NITROGEN MARKET SIZE, 2021-2028 ($ MILLION)