Insurance Analytics Market

Global Insurance Analytics Market Size, Share & Trends Analysis Report By Application (Claims Management, Risk Management, Customer Management, and Personalization, Process Optimization, and Others), By Deployment (On-premise and Cloud), By End-User (Insurance Companies, Government Agencies, and Third-party Administrators, Brokers, & Consultancies), and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global insurance analytics market is projected to grow at a CAGR of around 12% during the forecast period. Insurance analytics provide services and tools that can be used to process and analyze data to generate insights, which are helpful in decision making. Growing competition in the market is encouraging companies to upgrade their existing business model, streamline operations, and enhance processes. Moreover, rapidly maturing digital infrastructure and increasing fraudulent activities in the insurance industry are expected to increase the demand for analytics solutions. Owing to the changing financial policies and regulations across the globe, insurance facilities are compelled to opt for analytics to control their operations.

Through the adoption of analytics, companies are focusing on improving customer experience as well as offering solutions based on a deep understanding of customer behavior and needs. By using customer’s behavioral data, the insurer can revise and redevelop new strategies and products, which may get more sales success in the market. Furthermore, it allows insurers to empower distributors or agents with tools to identify various business opportunities and service existing customers. These solutions also allow companies to minimize overall customer handling cost, time, and fraud cases, which is expected to drive market demand.

Impact of COVID-19 Pandemic on Global Insurance Analytics Market

Several insurance providers are accelerating investments in digitization and closing gaps in business continuity models. The integration of third-party data to mitigate risk is increasing in urgency. Throughout this time, customers are reminded of how significant the role of insurance is in their lives. For instance, health coverage assists with drug and treatment plans for the ill, employment insurance helps those impacted by the economic turmoil, and business interruption coverage supports businesses unable to operate. Companies must continue investing and enabling access for customers while ensuring underwriters are well-informed of upcoming risks. Emergencies, such as COVID-19, highlight the need for insurers to seamlessly integrate reliable data sources, actionable insights, and responsive control measures to help navigate the uncertain landscape. By leveraging data and investing in digitization and analytics, insurers can navigate this challenging period and move the industry forward.

Segmental Outlook

The global insurance analytics market is segmented based on application, deployment, and end-users. Based on the application, the market is segmented into claims management, risk management, customer management and personalization, process optimization, and others. Based on the deployment, the market is classified into on-premise and cloud. Based on End-Users Insurance Companies, Government Agencies, and Third-party Administrators, Brokers, & Consultancies.

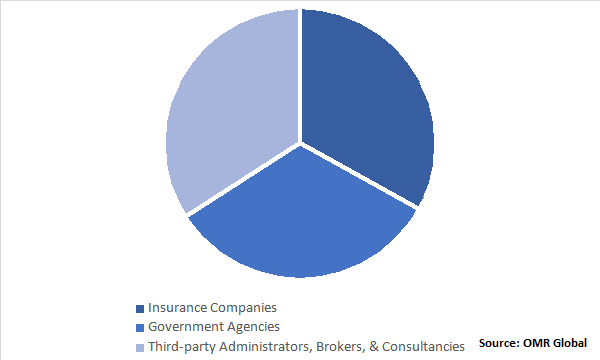

Global Insurance Analytics Market by End-User Industry, 2019 (%)

Insurance Companies Segment to Hold a Lucrative Share in the Global Insurance Analytics Market

Based on end-user, the insurance companies’ segment is estimated to hold a prominent share in the overall insurance analytics market during the forecast period. The large share of this segment is linked to the power of privatization in making business effective decisions, that encourage the high use of modern technologies in order to attract and serve a huge population of customers. However, the government agencies segment is expected to grow with the lucrative CAGR during the forecast period.

