IoT Sensors Market

Global IoT Sensors Market Size, Share & Trends Analysis by Type (Pressure Sensor, Temperature Sensor, Optical Sensor, Chemical Sensor, Image Sensor, Motion Sensor, and Others), by Technology (Wired and Wireless), and by Application (Consumer, Commercial, and Industrial) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global IoT Sensors market is anticipated to grow at a significant CAGR of 25.0% during the forecast period. The major factors contributing to the growth of the market include rising industrialization across the globe, increasing demand for smart sensors in several industries, and the advent of smart homes and connected cars. Rapid industrialization has been witnessed in emerging countries owing to the growing presence of multinationals and the rising government initiatives to encourage industrialization in the country. For instance, in May 2015, the Chinese government introduced Made in China (MIC) 2025 initiative which comprises a range of state-backed programs that aims to accelerate productivity, modernize the Chinese economy, and make innovations in industrial processes.

The MIC 2025 plan signifies that the country’s manufacturing sector is large, however, it lacks in quality of industrial infrastructure, innovation capacity, degree of digitalization, and the effectiveness of resource utilization. Under the plan, the Chinese government seeks to carry out the task of upgrading infrastructure and leveraging technological developments. MIC 2025 aims to move China in the manufacturing value chain through smart manufacturing and advanced manufacturing technologies. The first step of MIC 2025 is to accelerate the total quality of manufacturing, and labor productivity, and stimulate innovation. In addition, the plan enables the integration of advanced levels of information technology solutions, decreases material and energy consumption, and develops industrial clusters and multinational enterprises. This contributes to the demand for IoT sensors in industrial processes to increase safety and facilitate industrial processes.

In industrial facilities, sensors are used to measure process variables, including pressure, temperature, flow, and pH, as well as electrical variables such as frequency, voltage, and current; and mechanical variables, including the number of cycles, travel direction, rotation, static, proximity, position, and dynamic pressures. The energy, chemical, and oil and gas industries require sensors for the management of critical processes. The energy industry also requires sensors for the management of geographically large power transmission and distribution systems. For such kinds of critical infrastructure, standards have been developed to address security, interoperability, communication, calibration, reliability, and accuracy for smart sensors. Apart from these, IoT sensors can be used in a range of applications such as smart waste management, fire hydrant control, real-time water-level updates, streetlight control, and air-quality monitoring.

Impact of COVID-19 Pandemic on Global IoT Sensors Market

The COVID-19 pandemic and dissemination have had a significant impact on the global growth of the IoT sensor market. Due to the spread of the virus in different parts of the world, global sales of IoT sensors for key industrial and commercial verticals dropped by 10–15% in the fiscal year 2020. The IoT sensors industry has been impacted by a drop in the number of new industrial projects, temporary shutdowns of production facilities, and a drop in crude oil prices, to name a few issues. Market expansion in key regions was also hampered by short-term supply chain disruptions. Due to the closure of several production sites around the world, COVID-19 has had a significant influence on the global industrial sector.

Segmental Outlook

The global IoT sensors market is segmented based on type, technology, and application. Based on type, the market is classified into pressure sensors, temperature sensors, optical sensors, chemical sensors, image sensors, motion sensors, and others. The demand for pressure sensors is expected to grow significantly during the forecast period owing to their increasing application in industrial processes. Pressure gauges are being significantly utilized in industrial sites as it is better for pressure monitoring in closed environments.

For IoT devices, pressure sensors are the ideal solution that can be used in multiple fields, including the manufacturing industry, touch screen devices, automotive systems, and biomedical devices. In the medical field, the pressure sensor can be used to monitor the corresponding status of the patient during the procedure. In automotive, these sensors are used to minimize the consumption of fuel by maintaining a strict control ratio between air and fuel. The advent of Industry 4.0 will further drive the adoption of IoT sensors across industries. Based on technology, the market is classified into wired and wireless. Based on end-user, the market is classified into consumer, commercial, and industrial.

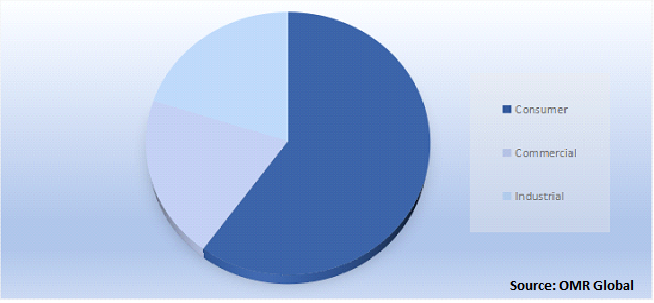

Global IoT Sensors Market Share by Application, 2021 (%)

The Consumer Segment is Anticipated to Hold a Prominent Share in the Global IoT Sensors Market

The consumer segment is anticipated to hold a prominent share in the market during the forecast period. The increasing demand for consumer electronics products is attributed to the adoption of IoT solutions. A significant rise in the demand for wearable devices, such as smartphones and smartwatches, and home automation solutions, including smart TVs, smart locks, and smoke detectors are contributing to the demand for IoT sensors. There is an increasing demand for smart home solutions which leads to the adoption of asset tracking systems with wireless technologies, including WiFi or Bluetooth Low Energy (BLE) for indoor real-time technology. IoT-based asset tracking solutions use IoT sensors for remotely tracking particular application details of the asset without any human intervention.

