Insulin Pump Sensor Market

Global Insulin Pump Sensor Market Research By Type (Invasive Glucose Sensor and Non-Invasive Glucose Sensor), and By End User (Homecare, Hospitals and Clinics, Diagnostic Center and Other) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global insulin pump sensor market is growing at a considerable CAGR of 8.2% during the forecast period. Rising demand for wearable insulin pump is one of the prime factors affecting and driving the market. Increasing awareness towards insulin delivering devices, regulatory clearance to new products among others is also estimated to be the prime factors that are contributing significantly towards the growth of the market. However, rising accuracy and longevity issues related with sensors along with high cost involvement in insulin pumps are major factors constraints that are hindering the growth of the global insulin pump sensor market across the globe.

However, development of non-invasive sensors along with technological advancements is the key factors that are creating opportunity for the market. New product launches in the market are likely to drive the growth of the global insulin pump sensor market. For instance, in January 2021, Insulet Corp. one of the tubeless insulin pump technology had introduced Omnipod DASH insulin management system in Canada. This system offers tubeless, wearable, waterproof pad along with easy to use touchscreen PDM.

Impact of COVID-19 on the Global Insulin Pump Sensor Market

The global insulin pump sensor market is hardly hit by the COVID-19 pandemic since December 2019. The COVID-19 pandemic in the major economies had disrupted the manufacturing and transportation sector. Moreover, non-essential surgeries have been also suspended due to COVID-19 pandemic which had adversely impacted the patients suffering from diabetes owing to the requirement of insulin medication by them for proper maintaining of blood sugar level and could suffer more problems due to weakened immunity.

Segmental Outlook

The market is segmented based on type and end user. Based on type, the market is segmented into invasive glucose sensor and non-invasive glucose sensor. Further, by end-user, market is segmented into homecare, hospitals and clinics, diagnostic center and other.

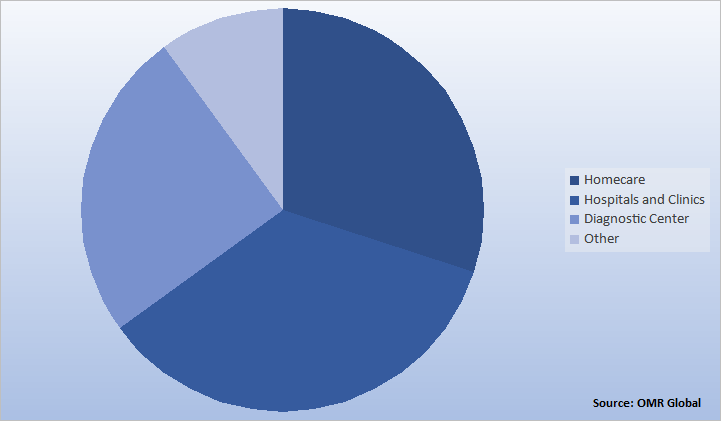

Global Insulin Pump Sensor Market by End User 2020 (%)

Based on the end user, hospital and clinics hold a significant share in the market. Hospital and clinics mostly use the insulin pump in order to provide effective treatment to the patients. Hospital and Clinics have been associated with large economic cost related with diabetes. Hospital and clinics keep proper record that which type of insulin formulation along with pump setting is given to the patient. Moreover, in hospital generally after the first injection of basal insulin, the insulin pump is discontinued at least for 2 hours.

Regional Outlooks

The global insulin pump sensor market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America held a considerable share in 2020 in the global insulin pump sensor market. Some factors that are boosting the market growth in North America are growing increasing incidence of diabetes, leading manufactures and players present in the region such as Abbott, Tandem Diabetes Care, Inc. among others. Additionally, well developed infrastructure of health that has led to adoption of new products and treatments along with favorable reimbursement environment for insulin pump is other factors that are promoting the growth of the market.

