Lab Automation in Genomics Market

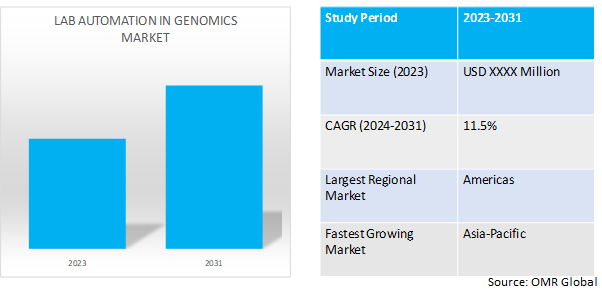

Lab Automation in Genomics Market Size, Share & Trends Analysis Report by Equipment Type (Automated Liquid Handler, Automated Plate Handler, Robotic Arms, Automated Storage & Retrieval System, and Vision Systems) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Lab automation in genomics market is anticipated to grow at a significant CAGR of 11.5% during the forecast period (2024-2031). The increasing advancements in genomic research, increasing prevalence of chronic disorders, and growing demand for lab automation are major factors driving the global market.

Market Dynamics

Growing Investment in Genomics Research

The growing investment in genomics research is a key factor driving the global market. For instance, in February 2023, Accenture has made a strategic investment, through Accenture Ventures, in Ocean Genomics, a technology and AI company that has developed advanced computational platforms to assist biopharma companies to discover and develop more effective diagnostics and therapeutics. Further, in October 2023, Canadian Institutes of Health Research to invest $15 million in creation of first-of-its-kind genome library to make genomic research more sustainable, secure, and equitable.

Rising Burden of Chronic Disorders

Genomics plays a key role in the early diagnosis of chronic disorders. Therefore, the increasing diagnostic procedures for the early detection of any disorder for its better care are another contributor to the market growth. For instance, cancer genomics research contributes to precision medicine by defining cancer types and subtypes based on their genetics. According to the World Health Organization (WHO), in 2020, cancer is a leading cause of mortality globally, accounting for nearly 10 million mortalities. With the automation of labs for genomic research these number of mortalities can be minimized thereby creating product demand.

Market Segmentation

Our in-depth analysis of the global lab automation in genomics market includes the following segments by equipment type:

- Based on equipment type, the market is sub-segmented into automated liquid handler, automated plate handler, robotic arms, storage & retrieval system, and vision systems.

Automated Liquid handler to Exhibit Highest GAGR

Based on the equipment type, the global lab automation in genomics market is sub-segmented into automated liquid handler, automated plate handler, robotic arms, automated storage & retrieval system, and vision systems. Automated liquid handling systems increase the efficiency and repeatability of pipetting operations, allowing scientists to devote more time to complex tasks such as experiment design and data analysis. Automation mitigates human error, helping to ensure the consistency and reliability of experimental results and leading to superior data quality. The high adoption of these systems owing to its offered benefits is a key factor driving the growth of this market segment.

Additionally, with the growing demand for the throughput and complexity of genomic assays, the need for integrated, all-in-one automated solutions becomes increasingly apparent. The increasing adoption of specialized workflows in genomics by labs for NGS is further aiding to the market growth. Integrated systems that offer a comprehensive liquid handling solution will enable labs to stay at the forefront of scientific discovery without needing to sacrifice premium lab space.

Regional Outlook

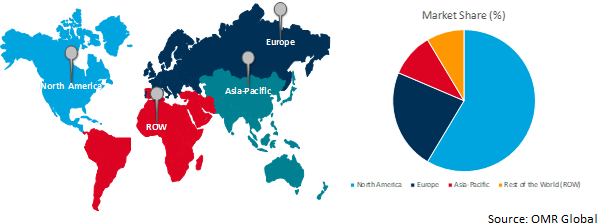

The global lab automation in genomics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Lab Automation in Genomics Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the growing regional focus on clinical research. The US is home to several major biopharmaceutical companies such as Abbott Laboratories, Pfizer, Johnson & Johnson, and Novartis among others. The highest concentration of contract research organizations (CROs) across the region is further aiding its market growth. IQVIA, Syneos Health, and Parexel International Corp. are some prominent CROs of the region. Significant investment in genomic research by regional government is another major contributor to the regional market growth.

