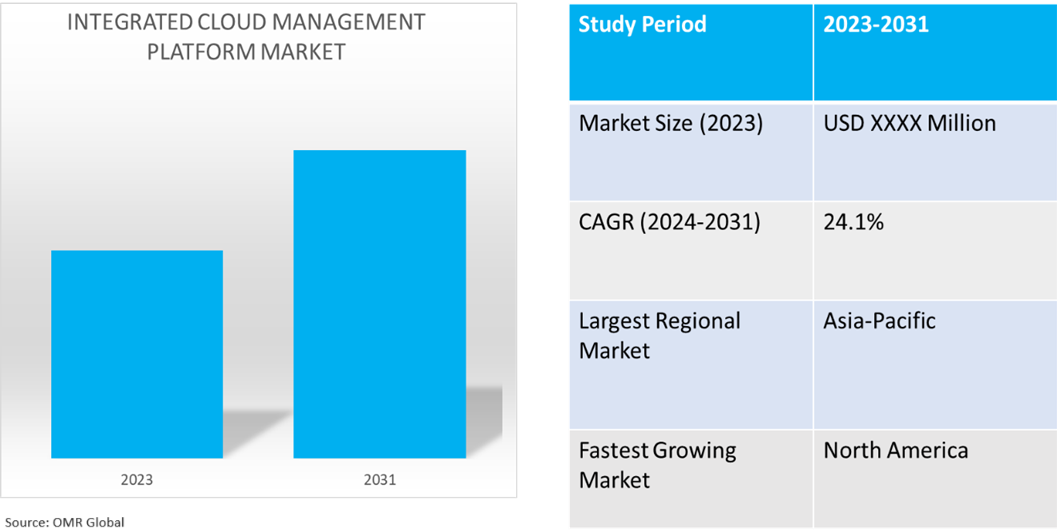

Integrated Cloud Management Platform Market

Integrated Cloud Management Platform Market Size, Share & Trends Analysis Report by Component (Solution, and Services), and by Vertical (Government and Public Sector, BFSI, Retail and Consumer Goods, Energy and Utilities, Healthcare and Lifesciences, Manufacturing, IT and Telecommunications, and Others) Forecast Period (2024-2031)

Integrated cloud management platform market is anticipated to grow at a significant CAGR of 24.1% during the forecast period (2024-2031). The demand for integrated cloud management platforms that provide all-inclusive solutions for managing, optimizing, and securing cloud environments is driven by the growth of cloud technologies. The platforms facilitate innovation, manage resources, and assist with digital transformation projects. Cloud performance management requires real-time analytics and monitoring, and new developments in cloud computing technologies such as edge computing and serverless computing are influencing the demands for cloud management.

Market Dynamics

Adoption of Multi-Cloud and Hybrid Cloud Strategies

The adoption of innovative technologies to minimize vendor lock-in is driving the growth of multi-cloud and hybrid-cloud methods. For instance, in December 2023, Hitachi Vantara launched a hybrid system integrating with Google Cloud, the Hitachi Unified Compute Platform (UCP) for GKE Enterprise. By providing a single, integrated platform for managing hybrid cloud operations, the platform improves infrastructure and application flexibility, scalability, and efficiency. By combining the adaptability of Google Distributed Cloud Virtual (GDCV) with the flexibility of Hitachi UCP, the integration enables it to deploy and manage workloads across edge locations, cloud environments and on-premises data centers.

Demand for Cloud Governance and Compliance

As cloud computing advances, there is a growing demand for effective governance and compliance to ensure the efficient use of cloud resources. For instance, in April 2024, Anodot released its yearly survey report on cloud cost optimization, summarizing important discoveries from significant FinOps companies. According to the research, approximately 80.0% of the total savings can be attributed to data and storage optimizations, with 90.0% of recommendations focusing on workload optimization. In 2023, Ebs-unattached, ec2-stopped-instance, ip-unattached, ebs-outdated-snapshot, and cloudtrail-duplicate-trails were the top 5 optimizations implemented by FinOps practitioners.

Advancements in Cloud Security

The increasing investments in cloud technology have led to a growing emphasis on improving cloud security and compliance. According to the IEEE. Org., in November 2023, Global investment in cloud infrastructure services reached $73.5 billion in the third quarter of 2023, up 16.0% from the previous quarter. AWS, Microsoft Azure, and Google Cloud, the top three providers, rose by 20.0% combined and accounted for 65.0% of all spending. The flexibility of the cloud sector is partially attributable to growing interest in AI, balancing reductions in funding.

Market Segmentation

- Based on the component, the market is segmented into solutions, and services.

- Based on the verticals, the market is segmented into government and public sector, BFSI, retail and consumer goods, energy and utilities, healthcare and life sciences, manufacturing, it and telecommunications, and others (education, and government).

