Kidney Function Tests Market

Kidney Function Tests Market Size, Share & Trends Analysis Report by Product Type (Dipsticks, Reagents, and Disposables) by Test Type (Urine Test, and Blood Test) and by End Users (Hospitals, Diagnostic Laboratories, Research Laboratories and Institutes, and Others) Forecast Period (2024-2031)

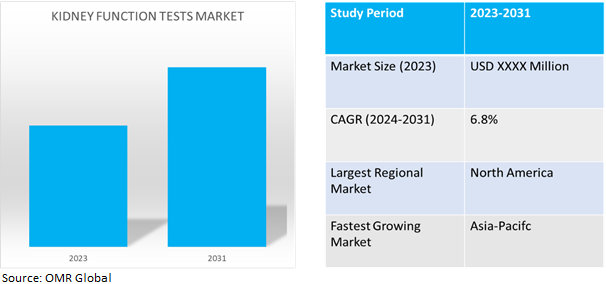

Kidney function tests market is anticipated to grow at a CAGR of 6.8% during the forecast period (2024-2031). Kidney function tests market is driven by the increasing prevalence of kidney diseases, such as chronic kidney disease, diabetic nephropathy, and glomerulonephritis, in addition to the diagnostic significance of these tests. Key players include diagnostic companies, laboratory equipment manufacturers, and healthcare institutions. Technological advancements, such as automation and molecular diagnostics, have improved the accuracy and accessibility of these tests. Investments in healthcare infrastructure, particularly in emerging economies, support the expansion of kidney function testing services. Preventive healthcare initiatives, public health campaigns, and community outreach programs also contribute to the demand for kidney function tests. Healthcare policy and reimbursement policies additionally influence the adoption and utilization of these tests. Public health awareness and education also play an essential role in promoting kidney health and early detection of kidney diseases.

Market Dynamics

Technological Advancements

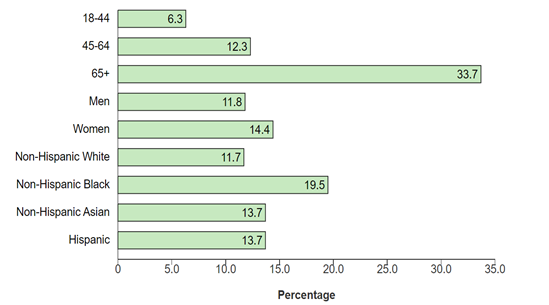

The market is expanding as a result of improvements in kidney function tests' accessibility, speed, and accuracy provided by advancements in diagnostic technologies, such as molecular diagnostics and point-of-care devices. According to the Centers for Disease Control and Prevention (.gov), in May 2023, chronic kidney disease (CKD) is a prevalent condition among US adults, with an estimated 35.5 million individuals, or 14.0% of the population, being affected. The prevalence of CKD varies across age groups, with higher rates observed in individuals aged 65 years or older (34.0%) compared to those aged 45-64 (12.0%) and 18-44 (6.0%). Furthermore, CKD is slightly more common in women (14.0%) than in men (12.0%), and non-hispanic black adults have the highest prevalence (20.0%) compared to non-hispanic Asian adults (14.0%), non-hispanic white adults (12.0%), and hispanic adults (14.0%).

The percentage of US adults aged 18 and older with CKD, categorized by age, sex, and race/ethnicity

Source: Centers for Disease Control and Prevention (.gov),

Increasing Prevelance Of An Aging Population

The development of diabetes is largely attributed to the aging of the globe's population; age is an established risk factor, and declining kidney function renders older persons more vulnerable. According to the International Diabetes Federation (IDF) Diabetes Atlas (2021), the global prevalence of diabetes among adults (20-79 years) is 10.5%. By 2045, it is projected that approximately 783.0 million adults will be living with diabetes, representing a 46.0% increase. Over 90.0% of diabetes cases are attributed to type 2 diabetes, influenced by factors such as urbanization, an aging population, decreased physical activity, and increased rates of overweight and obesity. However, implementing preventive measures and ensuring early diagnosis and proper care can help mitigate the impact of diabetes.

Market Segmentation

Our in-depth analysis of global kidney function tests market includes the following segments by product, test type, and end-user:

- Based on product, the market is segmented into dipsticks, reagents, and disposables.

- Based on test type, the market is segmented into urine tests, and blood tests.

- Based on end-users, the market is segmented into hospitals, diagnostic laboratories, research laboratories and institutes, and others (clinics, home care settings, and outpatient centers ).

Urine Tests Are Projected To Emerge As The Largest Segment

The urine tests segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the demand for standardized testing solutions to guarantee consistent and dependable urine sediment analysis results, healthcare facilities particularly small and medium-sized ones—seek standardized testing solutions. For instance, in September 2022, Sysmex Corp. launched the UF-1500 Fully Automated Urine Particle Analyzer (UF-1500), a new product for urine sediment testing. The UF-1500 inherits the functionality of the UF-5000 model while downsizing it. The product aims to provide a wider range of solutions tailored to customers' environments and contribute to the standardization of urine testing at small and medium-sized facilities.

Diagnostic Laboratories Segment to Hold a Considerable Market Share

Regulatory compliance and adherence to quality standards play a vital role in maintaining the accuracy and reliability of kidney function tests, thereby instilling confidence in the diagnostic and preventive services provided. For instance, in September 2021, Signify Health added a kidney health evaluation to its Diagnostic and Preventive Services offering. The evaluation, part of an In-home Health Evaluation (IHE), is available at no additional cost to Medicare Advantage plan members. The results help clinicians determine the best treatment and management plan for kidney health.

