Laboratory Centrifuge Market

Global Laboratory Centrifuge Market Size, Share & Trends Analysis Report By Product Type (Devices and Accessories), By Application (Diagnostic, Microbiology, Genomics, Proteomics, Blood Component Separation, and Others), By End-User (Hospitals, Academic & Research Institutes, and Biotechnology & Pharmaceutical Companies) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global laboratory centrifuge market is growing at a CAGR of 2.5% during the forecast period (2021-2027). These devices use centrifugal force for the separation of a range of liquids or gas, based on density. Major factors that are contributing to the growth of the market include the rising prevalence of chronic diseases such as malaria, HIV, and tuberculosis, and rising pharmaceutical and biological research studies. For this, the use of centrifuges for disease diagnosis and blood component separation has expanded dramatically in recent years, particularly in blood banks. This aids in the detection of the diseases mentioned above, and the high prevalence of these diseases will increase the use of centrifuges. Moreover, centrifuges are widely used in blood banks for separating whole blood into red blood cells, platelets, and plasma. However, the high cost of the centrifuge device and its maintenance, decrease in sales due to extended lifespan, and release of chemical, biological, and radioactive agents are some of the constraints which are estimated to hamper the growth of the market in the forecast period.

Conversely, innovation in technologies enhancing speed, durability safety, efficiency, and accuracy is estimated as an opportunity for the market players as it will increase the interest of the customers. For instance, in April 2021, Eppendorf AG introduced Eppendorf Centrifuge 5910 Ri to accelerate the centrifugation steps of the workflow The technology is a touch screen interface that allows for quick setting of desired parameters while three levels of user management and new documentation options provide enhanced security and traceability. Moreover, in March 2021, ThermoFisher Scientific Inc. launched a 1.6 L benchtop and 4 L floor-standing centrifuge systems. The features of the model include unique full color, glass touchscreen display for efficient workflow. The 4 L systems in the General Purpose Pro Centrifuge Series feature a high-speed rotor for both microplates and tube centrifuges and have high product safety.

Impact of COVID-19 on the Global Laboratory Centrifuge Market

The global laboratory centrifuge market is hardly hit by the COVID-19 pandemic since December 2019. The outbreak of COVID-19 in these major economies has disrupted the manufacturing and supply of raw materials across the globe which resulted in a low supply of the products. This was mainly due to the lockdowns imposed by the governments of several countries. However, the studies show that a centrifuge to detect Sars-CoV-2 in saliva samples is a great market opportunity for the players and that the centrifuges are estimated to fight against the COVID-19 virus.

Segmental Outlook

The market is segmented based on product type, application, and end-user. Based on the product type segment, the market is segmented into devices and accessories. Based on the device segment, the market is further sub-segmented into microcentrifuge, multipurpose centrifuge, floor-based centrifuge, and ultracentrifuge. Based on the application segment, the market is segmented into diagnostic, microbiology, genomics, proteomics, blood component separation, and others (cellomics). Moreover, based on the end-user segment, the market is bifurcated into hospitals, academic & research institutes, biotechnology & pharmaceutical companies.

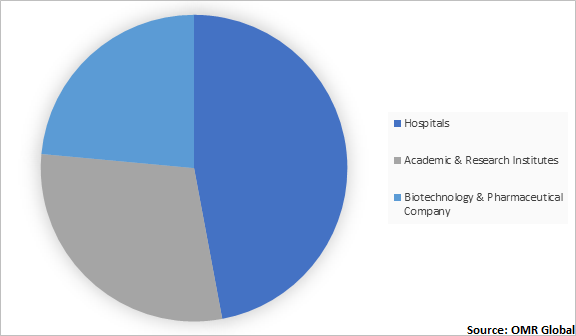

Global Laboratory Centrifuge Market Share by End-User, 2020 (%)

Hospitals Segment to Hold a Lucrative Share in the Global Laboratory Centrifuge market