This is considered a personal security solution with location tracking capability. It holds the capability to track and locate individuals and assets in real time. The emerging focus on safety due to the increasing crime rates and increasing smart city projects are driving the demand for smart home solutions and thereby leading to the adoption of sensors to support remote monitoring and effectively manage appliances and systems.

Regional Outlooks

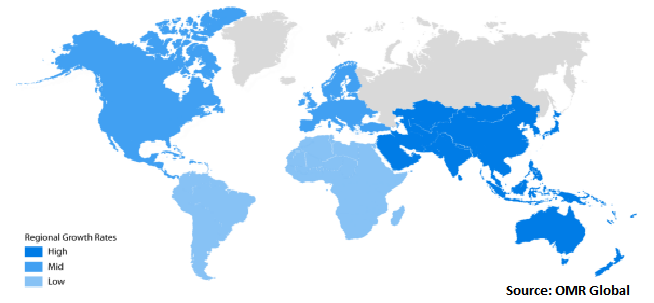

The global IoT sensors market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the Asia-Pacific regional market is expected to cater to considerable growth during the forecast period owing to the emerging demand for IoT solutions coupled with the increasing digitalization in the region. The increasing number of smart city projects in China and India is offering an opportunity for market growth in the region.

Global IoT Sensors Market Growth, by Region 2022-2028

The North American Region is Expected to Hold a Prominent Share in the Global IoT Sensors Market

The North American region is expected to hold a prominent share in the global IoT sensors market due to the region's established vendors and early use of IoT technology in numerous industries, North America is one of the major marketplaces. Most companies in this region are increasingly using IoT to monitor the functioning of their products, preventing costly breakdowns and inefficient routine maintenance shutdowns. The use of IoT in the region is also propelling the market under study. According to a study conducted by Stanford University and Avast, households in North America have the highest density of IoT devices of any location on the planet. Interestingly, at least one IoT device is found in 66% of residences in the region. Furthermore, 25% of North American households have more than two gadgets.

Market Players Outlook

The major companies serving the global IoT sensors market include Honeywell International Inc., Schneider Electric SE, Analog Devices, Inc., Texas Instruments Inc., and IBM Corp. among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, and geographical expansion, to stay competitive in the market. For instance, in February 2022, iMatrix Systems completed the initial funding for $2 million, which was raised to launch a complete SaaS iMatrix IoT solutions comprising the portfolio of wireless IoT sensors.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global IoT sensors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global IoT Sensors Market

- Recovery Scenario of Global IoT Sensors Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.1.1.Overview

3.1.2.Financial Analysis

3.1.3.SWOT Analysis

3.1.4.Recent Developments

3.2.Key Strategy Analysis

3.3.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global IoT Sensors Market by Type

4.1.1.Pressure Sensor

4.1.2.Temperature Sensor

4.1.3.Optical Sensor

4.1.4.Chemical Sensor

4.1.5.Image Sensor

4.1.6.Motion Sensor

4.1.7.Others

4.2.Global IoT Sensors Market by Technology

4.2.1.Wired

4.2.2.Wireless

4.3.Global IoT Sensors Market by Application

4.3.1.Consumer

4.3.2.Commercial

4.3.3.Industrial

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.ABB Ltd.

6.2.Analog Devices, Inc.

6.3.Digi International Inc.

6.4.Ericsson AB

6.5.Fujitsu Ltd.

6.6.Honeywell International Inc.

6.7.IBM Corp.

6.8.Infineon Technologies AG

6.9.KONUX Gmbh

6.10.Libelium Comunicaciones Distribuidas S.L

6.11.NXP Semiconductors N.V.

6.12.Omron Corp.

6.13.Robert Bosch GmbH

6.14.Samsung Electronics Co., Ltd.

6.15.Schneider Electric SE

6.16.STMicroelectronics N.V.

6.17.TE Connectivity Ltd.

6.18. Texas Instruments Inc.

1. GLOBAL IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL IOT PRESSURE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL IOT TEMPERATURE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL IOT OPTICAL SENSORS MARKET RESEARCH AND ANALYSIS BY MODE, 2018-2025 ($ MILLION)

5. GLOBAL IOT CHEMICAL SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL IOT IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL IOT MOTION SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OTHER IOT SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

10. GLOBAL WIRED IOT SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL WIRELESS IOT SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL IOT SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

13. GLOBAL IOT SENSORS IN CONSUMER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL IOT SENSORS IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL IOT SENSORS IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL IOT SENSORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN IOT SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. NORTH AMERICAN IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

20. NORTH AMERICAN IOT SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION

21. EUROPEAN IOT SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. EUROPEAN IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

23. EUROPEAN IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

24. EUROPEAN IOT SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC IOT SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC IOT SENSORS E MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC IOT SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

29. REST OF THE WORLD IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

30. REST OF THE WORLD IOT SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

31. REST OF THE WORLD IOT SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL IOT SENSORS MARKET SHARE BY TYPE, 2019 VS 2025 (%)

2. GLOBAL IOT SENSORS MARKET SHARE BY TECHNOLOGY, 2019 VS 2025 (%)

3. GLOBAL IOT SENSORS MARKET SHARE BY APPLICATION, 2019 VS 2025 (%)

4. US IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY IOT SENSORS MARKET, 2018-2025 ($ MILLION)

10. SPAIN IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD IOT SENSORS MARKET SIZE, 2018-2025 ($ MILLION)