The BFSI Segment is projected to hold the Largest Market Share

By tracking, reporting, and enforcing regulations, integrated cloud management solutions contribute to BFSI institutions in satisfying regulatory obligations while promoting market growth and abiding by the relevant regulations and industry standards. For instance, in December 2023, FICO, launched its cloud-based platform in India, attracting banks such as HDFC Bank, Axis Bank, and AU Small Finance Bank. The platform aims to improve customer satisfaction and business growth in the country, with AU Small Finance Bank reporting a 30.0% increase in vehicle loan automation. The platform also offers benefits such as customer connections, organizational transformation, alignment between IT projects and management KPIs, and rapid project implementation time.

In January 2024, Temenos launched Temenos Enterprise Services on the Temenos Banking Cloud, allowing banks to deploy software solutions in just 24 hours and reduce modernization costs. The services offer over 120 pre-packaged banking products, predefined customer journeys, and 700 pre-configured APIs, enabling banks to launch new business lines or modernize legacy systems. They offer faster time to market, growth, and value delivery. The Services are delivered as SaaS, offering continuous updates, security controls, resilience, and high-performance Service Level Agreements. It additionally supports various regulatory requirements, enabling banks to meet their business, risk, and compliance needs quickly.

Regional Outlook

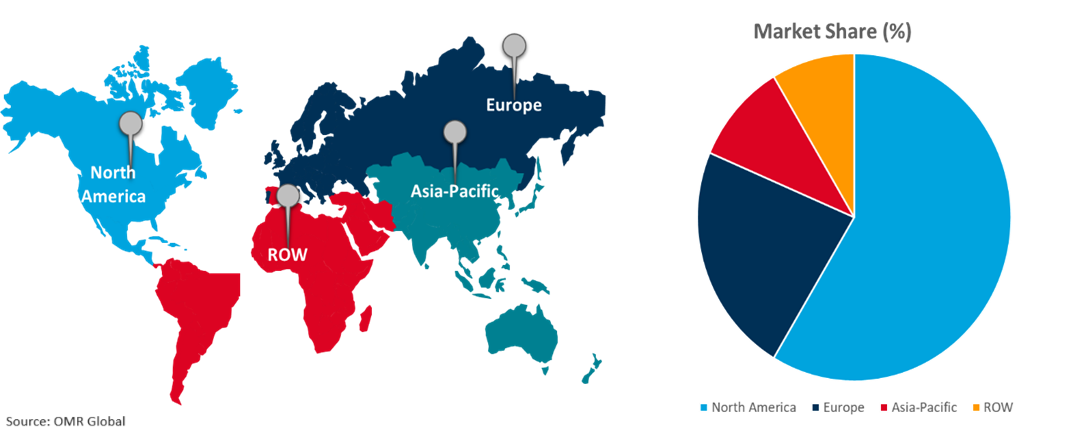

The global integrated cloud management platform market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Demand for Cost Optimization Solutions In Asia-Pacific Region

The market is increasing as a result of rising demand for ICMPs' cost optimization solutions, that offer automation and insights for monitoring and maximizing cloud spending. According to the India Brand Equity Foundation (IBEF), in January 2024, India's economy is changing from emergent to developed, with a projected GDP of $26.0 trillion by 2047. India's growing digital population and economy necessitate the government to increase the number of its data centers. By 2026, cloud computing is expected to contribute $310.0 billion–$380.0 billion to India's GDP, an increase of almost 8.0%. India needs to invest a total of $18.5 billion in cloud computing over the next five years, or a 25.0%–30.0% increase, to fully maximize the cloud industry. India's public cloud spending is expected to rise as a result of increased investments in serverless computing, Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS),

Global Integrated Cloud Management Platform Market Growth by Region 2024-2031

North America Holds Major Market Share

Governments and organizations are prioritizing data and infrastructure security owing to the growing sophistication of cyberattacks and the reliance on effective cybersecurity measures. According to the World Economic Forum, in January 2024, the cost of cybercrime is projected to reach $23.8 trillion by 2027, up from $8.4 trillion in 2022. In 2023, significant cyberattacks occurred, including one targeting the US State Department. The World Economic Forum’s Centre for Cybersecurity is working to address these challenges and enhance digital trust.?

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the integrated cloud management platform market include Amazon Web Services, Inc., Google LLC, Microsoft, Broadcom, Inc., and IBM Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In March 2023, Hewlett Packard Enterprise acquired OpsRamp, an IT operations management company that manages IT infrastructure, cloud resources, workloads, and applications for hybrid and multi-cloud environments. The deal integrated OpsRamp's hybrid digital operations management solution with HPE GreenLake, reducing operational complexity in multi-vendor and multi-cloud IT environments. The acquisition helped manage IT operations across heterogeneous cloud environments, a growing concern for enterprises.

