Infant Nutrition Market

Infant Nutrition Market Size, Share & Trends Analysis Report Market, by Infant Formula (First Infant Formula, Follow-On Formula, Growing-Up Formula, and Specialty Baby Formula) and by Baby Food (Prepared Food, Fried Food, and Others) Forecast Period (2022-2030) Update Available - Forecast 2025-2035

Infant nutrition market is anticipated to grow at a considerable CAGR of 7.3% during the forecast period. The infant nutrition market is driven by the increasing adoption of prepared organic baby food due to busy lifestyle, rising number of strategic investments in the infant nutrition category. A significant increase in the working mother population, higher spending on baby health, and the rising demand for organic baby food has further contributing to the market growth. Over the past few years, there has been a remarkable increase in the population of young working mothers.

For instance, according to the data published by Office for National Statistics (ONS) of the United Kingdom in 2021, the number of mothers in the labor market had grown substantially over the last two decades. From April to June 2021, three in four mothers (75.6%) were working in the UK, reaching its highest level in the equivalent quarter over the last 20 years, up from 66.5% in 2002. In 2021, the employment rate for mothers (75.6%) was greater than that for women without dependent children (69.1%). The low wages and high cost of living in cities have increased the number of women working to support their families. Therefore, this factor has been driving the infant food nutrition market, as working mothers are primarily dependent on processed child nutrition products.

Mother milk is the best food for infants however, stress seems to be a common problem among working mothers that causes low milk production in them. These factors have encouraged the adoption of convenience-oriented lifestyles, making infant nutrition and baby foods more desirable. However, concerns regarding food safety and stringent regulations for infant food are anticipated to restrain market growth.

Segmental Outlook

The global infant nutrition market is segmented based on product type. Based on product type, the market is segmented into infant food and baby food. The infant food market is sub-segmented into first infant formula, follow-on formula, growing-up formula, and specialty baby formula. Based on baby food, the market is sub-segmented into prepared food, dried food, and other baby foods.

Infant Food Held Major Market Share in Global Market

Dried baby food products are easy to carry and consume and hence held major share in the market. Nutrient-rich formula and the option of lactose- and soy-free milk versions make this a good option, especially for working women. New product launches in this category is further driving the market growth. For instance, in February 2021, the company planned to launch instant baby cereal, pureed fruits and vegetables, freeze-dried finger foods, and teething biscuits in the near term.

Regional Outlook

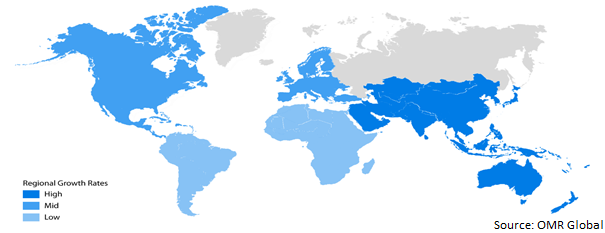

The global infant nutrition market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). North America held considerable share in the global infant nutrition market. The presence of key market players with their promising products, and growing expenditure on baby’s health is some of the key factors that are contributing to the potential share of the regional market.

Global Infant Nutrition Market Growth by Region 2023-2030

Asia-Pacific to Exhibit Fastest CAGR in the Global Infant Nutrition Market

Asia-Pacific is anticipated to exhibit highest CAGR during the forecast period. The increasing awareness about the consumption of organic baby foods among consumers while selecting the right food for their babies. The convenience of baby cereals, as well as the growing range of flavors and varieties, continues to encourage mothers to buy them as a weaning food. To cater growing demand for infant nutrition, key players are making new product launches. For instance, in March 2019, Indian brand Mimmo Organics has so far launched a variety of pasta for children aged 10 months and older, as well as teething wafers and tender yums. The ingredients used in these products include ragi, millet, buckwheat, and whole wheat.

China forms a lucrative market offering potential growth opportunities for the key players in the global marketplace. The country remains a strong market for infant nutrition, driven by product innovation and a preference for imported products. The relaxation of China’s one-child policy could also bring a positive impact on pre-packaged baby foods. The potential of increasing wealth and a rising number of newborns give China’s baby food and drink manufacturers adequate stimulus to develop packaged organic food products to cater to the consumer demand for better quality baby food and drink.

