Ketamine treatment Market

Ketamine treatment Market Size, Share & Trends Analysis Report by Route of Administration (Oral, Infusions, and Nasal Spray), by Application (Treatment-Resistant Depression (TRD), Anxiety Disorder, Post-Traumatic Stress Disorder (PTSD), and Others), and by End User (Hospitals and Medical Centers, Specialized Ketamine Clinics, Psychiatric Hospitals, and Others), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

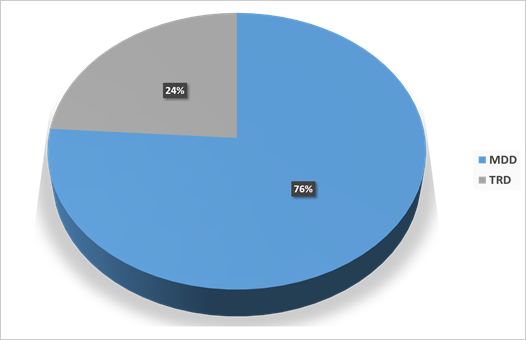

Ketamine treatment market is anticipated to grow at a CAGR of 43.74% during the forecast period (2023-2030). The market’s growth is attributed to prevalence of treatment-resistant depression. A considerable number of individuals with MDD do not respond to standard therapies, resulting in a patient group known as TRD. This population has a significant unmet medical need. Ketamine's ability to bring relief to TRD sufferers has resulted in its increased use as a treatment option, sustaining market growth. According to MDPI, in May 2023, MDD is a common diagnosis, affecting an estimated 280 million people worldwide and 21 million adults in the US alone, and can lead to impaired functioning and increased risk of suicidality. The current treatments for MDD include pharmacotherapeutics, such as SSRIs and SNRIs, psychotherapy, and somatic treatments, such as electroconvulsive therapy. These treatments are generally effective for many patients, however, some patients don't respond to treatment and are classified as having treatment-resistant depression (TRD). In addition, it can take several weeks to months for the effects of these treatments to take effect. Long-term administration is also typically needed in order to maintain therapeutic efficacy.

Furthermore,the high prevalence of TRD has highlighted the need for improved treatments. Ketamine has demonstrated potential as a beneficial treatment for a significant portion of individuals with TRD. As a result, it is a popular choice of treatment. In 2017, 8.9 million adults in the US were treated for MDD over twelve months, and 30.9%, or 2.8 million, of those were diagnosed with TRD. This increase in prevalence of TRD has created a social and fiscal burden, that highlights the need for more effective treatments and a better understanding of the mechanisms of depression.

Prevalence of Major Depressive Disorder (MDD) and Treatment-Resistant Depression (TRD) in the US

Source: According to MDPI

Segmental Outlook

The global ketamine treatment market is segmented on the route of administration, application, and end user. Based on the route of administration, the market is sub-segmented into oral, infusions, and nasal spray. Based on the application, the market is sub-segmented into treatment-resistant depression (TRD), anxiety disorder, post-traumatic stress disorder (PTSD), and others. Furthermore, on the basis of end-user, the market is sub-segmented into hospitals and medical centers, specialized ketamine clinics, psychiatric hospitals, and others. The infusions subcategory is expected to capture a significant portion of the market share within the route of administration segment. This is attributed to the depressed and mood disorders are increasingly prevalent as increased knowledge of ketamine treatment efficacy and a growing number of specialized Ketamine clinics constitute significant drivers influencing sector expansion during the projection period.

The Nasal Spray Sub-Segment is Anticipated to Hold a Considerable Share of the Global Ketamine treatment Market

Among the route of administration, the nasal spray sub-segment is expected to hold a considerable share of the global Ketamine treatment market. The segmental growth is attributed to the growing diversification of treatment options. New medicines, such as SPRAVATO, are expanding the number of alternatives available to individuals with TRD or severe MDD. This diversification serves the diverse needs of patients while additionally enhancing overall therapy effectiveness. For instance, in June 2022, Ketamine Wellness Centers (KWC), expanded the availability of SPRAVATO to three new cities and increased the total number of clinics offering the FDA-approved esketamine nasal spray to six. SPRAVATO is an FDA-approved medication for individuals that are suffering from treatment-resistant depression (TRD) or depressive symptoms related to major depressive disorder (MDD). Patients that are interested in this treatment option can participate with the company's skilled intake and screening teams to ensure that SPRAVATO is the most suitable option for individuals.

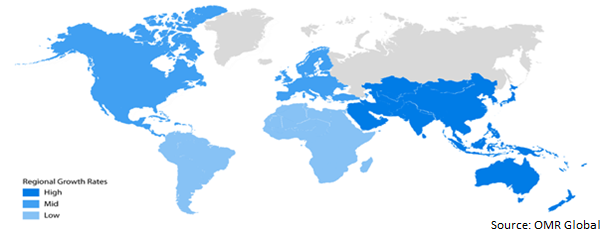

Regional Outlook

The global ketamine treatment market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, Europe is anticipated to hold a prominent share of the market across the globe, owing to the development of Ketamine clinics that provide therapy for a variety of mental health disorders is propelling growth.

Global Ketamine treatment Market Growth by Region 2023-2030

The North America Region is Expected to Grow at a Significant CAGR in the Global Ketamine treatment Market

Among all regions, the North America regions is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to the rising PTSD prevalence across the region. The growing recognition of PTSD, in addition to its high incidence in certain communities, such as military veterans and first responders, is driving the desire for more effective and accessible treatment alternatives. According to the National Institute of Health, in March 2023, posttraumatic stress disorder (PTSD) is a long-term mental health condition that can have a significant economic and social impact. Its lifetime prevalence in the general population is 3.9%, and 5.9% among those who have experienced trauma, with variations based on country and income level. Military veterans, first responders, and Indigenous People of the Americas are more likely to be affected by PTSD, with a 1.4 times greater chance of developing it.

