IT Vendor Risk Management Market

IT Vendor Risk Management Market Size, Share & Trends Analysis Report by Deployment Type (On-Premises, and Cloud), by Organization Size (Small and Medium Enterprises (SMES), and Large Enterprises), by Industry Vertical (BFSI, Telecommunications and Information Technology (IT), Healthcare, Government, Consumer Goods and Retail, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

IT vendor risk management market is anticipated to grow at a significant CAGR of 14.8% during the forecast period. The market growth is attributed to factors such as growing regulatory compliance, growing cyber-attacks, technological advancements, growing cloud adoption by organizations, and the need to continuously monitor vendor performance among others. Apart from this growing competition and global economic uncertainties have pushed industries to outsource operations to reduce costs. A vendor risk management program is a systematic approach to identifying, assessing, and mitigating risks posed by third-party vendors. It helps organizations to protect their sensitive data, such as personally identifiable information (PII), protected health information (PHI), and intellectual property, from data breaches, data leaks, and cyber-attacks. By reducing the frequency and severity of these incidents, vendor risk management programs can help to ensure business continuity.

Segmental Outlook

The global IT vendor risk management market is segmented based on the deployment type, organization size, and industry vertical. Based on the deployment type the market is sub-segmented into cloud-based deployment and on-premises deployment. Based on organization size, the market is sub-segmented into SMEs and large enterprises. Based on industry vertical, the market is sub-segmented into the BFSI, telecommunications and information technology (IT), healthcare, government, consumer goods, and retail, and others (energy and utilities, education) The healthcare sector is anticipated to hold a prominent share in the global IT vendor risk management industry.

BFSI Vertical is Anticipated to Hold a Prominent Share in the Global IT Vendor Risk Management Market

The BFSI sector is highly interconnected and regulated. Greater interconnectivity poses high risks for cybersecurity and growing regulatory compliance are some of the driving factors for demand for IT vendor risk management services in this sector. The primary factors financial institutions primarily work with third-party vendors is to scale up their internal team and increase flexibility by hiring third-party vendors, to cut costs, especially in recruitment which can also be a time-consuming process, to increase efficiency in operations and overall business, and to introduce new technologies and innovations with minimal risks. With these benefits, working with third-party vendors also has key challenges some of which are risks of data leaks, cybersecurity risks, compliance issues, and operational disruptions which can cause reputational damages and financial losses. For instance, In September 2023, Several Czech banks and the Prague Stock Exchange were targeted by hackers, with strikes aimed at banks' websites or internet banking services, and the stock exchange’s website.

To overcome these problems, IT vendor risk management services provide solutions to ensure proper regulatory compliance, decrease cybersecurity risks, and efficiently manage relationships with third parties.

Regional Outlook

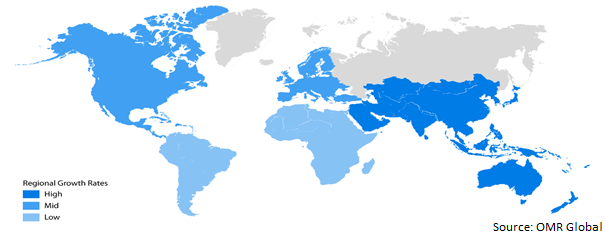

The IT vendor risk management market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among all regions, North America holds a prominent share in the global vendor risk management market owing to factors such as an increasing due to growing number of cyber-attacks, growing regulatory compliance requirements, and increased awareness of vendor risk management among business organizations. For instance, in June 2023, Federal Deposit Insurance Corporation (FDIC), Federal bank regulatory agencies today issued final joint guidance designed to help banking organizations manage risks associated with third-party relationships, including relationships with financial technology companies. The final guidance describes principles and considerations for banking organizations’ risk management of third-party relationships. The final guidance covers risk management practices for the stages in the life cycle of third-party relationships: planning, due diligence and third-party selection, contract negotiation, ongoing monitoring, and termination.

Global IT Vendor Risk Management Market Growth by Region 2023-2030

Europe is Expected to Hold a Prominent Share in the IT vendor risk management market.

The European region is expected to hold a prominent share of the global IT vendor risk management market. As per the data from the European Council, with more than 10 terabytes of data stolen monthly, ransomware is one of the biggest cyber threats in the EU, with phishing now identified as the most common initial vector of such attacks. Regional servers of almost 90% of assets were targeted by an attack in 2022. For instance, in August 2023, Russian hacktivists launched several DDoS attacks that knocked the Polish government’s website offline, as well as the Warsaw Stock Exchange and several Polish national banks. To overcome these challenges, companies are also collaborating on technological innovations. For instance, in March 2023, Advisory and professional services firm PwC UK partnered with security firm Reversing Labs to develop a third-party risk management (TPRM) platform to help businesses address software supply chain security risks. Alongside Reversing Labs, the firm aims to help customers modernize traditional TPRM programs to better suit the modern software supply chain, operationalizing the detection and mitigation of threats inherent in third-party software.

