Industrial Sensors Market

Global Industrial Sensors Market Size, Share & Trends Analysis Report by Sensor Type (Flow Sensor, Pressure Sensor, Proximity Sensor, Level Sensor, Temperature Sensor, Image Sensor, and Others), By Vertical (Oil & Gas, Manufacturing, Chemicals, Pharmaceuticals, Energy & Power, and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2031

The global Industrial sensors market is projected to grow at a CAGR of around 7% during the forecast period. The market growth is mainly driven by technological development in sensor technology coupled with the growing automation in various industrial sectors such as manufacturing, oil & gas, chemicals, and others. The rising demand for human-assisted robots in these sectors for overall cost reduction is substantially driving the market.

Robots are playing an imperative role in the manufacturing sector. The rise of AI industrial robots witnessed a hefty expansion in developed countries and certainly seems to be inevitable being driven by a range of production demands, including a continued proliferation of automation and the IoT, increased resource efficiency, and need for safer and more simplified robotic technologies to work in collaboration with humans. According to IFR (International Federation of Robotics) in 2018, there are more than 1 million industrial robots at work in industrial units across the globe. Proximity sensors are used in advanced robots for automobiles manufacturing.

Segmental Outlook

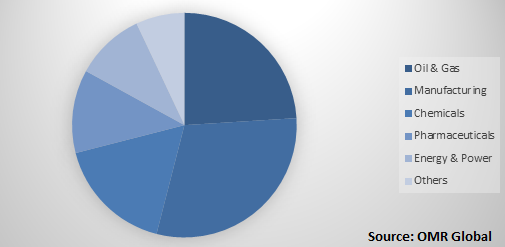

The global Industrial sensors market is segmented on the basis of sensor type and vertical. Based on sensor type, the market is divided into flow sensors, pressure sensors, proximity sensors, level sensors, temperature sensors, image sensors, and others such as humidity and moisture sensors. The industrial proximity sensors segment is projected to have significant growth in the market. On the basis of vertical, the market is segregated into oil & gas, manufacturing, chemicals, pharmaceuticals, energy & power, and others.

Global Industrial Sensors Market Share by Vertical, 2018(%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial sensors market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Honeywell International Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Rockwell Automation Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Siemens AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. STMicroelectronics International N.V.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Texas Instruments Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Industrial sensors Market by Sensor Type

5.1.1. Flow Sensor

5.1.2. Pressure Sensor

5.1.3. Proximity Sensor

5.1.4. Level Sensor

5.1.5. Temperature Sensor

5.1.6. Image Sensor

5.1.7. Others (Humidity and Moisture Sensor

5.2. Global Industrial sensors Market by Vertical

5.2.1. Oil & Gas

5.2.2. Manufacturing

5.2.3. Chemicals

5.2.4. Pharmaceuticals

5.2.5. Energy & Power

5.2.6. Others

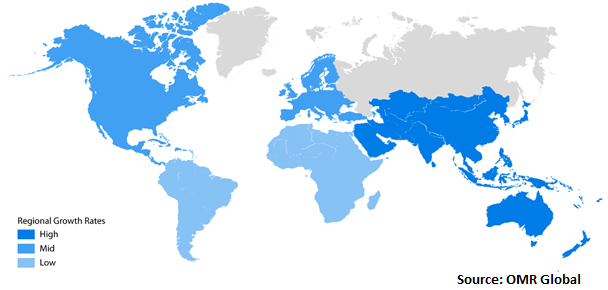

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amphenol Corp.

7.2. ams AG

7.3. Endress+Hauser Management AG

7.4. Figaro Engineering Inc.

7.5. First Sensor AG

7.6. Honeywell International Inc.

7.7. NXP Semiconductors N.V.

7.8. OMEGA Engineering, Inc., a Spectris PLC Company

7.9. OMRON Corp.

7.10. Panasonic Corp.

7.11. Renesas Electronics Corp.

7.12. Robert Bosch GmbH

7.13. Rockwell Automation Inc.

7.14. Safran Colibrys SA

7.15. Sensirion AG

7.16. Siemens AG

7.17. STMicroelectronics International N.V.

7.18. TE Connectivity Ltd.

7.19. Teledyne Technologies Inc.

7.20. Texas Instruments Inc.

1. GLOBAL INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY SENSOR TYPE, 2018-2025 ($ MILLION)

2. GLOBAL INDUSTRIAL FLOW SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL INDUSTRIAL PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL INDUSTRIAL PROXIMITY SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL INDUSTRIAL LEVEL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL INDUSTRIAL TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL INDUSTRIAL IMAGE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OTHER INDUSTRIAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

10. GLOBAL INDUSTRIAL SENSORS IN OIL & GAS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL INDUSTRIAL SENSORS IN MANUFACTURING INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL INDUSTRIAL SENSORS IN CHEMICAL INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL INDUSTRIAL SENSORS IN PHARMACEUTICALS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL INDUSTRIAL SENSORS IN ENERGY & POWER INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL INDUSTRIAL SENSORS IN OTHER VERTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY SENSOR TYPE, 2018-2025 ($ MILLION)

19. NORTH AMERICAN INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

20. EUROPEAN INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. EUROPEAN INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY SENSOR TYPE, 2018-2025 ($ MILLION)

22. EUROPEAN INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY SENSOR TYPE, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

26. REST OF THE WORLD INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY SENSOR TYPE, 2018-2025 ($ MILLION)

27. REST OF THE WORLD INDUSTRIAL SENSORS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

1. GLOBAL INDUSTRIAL SENSORS MARKET SHARE BY SENSOR TYPE, 2018 VS 2025 (%)

2. GLOBAL INDUSTRIAL SENSORS MARKET SHARE BY VERTICAL, 2018 VS 2025 (%)

3. GLOBAL INDUSTRIAL SENSORS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD INDUSTRIAL SENSORS MARKET SIZE, 2018-2025 ($ MILLION)