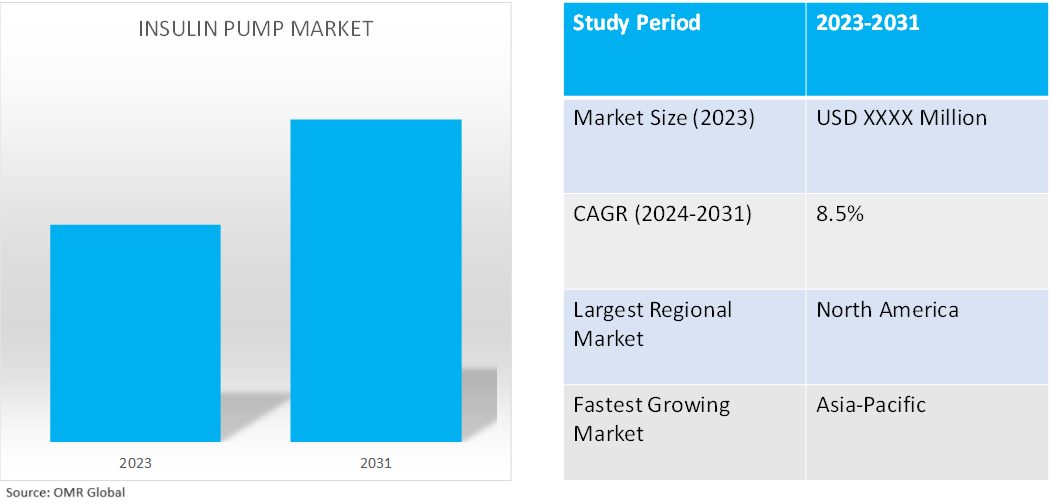

Insulin Pump Market

Insulin Pump Market Size, Share & Trends Analysis Report by Type (Traditional Pumps, Disposable Pumps, Smart Pumps), and by End-User (Hospitals & Clinics, and Homecare) Forecast Period (2024-2031)

Insulin pump market is anticipated to grow at a significant CAGR of 8.5% during the forecast period (2024-2031). An insulin pump is a portable device that delivers a specific amount of insulin to the body at specific time intervals. Additionally, a user can administer an extra insulin dose as per food intake (Bolus doses) to correct the blood glucose level. Insulin pumps are potential alternatives to insulin injections as they reduce the need for multiple insulin jabs and increase the ability to control blood and glucose levels in the body. The increasing prevalence of diabetes across the globe and advancements in drug delivery devices are estimated to be the primary factors that are driving the growth of the market.

Market Dynamics

Technological Advancement in Insulin Pumps

Medical device companies are developing next-generation insulin pumps with advanced technology to provide better compliance and integration with IT devices, which is contributing to the growth of the market. For instance, in January 2024, Medtronic plc announced CE (Conformité Européenne) Mark approval for the MiniMed 780G system with Simplera Sync, a disposable, all-in-one continuous glucose monitor (CGM) requiring no fingersticks or overtape. Simplera Sync features an improved user experience with a simple, two-step insertion process and is half the size of previous Medtronic sensors.

Increasing Prevalence of Diabetes

The increasing prevalence of diabetes has driven the demand for technically advanced insulin pumps globally. According to the International Diabetes Federation (IDF) Diabetes Atlas, 537 million adults (aged 20–79) worldwide had diabetes in 2021, which is 10.5% of the adult population in that age group. This includes both type 1 and type 2 diabetes, as well as diagnosed and undiagnosed cases. The IDF projects that this number will increase to 643 million by 2030 and 783 million by 2045.

Market Segmentation

- Based on the type, the market is segmented into traditional pumps, disposable pumps, and smart pumps.

- Based on the end-user, the market is segmented into hospitals & clinics, and home care.

Smart Insulin Holds Major Share Based on Type

Smart insulin pumps come with additional capabilities of collecting information and doing calculations to assist the user with insulin dosing. They also help to minimize highs and lows and prevent an overdose of insulin that would cause hypoglycemia by keeping track of insulin given in the preceding several hours. Most of the pumps have software that lets the user download all the finger-stick glucose and insulin data to a computer and examine the information. In January 2024, Medtronic received European approval to combine its latest automated insulin pump with its newest glucose sensor for the first time. The CE mark covers the MiniMed 780G pump and the Simplera Sync system, described as a disposable, all-in-one blood sugar sensor that takes less than 10 seconds to insert under the skin while requiring no fingersticks. Such developments are further aiding the growth of this market segment.

