Industrial Safety Market

Global Industrial Safety Market Size, Share & Trends Analysis Report, By Type (Machine Safety and Workers Safety), By Component (Presence Sensing Safety Sensors, Safety Controllers/ Modules/ Relays, Programmable Safety Systems, Safety Interlock Switches, Emergency Stop Controls, Two-Hand Safety Controls and Others), By Industry (Oil & Gas, Energy & Power, Chemicals, Food & Beverages, Aerospace & Defense, Automotive and Others), Forecast (2022-2028).

The global industrial safety market is anticipated to grow at a significant CAGR during the forecast period. Industrial safety solutions are systems and technologies which help companies to ensure enhanced and automated safety in their plants. The major factor driving the growth of the global industrial safety market during the forecast is the increasing requirements to enhance the safety of workers and the company’s assets. Additionally, the growth of the market can also be attributed to the stringent government regulations concerning the mandatory requirements for the installation of safety systems in the company. For instance, the EU Machinery Directives and North America's OSHA standards regulations have mandated the installation of several safety systems in the industries which in turn is boosting the demand for safety solutions during the forecast period. Furthermore, the increasing digital technologies and IoT across the industries are further driving the growth of the market.

Impact of COVID-19 Pandemic on Global Industrial Safety Market

The COVID-19 pandemic had impacted the global industrial safety market to a great extent. Oil & gas is one of the key industries that require safety systems and components. The oil & gas industry was impacted badly due to which the oil prices slashed drastically. Additionally, as the pandemic spread to over 213 countries, governments across the globe restricted the exports and imports which further affected the demand for oil and gas which resulted in a huge gap between the supply and demand. Furthermore, several others industries were affected badly such as chemicals and energy & power industries. These industries also witnessed reduced demand due to the global pandemic. However, the increasing demand from the energy & power sector will drive the industrial safety market for the energy & power end-use industry during the forecast period.

Segmental Outlook

The global Industrial Safety market is segmented based on type, component and industry. Based on the type, the market is sub-segmented into machine safety and workers safety. Based on component, the market is sub-segmented into presence sensing safety sensors, safety controllers/ modules/ relays, programmable safety systems, safety interlock switches, emergency stop controls, two-hand safety controls and others. Based on the industry, the market is sub-segmented into oil & gas, energy & power, chemicals, food & beverages, aerospace & defense, automotive and others.

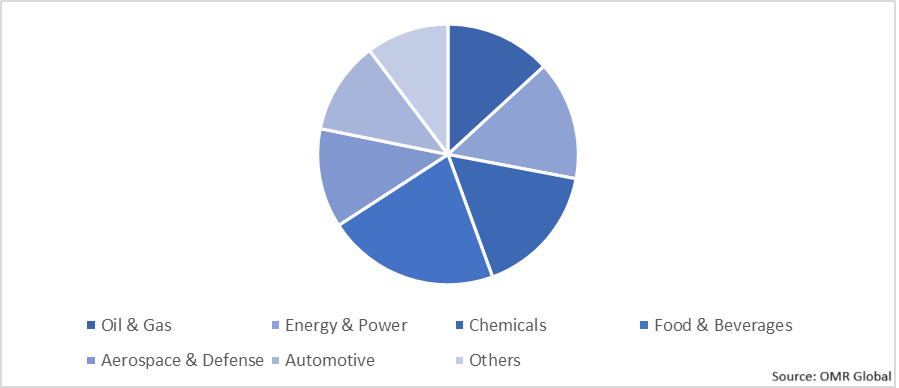

Global Industrial Safety Market Share by Industry, 2021 (%)

Food & Beverages Segment Holds a Prominent Share in the Global Industrial Safety Market.

Based on the industry, the food & beverages segment in the global industrial safety market holds a prominent share in 2021. The factor driving the food & beverages segment includes the increasingly stringent rules and regulations for safety. Additionally, this is also driving the demand for industrial safety systems for safe and efficient operations in food & beverage manufacturing plants. Furthermore, to achieve high quality and consistent production at a low cost in food & beverages plants can be done by making it more safe, flexible, and profitable by choosing an integrated approach of automated safety control systems such as industrial safety solutions which in turn is driving the growth of the segment in the market.

Regional Outlook

The global Industrial Safety market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Germany, Italy, Spain, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

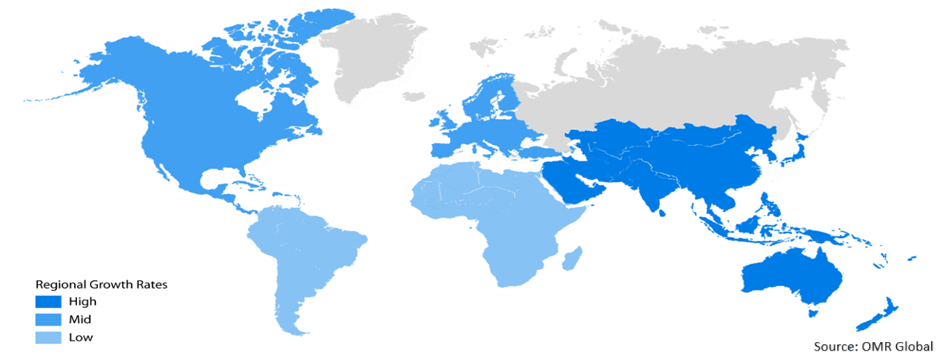

Global Industrial Safety Market Growth by Region, 2022-2028

Asia-Pacific Region Holds the Major Share in the Global Industrial Safety Market.

Asia-Pacific region holds a prominent share in the industrial safety market. The reason is due to the growing industrialization in emerging economies in the region such as China and India. Additionally, industrial safety in various processes such as oil & gas and power generation has already been adopted by China and India which is also boosting the growth of the market in the region. Furthermore, the adoption of safety automation solutions in manufacturing industries is increasing significantly owing to the rapid industrialization in the region which is propelling the growth of the market.

