Insurtech Market

Insurtech Market Size, Share & Trends Analysis Report by Type (Auto, Business, Health, Home, Specialty, Travel, and Others), by Service (Consulting, Support & Maintenance, and Managed Services), by End-User (Automotive, BFSI, Government, Healthcare, Manufacturing, Retail, Transportation, and Others), and by Technology (Artificial Intelligence (AI), Cloud Computing, Blockchain, Big Data & Business Analytics, Internet-of-Things (IoT), and Others) Forecast Period (2023-2029) Update Available - Forecast 2025-2031

Insurtech market is anticipated to grow at a CAGR of 38.8% during the forecast period. The primary factor boosting the market growth includes the increasing number of insurance claims across the globe. According to a 2021 study by the Insurance Barometer, 36% of American respondents purchased life insurance. Owing to which, insurance companies are shifting towards the integration of digital technologies such as blockchain and others. Blockchain technology enables insurance companies to cut down on operational costs and drive operational efficiencies. This technology can be used to drive growth, integrate varied insurtech platforms, and enable new services to come to market, particularly for those who could not access insurance previously. Insurtech companies are expected to aggressively opt for blockchain technology owing to its features such as smart contracts, advanced automation, and strong cybersecurity. For instance, in

Segmental Outlook

The global Insurtech market is segmented based on the type, service, end-user, and technology. Based on the type, the market is segmented into auto, business, health, home, specialty, travel and others. Based on the service, the market is sub-segmented into consulting, support & maintenance, and managed services. Further, based on end-user, the market is segmented into automotive, BFSI, government, healthcare, manufacturing, retail, transportation, and others. Based on technology, the market is segmented into AI, cloud computing, blockchain, big data & business analytics, IoT, and others. Among the services, the managed services sub-segment is anticipated to hold a considerable share of the market, as managed service providers offer best processes, practices, and regulatory considerations to insurers.

The Health Sub-Segment is Anticipated to Hold Prominent Share in the Global Insurtech Market

Among the end-users, the health sub-segment is expected to hold a prominent share of the global insurtech market across the globe, owing to the high demand for digital platforms, which connect exchanges, brokers, providers, and carriers in health insurance among all age group. Life and health insurers are focusing on using advanced analytics to better serve and understand their customers. Numerous health insurance companies are adopting insurtech solutions to streamline claims processing procedures. Insurers are also focusing on combining their health insurance services with mobility features for added convenience.

The rising digitization in the insurance sector is expected to drive the adoption of insurtech solutions in the healthcare industry. The growing number of devices has created a need for effective monitoring, management, and maintenance of data across healthcare organizations. The growing digitization among customers has amplified the demand for easier and better access to insurance technology services. Furthermore, the rise in the use of blockchain-based technology among health and life insurance companies is also expected to drive the segment growth.

Regional Outlook

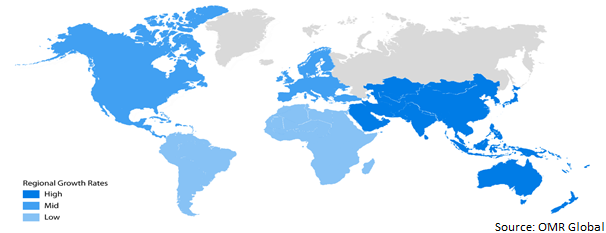

The global Insurtech market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for particular region or country level as per the requirement. Among these, the Asia-Pacific regional market is expected to cater prominent growth over the forecast period, however, the North American region is projected to experience considerable growth in the Insurtech market.

Global Insurtech Market Growth, by Region 2023-2029

The Asia-Pacific Region is Expected to Hold Prominent Share in the Global Insurtech Market

Among all regions, the Asia-Pacific region is anticipated to emerge as the fastest-growing regional market over the forecast period. The region is expected to witness significant growth due to the presence of numerous emerging economies and financial hubs in countries such as Singapore, India, and Hong Kong, among others. Insurance service providers in the region are aiming to offer affordable insurance premium plans. For instance, in April 2022, NTUC Income (Income) launched lexiTravel Hourly Insurance, Singapore’s first travel insurance that enables travellers to purchase travel protection as needed by the hour. Available for those who are travelling only to Bintan, Batam and Malaysia, FlexiTravel Hourly Insurance is a flexible and affordable way for travellers to insure themselves for short or sudden regional trips by land/ sea that range from a few hours to a full weekend.

