Intelligent Document Processing Market

Intelligent Document Processing Market Size, Share & Trends Analysis Report by Enterprise Type (Small, and Medium-Sized Enterprises, and Large Enterprises), by Function (Finance & Accounting, Human Resources, Supply Chain & Procurement, and Others (Legal, Marketing)), by Deployment (On-premise, and Cloud), and by Industry (BFSI, Healthcare & Life Sciences, Retail & E-Commerce, Manufacturing, Government, IT & Telecom, and Others (Construction, Travel & Transportation, Energy & Power)), Forecast Period (2024-2031)

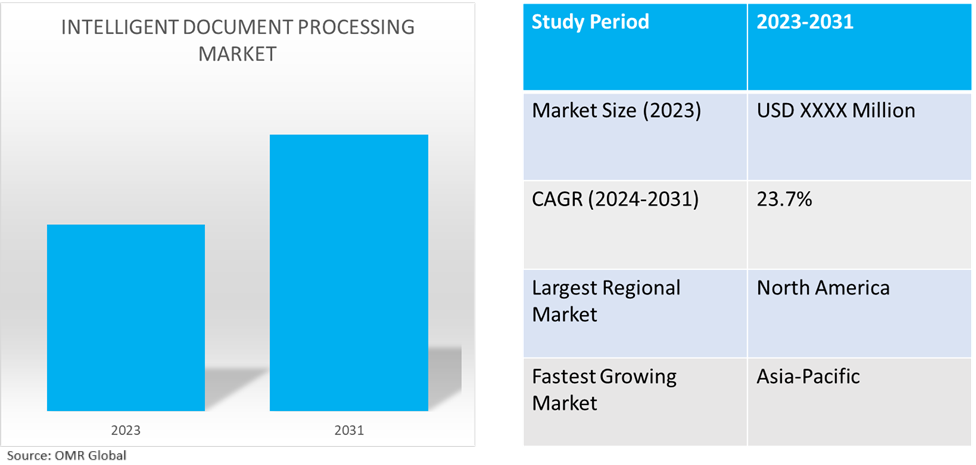

Intelligent document processing market is anticipated to grow at a CAGR of 23.7% during the forecast period (2024-2031). The market growth is attributed to the rising use of automation in document processing, the adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) in document processing, and organizational efforts to reduce cost alongside increasing overall efficiency. In recent years, the market has recorded an exponential increase in usage of intelligent document processing software in industries such as BFSI, healthcare & life sciences, retail & e-commerce owing to an increase in the number of documents to be processed. Further, the market trends are moving towards an increase in cloud-based offerings, integration of human-in-the-loop (HITL) systems, and enhanced customer experience through reducing response time.

Market Dynamics

Rising Adoption of Intelligent Automation by Organizations

The growth in the intelligent document processing market is driven by the rising adoption of intelligent automation across organizations to increase productivity and efficiency. Major functions in the organization such as marketing, HR, finance, and analytics are utilizing intelligent document processing software to gather insights, scan documents, and shortlist candidates, resulting in reduced workload and optimal decision-making process. For instance, according to the report by World Economic Forum, by 2025, automation and a new division of labor between humans and machines will disrupt 85 million jobs globally in medium and large businesses across 15 industries and 26 economies and more than 80.0% of business executives are accelerating plans to digitize work processes and deploy new technologies, while 50.0% of employers are expecting to accelerate the automation of some roles in their companies.

Increasing Digitalization in Developing Nations

The other factor driving the market growth is increasing digitalization, especially in developing countries such as India, African nations, and Brazil, among others. Most developing nations are increasingly investing and transforming their functioning across industries to optimize resources and streamline processes to create cost efficiency and better workforce utilization. Moreover, countries have integrated document processing software into administrative workflows to digitize application, verification, and KYC procedures. For instance, in Indian governments, DigiLocker has provided a dedicated cloud-based platform as a personal space to residents for storage, sharing, and verification of documents & certificates, thus it is helping in eliminating the use of physical documents. Over 13.5 crore users are registered with DigiLocker and over 562 crore documents are accessible via DigiLocker. Similarly, the Electronic Human Resource Management System (eHRMS): eHRMS application is responsible for the maintenance of employee records in electronic form, from hiring to retirement. The project includes scanning/digitization of the service book to capture the legacy data and provision of numerous online services through various modules; namely Service Book, Leave, LTC, Personal Information, Reimbursements, Advances, Tour, and Helpdesk, among others.

Segmental Outlook

- Based on enterprise type, the market is segmented into small and medium-sized enterprises and large enterprises.

