Industrial Packaging Market

Global Industrial Packaging Market Size, Share & Trends Analysis Report, By Product (IBCs, Drums, Sacks, Pails, Crates, and Others), By Material (Plastic, Metal, Wood, Paperboard, and Others), By End-User Vertical (Food and Beverage, Chemical and Pharmaceutical, Building and Construction, Automotive, Oil and Gas, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global industrial packaging market is estimated to grow at a CAGR of nearly 4.8% during the forecast period. Significant application in end-user industries and rising international trade are primarily driving the market growth. Industrial packaging has a potential application across industries for protection, shipping, and storing a comprehensive range of products. Normally, it is employed at the manufacturing site, after production. However, industrial packaging products can be utilized at any stage of the supply chain. This kind of packaging is normally utilized for sensitive products and products that are dependent heavily on stability. In addition, it is used for bulky or hazardous products or for components that are sensitive to each other.

Industrial packaging is normally used by the highly sensitive equipment manufacturers, automotive industry, machinery manufacturers, technology industry, and others that need the protection of their products from everything ranging from moisture to vibrations. Protection is the major objective of properly designed packaging for industrial applications. Packaging which is designed for protection of industrial goods can ensure products’ safety during shipping and enables to preserve the product during long storage duration. It offers hermetically sealed protection against moisture, contaminants, and more. A comprehensive range of customizations is available for the protection of products that comprise environmental-friendly options. Some customizable options comprise dunnage bags, plastic pallets, covers, pouches, and more.

Industrial packaging materials include wood, stainless steel, corrugated cardboard, and polypropylene. Wood include wooden boxes, derails board, wood board, plywood, skids, and more. Combination of materials is used for packaging of industrial products to ensure secure, safe storage and shipping of the products. Generally, a combination of materials is applied to work together to offer superior results. For instance, corrugated cardboard combined with plastic forms or wood blocks combined with stainless sheets. Determining the combination of materials rely on the product. Industrial packaging meets the need for sturdy packaging which has major importance in any production site. Therefore, industrial packaging plays a vital role in food and beverage, pharmaceutical, chemical, automotive, and other manufacturing industries.

Market Segmentation

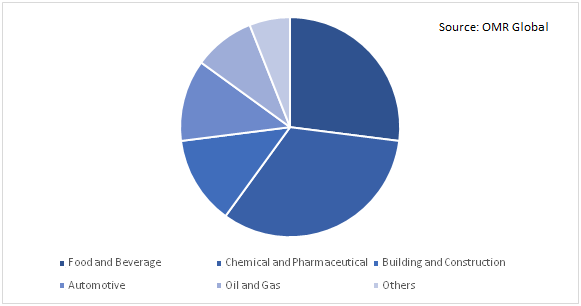

The global industrial packaging market is segmented into product, material, and end-user vertical. Based on the product, the market is classified into Intermediate bulk containers (IBCs), drums, sacks, pails, crates, and others. Based on material, the market is classified into plastic, metal, wood, paperboard, and others. Based on end-user vertical, the market is classified into food and beverage, chemical and pharmaceutical, building and construction, automotive, oil and gas, and others.

Industrial Packaging Finds Significant Application in Pharmaceutical Packaging

Growing pharmaceutical industry is significantly contributing to the increasing demand for industrial packaging products. The pharmaceutical industry is witnessing enormous growth across the globe owing to the increasing prevalence of chronic and infectious diseases. North America is the major producer of pharmaceuticals. As per the European Federation of Pharmaceutical Industries and Associations (EFPIA), 65.2% of sales of new medicines introduced between 2013-2018 were on the US market than 17.7% on the European market. In 2017, the US spent nearly $55.8 billion in pharmaceutical R&D, which is the largest compared to other regions.

This is expected to accelerate the demand for industrial packaging products in pharmaceutical products. IBCs are being significantly used for liquids and particulates (such as powders, granulates, and resins), products that after undergo filling into smaller packaging or will be a component or an ingredient in a manufacturing process. In pharmaceutical manufacturing, IBCs are extensively used for storage and transportation. The growing in-container applications, blending vessels is further encouraging the demand for IBCs.