Regional Outlook

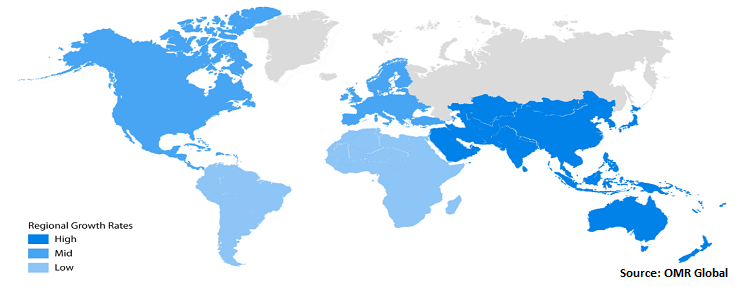

The global Insurance Analytics market is segmented on the basis of region into North America (the US and Canada), Europe (Germany, Spain, Italy, France, the UK, and the Rest of Europe), Asia-Pacific (India, China, Japan, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America). The North American region is estimated to command the largest share of the global insurance analytics market in 2019, followed by Europe. However, the Asia-Pacific region is expected to witness rapid growth during the forecast period.

Global Insurance Analytics Market Growth by Region, 2020-2026

Market Players Outlook

Some of the prominent players operating in the global insurance analytics market include Hexaware Technologies, LexisNexis Risk Solutions, OpenText, PEGASYSTEMS INC., Sapiens International, Tableau Software, LLC, and Verisk Analytics, Inc., among others. These players are adopting various strategies such as new product launches and approvals, mergers and acquisitions, partnerships and collaborations, and many others in order to thrive in a competitive environment. For instance, in April 2020, OpenText collaborated with Amazon Web Services (AWS). Through this agreement, OpenText can provide customers more excellent choices in deploying their business-critical information management solutions.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global insurance analytics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Insurance Analytics Market by Application

5.1.1. Claims Management

5.1.2. Risk Management

5.1.3. Customer Management and Personalization

5.1.4. Process Optimization

5.1.5. Others (workforce management and fraud detection)

5.2. Global Insurance Analytics Market by Deployment

5.2.1. On-premise

5.2.2. Cloud

5.3. Global Insurance Analytics Market by End User

5.3.1. Insurance Companies

5.3.2. Government Agencies

5.3.3. Third-party Administrators, Brokers,& Consultancies

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Applied Systems, Inc.

7.2. Aptitive

7.3. Board International SA

7.4. BRIDGEi2i

7.5. CyberCube Analytics Inc.

7.6. Damco Group

7.7. Hexaware Technologies Ltd.

7.8. IBM Corp.

7.9. InsuredMine Inc.

7.10. LexisNexis Risk Solutions Group

7.11. Luminant Analytics GmbH

7.12. OpenText Corp.

7.13. Pentation AnalyticsPvt Ltd.

7.14. Qlik International AB

7.15. RiskVille Ltd.

7.16. SAP SE

7.17. Sapiens International Corp.

7.18. Tableau Software LLC

7.19. TIBCO Software Inc.

7.20. Verisk Analytics, Inc.

7.21. Vertafore Inc.

7.22. WNS(Holdings) Ltd.

1. GLOBAL INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

2. GLOBAL INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

3. GLOBAL CLAIMS MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL CUSTOMER MANAGEMENT AND PERSONALIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PROCESS OPTIMIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER INSURANCE ANALYTICS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2019-2026 ($ MILLION)

9. GLOBAL ON-PREMISE INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL CLOUD-BASED INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

12. GLOBAL INSURANCE ANALYTICS FOR INSURANCE COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL INSURANCE ANALYTICS FOR GOVERNMENT AGENCIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL INSURANCE ANALYTICS FOR THIRD-PARTY ADMINISTRATORS, BROKERS, & CONSULTANCIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. NORTH AMERICAN INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2019-2026 ($ MILLION)

19. NORTH AMERICAN INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY END-USER2019-2026 ($ MILLION)

20. EUROPEAN INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. EUROPEAN INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2019-2026 ($ MILLION)

23. EUROPEAN INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

28. REST OF THE WORLD INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

29. REST OF THE WORLD INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2019-2026 ($ MILLION)

30. REST OF THE WORLD INSURANCE ANALYTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL INSURANCE ANALYTICS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL INSURANCE ANALYTICS MARKET SHARE BY DEPLOYMENT, 2019 VS 2026 (%)

3. GLOBAL INSURANCE ANALYTICS MARKET SHARE BY END-USER, 2019 VS 2026 (%)

4. GLOBAL INSURANCE ANALYTICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

12. REST OF EUROPE INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD INSURANCE ANALYTICS MARKET SIZE, 2019-2026 ($ MILLION)