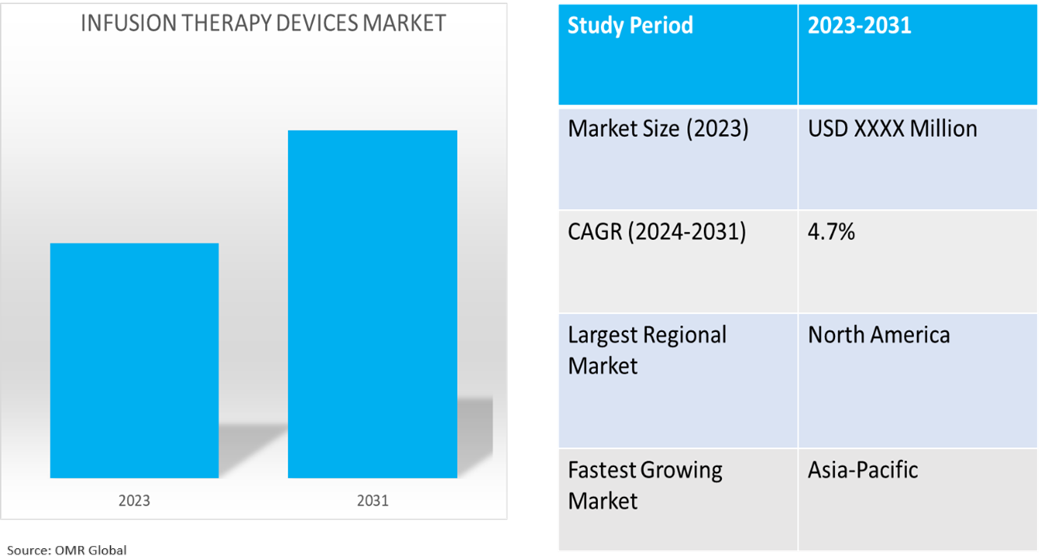

Infusion Therapy Devices Market Size

Infusion Therapy Devices Market Size, Share & Trends Analysis Report by Product Type (Infusion Pumps, and Consumables and Accessories), by Application (Oncology, Diabetes, Gastroenterology, Analgesia, Hematology, and Others) and by End-User (Hospitals, Homecare, and Ambulatory Surgery Centers) Forecast Period (2024-2031)

Infusion therapy devices market is anticipated to grow at a significant CAGR of 4.7% during the forecast period (2024-2031). The rising advancements in technology, the frequency of chronic diseases, outpatient treatments in ambulatory surgery centers, remote monitoring, and home-based healthcare are driving demand for infusion therapy equipment. Additionally, the aging population, cost-effectiveness, and the expansion of the healthcare infrastructure are driving demand.

Market Dynamics

Increasing Prevalence of Chronic Diseases

The demand for infusion treatment devices is increasing owing to the rising incidence of chronic diseases including cancer, diabetes, and cardiovascular disorders globally. For therapies such as chemotherapy and insulin administration, patients with severe conditions frequently depend on infusion pumps. According to the National Center for Chronic Disease Prevention and Health Promotion, in February 2024, an estimated 129 million individuals in the US are affected by at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension. According to the US Department of Health and Human Services, five out of the top ten leading causes of mortality in the country are linked to preventable and treatable chronic diseases. A significant portion of the American population is managing multiple chronic conditions, with 42.0% having two or more and 12.0% having at least five, contributing to the substantial impact on the US healthcare system, which allocates about 90.0% of its annual $4.1 trillion expenditure to the management and treatment of chronic diseases and mental health conditions.

Technological Advancements

The market expansion in infusion treatment technology has been driven by the Infusion System, which offers features such as wireless connectivity, smart pumps, dose error reduction software, multi-therapy capabilities, and remote monitoring. For instance, in April 2023, Eitan Medical unveiled the Avoset Infusion device, a connected ambulatory multi-therapy infusion device intended to enhance specialty infusion therapy and post-acute care. The technology improves patient care and experience by enabling remote monitoring of infusion treatment data.

Market Segmentation

- Based on the product type, the market is segmented into infusion pumps, and consumables and accessories.

- Based on the therapy, the market is segmented into oncology, diabetes, gastroenterology, analgesia, hematology, and others (pediatrics).

- Based on the end-user, the market is segmented into hospitals, home care, and ambulatory surgery centers.

Infusion Pumps is Projected to Hold the Largest Market Share

Healthcare institutions are using an increasing number of infusion pumps, which renders fleet management essential. It enables numerous pumps to be connected and managed with a single application that propels market expansion. For instance, in June 2023, B. Braun Medical launched DoseTrac enterprise infusion management software. It provides capabilities for fleet management of infusion pumps, including immediate monitoring and retrospective reporting. With a single application, the platform can connect up to 40,000 pumps across several locations, facilitating smooth pump movement and ongoing quality improvement.