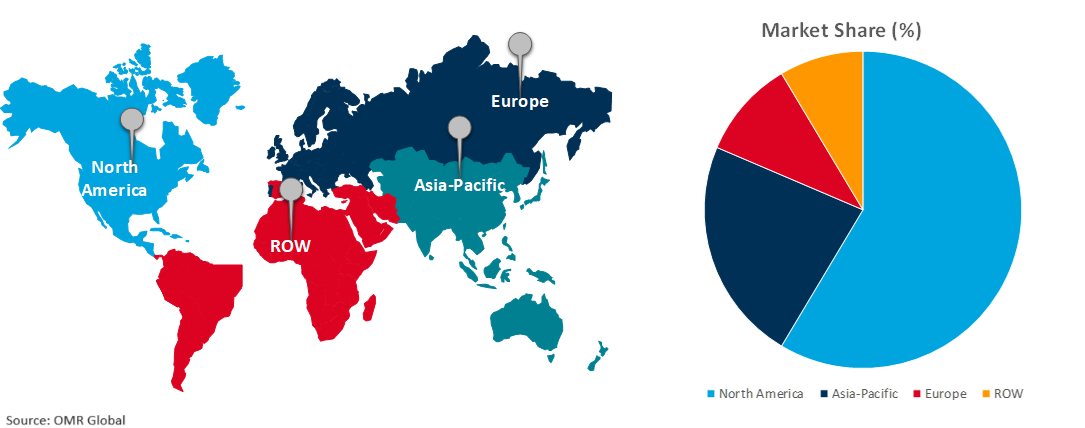

Regional Outlook

The global insulin pump market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Insulin Pump Market Growth by Region 2024-2031

Asia-Pacific is Anticipated to Exhibit Significant Growth in the Global Market.

Asia-Pacific region is estimated to be the fastest-growing market during the forecast period. The increasing diabetic population, rising awareness towards advanced insulin devices, and glycemic control are estimated to be the major factors that are driving the growth of the market. According to a 2023 study by the Indian Council of Medical Research (ICMR), the prevalence of diabetes in India is 10.1 crores. This is equivalent to 11.4% of the country's population, or 101 million people, living with diabetes. The study also found that 15.3% of the population, or 136 million people, could be living with pre-diabetes. Further, technological advancement in insulin pumps in the region is also backing the growth of the market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global insulin pump market include B. Braun Melsungen AG, Insulet Corp. (Omnipod), Medtronic Plc, Tandem Diabetes Care, Inc., and Sanofi SA among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In February 2024, Tandem Diabetes Care, Inc. announced the US commercial launch of its new Tandem Mobi, the smallest, durable automated insulin delivery system for people living with diabetes. The company has begun taking orders and shipping to eligible customers in the US.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global insulin pump market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Global Insulin Pump Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Traditional Insulin Pumps Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Disposable Insulin Pumps Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Smart Insulin Pumps Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Insulin Pump Market Research And Analysis By End-User, 2023-2031 ($ Million)

6. Global Insulin Pump For Hospitals & Clinics Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Insulin Pump For Homecare Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Insulin Pump Market Research And Analysis By Region, 2023-2031 ($ Million)

9. North American Insulin Pump Market Research And Analysis By Country, 2023-2031 ($ Million)

10. North American Insulin Pump Market Research And Analysis By Type, 2023-2031 ($ Million)

11. North American Insulin Pump Market Research And Analysis By End-User, 2023-2031 ($ Million)

12. European Insulin Pump Market Research And Analysis By Country, 2023-2031 ($ Million)

13. European Insulin Pump Market Research And Analysis By Type, 2023-2031 ($ Million)

14. European Insulin Pump Market Research And Analysis By End-User, 2023-2031 ($ Million)

15. Asia-Pacific Insulin Pump Market Research And Analysis By Country, 2023-2031 ($ Million)

16. Asia-Pacific Insulin Pump Market Research And Analysis By Type, 2023-2031 ($ Million)

17. Asia-Pacific Insulin Pump Market Research And Analysis By End-User, 2023-2031 ($ Million)

18. Rest Of The World Insulin Pump Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Rest Of The World Insulin Pump Market Research And Analysis By Type, 2023-2031 ($ Million)

20. Rest Of The World Insulin Pump Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Insulin Pump Market Share By Type, 2023 Vs 2031 (%)

2. Global Traditional Insulin Pumps Market Share By Region, 2023 Vs 2031 (%)

3. Global Disposable Insulin Pumps Market Share By Region, 2023 Vs 2031 (%)

4. Global Smart Insulin Pumps Market Share By Region, 2023 Vs 2031 (%)

5. Global Insulin Pump Market Share By End-User, 2023 Vs 2031 (%)

6. Global Insulin Pump For Hospitals & Clinics Market Share By Region, 2023 Vs 2031 (%)

7. Global Insulin Pump For Homecare Market Share By Region, 2023 Vs 2031 (%)

8. Global Insulin Pump Market Share By Region, 2023 Vs 2031 (%)

9. US Insulin Pump Market Size, 2023-2031 ($ Million)

10. Canada Insulin Pump Market Size, 2023-2031 ($ Million)

11. UK Insulin Pump Market Size, 2023-2031 ($ Million)

12. France Insulin Pump Market Size, 2023-2031 ($ Million)

13. Germany Insulin Pump Market Size, 2023-2031 ($ Million)

14. Italy Insulin Pump Market Size, 2023-2031 ($ Million)

15. Spain Insulin Pump Market Size, 2023-2031 ($ Million)

16. Rest Of Europe Insulin Pump Market Size, 2023-2031 ($ Million)

17. India Insulin Pump Market Size, 2023-2031 ($ Million)

18. China Insulin Pump Market Size, 2023-2031 ($ Million)

19. Japan Insulin Pump Market Size, 2023-2031 ($ Million)

20. South Korea Insulin Pump Market Size, 2023-2031 ($ Million)

21. Rest Of Asia-Pacific Insulin Pump Market Size, 2023-2031 ($ Million)

22. Latin America Insulin Pump Market Size, 2023-2031 ($ Million)

23. Middle East And Africa Insulin Pump Market Size, 2023-2031 ($ Million)