Market Players Outlook

The major companies serving the global Insurtech market include Banc Insurance Agency Inc (Insuritas), Policy Bazaar, ZhongAn Online Property & Casualty Insurance Co. Ltd., Clover Health Insurance, Acko General Insurance Limited, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2020, Amodo, an insurtech firm partnered with Galileo Platforms Ltd., a technology firm. The companies will leverage blockchain technologies to enable insurance companies to deliver new insurance products and alter their client experience as a result of their relationship.

The Report Covers

- Market value data analysis of 2023 and forecast to 2029.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global insurtech market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Insurtech Market by Type

4.1.1. Auto

4.1.2. Business

4.1.3. Health

4.1.4. Home

4.1.5. Specialty

4.1.6. Travel

4.1.7. Others

4.2. Global Insurtech Market by Service

4.2.1. Consulting

4.2.2. Support & Maintenance

4.2.3. Managed Services

4.3. Global Insurtech Market by End-User

4.3.1. Automotive

4.3.2. BFSI

4.3.3. Government

4.3.4. Healthcare

4.3.5. Manufacturing

4.3.6. Retail

4.3.7. Transportation

4.3.8. Others

4.4. Global Insurtech Market by Technology

4.4.1. Artificial Intelligence (AI)

4.4.2. Cloud Computing

4.4.3. Blockchain

4.4.4. Big Data & Business Analytics

4.4.5. Internet-of-Things (IoT)

4.4.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Acko General Insurance Ltd.

