Lab Automation Market

Lab Automation Market Size, Share & Trends Analysis Report by Product Type (Automated Workstations, Microplate Readers, Automated ELISA Systems, and Automated Nucleic Acid Purification Systems), by Application (Drug Discovery, Diagnostics, Genomics Solutions, Proteomics Solutions, Microbiology, and Other) and by End-User (Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostic Laboratories, Research and Academic Institutes, Forensic Laboratories, Environmental Testing Laboratories, and Food & Beverage Industry) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Lab automation market is anticipated to grow at a significant CAGR of 7.9% during the forecast period. The key factors contributing to the market growth include increasing investments and funding activities by key players and the government for the implementation, integration, and development of new technology in lab automation. For instance, in February 2022, Automata raised funding of $50 million to automate entire lab processes from start to finish in $7.4 million was focused on developing and deploying its Eva robotic arm. Thus attributed to funding and investment the companies and new start-ups are focusing on adopting and implementing new lab automation in daily practice which is attributed to contributing to the market growth. However, the higher cost of laboratory automation systems and slow adoption by small and medium-sized laboratories of lab automation are factors that hinder markt growth.

Segmental Outlook

The global lab automation market is segmented based on product type, application, and end-user. On the basis of product type, the market is segmented into automated workstations, microplate readers, automated ELISA systems, and automated nucleic acid purification systems. Based on the application, the market is subdivided into drug discovery, diagnostics, genomics solutions, proteomics solutions, microbiology, and others. Based on the end-user, the market is segmented into biotechnology and pharmaceutical companies, hospitals and diagnostic laboratories, research and academic institutes, forensic laboratories, environmental testing laboratories, and the food & beverage industry. Among the end-user segments biotechnology and Pharmaceutical, Companies segment is anticipated to hold a prominent share in the market due to the large presence of pharmaceutical companies globally and the raising adoption of robotics & laboratory automation. The shift of laboratory automation to R&D within pharmaceutical companies, and increasing product intricacy, pricing pressure are such factors that drive segmental growth in the market.

The automated workstations segment among product type segment is predicted to hold a prominent share in the market due to new and continuous technological advancements and the growth in drug discovery and high demand for workflow solutions integration are such factors that drive segmental growth. For instance, In May 2021, Beckman Coulter launched a new workflow automation solution the DxA 5000 Fit, for medium-sized labs that run fewer than 5,000 tests a day. This new system enables many analyzers to perform different types of tests on different sample matrices and offers benefits such as Comprehensive workflow, and intelligent routing, among others. Moreover, due to the more sophistication of clinical studies, there is an increase in demand for imaging, monitoring, and cell detection systems that provides key opportunities for the introduction of new solutions by key players.

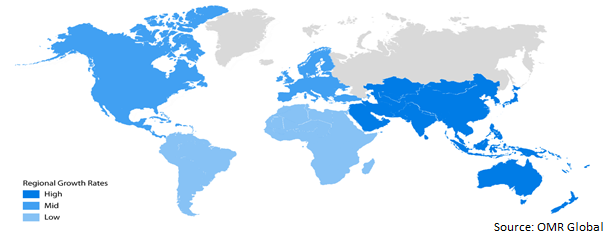

Regional Outlooks

The global lab automation market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. North America region is estimated to hold a prominent share owing to the high and early adoption of technology-based systems and software are driving market growth further in the region.