- In April 2024, Baxter International received FDA approval under 510(k) for its Novum IQ large volume infusion pump (LVP) equipped with Dose IQ safety software. Clinicians can utilize a single, integrated system across a variety of patient care settings utilizing the Novum IQ Infusion Platform, which combines Baxter's syringe infusion pump (SYR) with Dose IQ safety software. By integrating the user experience across SYR and LVP pumps, the platform relieves doctors of non-essential activities and frees them up to concentrate on patient care.

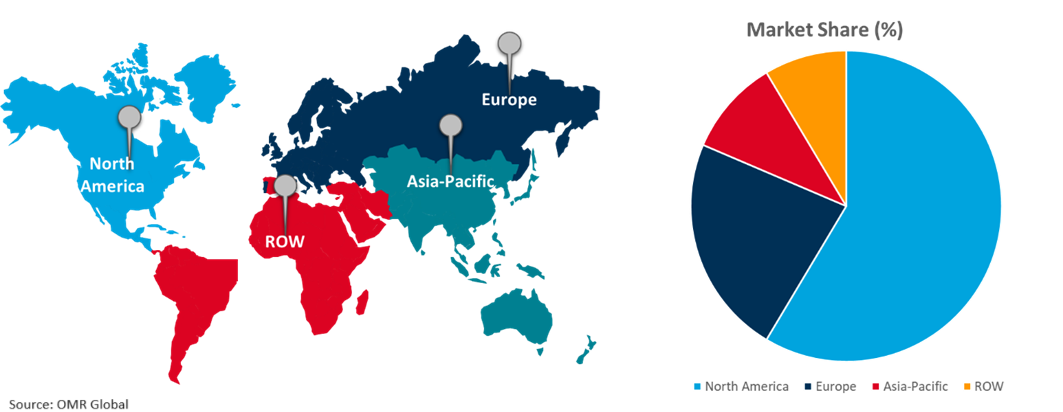

Regional Outlook

The global infusion therapy devices market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Geriatric Population in Asia-Pacific

- The aging population in the region contributes to the regional market growth, as elderly people are more prone to chronic diseases and require the usage of infusion therapy devices for proper management. According to Niti.Gov., in January 2023, senior citizens, made up over 10.0% of the population, equating to approximately 104.0 million individuals, in India. According to projections by the United Nations Population Fund (UNFPA), this number is expected to increase to 158.0 million by 2025 and further rise to 319.0 million by 2050, representing 19.5% of the total population. Additionally, the total dependency ratio, which was 56.9 in 2020, is forecasted to decrease until 2025 owing to a higher percentage of the working-age population, however, it is anticipated to climb back to 61.2 by 2050.

Global Infusion Therapy Devices Market Growth by Region 2024-2031

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the infusion therapy devices market include Baxter International, Inc., Becton, Dickinson and Co., Medtronic plc, Pfizer Inc., and Smiths Group plc among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In January 2024, Elevance Health acquired Paragon Healthcare, a company specializing in life-saving therapies, to enhance its multi-site infusion services and specialty pharmacy capabilities, particularly for members with chronic and complex illnesses.

- In April 2022, Fresenius Kabi acquired Ivenix, a US-based medical technology company, for $240.0 million, including an upfront payment and milestone payments for commercial and operating targets, which includes an infusion system.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global infusion therapy devices market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baxter International, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Becton, Dickinson, and Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Medtronic plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Infusion Therapy Devices Market by Product Type

4.1.1. Infusion Pumps

4.1.2. Consumables and Accessories

4.2. Global Infusion Therapy Devices Market by Application

4.2.1. Oncology

4.2.2. Diabetes

4.2.3. Gastroenterology

4.2.4. Analgesia

4.2.5. Hematology

4.2.6. Others(Pediatrics)

4.3. Global Infusion Therapy Devices Market by End-User

4.3.1. Hospitals

4.3.2. Homecare

4.3.3. Ambulatory Surgery Centers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. 3M Co.

6.2. Agiliti Health, Inc.

6.3. Avanos Medical, Inc.

6.4. Biomedix Medical, Inc.

6.5. Convatec Group PLC

6.6. Fresenius SE & Co. KGaA

6.7. ICU Medical, Inc

6.8. InfuSystem Inc.

6.9. JMS North America Corp.

6.10. Johnson & Johnson Services, Inc.

6.11. Medline Industries, LP

6.12. Mindray Medical India Pvt. Ltd.

6.13. Moog Inc.

6.14. Nipro Europe Group Co.

6.15. Owens & Minor

6.16. Pall Corp.

6.17. Pfizer Inc.

6.18. Smiths Group plc

6.19. Terumo Medical Corp.