Industrial Sugar Market

Global Industrial Sugar Market Size, Share & Trends Analysis Report, By Type (White, Brown, and Liquid), By Source (Cane Sugar and Beet Sugar), By Form (Granulated, Powder, and Syrup), By Application (Bakery and Confectionery, Dairy, Beverages, Canned and Frozen Foods, Other Foods, and Pharmaceuticals) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global industrial sugar market is estimated to grow at a CAGR of nearly 5.6% during the forecast period. The major factors contributing to the market growth include significant applications in the food and beverage industry and increasing production of sugarcane. As per the International Sugar Organization, the global sugar production represented an increase of 8.034 million tons to a record 178.612 million tons in 2018. In 2018, a considerable rise in sugar production has witnessed in India (+10.845 million tons) and Thailand (+4.653 million tons) than in 2017. Sugar is produced by nearly 110 countries from either beet or cane, and production of sugar with both cane and beet has witnessed in eight countries.

Sugarcane accounts for approximately 80% of global sugar production. In 2018, the top 10 sugar-producing countries were India, Brazil, Thailand, China, the US, Mexico, Russia, Pakistan, France, Australia. These accounted for approximately 70% of the global output. Rising consumption of sugar in households and industrial production is the major cause for accelerating production output of sugar. The food industry uses white and brown crystalline sugars as sweeteners. In baking and confectionery, powdered sugars are utilized as icing sugar. In addition, sugar syrups are utilized as a base for flavored syrups, toppings, and fruit sauces, and in beverages. Sugars are used in medical syrups, tomato sauces, and mayonnaise, to deal with acidic and bitter tastes. Therefore, there is a considerable application of sugar in food and beverage industry. However, increasing shift towards alternate sweeteners is acting as a major restraining factor for the market growth.

Market Segmentation

The global industrial sugar market is classified into type, source, form, and application. Based on type, the market is classified into white, brown, and liquid. Based on the source, the market is classified into cane sugar and beet sugar. Based on form, the market is classified into granulated, powder, and syrup. Based on application, the market is classified into bakery and confectionery, dairy, beverages, canned and frozen foods, other foods, and pharmaceuticals.

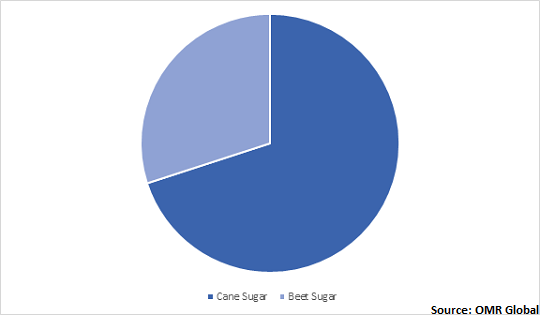

Cane Sugar Held the Largest Share in the Industrial Applications

Significant rise in the production of sugarcane and the rising concerns about genetically modified organisms boosts the preference for cane sugar in industrial applications. In the US, it is estimated that nearly 95% of sugar beets are genetically modified, however, all sugarcanes produced in the country is considered as non-GMO. The consumers prefer to avoid genetically modified organisms (GMOs) due to concerns about food allergies, antibiotic resistance, and other adverse effects on health. Therefore, food manufacturers may primarily use non-GMO ingredients including cane sugar due to the increasing preference of consumers for non-GMO products. This, in turn, is contributing to the adoption of non-GMO cane sugar in food and beverage applications.

Global Industrial Sugar Market Share by Source, 2019 (%)

Regional Outlook

Geographically, Asia-Pacific is estimated to witness potential growth during the forecast period. Significant production of sugar and expansion of pharmaceutical and food and beverage industry is primarily contributing to the market growth in the region. Ease in foreign direct investment (FDI) has led to the expansion of industrial production facilities in the region, which leads to an emerging demand for sugar in pharmaceutical and food and beverage applications. Sugar has been utilized as a clean carbon source by the fermentation industry to produce pharmaceuticals, primarily antibiotics, and other pharmaceutical products including syrup for human consumption. India is home to some major pharmaceutical companies such as Sun Pharmaceutical, Dr Reddy’s Laboratories, and Cipla. This, in turn, increased the pharmaceutical production capabilities in the country, which thereby is encouraging the demand for sugar in the region.