Global Lab Automation Market Growth, by Region 2022-2028

The Asia-Pacific Region is Fastest Growing in the Global Lab Automation Market

The region is estimated to witness the fastest growth in the market owing to the rising prevalence of infectious diseases that leads to the adoption of lab testing, increasing adoption of several initiatives by players that provide accessibility, and adoption of novel lab automation solutions such factors that drive regional market growth. For instance, in March 2021, MGI introduced new laboratory automation products at the 18th China Association of Clinical Laboratory Practice Expo (CACLP 2021). The company product range includes automated sample transfer processing system MGISTP series, automated nucleic acid extractor MGISP-NE series, and automated sample preparation system MGISP series, among others. In addition, in October 2021, GC Labs launched "WASPLab" an automated test system, which is the first microbiology Total Laboratory Automation system in Korea. This new system automatically processes a series of steps from sample receipt to inoculation, culture, and interpretation, and is aimed to further improve competitiveness such as efficiency and quality. This newly launched product has also received National Medical Products Administration (NMPA) qualifications. Moreover, increasing demand for lab automation in emerging economies, such as India and China, a rise in several pharmaceutical companies, and a rise in several hospitals equipped with advanced medical facilities.

Market Players Outlook

The major companies serving the global lab automation market include Becton, Dickinson and Co., Bio-Rad Laboratories, Inc., Danaher Corp., F. Hoffmann-La Roche Ltd., HighRes Biosolutions, PerkinElmer Inc., Siemens Healthineers AG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in December 2020, Todaro Robotics and PAA, has partnered to broaden their solution capabilities for the global life science, biotech, and drug development markets and expanded their best-in-breed laboratory automation offerings. Under this colloboration, Todaro Robotics developed two incredibly versatile systems and leveraged these solutions that dramatically increase throughput and productivity.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global lab automation market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. ByRegion

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Becton, Dickinson and Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Danaher Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. F. Hoffmann-La Roche Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. PerkinElmer Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens Healthineers AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Lab Automation Market By Product Type

4.1.1. Automated Workstations

4.1.1.1. Automated Liquid handling systems

4.1.1.1.1. Automated Integrated Workstations

4.1.1.1.2. Pipetting Systems

4.1.1.1.3. Reagent Dispensers

4.1.1.1.4. Microplate Washers

4.1.2. Microplate readers

4.1.2.1. Multi-mode Microplate Readers

4.1.2.1.1. Filter-based

4.1.2.1.2. Monochromator-based

4.1.2.1.3. Hybrid

4.1.2.2. Single-mode Microplate Readers

4.1.2.2.1. Fluorescence

4.1.2.2.2. Absorbance

4.1.2.2.3. Luminescence

4.1.3. Automated ELISA Systems

4.1.4. Automated Nucleic Acid Purification Systems

4.1.4.1. Off-the-shelf Automated Workcells

4.1.4.1.1. Pre-analytical Automation

4.1.4.1.2. Post-analytical Automation

4.1.4.1.3. Total Lab Automation

4.1.4.2. Robotic Systems

4.1.4.2.1. Robotic Arms

4.1.4.2.2. Track Robots

4.1.4.3. Automated Storage and Retrieval Systems

4.1.4.4. Software

4.1.4.4.1. LIMS

4.1.4.4.2. ELN

4.1.4.4.3. LES

4.1.4.4.4. SDMS

4.1.4.4.5. Other Lab Automation Equipment(Includes barcode readers, weighing platforms, microplate coolers, tube recognition devices, bulk loaders, and automated cappers/decappers.)

4.2. Global Lab Automation Market By Application

4.2.1. Drug Discovery

4.2.1.1. ADME Screening

4.2.1.2. High-throughput Screening

4.2.1.3. Compound Management

4.2.1.4. Compound Weighing & Dissolution

4.2.1.5. Other Drug Discovery Applications

4.2.2. Diagnostics

4.2.2.1. Pre-analytics/Sample Preparation

4.2.2.2. Sample Distribution, Splitting, and Archiving

4.2.2.3. EIA

4.2.3. Genomics Solutions

4.2.4. Proteomics Solutions

4.2.5. Microbiology

4.2.6. Other Applications (Includes cell biology and biobanking)

4.3. Global Lab Automation Market By End-User

1.1.1. Biotechnology and Pharmaceutical Companies

1.1.2. Hospitals and Diagnostic Laboratories

1.1.3. Research and Academic Institutes

1.1.4. Forensic Laboratories

1.1.5. Environmental Testing Laboratories

1.1.6. Food & Beverage Industry

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agilent Technologies, Inc.