6.2. Banc Insurance Agency Inc (Insuritas)

6.3. Clover Health Insurance

6.4. Damco Group

6.5. DXC Technology Co.

6.6. Insurance Technology Services

6.7. Majesco

6.8. Oscar Insurance

6.9. OutSystems

6.10. Policy Bazaar

6.11. Quantemplate

6.12. Shift Technology

6.13. Trov Insurance Solutions, LLC

6.14. Wipro Ltd.

6.15. Zhongan Insurance

1. GLOBAL INSURTECH MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

2. GLOBAL AUTO INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

3. GLOBAL BUSINESS INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

4. GLOBAL HEALTH INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

5. GLOBAL HOME INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

6. GLOBAL SPECIALTY INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

7. GLOBAL TRAVEL INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

8. GLOBAL OTHER TYPES INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

9. GLOBAL INSURTECH MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2029 ($ MILLION)

10. GLOBAL CONSULTING IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

11. GLOBAL SUPPORT & MAINTENANCE IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

12. GLOBAL MANAGED SERVICES IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

13. GLOBAL INSURTECH MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2029 ($ MILLION)

14. GLOBAL INSURTECH FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

15. GLOBAL INSURTECH FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

16. GLOBAL INSURTECH FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

17. GLOBAL INSURTECH FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

18. GLOBAL INSURTECH FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

19. GLOBAL INSURTECH FOR RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

20. GLOBAL INSURTECH FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

21. GLOBAL INSURTECH FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

22. GLOBAL INSURTECH MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2029 ($ MILLION)

23. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

24. GLOBAL CLOUD COMPUTING IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

25. GLOBAL BLOCKCHAIN IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

26. GLOBAL BIG DATA & BUSINESS ANALYTICS IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

27. GLOBAL INTERNET-OF-THINGS (IOT) IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

28. GLOBAL OTHER TECHNOLOGIES IN INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

29. GLOBAL INSURTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

30. NORTH AMERICAN INSURTECH MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

31. NORTH AMERICAN INSURTECH MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

32. NORTH AMERICAN INSURTECH MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2029 ($ MILLION)

33. NORTH AMERICAN INSURTECH MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2029 ($ MILLION)

34. NORTH AMERICAN INSURTECH MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2029 ($ MILLION)

35. EUROPEAN INSURTECH MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

36. EUROPEAN INSURTECH MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

37. EUROPEAN INSURTECH MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2029 ($ MILLION)

38. EUROPEAN INSURTECH MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2029 ($ MILLION)

39. EUROPEAN INSURTECH MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2029 ($ MILLION)

40. ASIA-PACIFIC INSURTECH MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

41. ASIA-PACIFIC INSURTECH MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

42. ASIA-PACIFIC INSURTECH MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2029 ($ MILLION)

43. ASIA-PACIFIC INSURTECH MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2029 ($ MILLION)

44. ASIA-PACIFIC INSURTECH MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2029 ($ MILLION)

45. REST OF THE WORLD INSURTECH MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

46. REST OF THE WORLD INSURTECH MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

47. REST OF THE WORLD INSURTECH MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2029 ($ MILLION)

48. REST OF THE WORLD INSURTECH MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2029 ($ MILLION)

49. REST OF THE WORLD INSURTECH MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2029 ($ MILLION)

1. GLOBAL INSURTECH MARKET SHARE BY TYPE, 2021 VS 2029 (%)

2. GLOBAL AUTO INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

3. GLOBAL BUSINESS INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

4. GLOBAL HEALTH INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

5. GLOBAL HOME INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

6. GLOBAL SPECIALTY INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

7. GLOBAL TRAVEL INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

8. GLOBAL OTHER TYPES INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

9. GLOBAL INSURTECH MARKET SHARE BY SERVICE, 2021 VS 2029 (%/)

10. GLOBAL CONSULTING IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

11. GLOBAL SUPPORT & MAINTENANCE IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

12. GLOBAL MANAGED SERVICES IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

13. GLOBAL INSURTECH MARKET SHARE BY END-USER, 2021 VS 2029 (%)

14. GLOBAL INSURTECH FOR AUTOMOTIVE MARKET SHARE BY REGION, 2021 VS 2029 (%)

15. GLOBAL INSURTECH FOR BFSI MARKET SHARE BY REGION, 2021 VS 2029 (%)

16. GLOBAL INSURTECH FOR GOVERNMENT MARKET SHARE BY REGION, 2021 VS 2029 (%)

17. GLOBAL INSURTECH FOR HEALTHCARE MARKET SHARE BY REGION, 2021 VS 2029 (%)

18. GLOBAL INSURTECH FOR MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

19. GLOBAL INSURTECH FOR RETAIL MARKET SHARE BY REGION, 2021 VS 2029 (%)

20. GLOBAL INSURTECH FOR TRANSPORTATION MARKET SHARE BY REGION, 2021 VS 2029 (%)

21. GLOBAL INSURTECH FOR OTHER END-USERS MARKET SHARE BY REGION, 2021 VS 2029 (%)

22. GLOBAL INSURTECH MARKET SHARE BY TECHNOLOGY, 2021 VS 2029 (%)

23. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

24. GLOBAL CLOUD COMPUTING IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

25. GLOBAL BLOCKCHAIN IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

26. GLOBAL BIG DATA & BUSINESS ANALYTICS IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

27. GLOBAL INTERNET-OF-THINGS (IOT) IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

28. GLOBAL OTHER TECHNOLOGIES IN INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

29. GLOBAL INSURTECH MARKET SHARE BY REGION, 2021 VS 2029 (%)

30. US INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

31. CANADA INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

32. UK INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

33. FRANCE INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

34. GERMANY INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

35. ITALY INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

36. SPAIN INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

37. REST OF EUROPE INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

38. INDIA INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

39. CHINA INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

40. JAPAN INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

41. SOUTH KOREA INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

42. REST OF ASIA-PACIFIC INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)

43. REST OF THE WORLD INSURTECH MARKET SIZE, 2021-2029 ($ MILLION)