- Based on function, the market is segmented into finance & accounting, human resources, supply chain & procurement, and others (legal, and marketing).

- Based on deployment, the market is segmented into on-premise and cloud.

- Based on industry, the market is segmented into BFSI, healthcare & life sciences, retail & e-commerce, manufacturing, government, IT & telecom, and others (construction, travel & transportation, energy & power).

Cloud is the Prominent Deployment Type Segment

Cloud-based deployment types have been growing since the launch of cloud-based storage services, as companies use the model to decrease cost, increase collaboration & productivity, and reduce hardware constraints. Moreover, owing to changes in business models and working conditions, individuals and organizations require documents and processes to be available beyond geographical constraints, creating scope for the deployment type. For instance, in March 2024, Quantiphi, an AI-first digital engineering company, announced that Dociphi, its Intelligent Document Processing SaaS Platform, is available on Google Cloud Marketplace, allowing businesses to minimize manual tasks and save time and resources.

BFSI is the Dominant Industry

BFSI is the dominant industry in the market owing to the increasing rate of physical documentation, adoption of digital platforms for data collection and storage, organization efforts to replace repetitive back-office tasks with automation, and increasing personnel efficiency. For instance, in October 2021, CGI collaborated with the Bank of Montreal (BMO) and the National Bank of Canada (NBC) to test the application of intelligent process automation in document capture, identification, and classification as part of the CGI Trade360 global trade platform's transaction flow. The pilot's goal is to help these banks and others speed their digital transformation by automating paper document flows, resulting in improved trade finance operations, compliance, and relationship management.

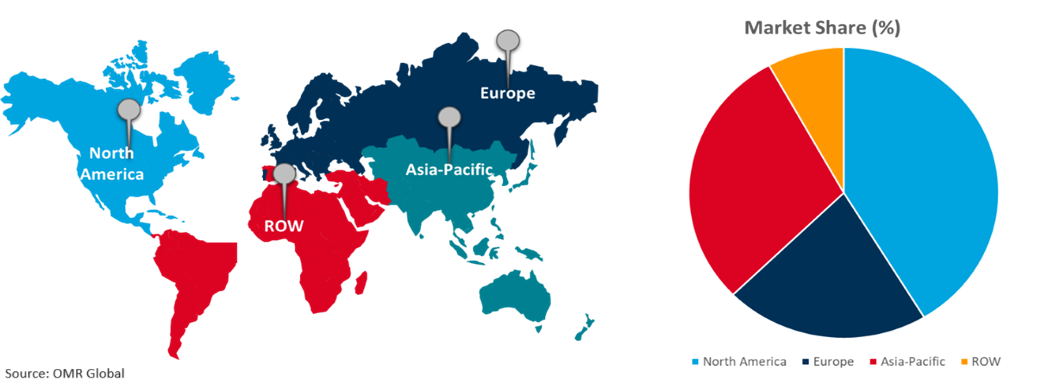

Regional Outlook

The global intelligent document processing market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Intelligent Document Processing Market

North America holds the highest share of global intelligent document processing attributed to factors including the presence of major AI & ML technology companies such as Google, Oracle Corporation, IBM, and Amazon Web Services, the growing trend of automating workflows by organizations in the region, increasing investments in AI & ML technology, organizational efforts to optimize asset allocation, and ample government support. For instance, in October 2023, Moody's Corporation and Google Cloud announced a new strategic partnership to investigate combining Moody's expertise in financial analysis with Google Cloud's advanced generative AI (gen AI) technologies to assist Moody's customers and employees in leveraging new large language models (LLMs) to gain new financial insights and summarize financial data more quickly.

Global Intelligent Document Processing Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in Intelligent Document Processing market

- Asia-Pacific regional market growth is driven by rising investment in AI & ML technology to automate workflows alongside digitalizing document processing across industries. For instance, according to a development plan for new-generation AI, China aims to become the world's major AI innovation center by 2030, with the scale of its AI core industry exceeding $140.9 billion, and the scale of related industries exceeding $1.4 trillion.