The availability of new genome sequencing technologies, well-established healthcare infrastructure, and the increasing geriatric population are significant contributing factors toward the revenue growth of the market.

In May 2023, Opentrons launched Opentrons Flex robot, a new generation of affordable and easy-to-program liquid-handling lab robots designed to level the playing field for labs of all sizes and bring advanced lab automation to more researchers. Fusing advanced robotics with a deep ecosystem of open-source software, Flex is compatible with AI tools and has near-limitless potential to learn new protocols. Such innovative product launches are promoting regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global lab automation in genomics market include Thermo Fisher Scientific Inc., Danaher Corp. / Beckman Coulter, Hudson Robotics Inc., Becton, Dickinson and Company and Synchron Lab Automation among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2023, the Francis Crick Institute's Advanced Sequencing Facility has partnered with Automata to integrate automation in genomics sample preparation. The partnership is based on the premise that automation can unlock a step change in the potential of genomics labs. The integration of automation will support Crick’s advanced genomics laboratory with greater walkaway time, R&D flexibility, and data quality than ever before.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global lab automation in genomics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Becton, Dickenson & Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Danaher Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hudson Robotics Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Synchron Lab Automation

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Lab Automation in Genomics Market by Equipment

4.1.1. Automated Liquid Handler

4.1.2. Automated Plate Handler

4.1.3. Robotic Arms

4.1.4. Automated Storage & Retrieval System

4.1.5. Vision Systems

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agilent Technologies, Inc.

6.2. Beckman Coulter, Inc.

6.3. Bio-Rad Laboratories, Inc.

6.4. BMG LABTECH GmbH

6.5. bioMérieux SA

6.6. E & I Sales

6.7. Eppendorf SE

6.8. Gilson, Inc.

6.9. Hamilton Bonaduz AG

6.10. HighRes Biosolutions

6.11. Hudson Robotics

6.12. Labforward GmbH

6.13. NSK Americas

6.14. OPENTRONS

6.15. Peak Analysis and Automation Ltd. (PAA)

6.16. QIAGEN GmbH

6.17. Sysmex Europe SE

6.18. Tecan Group

6.19. Thermo Fisher Scientific

6.20. WATERS CORP.

1. GLOBAL LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

2. GLOBAL AUTOMATED LIQUID HANDLER IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AUTOMATED PLATE HANDLER IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ROBOTIC ARMS IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AUTOMATED STORAGE & RETRIEVAL SYSTEM IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL VISION SYSTEMS IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LAB AUTOMATION IN GENOMICS IN AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

11. EUROPEAN LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. EUROPEAN LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

13. ASIA-PACIFIC LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. ASIA-PACIFIC LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

15. REST OF THE WORLD LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. REST OF THE WORLD LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

1. GLOBAL LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023 VS 2031 (%)

2. GLOBAL AUTOMATED LIQUID HANDLER IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL AUTOMATED PLATE HANDLER IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL ROBOTIC ARMS IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL AUTOMATED STORAGE & RETRIEVAL SYSTEM IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL VISION SYSTEMS IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL LAB AUTOMATION IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. US LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

9. CANADA LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

10. UK LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

11. FRANCE LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

12. GERMANY LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

13. ITALY LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

14. SPAIN LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

15. REST OF EUROPE LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

16. INDIA LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

17. CHINA LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

18. JAPAN LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

19. SOUTH KOREA LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF ASIA-PACIFIC LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)

23. THE MIDDLE EAST & AFRICA LAB AUTOMATION IN GENOMICS MARKET SIZE, 2023-2031 ($ MILLION)