Kidney Cancer Diagnosis and Treatment Market

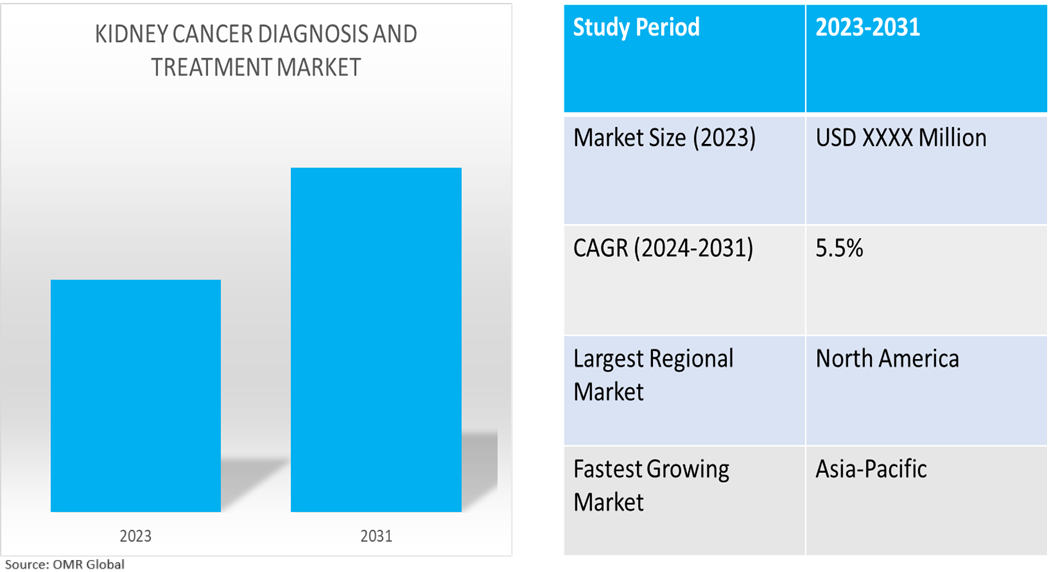

Kidney Cancer Diagnosis and Treatment Market Size, Share & Trends Analysis Report by Cancer Type (Renal Cell Carcinoma (RCC), Transitional Cell Cancer, and Wilm’s Tumour), by Cancer Cell (Clear Cell, Papillary, and Others), by Diagnosis Method (Biopsy, Computed Tomography (CT) scan, Magnetic Resonance Imaging (MRI), and Ultrasound), and by Therapy (Surgery, Immunotherapy, Chemotherapy, Radiation Therapy, and Cryotherapy) Forecast Period (2024-2031)

Kidney cancer diagnosis and treatment market is anticipated to grow at a significant CAGR of 5.5% during the forecast period (2024-2031). Kidney cancer incidence is rising globally owing to aging populations, lifestyle changes, and risk factors. The rising prevalence of kidney cancer, advancements in diagnostic technologies, targeted therapies, and immunotherapies are contributing to the growth of global kidney cancer diagnosis and treatment. Increased funding, awareness, and minimally invasive surgeries have led to market growth.

Market Dynamics

Increasing Incidence of Kidney Cancer

The incidence of kidney cancer is rising rapidly as a result of aging populations and lifestyle choices such as obesity, smoking, and high blood pressure. According to the American Cancer Society, in May 2024, it is estimated that there will be approximately 81,610 new cases of kidney cancer in the US, with 52,380 cases in men and 29,230 cases in women. Additionally, about 14,390 individuals (9,945 men and 4,940 women) mortalities are expected from this disease. These statistics encompass all types of kidney and renal pelvis cancers, with most cases occurring in individuals aged 55 to 74; the average age at diagnosis is 65, and kidney cancer is rare in those under 45.

Advancements in Diagnostic Technologies

The market is growing as a result of advancements in imaging methods, genetic testing, and biomarkers that improve kidney cancer early detection and precise diagnosis. For instance, in October 2023, the National Kidney Foundation launched an educational animated video series on kidney cancer, translated into eight languages, aimed at providing complex health information to patients in various countries, helping them understand the diagnosis and treatment options.

Market Segmentation

- Based on the cancer type, the market is segmented into renal cell carcinoma (RCC), transitional cell cancer, wilm’s tumor (nephroblastoma), and others (sarcoma, lymphoma).

- Based on the application, the market is segmented into clear cells, papillary, and others (chromophobe).

- Based on the application, the market is segmented into biopsy, computed tomography (CT) scan, magnetic resonance imaging (MRI), and ultrasound.

- Based on the therapy, the market is segmented into surgery, immunotherapy, chemotherapy, radiation therapy, and cryotherapy.

Computed Tomography (CT) scan is Projected to Hold the Largest Segment

The growing awareness of kidney cancer and its early detection has led to more widespread screening programs, facilitating early diagnosis and treatment. According to the NHS England Report (Diagnostic Imaging Dataset Annual Statistical Data), in November 2023, 11.1 million tests were used to diagnose or rule out cancer, which is a 2.9% increase over the 10.8 million tests that were performed the year before. Referrals for chest X-rays reached 2.2%, while referrals for pelvic and kidney ultrasounds developed by 2.4% and 4.2%, respectively. GP referrals for pelvic and kidney ultrasounds remain lower, but activity for brain MRI and CT scans has exceeded pre-pandemic levels.