Global Industrial Packaging Market Share by End-User Vertical, 2019 (%)

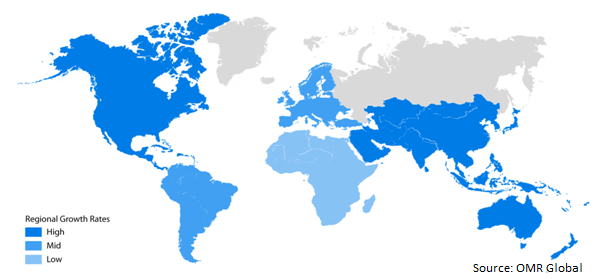

Regional Outlook

Geographically, in 2019, Asia-Pacific is estimated to hold a potential share in the market. The significant production base of chemicals, pharmaceutical, and food and beverages are the major factors encouraging the demand for industrial packaging in the region. Foreign companies are expanding their production facilities in this region coupled with the availability of low cost of labor and availability of raw material. Increasing FDI approval is also supporting the entrance of pharmaceutical firms in the region. This results in the rising production across various sectors in the region, which, in turn, will accelerate the adoption of industrial packaging for protection of products later production from moisture exposure and protection against contaminants.

Global Industrial Packaging Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Amcor plc, Grief, Inc., Mondi plc, Tank Holdings Corp., and Sealed Air Corp. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in March 2020, Tank Holding acquired the IBC manufacturing assets from Hoover Ferguson. It will further reinforce Tank’s position, as one of the major North American manufacturers of returnable and reusable IBCs, also referred to as portable tote tanks used for transportation of chemicals and food products.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial packaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Amcor plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Greif, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Mondi plc

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Tank Holdings Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Sealed Air Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Industrial Packaging Market by Product

5.1.1. Intermediate Bulk Containers (IBCs)

5.1.2. Drums

5.1.3. Sacks

5.1.4. Pails

5.1.5. Crates

5.1.6. Others

5.2. Global Industrial Packaging Market by Material

5.2.1. Plastic

5.2.2. Metal

5.2.3. Wood

5.2.4. Paperboard

5.2.5. Others

5.3. Global Industrial Packaging Market by End-User Vertical

5.3.1. Food and Beverage

5.3.2. Chemical and Pharmaceutical

5.3.3. Building and Construction

5.3.4. Automotive

5.3.5. Oil and Gas

5.3.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amcor plc

7.2. AmeriGlobe, LLC

7.3. BAG Corp.

7.4. Balmer Lawrie & Co. Ltd.

7.5. Beacon Converters, Inc.

7.6. Bemis Co., Inc.

7.7. Colorado Industrial Packaging

7.8. Constantia Flexibles Group GmbH

7.9. East India Drums & Barrels Mfg. Co.

7.10. Greif, Inc.

7.11. International Paper

7.12. IPS Packaging

7.13. MAUSER Corporate GmbH

7.14. Mondi plc

7.15. Orora Ltd.

7.16. Sealed Air Corp.

7.17. Sigma Plastics Group (Alpha Industries)

7.18. Sonoco Products Co.

7.19. Tank Holdings Corp.

7.20. Veritiv Corp.

7.21. WestRock Co.

1. GLOBAL INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL INTERMEDIATE BULK CONTAINERS (IBCs) FOR INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL DRUMS FOR INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SACKS FOR INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL PAILS FOR INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL CRATES FOR INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER INDUSTRIAL PACKAGING PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

9. GLOBAL PLASTIC-BASED INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL METAL-BASED INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL WOOD-BASED INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL PAPERBOARD-BASED INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL OTHER INDUSTRIAL PACKAGING MATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2019-2026 ($ MILLION)

15. GLOBAL INDUSTRIAL PACKAGING IN FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL INDUSTRIAL PACKAGING IN CHEMICAL AND PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL INDUSTRIAL PACKAGING IN BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL INDUSTRIAL PACKAGING IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

19. GLOBAL INDUSTRIAL PACKAGING IN OIL AND GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

20. GLOBAL INDUSTRIAL PACKAGING IN OTHER END-USER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

21. GLOBAL INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

22. NORTH AMERICAN INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. NORTH AMERICAN INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

24. NORTH AMERICAN INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

25. NORTH AMERICAN INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2019-2026 ($ MILLION)

26. EUROPEAN INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

27. EUROPEAN INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

28. EUROPEAN INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

29. EUROPEAN INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

33. ASIA-PACIFIC INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2019-2026 ($ MILLION)

34. REST OF THE WORLD INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

35. REST OF THE WORLD INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

36. REST OF THE WORLD INDUSTRIAL PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2019-2026 ($ MILLION)

1. GLOBAL INDUSTRIAL PACKAGING MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL INDUSTRIAL PACKAGING MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

3. GLOBAL INDUSTRIAL PACKAGING MARKET SHARE BY END-USER VERTICAL, 2019 VS 2026 (%)

4. GLOBAL INDUSTRIAL PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. UK INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD INDUSTRIAL PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)