Intravenous Solutions Market

Intravenous Solutions Market Size, Share & Trends Analysis Report by Product (Total Parenteral Nutrition, and Peripheral Parenteral Nutrition), and by Nutrients (Carbohydrates, Vitamins and Minerals, Single Dose Amino Acids, Parenteral Lipid Emulsion, Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Intravenous solutions market is anticipated to grow at a significant CAGR of 8.7% during the forecast period. The rising number of gastrointestinal diseases such as IBS (Irritable bowel syndrome), and others is growing the demand for intravenous solution across the globe during the forecast period. These intravenous solutions are the main sources of energy for patients going through various treatment. According to International Foundation for Functional Gastrointestinal Disorders (IFFGD), around 5-10% peoples across the globe is having IBS, most persons with IBS are under the age of 50. Gastrointestinal diseases affect the gastrointestinal (GI) tract from the mouth to the anus. Approximately 20 to 40% of all visits to gastroenterologists are due to IBS symptoms. IBS affects between 25 and 45 million people in the US. About 2 in 3 IBS sufferers are female and about 1 in 3 IBS sufferers are male. Intravenous solutions are liquids which are injected into a person’s veins through an IV (intravenous) tube. They prevent or treat dehydration and correct the electrolyte imbalances in body by providing important nutrients to the body. These intravenous solutions can help individuals with IBS by quickly getting vitamins and other nutrients into the body. The stomach and other parts of the digestive system may be sensitive to oral vitamins and experience irritation from things like magnesium or vitamin C, the intravenous solution can will help get the nutrients into your bloodstream and cells without having to enter the digestive tract and potentially upsetting the stomach. These factors supports the growth of the intravenous solutions during the forecast period as they are majorly used during various tratements.

Segmental Outlook

The global intravenous solutions market is segmented based on product and nutrients. Based on the product, the market is segmented into total parenteral nutrition, and peripheral parenteral nutrition. Based on nutrients, the market is sub-segmented into carbohydrates, vitamins and minerals, single dose amino acids, parenteral lipid emulsion, others. The above mentioned segments can be customized as per the requirements. Based on product the total parenteral nutrition (TPN) segment is anticipated to grow at the fastest rate during the forecast period owing to the increasing number of old-age population across the globe. Many of the old-age patients are unable to absorb essential nutrients and thus, these essential nutrients are delivered through an intravenous solution directly in the body. According to UN world population ageing data, there were around 727 million persons aged 65 years or over in 2020 and it is expected to reach around 1.5 billion by 2050. Across the globe,the share of the population aged 65 years or over is expected to increase from 9.3% in 2020 to around 16.0% in 2050. Hence, this increasing aging population will boost total parenteral nutrition (TPN) segment as old-age patients require the feeding of essential nutrients through intravenous routes in the form of intravenous solutions.

Regional Outlooks

The global intravenous solutions market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The North America is anticipated to grow at the fastest rate during the forecast period owing to the presence of high expenditure by public as well as private entities in the research sector along with technological advancements and the increasing number of collaborations between various stakeholders, including the medical fraternity, universities, and others. Also the increasing healthcare spending is boosting the demand for intravenous fluids in North America. According to US Centers for Medicare & Medicaid Services, data the national health expenditure(NHE) grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20% of total NHE. Hospital expenditures grew 6.4% to $1,270.1 billion in 2020, slightly faster than the 6.3% growth in 2019. Prescription drug spending increased 3.0% to $348.4 billion in 2020. These factors shows the increasing healthcare expenditure and spending which further boosts the demand for intravenous solution by patients and hopitals.

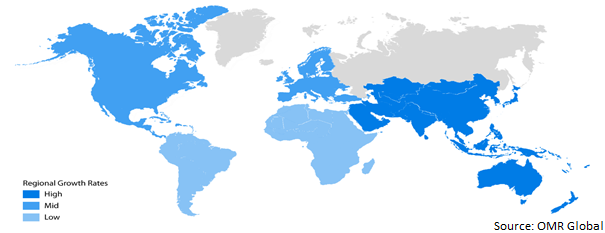

Global Intravenous Solutions Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Intravenous Solutions Market during the Forecast Period.

The Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Intravenous Solutions Market during the Forecast Period. The increasing number of road accidents in the Asia-Pacific region is boosting the intravenous solutions market during the forecast period with an estimated 1.7 billion people, South Asia represents around 25% of the world’s population. According to WHO, The South Asia region is the least urbanized region in the world, has 10% of the world’s vehicle fleet, and accounts for 25 % of the world’s crash fatalities. In addition, according to Ministry of Road Transport and Highways, Government of India data, in 2020 the total recorded 3,66,138 road accidents caused loss of 1,31,714 persons lives and injured 3,48,279 persons. The worst affected age group in Road accidents was 18-45 years, which accounts for about 70% of total accidental deaths. These increasing accidents in the Asia-Pacific region is creating the deamand for intravenous solution as, these accident patients are hospitalized and most of the patients need essential nutrients during for recovery after the treatment and these solutions are also used for keeping the patient hydrated due to the loss of essential fluids from the body hence, growing the market.

Market Players Outlook

The major companies serving the global intravenous solutions market include Ajinomoto Co., Inc., B. Braun Melsungen AG , Baxter International, Inc., Grifols International, S.A., ICU Medical, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in februray 2022, B. Braun Melsungen AG receives FDA approval of daytona beach pharmaceutical manufacturing site. This new daytona beach facility is part of B. Braun's commitment to invest over $1 billion dollars to alleviate IV fluid shortages by creating additional supply and manufacturing capacity in the US.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global intravenous solutions market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Ajinomoto Co., Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. B. Braun Melsungen AG

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Baxter International, Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Grifols International, S.A.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. ICU Medical, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Intravenous Solutions Market by Product

4.1.1. Total Parenteral Nutrition

4.1.2. Peripheral Parenteral Nutrition

4.2. Global Intravenous Solutions Market by Nutrients

4.2.1. Carbohydrates

4.2.2. Vitamins and Minerals

4.2.3. Single Dose Amino Acids

4.2.4. Parenteral Lipid Emulsion

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Amanta Healthcare Ltd.

6.2. Anhui Medipharm Co. Ltd

6.3. Axa Parenterals Ltd.

6.4. Fresenius Kabi AG

6.5. JW Group corp.

6.6. Omnicare, Inc.

6.7. Otsuka Pharmaceutical Co., Ltd.

6.8. Salius Pharma Private Ltd.

6.9. Vifor Pharma Management Ltd.

6.10. Wuhan Uni-Pharma Bio-Tech Co. Ltd

1. GLOBAL INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL TOTAL PARENTAL NUTRITION FOR INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PERIPHERAL PARENTAL NUTRITION FOR INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY NUTRIENTS, 2021-2028 ($ MILLION)

5. GLOBAL CARBOHYDRATES BY INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY NUTRIENTS, 2021-2028 ($ MILLION)

6. GLOBAL VITAMINS AND MINERALS BY INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SINGLE DOSE AMINO ACIDS BY INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL PARENTERAL LIPID EMULSION BY INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL OTHER NUTRIENTS BY INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. NORTH AMERICAN INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

13. NORTH AMERICAN INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY NUTRIENTS, 2021-2028 ($ MILLION)

14. EUROPEAN INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

16. EUROPEAN INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY NUTRIENTS, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY NUTRIENTS, 2021-2028 ($ MILLION)

20. REST OF THE WORLD INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

22. REST OF THE WORLD INTRAVENOUS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY NUTRIENTS, 2021-2028 ($ MILLION)

1. GLOBAL INTRAVENOUS SOLUTIONS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL TOTAL PARENTERAL NUTRITION FOR INTRAVENOUS SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL PERIPHERAL PARENTERAL NUTRITION FOR INTRAVENOUS SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL INTRAVENOUS SOLUTIONS MARKET SHARE BY NUTRIENTS, 2021 VS 2028 (%)

5. GLOBAL CARBOHYDRATES BY INTRAVENOUS SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL VITAMINS AND MINERALS BY INTRAVENOUS SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL SINGLE DOSE AMINO ACIDS BY INTRAVENOUS SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL PARENTERAL LIPID EMULSION BYB INTRAVENOUS SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL OTHER NUTRIENTS BY INTRAVENOUS SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL INTRAVENOUS SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. US INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

13. UK INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD INTRAVENOUS SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)