- Most Asia-Pacific developing countries such as India, Nepal, Vietnam, Myanmar, and others are having an increasing trend for digitalization, and are either developing or outsourcing automation technology to enhance and automate business and administrative processes.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global intelligent document processing market include Amazon Web Services, Inc., ABBYY Solutions, IBM Corporation, Microsoft Corporation, and Oracle Corporation, among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion, among others. For instance, in June 2023, Ripcord and Oracle established a partnership that promises to transform document processing for enterprises globally. This integration combines Ripcord's Document Intelligence as a Service (DIaaS) with Oracle ERP products to provide a one-of-a-kind solution that transforms how businesses manage documents and activate data.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global intelligent document processing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Enterprise Type Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABBYY Solutions

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Amazon Web Services, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corporation

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Microsoft Corporation

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Oracle Corporation

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Intelligent Document Processing MARKET by Enterprise Type

4.1.1. Small and Medium-sized Enterprises

4.1.2. Large Enterprises

4.2. Global Intelligent Document Processing MARKET by Function

4.2.1. Finance & Accounting

4.2.2. Human Resources

4.2.3. Supply Chain & Procurement

4.2.4. Others (Legal, Marketing)

4.3. Global Intelligent Document Processing MARKET by Deployment

4.3.1. On-Premise

4.3.2. Cloud

4.4. Global Intelligent Document Processing MARKET by Industry

4.4.1. BFSI

4.4.2. Healthcare & Life Sciences

4.4.3. Retail & E-commerce

4.4.4. Manufacturing

4.4.5. Government

4.4.6. IT & Telecom

4.4.7. Others (Construction, Travel & Transportation, Energy & Power)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East and Africa

6. Company Profiles

6.1. Acodis AG

6.2. AmyGB.ai.

6.3. Appian Corp.

6.4. Automation Anywhere, Inc.

6.5. Celaton Ltd.

6.6. Datamatics Global Services Ltd.

6.7. Deloitte LLP

6.8. HCL Technologies Ltd.

6.9. Hyperscience

6.10. InData Labs Group Ltd.

6.11. Kodak Alaris Group

6.12. Parascript, LLC

6.13. Tungsten Automation Corp.

6.14. UiPath Inc.

6.15. WorkFusion, Inc.

1. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR SMALL AND MEDIUM-SIZED ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

5. GLOBAL INTELLIGENT DOCUMENT PROCESSING (IDP) IN FINANCE & ACCOUNTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL INTELLIGENT DOCUMENT PROCESSING (IDP) IN HUMAN RESOURCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INTELLIGENT DOCUMENT PROCESSING (IDP) IN SUPPLY CHAIN & PROCUREMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL INTELLIGENT DOCUMENT PROCESSING (IDP) IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

10. GLOBAL ON-PREMISE INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CLOUD BASED INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

13. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR HEALTHCARE & LIFE SCIENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL INTELLIGENT DOCUMENT PROCESSING (IDP) FOR RETAIL & E-COMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL INTELLIGENT DOCUMENT PROCESSING (IDP) FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL INTELLIGENT DOCUMENT PROCESSING (IDP) FOR IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. NORTH AMERICAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. NORTH AMERICAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE TYPE, 2023-2031 ($ MILLION)

23. NORTH AMERICAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

24. NORTH AMERICAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

25. NORTH AMERICAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

26. EUROPEAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. EUROPEAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE TYPE, 2023-2031 ($ MILLION)

28. EUROPEAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

29. EUROPEAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

30. EUROPEAN INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE TYPE, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

36. REST OF THE WORLD INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

37. REST OF THE WORLD INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE TYPE, 2023-2031 ($ MILLION)

38. REST OF THE WORLD INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

39. REST OF THE WORLD INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

40. REST OF THE WORLD INTELLIGENT DOCUMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR LARGE ENTERPRISES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET SHARE BY FUNCTION, 2023 VS 2031 (%)

5. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR FINANCE & ACCOUNTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR HUMAN RESOURCES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR SUPPLY CHAIN & PROCUREMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET SHARE BY DEPLOYMENT, 2023 VS 2031 (%)

10. GLOBAL ON-PREMISE INTELLIGENT DOCUMENT PROCESSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CLOUD-BASED INTELLIGENT DOCUMENT PROCESSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET SHARE BY FUNCTION, 2023 VS 2031 (%)

13. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR HEALTHCARE & LIFE SCIENCES MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR RETAIL & E-COMMERCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR GOVERNMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR IT & TELECOM MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL INTELLIGENT DOCUMENT PROCESSING FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. US INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

22. CANADA INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

23. UK INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

24. FRANCE INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

25. GERMANY INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

26. ITALY INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

27. SPAIN INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF EUROPE INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

29. INDIA INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

30. CHINA INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

31. JAPAN INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

32. SOUTH KOREA INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

33. REST OF ASIA-PACIFIC INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

34. LATIN AMERICA INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)

35. THE MIDDLE EAST AND AFRICA INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, 2023-2031 ($ MILLION)