Furthermore, PTSD often co-occurs with other mental health conditions, such as MDD, anxiety disorders, and substance abuse. These multiple comorbidities can be difficult to treat. Ketamine therapy has demonstrated promise in managing multiple comorbidities at the same time. PTSD is a condition that is associated with a range of symptoms, including intrusive thoughts, stimuli avoidance, negative affect, and autonomic arousal. These symptoms can lead to functional and psychosocial impairment, and can have a negative impact on a person's quality of life. Studies have found that pre- and peri-trauma risk factors such as childhood adversity and trauma severity can contribute to the development of PTSD. Additionally, 78.5% of people with PTSD also meet the criteria for at least one other mental illness, most commonly major depressive disorder (MDD). People with PTSD are also 2-4 times more likely to have depressive and anxiety disorders, as well as alcohol and substance abuse.

Market Players Outlook

The major companies serving the ketamine treatment market include Core One Labs Inc., Enso Discoveries, LLC., Johnson & Johnson Pvt. Ltd., Ketamine Research Institute, Ketamine Wellness Centers, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2021,Seelos Therapeutics Acquired an Exclusive License of iX Biopharma's for Wafermine a sublingual racemic ketamine wafer, in addition to a global license for other sublingual ketamine wafers, delivered via WaferiX, a proprietary fast-dissolving wafer-based drug delivery platform technology.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ketamine treatment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Actify Neurotherapies

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Arevipharma GmbH

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Biotechnica DWC LLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Ketamine Treatment Market by Route of Administration

4.1.1. Oral

4.1.2. Infusions

4.1.3. Nasal Spray

4.2. Global Ketamine Treatment Market by Application

4.2.1. Treatment-Resistant Depression (TRD)

4.2.2. Anxiety Disorder

4.2.3. Post-Traumatic Stress Disorder (PTSD)

4.2.4. Others (Anesthesia and Sedation, Bipolar Depression, and Chronic Pain Management)

4.3. Global Ketamine Treatment Market by End-User

4.3.1. Hospitals and Medical Centers

4.3.2. Specialized Ketamine Clinics

4.3.3. Psychiatric Hospitals

4.3.4. Others (Rehabilitation Centers, Primary Care Physicians, Individual Patients and Research & Academic Institutions)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Core One Labs Inc.

6.2. Enso Discoveries, LLC.

6.3. Johnson & Johnson Pvt. Ltd.

6.4. Ketamine Research Institute

6.5. Ketamine Wellness Centers

6.6. Klarisana

6.7. Koch Industries, Inc.

6.8. Mindbloom, Inc.

6.9. Pfizer

6.10. saveminds.co.uk

6.11. Stella MSO LLC

6.12. Unión Químico Farmacéutica, S.A.U.

1. GLOBAL KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2022-2030 ($ MILLION)

2. GLOBAL KETAMINE TREATMENT BY ORAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL KETAMINE TREATMENT BY INFUSIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL KETAMINE TREATMENT BY NASAL SPRAY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL KETAMINE TREATMENT FOR TRD MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL KETAMINE TREATMENT FOR ANXIETY DISORDER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL KETAMINE TREATMENT FOR POST-TRAUMATIC STRESS DISORDER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL KETAMINE TREATMENT FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

11. GLOBAL KETAMINE TREATMENT IN HOSPITALS AND MEDICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL KETAMINE TREATMENT IN SPECIALIZED KETAMINE CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL KETAMINE TREATMENT IN PSYCHIATRIC HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL KETAMINE TREATMENT IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. NORTH AMERICAN KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. NORTH AMERICAN KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION , 2022-2030 ($ MILLION)

18. NORTH AMERICAN KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

19. NORTH AMERICAN KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

20. EUROPEAN KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. EUROPEAN KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2022-2030 ($ MILLION)

22. EUROPEAN KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

23. EUROPEAN KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

28. REST OF THE WORLD KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2022-2030 ($ MILLION)

29. REST OF THE WORLD KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

30. REST OF THE WORLD KETAMINE TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL KETAMINE TREATMENT MARKET SHARE BY ROUTE OF ADMINISTRATION, 2022 VS 2030 (%)

2. GLOBAL KETAMINE TREATMENT BY ORAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL KETAMINE TREATMENT BY INFUSIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL KETAMINE TREATMENT BY NASAL SPRAY MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL KETAMINE TREATMENT MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

6. GLOBAL KETAMINE TREATMENT FOR TRD MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL KETAMINE TREATMENT FOR ANXIETY DISORDER MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL KETAMINE TREATMENT FOR POST-TRAUMATIC STRESS DISORDER MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL KETAMINE TREATMENT FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL KETAMINE TREATMENT MARKET SHARE BY END-USER, 2022 VS 2030 (%)

11. GLOBAL KETAMINE TREATMENT IN HOSPITALS AND MEDICAL CENTERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL KETAMINE TREATMENT IN SPECIALIZED KETAMINE CLINICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL KETAMINE TREATMENT IN PSYCHIATRIC HOSPITALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL KETAMINE TREATMENT IN OTHER END-USERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL KETAMINE TREATMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. US KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

17. CANADA KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

18. UK KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

19. FRANCE KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

20. GERMANY KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

21. ITALY KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

22. SPAIN KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF EUROPE KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

24. INDIA KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

25. CHINA KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

26. JAPAN KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

27. SOUTH KOREA KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF ASIA-PACIFIC KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF THE WORLD KETAMINE TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)