6.2. Beckman Coulter, Inc.

6.3. Bio-Rad Laboratories, Inc.

6.4. BMG LABTECH GmbH

6.5. bioMérieux SA

6.6. E & I Sales

6.7. Eppendorf SE

6.8. Gilson, Inc.

6.9. Hamilton Bonaduz AG

6.10. HighRes Biosolutions

6.11. Hudson Robotics

6.12. Labforward GmbH

6.13. NSK Americas

6.14. OPENTRONS

6.15. Peak Analysis and Automation Ltd. (PAA)

6.16. QIAGEN GmbH

6.17. Synchron Lab Automation

6.18. Sysmex Europe SE

6.19. Tecan Group

6.20. Thermo Fisher Scientific

6.21. WATERS CORP

1. GLOBAL LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL LAB AUTOMATED WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL LAB AUTOMATION MICROPLATE READERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL LAB AUTOMATED ELISA SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL LAB AUTOMATED NUCLEIC ACID PURIFICATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL LAB AUTOMATION IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL LAB AUTOMATION IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL LAB AUTOMATION IN GENOMICS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL OWNED LAB AUTOMATION IN PROTEOMICS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL LAB AUTOMATION IN MICROBIOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL OWNED LAB AUTOMATION IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

14. GLOBAL LAB AUTOMATION IN BIOTECHNOLOGY AND PHARMACEUTICAL COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL LAB AUTOMATION IN HOSPITALS AND DIAGNOSTIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL LAB AUTOMATION IN RESEARCH AND ACADEMIC INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL OWNED LAB AUTOMATION IN FORENSIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL LAB AUTOMATION IN ENVIRONMENTAL TESTING LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL OWNED LAB AUTOMATION IN FOOD & BEVERAGE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

21. NORTH AMERICAN LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. NORTH AMERICAN LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

23. NORTH AMERICAN LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. NORTH AMERICAN LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

25. EUROPEAN LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. EUROPEAN LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

27. EUROPEAN LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

28. EUROPEAN LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

33. REST OF THE WORLD LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. REST OF THE WORLD LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

36. REST OF THE WORLD LAB AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)?

1. GLOBAL LAB AUTOMATION MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

2. GLOBAL LAB AUTOMATED WORKSTATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL LAB AUTOMATION MICROPLATE READERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL LAB AUTOMATED ELISA SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL LAB AUTOMATED NUCLEIC ACID PURIFICATION SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL LAB AUTOMATION MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

7. GLOBAL LAB AUTOMATION IN DRUG DISCOVERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL LAB AUTOMATION IN DIAGNOSTICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL LAB AUTOMATION IN GENOMICS SOLUTIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL LAB AUTOMATION IN PROTEOMICS SOLUTIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL LAB AUTOMATION IN MICROBIOLOGY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL LAB AUTOMATION IN OTHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL LAB AUTOMATION MARKET SHARE BY END-USER, 2021 VS 2028 (%)

14. GLOBAL LAB AUTOMATION IN BIOTECHNOLOGY AND PHARMACEUTICAL COMPANIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL LAB AUTOMATION IN HOSPITALS AND DIAGNOSTIC LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL LAB AUTOMATION IN RESEARCH AND ACADEMIC INSTITUTES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL LAB AUTOMATION IN FORENSIC LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL LAB AUTOMATION IN ENVIRONMENTAL TESTING LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL LAB AUTOMATION IN FOOD & BEVERAGE INDUSTRY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL LAB AUTOMATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. GLOBAL LAB AUTOMATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

22. US LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

23. CANADA LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

24. UK LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

25. FRANCE LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

26. GERMANY LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

27. ITALY LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

28. SPAIN LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF EUROPE LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

30. INDIA LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

31. CHINA LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

32. JAPAN LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

33. SOUTH KOREA LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

34. REST OF ASIA-PACIFIC LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD LAB AUTOMATION MARKET SIZE, 2021-2028 ($ MILLION)