Industrial Robotics Market

Global Industrial Robotics Market Size, Share & Trends Analysis Report by Type (Traditional Robots and Collaborative Robots), and End User Industry (Automotive; Chemical, Rubber, and Plastic; Electrical & Electronics; Food & Beverages; Metal & Heavy Machinery; and Others), Forecast 2019-2025 Update Available - Forecast 2025-2031

The global industrial robotics market is estimated to grow at a CAGR of around 10% during the forecast period. Industrial robots assist in the manufacturing units and perform various industrial procedures such as assembling, processing, welding, labeling, packaging, and many others. There is an increasing demand for industrial robots owing to the increasing adoption of smart factory systems, in which industrial robots play an important role.

The growing demand for reducing the operational costs in the manufacturing plants is one of the key factors driving the growth of the global industrial robotics market. The decrease in functional cost can be achieved by eliminating raw material wastage, errors in the production workflow, and improvement in operational flexibility. The adoption of robotic solutions in the automotive industry will provide efficient ways to eliminate these operational costs, which in turn will foster the profitability of the OEMs. Thus, providing growth opportunities to the market.

However, lack of skilled labor or workforce for operating as well as the high costs of installation and maintenance are the factors that challenge the market growth during the forecast period. Moreover, the availability of online delivering services with the increasing adoption of internet-based services is positively affecting the market growth. For instance, ABB is shifting from the conventional approach of providing break and fix services to predictive and proactive services through a combination of their remote service platform and IoT.

Segmental Outlook

The global industrial robotics market is segmented on the basis of the type and end-user industry. Based on the type, the market is bifurcated into traditional robots and collaborative robots. traditional robots include articulated robots, delta robots, SCARA robots, dual-arm robots, and others. Based on the end-user industry, the market is segmented into automotive; chemical, rubber, and plastic; electrical &electronics; food &beverages; metal & heavy machinery; and others.

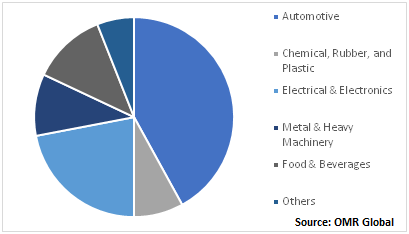

Global Industrial Robotics Market by End-User Industry, 2018 (%)

Automotive Sector to Hold Significant Share in the Market During the Forecast Period

Based on the end-user industry, the automotive sector is estimated to hold the most significant market share. The growth is attributed to the increased use of robots for the manufacturing and assembling components such as chassis, axels, brakes, and engines among others. The automotive sector is one of the most significant users of industrial robots, as it assists in performing several functions. Besides, the food & beverage sector is also expected to provide growth opportunities to the market as it requires high precision and accuracy. Thus, the market is projected to rise in the near future.

Regional Outlook

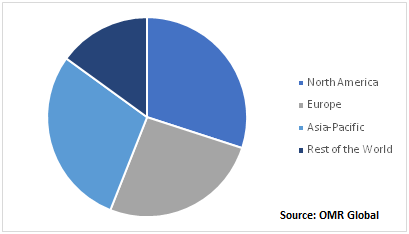

The global industrial robotics market is geographically segmented into North America, Europe, Asia-Pacific and the Rest of the World. North America is estimated to hold a prominent share in the global industrial robotics market. This is attributed to the availability of novel and advanced manufacturing facilities in the region based on new technologies and innovations to manufacture high-quality robots at fast speed with lower costs. According to the Association for Advancing Automation (A3), the North American automation market for the first nine months of 2017, witnessed 27,294 orders of robots, valued at around $1.5 billion in North America.

Global Industrial Robotics Market, by Region 2018 (%)

Market Players Outlook

The prominent players operating in the global industrial robotics market include FANUC Corp., ABB Ltd., Mitsubishi Electric Corp., KUKA AG, Yaskawa Electric Corp., Liebherr Group, Hirata Corp., and many others. These players are adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global industrial robotics market.

- In January 2020, FANUC introduced the new ROBONANO ?-NTiA at SPIE Photonics West 2020 in San Francisco. Designed to help manufacturers improve productivity, the ROBONANO is an ultra-precise machine tool that offers the ultimate in finish quality for optical surfaces. The new product meets the requirements of the most demanding applications in the automotive, biomedical, and watch making industries.

- In December 2019, Realtime Robotics announced that it is working with Mitsubishi Electric Corp. for the development of a custom integrated solution that pairs smart motion planning technology of Realtime Roboticswith industrial and collaborative robot product lines of Mitsubishi Electric Corp.

- In April 2019, Yaskawa Electric Corp. opened its new robot manufacturing facility in Slovenia along with the European robotics development center, with a total investment of $27.72 million. With this new production facility, the company aims to provide a wide range of robotics solutions to its customers across Europe as well as across the globe.

- In September 2018, Yaskawa Electric Corp. introduced a new software solution that integrates robotic controllers and machine controllers. In addition, it provides solutions based on the i3-Mechatronics concept, that enables operators to control robots by machine controller program, which in turn aids in the growth of the company.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial robotics market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. FANUC Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. ABB Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Mitsubishi Electric Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. KUKA AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Yaskawa Electric Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Industrial Robotics Market by Type

5.1.1. Traditional Robots

5.1.1.1. Articulated Robots

5.1.1.2. Delta Robots

5.1.1.3. SCARA Robots

5.1.1.4. Others

5.1.2. Collaborative Robots

5.2. Global Industrial Robotics Market by END-USER Industry

5.2.1. Automotive

5.2.2. Chemical, Rubber and Plastics

5.2.3. Metal & Heavy Machinery

5.2.4. Electrical &Electronics

5.2.5. Food &Beverages

5.2.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. American Robot Corp.

7.3. ARC Specialties Inc.

7.4. AUBO Robotics Inc.

7.5. Bosch Rexroth AG, aBosch Company

7.6. Comau S.p.A

7.7. DENSO Robotics

7.8. Empire Robotics, Inc.

7.9. Energid Technologies Corp.

7.10. EPSON Robots, a company of Seiko Epson Corp.

7.11. FANUC Corp.

7.12. F&P Robotics AG

7.13. Gudel Group AG

7.14. Hirata Corp.

7.15. Kuka AG

7.16. Liebherr Group

7.17. Mitsubishi Electric Corp.

7.18. Nachi-Fujikoshi Corp.

7.19. Omron Corp.

7.20. Precise Automation Inc.

7.21. Teradyne Inc., a Universal Robots Company

7.22. Toshiba Machine Co. Ltd.

7.23. Yaskawa Electric Corp.

1. GLOBAL INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL TRADITIONAL INDUSTRIALROBOTSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL COLLABORATIVE ROBOTSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

5. GLOBAL INDUSTRIAL ROBOTICS IN AUTOMOTIVEMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL INDUSTRIAL ROBOTICS IN METAL & HEAVY MACHINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBALINDUSTRIAL ROBOTICS IN CHEMICAL, PLASTIC, AND RUBBERMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL INDUSTRIAL ROBOTICS IN ELECTRICAL &ELECTRONICSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL INDUSTRIAL ROBOTICS IN FOOD &BEVERAGESMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL INDUSTRIAL ROBOTICS IN OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

14. NORTH AMERICAN INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

15. EUROPEAN INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

17. EUROPEAN INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

21. REST OF THE WORLD INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

22. REST OF THE WORLD INDUSTRIAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL INDUSTRIAL ROBOTICS MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL INDUSTRIAL ROBOTICS MARKET SHARE BY END-USER INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL INDUSTRIAL ROBOTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD INDUSTRIAL ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)