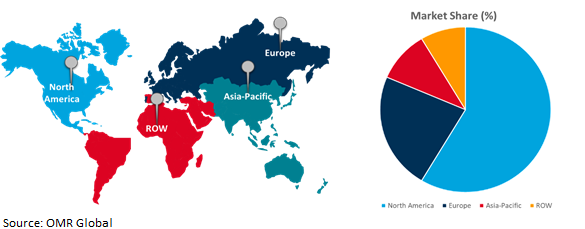

Regional Outlook

Global Kidney function tests market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Healthcare Access And Infrastructure In Asia-Pacific Region

Increasing health spending is a signal of a dedication to enhancing the healthcare system, that involves kidney function testing and improves access to healthcare services in addition to market expansion. According to the Invest India, in April 2023, the health expenditure in the Union Budget 2023-24 has been allocated at $11.3 billion indicating a 2.7% increase compared to the previous year.

Global Kidney Function Tests Market Growth by Region 2024-2031

North America Holds Major Market Shareidual

The kidney function tests are in high demand owing to the prevalence of chronic kidney disease (CKD), which affects both American and global populations. Risk factors for kidney failure include diabetes, hypertension, heart disease, and a family history of the condition. According to the National Institute of Diabetes and Digestive and Kidney Diseases, in May 2023, chronic kidney disease (CKD) affects a significant portion of the US adult population, with an estimated 37.0 million Americans, or more than 1 in 7, being affected. The risk for CKD is even higher for individuals with diabetes or high blood pressure, with nearly 1 in 3 people with diabetes and 1 in 5 people with high blood pressure having kidney disease. Other factors that increase the risk of developing kidney disease include heart disease and a family history of kidney failure.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global kidney function tests market include Abbott Laboratories, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Merck KGaA, and Siemens Healthineers co., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2023, the health department launched a state-wide program, 'Siruneeragam Kakkum Seermigu Maruthuva Thittam', distributing testing kits to hospitals and PHCs across the state for early diagnosis and treatment of kidney diseases.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global kidney function test market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bio-Rad Laboratories, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. F. Hoffmann-La Roche Ltd

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Kidney Function Tests Market by Product Type

4.1.1. Dipsticks

4.1.2. Reagents

4.1.3. Disposables

4.2. Global Kidney Function Tests Market by Test Type

4.2.1. Urine Tests

4.2.1.1. Urine Protein Tests

4.2.1.2. Microalbumin Tests

4.2.1.3. Creatinine Clearance Tests

4.2.2. Blood Tests

4.2.2.1. Serum Creatinine Tests

4.2.2.2. Blood Urea Nitrogen Tests

4.2.2.3. Glomerular Filtration Rate Tests

4.3. Global Kidney Function Tests Market by End-user

4.3.1. Hospitals

4.3.2. Diagnostic Laboratories

4.3.3. Research Laboratories And Institutes

4.3.4. Others (Clinics, Home Care Settings, and Outpatient Centers)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. ACON Laboratories, Inc.

6.2. Amgen Inc.

6.3. ARKRAY, Inc.

6.4. BIOMÉRIEUX

6.5. Danaher Corp.

6.6. Diasorin S.p.A.

6.7. Laboratory Corp. of America

6.8. Medtronic plc

6.9. Merck KGaA

6.10. Nephrology Associates

6.11. Nipro

6.12. Nova Biomedical

6.13. Quest Diagnostics

6.14. Randox Laboratories Ltd.

6.15. Siemens Healthineers AG

6.16. Sysmex Corp.

6.17. Thermo Fisher Scientific Inc.

6.18. URIT Medical Electronic Co., Ltd.

1. GLOBAL KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL DIPSTICKS KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL REAGENTS KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DISPOSABLES KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY TEST DISEASE INDICATION 2023-2031 ($ MILLION)

6. GLOBAL URINE KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BLOOD KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

9. GLOBAL KIDNEY FUNCTION TESTS IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL KIDNEY FUNCTION TESTS IN DIAGNOSTIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL KIDNEY FUNCTION TESTS IN RESEARCH LABORATORIES AND INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL KIDNEY FUNCTION TESTS IN OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

18. EUROPEAN KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

26. REST OF THE WORLD KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE , 2023-2031 ($ MILLION)

28. REST OF THE WORLD KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY TEST TYPE , 2023-2031 ($ MILLION)

29. REST OF THE WORLD KIDNEY FUNCTION TESTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL KIDNEY FUNCTION TESTS MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL DIPSTICKS KIDNEY FUNCTION TESTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL REAGENTS KIDNEY FUNCTION TESTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DISPOSABLES KIDNEY FUNCTION TESTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL KIDNEY FUNCTION TESTS MARKET SHARE BY TEST TYPE 2023 VS 2031 (%)

6. GLOBAL URINE KIDNEY FUNCTION TESTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BLOOD TESTS KIDNEY FUNCTION TESTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL KIDNEY FUNCTION TESTS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

9. GLOBAL KIDNEY FUNCTION TESTS IN HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL KIDNEY FUNCTION TESTS IN DIAGNOSTIC LABORATORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL KIDNEY FUNCTION TESTS IN RESEARCH LABORATORIES AND INSTITUTES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL KIDNEY FUNCTION TESTS IN OTHER END-USER MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL KIDNEY FUNCTION TESTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

16. UK KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA KIDNEY FUNCTION TESTS MARKET SIZE, 2023-2031 ($ MILLION)