Market Players Outlook

The major companies serving the global infant nutrition market include Abbott Laboratories, BABY GOURMET, Danone S.A., Reckitt Benckiser Group PLC, and Nestle S.A. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global infant nutrition market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BABY GOURMET

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nestlé S.A.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Infant Nutrition Market by Infant Formula

4.1.1. First Infant Formula

4.1.2. Follow-On Formula

4.1.3. Growing-Up Formula

4.1.4. Specialty Baby Formula

4.2. Global Infant Nutrition Market by Baby Food

4.2.1. Prepared food

4.2.2. Dried food

4.2.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ALDI, Inc. (Little Journey)

6.2. Amara Organic Foods

6.3. Ausnutria Dairy Corp. Ltd.

6.4. Baby Gourmet Foods, Inc.

6.5. Danone S.A.

6.6. Hero Group (Beech-Nut)

6.7. HiPP GmbH & Co. Vertrieb KG

6.8. Little Spoon, Inc.

6.9. Nascens Enterprises Pvt., Ltd.

6.10. North Castle Partners, LLC

6.11. Nurture, Inc.

6.12. NurturMe, Inc.

6.13. Ormeal Foods Pvt. Ltd.

6.14. Plum, PBC

6.15. Pristine Organics Pvt. Ltd.

6.16. PT Organics Ltd.

6.17. Sari Foods Co

6.18. Sprout Foods, Inc.

6.19. The Hain Celestial Group, Inc. (Earth's Best)

6.20. The Kraft Heinz Company

6.21. Upon A Farm LLC

1. GLOBAL INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY INFANT FORMULA, 2022-2030 ($ MILLION)

2. GLOBAL FIRST INFANT FORMULA FOR INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL FOLLOW-ON FORMULA FOR INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL GROWING-UP FORMULA FOR INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL SPECIALTY BABY FORMULA FOR INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY BABY FOOD, 2022-2030 ($ MILLION)

7. GLOBAL PREPARED FOOD FORMULA FOR INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL DRIED FOOD FORMULA FOR INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL OTHER FOOD FORMULA FOR INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY INFANT NUTRITION, 2022-2030 ($ MILLION)

13. NORTH AMERICAN INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY BABY FOOD, 2022-2030 ($ MILLION)

14. EUROPEAN INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY INFANT FORMULA, 2022-2030 ($ MILLION)

16. EUROPEAN INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY BABY FOOD, 2022-2030 ($ MILLION)

17. ASIA- PACIFIC INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA- PACIFIC INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY INFANT FORMULA, 2022-2030 ($ MILLION)

19. ASIA- PACIFIC INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY BABY FOOD, 2022-2030 ($ MILLION)

20. REST OF THE WORLD INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY INFANT NUTRITION, 2022-2030 ($ MILLION)

22. REST OF THE WORLD INFANT NUTRITION MARKET RESEARCH AND ANALYSIS BY BABY FOOD, 2022-2030 ($ MILLION)

1. GLOBAL INFANT NUTRITION MARKET SHARE BY INFANT FORMULA, 2022 VS 2030 (%)

2. GLOBAL FIRST INFANT FORMULA FOR INFANT NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL FOLLOW-ON FORMULA FOR INFANT NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL GROWING-UP FORMULA FOR INFANT NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL SPECIALTY BABY FORMULA FOR INFANT NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL INFANT NUTRITION MARKET SHARE ANALYSIS BY BABY FOOD, 2022-2030 ($ MILLION)

7. GLOBAL PREPARED FOOD FOR INFANT NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL DRIED FOOD FO RINFANT NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL OTHER FOOD INFANT NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL INFANT NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. US INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

13. UK INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

14. FRANCE INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

15. GERMANY INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

16. ITALY INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

17. SPAIN INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

22. SOUTH KOREA INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF ASIA-PACIFIC INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF THE WORLD INFANT NUTRITION MARKET SIZE, 2022-2030 ($ MILLION)