- In April 2024, IBM focused on hybrid and multi-cloud lifecycle management technologies when it acquired HashiCorp, Inc. for a $6.4 billion investment. It offers clients AI-driven application management tools, demonstrating commitment to AI and hybrid cloud technologies, facilitating synergies in strategic growth areas such as Red Hat, Watsonx, data security, IT automation, and consulting.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global integrated cloud management platform market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Google LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Integrated Cloud Management Platform Market by Component

4.1.1. Solution

4.1.2. Services

4.2. Global Integrated Cloud Management Platform Market by Vertical

4.2.1. Government and Public Sector

4.2.2. BFSI

4.2.3. Retail and Consumer Goods

4.2.4. Energy and Utilities

4.2.5. Healthcare and Lifesciences

4.2.6. Manufacturing

4.2.7. IT and Telecommunications

4.2.8. Others (Education, and Government)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Broadcom, Inc.

6.2. Cisco Systems, Inc.

6.3. Dynatrace LLC

6.4. Flexera Software LLC

6.5. HashiCorp, Inc.

6.6. Hewlett Packard Enterprise Co.

6.7. IBM Corp.

6.8. JumpCloud Inc.

6.9. Morpheus Data, LLC

6.10. NetApp, Inc.’s

6.11. Open Text Corp.

6.12. Oracle Corp.

6.13. Red Hat, Inc.

6.14. Scalr Inc.

6.15. ServiceNow

6.16. Splunk Inc.

6.17. SUSE Group

1. Global Integrated Cloud Management Platform Market Research And Analysis By Component, 2023-2031 ($ Million)

2. Global Integrated Cloud Management Platform Solution Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Integrated Cloud Management Platform Services Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Integrated Cloud Management Platform Market Research And Analysis By Vertical, 2023-2031 ($ Million)

5. Global Integrated Cloud Management Platform For Government and Public Sector Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Integrated Cloud Management Platform For BFSI Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Integrated Cloud Management Platform For Retail and Consumer Goods Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Integrated Cloud Management Platform For Energy and Utilities Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Integrated Cloud Management Platform For Healthcare and Lifesciences Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Integrated Cloud Management Platform For Manufacturing Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Integrated Cloud Management Platform For IT and Telecommunications Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Integrated Cloud Management Platform For Other Vertical Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Integrated Cloud Management Platform Market Research And Analysis By Region, 2023-2031 ($ Million)

14. North American Integrated Cloud Management Platform Market Research And Analysis By Country, 2023-2031 ($ Million)

15. North American Integrated Cloud Management Platform Market Research And Analysis By Component, 2023-2031 ($ Million)

16. North American Integrated Cloud Management Platform Market Research And Analysis By Vertical, 2023-2031 ($ Million)

17. European Integrated Cloud Management Platform Market Research And Analysis By Country, 2023-2031 ($ Million)

18. European Integrated Cloud Management Platform Market Research And Analysis By Component, 2023-2031 ($ Million)

19. European Integrated Cloud Management Platform Market Research And Analysis By Vertical, 2023-2031 ($ Million)

20. Asia-Pacific Integrated Cloud Management Platform Market Research And Analysis By Country, 2023-2031 ($ Million)

21. Asia-Pacific Integrated Cloud Management Platform Market Research And Analysis By Component, 2023-2031 ($ Million)

22. Asia-Pacific Integrated Cloud Management Platform Market Research And Analysis By Vertical, 2023-2031 ($ Million)

23. Rest Of The World Integrated Cloud Management Platform Market Research And Analysis By Region, 2023-2031 ($ Million)

24. Rest Of The World Integrated Cloud Management Platform Market Research And Analysis By Component, 2023-2031 ($ Million)

25. Rest Of The World Integrated Cloud Management Platform Market Research And Analysis By Vertical, 2023-2031 ($ Million)

1. Global Integrated Cloud Management Platform Market Share By Component, 2023 Vs 2031 (%)

2. Global Integrated Cloud Management Platform Solution Market Share By Region, 2023 Vs 2031 (%)

3. Global Integrated Cloud Management Platform Services Market Share By Region, 2023 Vs 2031 (%)

4. Global Integrated Cloud Management Platform Market Share By Vertical, 2023 Vs 2031 (%)

5. Global Integrated Cloud Management Platform For Government And Public Sector Market Share By Region, 2023 Vs 2031 (%)

6. Global Integrated Cloud Management Platform For BFSI Market Share By Region, 2023 Vs 2031 (%)

7. Global Integrated Cloud Management Platform For Retail And Consumer Goods Market Share By Region, 2023 Vs 2031 (%)

8. Global Integrated Cloud Management Platform For Energy And Utilities Market Share By Region, 2023 Vs 2031 (%)

9. Global Integrated Cloud Management Platform For Healthcare And Lifesciences Market Share By Region, 2023 Vs 2031 (%)

10. Global Integrated Cloud Management Platform For Manufacturing Market Share By Region, 2023 Vs 2031 (%)

11. Global Integrated Cloud Management Platform For IT And Telecommunications Market Share By Region, 2023 Vs 2031 (%)

12. Global Integrated Cloud Management Platform For Other Vertical Market Share By Region, 2023 Vs 2031 (%)

13. Global Integrated Cloud Management Platform Market Share By Region, 2023 Vs 2031 (%)

14. US Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

15. Canada Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

16. UK Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

17. France Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

18. Germany Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

19. Italy Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

20. Spain Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

21. Rest Of Europe Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

22. India Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

23. China Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

24. Japan Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

25. South Korea Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

26. Rest Of Asia-Pacific Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

27. Latin America Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)

28. Middle East And Africa Integrated Cloud Management Platform Market Size, 2023-2031 ($ Million)