Market Players Outlook

The major companies serving the global Industrial Safety market include ABB Ltd., Honeywell International Inc., Rockwell Automation Inc., Siemens AG, Schneider Electric SE, among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, partnerships and collaborations, and geographical expansion, to stay competitive in the market. For instance, in September 2021, Yokogawa announced that it has upgraded its Exaquantum Safety Function Monitoring (SFM) software. It is a solution that can identify if the actual operating performance meets safety design targets.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Industrial Safety market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Industrial Safety Market

- Recovery Scenario of Global Industrial Safety Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. ABB Ltd.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Honeywell International Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Rockwell Automation, Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Siemens AG

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Schneider Electric SE

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Industrial Safety Market by Type

4.1.1. Machine Safety

4.1.2. Worker Safety

4.2. Global Industrial Safety Market by Component

4.2.1. Presence Sensing Safety Sensors

4.2.2. Safety Controllers/ Modules/ Relays

4.2.3. Programmable Safety Systems

4.2.4. Safety Interlock Switches

4.2.5. Emergency Stop Controls

4.2.6. Two-Hand Safety Controls

4.2.7. Others

4.3. Global Industrial Safety Market by Industry

4.3.1. Oil & Gas

4.3.2. Energy & Power

4.3.3. Chemicals

4.3.4. Food & Beverages

4.3.5. Aerospace & Defense

4.3.6. Automotive

4.3.7. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Baker Hughes

6.2. BANNER ENGINEERING

6.3. Emerson Electric Co.

6.4. HIMA

6.5. JOHNSON CONTROLS

6.6. MITSUBISHI ELECTRIC

6.7. Omron Corp

6.8. SGS GROUP

6.9. VELAN INC.

6.10. Yokogawa Electric Corp.

1. GLOBAL INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL INDUSTRIAL MACHINE SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL INDUSTRIAL WORKER SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

5. GLOBAL INDUSTRIAL SAFETY BY PRESENCE SENSING SAFETY SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL INDUSTRIAL SAFETY BY SAFETY CONTROLLERS/ MODULES/ RELAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL INDUSTRIAL SAFETY BY PROGRAMMABLE SAFETY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL INDUSTRIAL SAFETY BY SAFETY INTERLOCK SWITECHES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL INDUSTRIAL SAFETY BY EMERGENCY STOP CONTROLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL INDUSTRIAL SAFETY BY TWO-HAND SAFETY CONTROLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL INDUSTRIAL SAFETY BY OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2021-2028 ($ MILLION)

13. GLOBAL INDUSTRIAL SAFETY FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL INDUSTRIAL SAFETY FOR ENERGY & POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL INDUSTRIAL SAFETY FOR CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL INDUSTRIAL SAFETY FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL INDUSTRIAL SAFETY FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL INDUSTRIAL SAFETY FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL INDUSTRIAL SAFETY FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

21. NORTH AMERICAN INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. NORTH AMERICAN INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

23. NORTH AMERICAN INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

24. NORTH AMERICAN INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2021-2028 ($ MILLION)

25. EUROPEAN INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. EUROPEAN INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

27. EUROPEAN INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

28. EUROPEAN INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2021-2028 ($ MILLION)

33. REST OF THE WORLD INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. REST OF THE WORLD INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

36. REST OF THE WORLD INDUSTRIAL SAFETY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL INDUSTRIAL SAFETY MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL INDUSTRIAL SAFETY MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL INDUSTRIAL SAFETY MARKET, 2022-2028 (%)

4. GLOBAL INDUSTRIAL SAFETY MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL INDUSTRIAL MACHINE SAFETY MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL INDUSTRIAL WORKER SAFETY MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL INDUSTRIAL SAFETY MARKET SHARE BY COMPONENT, 2021 VS 2028 (%)

8. GLOBAL INDUSTRIAL SAFETY BY PRESENCE SENSING SAFETY SENSORS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL INDUSTRIAL SAFETY BY SAFETY CONTOLLERS/ MODULES/ RELAYS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL INDUSTRIAL SAFETY BY PROGRAMMABLE SAFETY SYSTEMS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL INDUSTRIAL SAFETY BY SAFETY INTERLOCK SWITCHES MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL INDUSTRIAL SAFETY BY EMERGENCY STOP CONTROLS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL INDUSTRIAL SAFETY BY TWO-HAND SAFETRY CONTROLS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL INDUSTRIAL SAFETY BY OTHERS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL INDUSTRIAL SAFETY MARKET SHARE BY INDUSTRY, 2021 VS 2028 (%)

16. GLOBAL INDUSTRIAL SAFETY FOR OIL & GAS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL INDUSTRIAL SAFETY FOR ENERGY & POWER MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL INDUSTRIAL SAFETY FOR CHEMCIALS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL INDUSTRIAL SAFETY FOR FOOD & BEVERAGES MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL INDUSTRIAL SAFETY FOR AEROSPACE & DEFENSE MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

21. GLOBAL INDUSTRIAL SAFETY FOR AUTOMOTIVE MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

22. GLOBAL INDUSTRIAL SAFETY FOR OTHERS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

23. GLOBAL INDUSTRIAL SAFETY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

24. US INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

25. CANADA INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

26. UK INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

27. FRANCE INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

28. GERMANY INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

29. ITALY INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

30. SPAIN INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF EUROPE INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

32. INDIA INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

33. CHINA INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

34. JAPAN INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

35. SOUTH KOREA INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

36. REST OF ASIA-PACIFIC INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)

37. REST OF THE WORLD INDUSTRIAL SAFETY MARKET SIZE, 2021-2028 ($ MILLION)