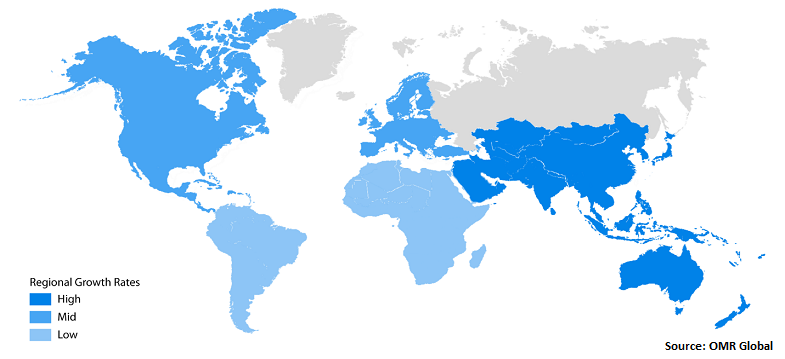

Global Insulin Pump Sensor Market, by Region 2021-2027

Asia-Pacific will have Considerable Growth in the Global Insulin Pump Sensor Market

Asia-Pacific region is expected to witness significant growth opportunities for the market. Increasing awareness regarding diabetes along with increasing adoption of wearable insulin pump in emerging economies of the region are likely to drive the growth of the regional market. Further due to, rising health care expenditure in India, China and South Korea are also some of the factors that are affecting and impacting the growth in this market.

Market Player Outlook

Key players of the global insulin pump sensor market are Abbott, Insulet Corp., Medtronic, Roche Diabetes Care, and Tandem Diabetes Care, Inc. among others. To survive in the market, these players adopt different marketing strategies such as product launches, acquisition and collaboration. For instance, in March 2021, Boston Scientific Corp. had acquired Israeli medtech Lumenis’s in around $1.07 billion. Through this acquisition the company will diversify its portfolio.

In December 2020, Novo Nordisk A/S had completed acquisition of Emisphere for a transaction amount of $1.35 billion in order to deliver drug for the treatment of type 2 diabetes.

In June 2020, Abbott has done collaboration with one of the medical device manufacturer companies named as Tandem Diabetes Care, Inc., through this both the company would come together and integrates their digital insulin delivery systems and glucose sensing technology in order to manage diabetes.

In October 2019, Novo Nordisk A/S had received the clearance and approval from the US Food and Drug Administration (FDA) for the purpose of expanding the label for Fiasp that can be included in insulin infusion pumps in order for betterment of glycemic control in adults having diabetes type 1 or type 2.

In August 2019, For the purpose of expanding the portfolio the acquisition of British minimally invasive device manufacturer BTG had been done for around $4.2 billion by Boston Scientific Corp.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global insulin pump sensor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where in the market.

1. GLOBAL INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL INSULIN PUMP SENSOR MARKET BY TYPE, 2020-2027 ($ MILLION)

3. GLOBAL INVASIVE GLUCOSE SENSOR MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL NON-INVASIVE GLUCOSE SENSOR MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL INSULIN PUMP SENSOR MARKET BY END USER, 2020-2027 ($ MILLION)

6. GLOBAL HOMECARE MARKET BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL HOSPITALS AND CLINICS MARKET BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL DIAGNOSIS CENTER MARKET BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL OTHER MARKET BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

13. NORTH AMERICAN INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

14. EUROPEAN INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. EUROPEAN INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

16. EUROPEAN INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

20. REST OF THE WORLD INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

21. REST OF THE WORLD INSULIN PUMP SENSOR MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL INSULIN PUMP SENSOR MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL INSULIN PUMP SENSOR MARKET SHARE BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL INSULIN PUMP SENSOR MARKET, 2021-2027 (%)

4. GLOBAL INSULIN PUMP SENSOR MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL INSULIN PUMP SENSOR MARKET SHARE BY END USER, 2020 VS 2027 (%)

6. GLOBAL INSULIN PUMP SENSOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL INVASIVE GLUCOSE SENSOR MARKET BY REGION, 2020 VS 2027 (%)

8. GLOBAL NON-INVASIVE GLUCOSE SENSOR MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL HOMECARE MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL HOSPITALS AND CLINICS MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL DIAGNOSIS CENTER MARKET BY REGION, 2020 VS 2027 (%)

12. GLOBAL OTHER MARKET BY REGION, 2020 VS 2027 (%)

13. US INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

14. CANADA INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

15. UK INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

16. FRANCE INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

17. GERMANY INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

18. ITALY INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

19. SPAIN INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

20. REST OF EUROPE INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

21. INDIA INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

22. CHINA INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

23. JAPAN INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

24. SOUTH KOREA INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF ASIA-PACIFIC INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF THE WORLD INSULIN PUMP SENSOR MARKET SIZE, 2020-2027 ($ MILLION)