Market Players Outlook

The major companies serving the global IT vendor risk management market include International Business Machines Corporations (IBM), NAVEX Global Inc., Resolver Inc., and RiskRecon, Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies and introducing new products and technological advancements. For instance, in July 2023, AuditBoard launched an IT risk management offering, AuditBoard ITRM, a purpose-built solution for CISOs and their teams. These solutions include the AuditBoard CrossComply IT framework, and compliance management solution that enables automated framework mapping, evidence collection, and continuous monitoring across the organization, and AuditBoard TPRM a scalable solution for managing third-party risk management programs, including IT vendor risk.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global IT vendor risk management market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for solid growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. International Business Machines Corporation (IBM)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. NAVEX Global Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Resolver Inc. (a subsidiary of Kroll, LLC)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. RiskRecon, Inc. (now a subsidiary of Mastercard)

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. RSA Security LLC (a subsidiary of Dell Technologies)

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global IT Vendor Risk Management Market by Deployment Type

4.1.1. On-Premises

4.1.2. Cloud-Based

4.2. Global IT Vendor Risk Management Market by Organization Size

4.2.1. Small and Medium Enterprises (SMES)

4.2.2. Large Enterprises

4.3. Global IT Vendor Risk Management Market by Industry Vertical

4.3.1. BFSI

4.3.2. Telecommunications and Information Technology (IT)

4.3.3. Healthcare

4.3.4. Government

4.3.5. Consumer Goods and Retail

4.3.6. Others (Energy and Utilities, Education)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aravo Solutions, Inc.

6.2. BitSight Technologies, Inc.

6.3. Brinqa, L

6.4. CyberGRX, Inc. (a subsidiary of ProcessUnity, Inc.)

6.5. LogicGate, Inc.

6.6. MetricStream, Inc.

6.7. OneTrust, LLC

6.8. Optiv Security, Inc.

6.9. Panorays Ltd.

6.10. Prevalent, Inc. (subsadiry of iMedX Information Services Pvt Ltd.)

6.11. ProcessUnity, Inc.

6.12. Quantivate, LLC

6.13. RiskWatch International

6.14. SecurityScorecard, Inc.

6.15. SureCloud Limited

6.16. UpGuard, Inc.

6.17. Venminder, Inc.

1. GLOBAL IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2022-2030 ($ MILLION)

2. GLOBAL ON-PREMISES IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL CLOUD-BASED IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2022-2030 ($ MILLION)

5. GLOBAL IT VENDOR RISK MANAGEMENT FOR SMES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL IT VENDOR RISK MANAGEMENT FOR LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

8. GLOBAL IT VENDOR RISK MANAGEMENT FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL IT VENDOR RISK MANAGEMENT FOR TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY (IT) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL IT VENDOR RISK MANAGEMENT FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL IT VENDOR RISK MANAGEMENT FOR CONSUMER GOODS AND RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL IT VENDOR RISK MANAGEMENT FOR OTHER INDUSTRY VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. NORTH AMERICAN IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2022-2030 ($ MILLION)

16. NORTH AMERICAN IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2022-2030 ($ MILLION)

17. NORTH AMERICAN IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

18. EUROPEAN IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. EUROPEAN IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2022-2030 ($ MILLION)

20. EUROPEAN IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2022-2030 ($ MILLION)

21. EUROPEAN IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

26. REST OF THE WORLD IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. REST OF THE WORLD IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2022-2030 ($ MILLION)

29. REST OF THE WORLD IT VENDOR RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

1. GLOBAL IT VENDOR RISK MANAGEMENT MARKET SHARE BY DEPLOYMENT TYPE, 2022 VS 2030 (%)

2. GLOBAL ON-PREMISES BASED IT VENDOR RISK MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL CLOUD-BASED IT VENDOR RISK MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL IT VENDOR RISK MANAGEMENT MARKET SHARE BY ORGANIZATION SIZE, 2022 VS 2030 (%)

5. GLOBAL IT VENDOR RISK MANAGEMENT FOR SMES MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL IT VENDOR RISK MANAGEMENT FOR LARGE ENTERPRISES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL IT VENDOR RISK MANAGEMENT MARKET SHARE BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

8. GLOBAL IT VENDOR RISK MANAGEMENT FOR BFSI MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL IT VENDOR RISK MANAGEMENT FOR TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY (IT) MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL IT VENDOR RISK MANAGEMENT FOR HEALTHCARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL IT VENDOR RISK MANAGEMENT FOR CONSUMER GOODS AND RETAIL MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL IT VENDOR RISK MANAGEMENT FOR OTHER INDUSTRY VERTICALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL IT VENDOR RISK MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. US IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

15. CANADA IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

16. UK IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

17. FRANCE IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

18. GERMANY IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

19. ITALY IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

20. SPAIN IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF EUROPE IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

22. INDIA IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

23. CHINA IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

24. JAPAN IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

25. SOUTH KOREA IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF ASIA-PACIFIC IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD IT VENDOR RISK MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)