Insulated Packaging Market

Global Insulated Packaging Market Size, Share & Trends Analysis Report by Material (Corrugated Cardboard, Plastics, Glass, and Others), by Product Type (Rigid, Semi-Rigid, and Flexible), and by Application (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, and Other Applications) Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global insulated packaging market is anticipated to grow at a CAGR of 4.7% during the forecast period (2020-2026). The key factors that drive the growth of the global insulated packaging market include the requirement for proper packaging of the product. Such advanced packaging technologies bring together a vast range of techniques and materials with two basic objectives: to protect the product and to display items for sale. According to the FAO report 2019, a majority of agricultural products are destroyed due to the absence of packaging. The causes of this loss are bad weather, physical, chemical, microbiological deterioration, and lack of desired packaging infrastructure. This increases the demand for insulated packaging and hence drives the market growth.

Insulated packaging offers resistance to the heat that transfers from one object to another with two different temperatures having low thermal conductivity. During transportation, thermal fluctuations of the temperature-sensitive products may deteriorate the quality of the product. To contain this, major companies are using insulated packaging, as it protects the product as well as maintain its specifications. Such properties offered by the insulated packaging encourage its adoption as well as aids in the growth of the global insulated packaging market over the forecast period. However, factors such as low awareness and low reach amongst the peoples may challenge the market growth over the forecast period. In addition, the higher cost of shipping smaller lots and the restricted number of destinations and temperature ranges available also acts as a barrier to the growth of the market over the forecast period.

Segmental Outlook

The global insulated packaging market is segmented on the basis of material, product type, and application. Based on the material, the market is segmented into corrugated cardboard, plastics & foams, wood, and others. Based on the product type, the market is segmented into rigid packaging, semi-rigid packaging, and flexible packaging. Based on the application, the market is segmented into food & beverages, pharmaceuticals, cosmetics & personal care, and other applications.

Plastics Segment is Estimated to Hold a Significant Market Share Over the Forecast Period

Amongst the material type segment of the market, the plastics segment is projected to hold a significant share in the market over the forecast period. The segmental growth of the market is attributed to a variety of properties possessed by plastic & foams, such as durability, cost-effectiveness as well as easy handling. Besides, plastics are widely accepted for food & beverage packaging applications. It is usually used in the packaging of those products which require controlled temperature and pressure. Preservation and packing of meat are usually packed in insulated plastic packages.

Regional Outlook

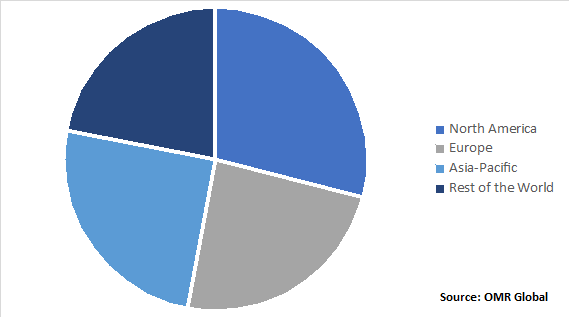

The global insulated packaging market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific region is estimated to grow significantly during the forecast period. The regional growth of the market is attributed to the continuous growth in the e-commerce sector. There has been a significant increase in the trend of the online channels across all applications ranging from food & beverages to cosmetics & personal care products. This, in turn, aids the growth of the market in the region. Further, the North American region is also likely to witness a significant growth rate over the forecast period owing to the presence of the key manufacturers in the region. The key players are continuously contributing to the growth of the market through several launches and innovations.

Global Insulated Packaging Market by Region, 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global insulated packaging market include DS Smith PLC, Nippon Paper Industries Co. Ltd, Huhtamaki Group Oyj, Amcor Plc, Sonoco Products Co., Airlite Plastics Co., and Marko Foam Products, Inc. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global insulated packaging market.

For instance, in August 2019, Airlite Plastics Co. took over Providence Packaging Inc.’s insulated packaging business unit. This acquisition by the company is likely to strengthen its position in the market as well as enhances its industry presence and product line offering of sustainable and innovative packaging for temperature-sensitive products to curb down the surging demands from a variety of industries.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global insulated packaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. DS Smith PLC

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Nippon Paper Industries Co. Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Huhtamaki Group Oyj

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Amcor Plc

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Sonoco Products Co.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Insulated Packaging Market by Material

5.1.1. Corrugated Cardboard

5.1.2. Plastics

5.1.3. Glass

5.1.4. Others

5.2. Global Insulated Packaging Market by Product Type

5.2.1. Rigid

5.2.2. Semi-Rigid

5.2.3. Flexible

5.3. Global Insulated Packaging Market by Application

5.3.1. Food & Beverages

5.3.2. Pharmaceuticals

5.3.3. Cosmetics & Personal Care

5.3.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Airlite Plastics Co.

7.2. Amcor Plc

7.3. American Aerogel

7.4. Cold Chain Technologies Inc.

7.5. Cold Ice Inc.

7.6. Cryopak, a TCP Company

7.7. Drew Foam of Georgia

7.8. Deutsche Post DHL

7.9. DS Smith PLC

7.10. Exeltainer

7.11. Huhtamaki Group Oyj

7.12. Innovative Energy Inc.

7.13. Insulated Products Corp.

7.14. Kite Packaging Ltd.

7.15. Marko Foam Products, Inc.

7.16. Nippon Paper Industries Co. Ltd.

7.17. Polar Tech Industries Inc.

7.18. SmartCAE Stefan Braun

7.19. Sonoco Products Co.

7.20. Suzhou Star New Material Co., Ltd.

7.21. Tempack (Temperature Packaging Solutions)

7.22. Temperpack Technologies, Inc.

7.23. TP Solutions

1. GLOBAL INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL INSULATED CORRUGATED CARDBOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL INSULATED PLASTICS PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL INSULATED GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

7. GLOBAL RIGID INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL SEMI-RIGID INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FLEXIBLE INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

11. GLOBAL INSULATED PACKAGING FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL INSULATED PACKAGING FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL INSULATED PACKAGING FOR COSMETICS & PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL INSULATED PACKAGING FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

18. NORTH AMERICAN INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

19. NORTH AMERICAN INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. EUROPEAN INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

22. EUROPEAN INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

23. EUROPEAN INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

28. REST OF THE WORLD INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

29. REST OF THE WORLD INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

30. REST OF THE WORLD INSULATED PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL INSULATED PACKAGING MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

2. GLOBAL INSULATED PACKAGING MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

3. GLOBAL INSULATED PACKAGING MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL INSULATED PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. UK INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. REST OF EUROPE INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD INSULATED PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)