Insurance Fraud Detection Market

Global Insurance Fraud Detection Market Size, Share & Trends Analysis Report by Component (Solution and Services), by Deployment Type (Cloud and On-Premises) by end-user (SMEs, and Large Enterprise), Forecast 2019-2025 Update Available - Forecast 2025-2035

Insurance fraud detection is anticipated to grow at a CAGR of 10.3% during the forecast period. The fraud detection system is a software application that is utilized to offer analytical solutions against fraud incidence and enables to identify future fraud occurrences. The different factors that include an increase in the sophistication level of cyber attack and large monetary losses due to this attack in the insurance sector are projected to drive the insurance fraud detection industry growth. Factors such as lack of awareness in the organization regarding the importance of fraud detection solution and lack of integration of fraud detection solution in the organization network may hamper the market during the forecast period.

The establishment of cloud computing services and big data analytics and an increase in mobile banking services are projected to drive the insurance fraud detection market. Cloud infrastructure provides business to fulfill the requirements of cloud security that are diversifying of duties and access control of protected data. Moreover, growth in the generation of enterprise data, rising in the incidence of fraud and the large industry-specific requirement is flourishing the growth of the market.

Segmental Outlook

The global insurance fraud detection market is segmented on the basis of component, deployment type, and end-user. Based on the deployment type, the market is segmented into the cloud and on-premises. The cloud segment is expected to be significant market growth during the forecast period. Cloud-based insurance fraud detection solution provides a unified way in the form of SaaS-based insurance fraud services to protect the business application. It is cost-efficient than an on-premises deployment that permitting the organization to reduce IT expenses, due to these factors businesses are adopting the cloud-based deployment on a large scale.

Based on end-user, the market is segmented into SMEs and large enterprises. The SMEs segment is anticipated growing at a higher rate during the forecast period due to a cyber-attack on SMEs and the rising number of incidences of insurance frauds. Based on the component, the market is segmented into solutions and services. Based on services, the market is further segmented into professional and managed. The professional segment adopted owing to rising government regulation, procedures for data protection and growing in fraudulent activities. Additionally, the increasing popularity of mobile devices has challenges to organizations and the government to implement effective solutions that identify to evolving threats.

Based on the solution, the market is segmented into fraud analytics and authentication. Fraud analytics is anticipated to be the largest segment in the insurance fraud detection market as it enables insurance organizations to handle the security challenges and threats owing to the rising adoption of digital technologies include BYOD and IoT in their business to expand the customer experience. It is a discipline that comprises a set of analytical techniques that analyze the organization system and database for determining the infirmity. These solutions enable and analyze data from different data sources, unusual behavior of all channels, offer a control mechanism to control fraudulent practices and detect anomalies.

Regional Outlook

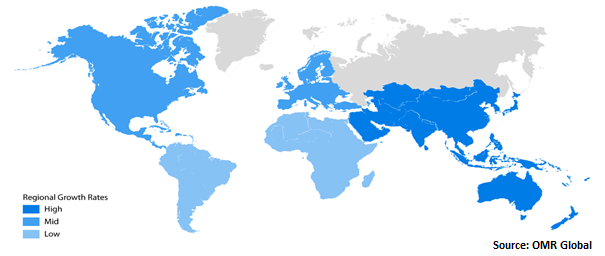

The global insurance fraud detection market is further segmented based on geography including North America, Europe, Asia-Pacific and Rest of the World. North America is expected to hold the largest market share in the market due to the increasing adoption of the insurance fraud detection solution and protecting enterprise-critical infrastructure. The mobile buyers have been targeted through the fraudsters as mobile banking has become an important tool for making a financial transaction. Moreover, rising trends that include penetration of smartphones and IoT have raised the volume of data and performed the transaction by online users. The presence of a large number of insurance fraud detection solution providers in the US is propelling to drive the growth of the market in terms of revenue.

Global Insurance Fraud Detection Market Growth, by Region 2019-2025

Asia-Pacific will augment with the fastest rate in insurance fraud detection market

The market in Asia-Pacific is expected to be the fastest-growing region mainly owing to a rise in the penetration of the internet and growing usage of mobile data for different applications that include mobile banking and social media that anticipated the growth of the region. Moreover, as the increasing number of smart devices, the BYOD trend is growing in the emerging countries, SMEs and large enterprises are becoming aware of increasing instances claim fraud, payment frauds, and identity thefts.

Market Players Outlook

The key players of the insurance fraud detection market include IBM Corp, Oracle Corp, SAS Institute Inc., Fair Isaac Corp, SAP SE, BAE Systems, PLC, ACI Worldwide, Inc., NCR Corp., Experian, PLC, FRISS, Software AG, and BRIDGEi2i Analytics Solutions.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global insurance fraud detection market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. IBM Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Oracle Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. SAS Institute, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. SAP SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Experian PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Insurance Fraud Detection Market by Component

5.1.1. Solution

5.1.1.1. Fraud Analytics

5.1.1.2. Authentication

5.1.2. Services

5.1.2.1. Professional

5.1.2.2. Managed

5.2. Global Insurance Fraud Detection Market by Deployment Type

5.2.1. Cloud

5.2.2. On-Premises

5.3. Global Insurance Fraud Detection Market by End-User

5.3.1. Small & Medium Enterprises

5.3.2. Large Enterprises

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ACI Worldwide, Inc.

7.2. BAE Systems, PLC

7.3. BRIDGEi2i Analytics Solutions

7.4. Datawalk, Inc.

7.5. DXC Technology Co.

7.6. Experian PLC

7.7. Fair Isaac Corp.

7.8. Fiserv, Inc.

7.9. FRISS

7.10. IBM Corp.

7.11. Infogix, Inc.

7.12. Kount, Inc.

7.13. LexisNexis Risk Solutions, Inc.

7.14. NCR Corp.

7.15. Oracle Corp.

7.16. SAP SE

7.17. SAS Institute, Inc.

7.18. Scorto, Inc.

7.19. TransUnion, LLC

7.20. Wipro, Ltd.

1. GLOBAL INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

2. GLOBAL INSURANCE FRAUD DETECTION SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL INSURANCE FRAUD DETECTION SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLYOMENT TYPE, 2018-2025 ($ MILLION)

5. GLOBAL CLOUD MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ON-PREMISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

8. GLOBAL SMALL & MEDIUM ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. NORTH AMERICA INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

12. NORTH AMERICAN INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLYOMENT TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

14. EUROPEAN INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

16. EUROPEAN INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

17. EUROPEAN INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

22. REST OF THE WORLD INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

23. REST OF THE WORLD INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

24. REST OF THE WORLD INSURANCE FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL INSURANCE FRAUD DETECTION MARKET SHARE BY COMPONENT, 2018 VS 2025 (%)

2. GLOBAL INSURANCE FRAUD DETECTION MARKET SHARE BY DEPLOYMENT TYPE, 2018 VS 2025 (%)

3. GLOBAL INSURANCE FRAUD DETECTION MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL INSURANCE FRAUD DETECTION MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

7. UK INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD INSURANCE FRAUD DETECTION MARKET SIZE, 2018-2025 ($ MILLION)