In January 2024, the General Practitioner Access to Community Diagnostics (GPACD) Scheme completed over 700,000 direct referred community radiology diagnostic scans. GPs are allowed to send patients for free tests including MRIs, CT scans, DXA scans, and X-rays under the programme, which has obtained €47.9 million for ongoing funding this year.

Regional Outlook

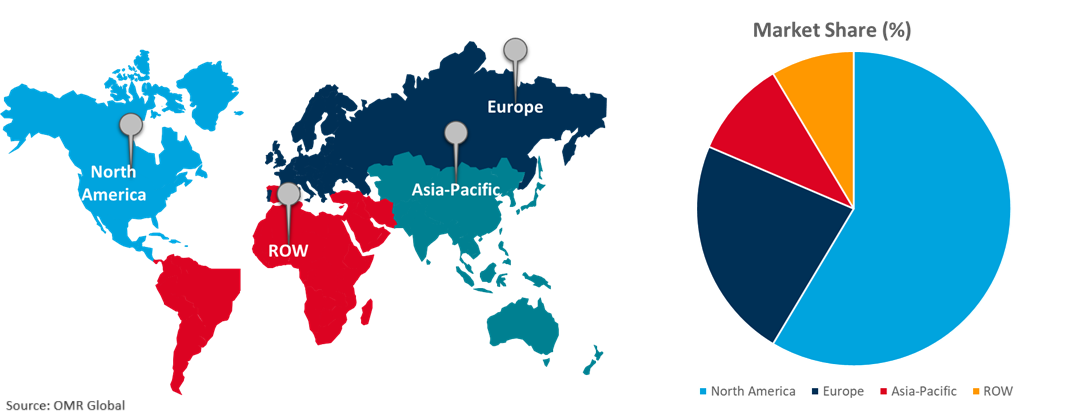

The global kidney cancer diagnosis and treatment market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Kidney Cancer Diagnosis and Treatment Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the high healthcare spending in the region, which has led to increased investment in cancer research and development, resulting in advancements in kidney cancer treatment and diagnosis. According to CMS.gov, in June 2024, National Health Insurance (NHE) increased by 4.1% to $4.5 trillion in 2022, or 17.3% of GDP. The growth in the NHE was facilitated by Medicare, Medicaid, private health insurance, and individual costs. Spending on other third-party payers, programmes, and public health initiatives, however, declined by 10.2%. Expenditure on hospitals increased 2.2% to $1,355.0 billion, while investment in doctors and clinical services increased 2.7% to $884.9 billion.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global kidney cancer diagnosis and treatment market include Bristol Myers Squibb, F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Pfizer Inc., and Novartis AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In July 2024, Ubie and the American Kidney Fund collaborated to improve the Symptom Checker AI for kidney disease prediction. The goal is to accelerate diagnosis, allowing patients to receive treatment earlier in the disease's progression, and improving outcomes. The collaboration aims to improve patient education and accelerate the time to diagnosis, as kidney disease kills more Americans than breast or prostate cancer.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global kidney cancer diagnosis and treatment market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bristol Myers Squibb

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Merck & Co., Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Pfizer Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Kidney Cancer Diagnosis and Treatment Market by Cancer Type

4.1.1. Renal Cell Carcinoma (RCC)

4.1.2. Transitional Cell Cancer

4.1.3. Wilm’s Tumour (Nephroblastoma)

4.1.4. Others (Sarcoma, Lymphoma)

4.2. Global Kidney Cancer Diagnosis and Treatment Market by Cancer Cell

4.2.1. Clear Cell

4.2.2. Papillary

4.2.3. Others (Chromophobe)

4.3. Global Kidney Cancer Market by Diagnosis Method

4.3.1. Biopsy

4.3.2. Computed Tomography (CT) scan

4.3.3. Magnetic Resonance imaging (MRI)

4.3.4. Ultrasound

4.4. Global Kidney Cancer Market by Therapy

4.4.1. Surgery

4.4.2. Immunotherapy

4.4.3. Chemotherapy

4.4.4. Radiation Therapy

4.4.5. Cryotherapy

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Active Biotech AB

6.2. Astex Therapeutics Ltd.

6.3. Bavarian Nordic A/S

6.4. Bayer AG

6.5. Celldex Therapeutics, Inc.

6.6. Cipla Ltd.

6.7. Eisai Co., Ltd.

6.8. Eli Lilly and Co.

6.9. Exelixis, Inc.

6.10. F. Hoffmann-La Roche Ltd

6.11. Genentech, Inc.

6.12. GlaxoSmithKline plc.

6.13. Ipsen Pharma

6.14. Jazz Pharmaceuticals, Inc.

6.15. Novartis AG

6.16. Taiho Pharmaceutical Co., Ltd.

6.17. Takeda Pharmaceutical Co. Ltd.