Global Industrial Sugar Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Cargill, Inc., Associated British Foods plc, Raízen Energia S.A., Südzucker AG, and Tereos. Product launches, mergers and acquisitions, geographical expansion, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in July 2019, Dalmia Bharat Sugar & Industries declared that it is looking to invest nearly $43 million to $58 million for scaling up the manufacturing capacity, either through acquisition or organically. This investment could be partly financed by equity and partly by debt in the ratio of 1:1. It will enable the company to expand its sugar production at its five units in Indian states, Uttar Pradesh (UP) and Maharashtra.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial sugar market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Cargill, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Associated British Foods plc

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Raízen Energia S.A.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Südzucker AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Tereos

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Industrial Sugar Market by Type

5.1.1. White

5.1.2. Brown

5.1.3. Liquid

5.2. Global Industrial Sugar Market by Source

5.2.1. Cane Sugar

5.2.2. Beet Sugar

5.3. Global Industrial Sugar Market by Form

5.3.1. Granulated

5.3.2. Powder

5.3.3. Syrup

5.4. Global Industrial Sugar Market by Application

5.4.1. Bakery and Confectionery

5.4.2. Dairy

5.4.3. Beverages

5.4.4. Canned and Frozen Foods

5.4.5. Other Foods

5.4.6. Pharmaceuticals

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AGRANA Beteiligungs-AG

7.2. American Crystal Sugar Co.

7.3. Archer Daniels Midland Co.

7.4. Associated British Foods plc

7.5. Cargill, Inc.

7.6. Dalmia Bharat Enterprises Ltd. (DBEL)

7.7. Dangote Sugar Refinery PLC

7.8. E.I.D. - Parry (India) Ltd.

7.9. Louis Dreyfus Co. B.V.

7.10. Mitr Phol Sugar Co. Ltd.

7.11. Nordzucker AG

7.12. NSL Sugars Ltd.

7.13. Raízen Energia S.A.

7.14. Shree Renuka Sugars Ltd.

7.15. Südzucker AG

7.16. Tereos

7.17. Thai Roong Ruang Group

7.18. Tongaat Hulett Group Ltd.

7.19. Triveni Engineering & Industries Ltd.

7.20. Wilmar International Ltd.

1. GLOBAL INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL INDUSTRIAL WHITE SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL INDUSTRIAL BROWN SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL INDUSTRIAL LIQUID SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

6. GLOBAL INDUSTRIAL CANE SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL INDUSTRIAL BEET SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

9. GLOBAL INDUSTRIAL SUGAR IN GRANULATED FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL INDUSTRIAL SUGAR IN POWDER FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL INDUSTRIAL SUGAR IN SYRUP FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

13. GLOBAL INDUSTRIAL SUGAR IN BAKERY AND CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL INDUSTRIAL SUGAR IN DAIRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL INDUSTRIAL SUGAR IN BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL INDUSTRIAL SUGAR IN CANNED AND FROZEN FOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL INDUSTRIAL SUGAR IN OTHER FOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL INDUSTRIAL SUGAR IN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

19. GLOBAL INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

20. NORTH AMERICAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. NORTH AMERICAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. NORTH AMERICAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

23. NORTH AMERICAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

24. NORTH AMERICAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. EUROPEAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

26. EUROPEAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. EUROPEAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

28. EUROPEAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

29. EUROPEAN INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

33. ASIA-PACIFIC INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

34. ASIA-PACIFIC INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

35. REST OF THE WORLD INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

36. REST OF THE WORLD INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

37. REST OF THE WORLD INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

38. REST OF THE WORLD INDUSTRIAL SUGAR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL INDUSTRIAL SUGAR MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL INDUSTRIAL SUGAR MARKET SHARE BY SOURCE, 2019 VS 2026 (%)

3. GLOBAL INDUSTRIAL SUGAR MARKET SHARE BY FORM, 2019 VS 2026 (%)

4. GLOBAL INDUSTRIAL SUGAR MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

5. GLOBAL INDUSTRIAL SUGAR MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

6. US INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

7. CANADA INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

8. UK INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

9. FRANCE INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

10. GERMANY INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

11. ITALY INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

12. SPAIN INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

13. ROE INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

14. INDIA INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

15. CHINA INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

16. JAPAN INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF ASIA-PACIFIC INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)

18. REST OF THE WORLD INDUSTRIAL SUGAR MARKET SIZE, 2019-2026 ($ MILLION)