Amongst the end-user industry segment of the global laboratory centrifuge market, the hospital segment held one of the largest shares in the end-user segment in 2020. The centrifuge devices are widely used in hospitals as they are used in the extraction of suspended material from a range of mediums and in the purification of cells, subcellular organelles, proteins, viruses, and nucleic acids. The prevalence of chronic diseases is also one of the major factors why these devices are used for diagnosis in hospitals. For instance, Centurion Scientific Ltd hospital centrifuges include Micro Centrifuges to 0.2L, Small Centrifuges to 0.5L, Medium Centrifuges to 1L, Floor Centrifuges to 4L and many more.

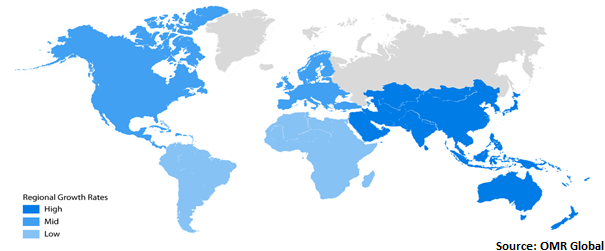

Regional Outlooks

The global laboratory centrifuge market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America (the US and Canada), Europe (Germany, Spain, Italy, France, the UK, and the Rest of Europe), Asia-Pacific (India, China, Japan South Korea, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America). North America is estimated to hold one of the largest shares in the market. Rising biological research studies, high reimbursement policies by the government, improved healthcare infrastructure, and awareness about early diagnosis are some of the factors that drive the growth of the market in this region.

Global Laboratory Centrifuge Market, by Region 2021-2027

Asia-Pacific is projected to highest Contributor to the growth of the Global Laboratory Centrifuge market

Asia-Pacific is anticipated to be the fastest-growing region in the global laboratory centrifuge market. In the region, China, South Korea, Japan, Singapore, and India are showing rapid progress. The region is growing due to the increasing use of molecular diagnostics in hospitals in emerging economies like China and India, and the rising prevalence of chronic diseases. Besides, the increasing R&D investments by pharmaceuticals and biotechnology companies in the region is the major factor for driving the growth of the market. For instance, Thermo Fisher Scientific, Inc. has incurred around $1.2 billion in R&D expenses in 2020.

Market Player Outlook

Key players of the global laboratory centrifuge market are Eppendorf AG, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Kubota Corp., PerkinElmer Inc., Merck KGaA, and Agilent Technologies, Inc., among others. To survive in the market these players adopt different marketing strategies such as a merger, acquisitions, product launch, and geographical expansion so on. For instance, in March 2020, Eppendorf AG announced the acquisition of Koki’s centrifuge business. Eppendorf AG by this acquisition aims to expand its centrifuge business and solidifies its strong market position as one of the world’s leading makers of high-end centrifuges for the pharma and life science industries as well as academic and commercial research.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global laboratory centrifuge market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies-

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Laboratory Centrifuge Industry

• Recovery Scenario of Global Laboratory Centrifuge Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Laboratory Centrifuge Market by Product Type

5.1.1. Devices

5.1.1.1. Microcentrifuge

5.1.1.2. Multipurpose Centrifuge

5.1.1.3. Floor-Based Centrifuge

5.1.1.4. Ultracentrifuge

5.1.2. Accessories (Tubes, Centrifuge Bottles, Buckets, Plates)

5.2. Global Laboratory Centrifuge Market by Application

5.2.1. Diagnostic

5.2.2. Microbiology

5.2.3. Genomics

5.2.4. Proteomics

5.2.5. Blood Component Separation

5.2.6. Others (Cellomics)

5.3. Global Laboratory Centrifuge Market by End-Users

5.3.1. Hospitals

5.3.2. Academic & Research Institutes

5.3.3. Biotechnology & Pharmaceutical Companies

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agilent Technologies, Inc.

7.2. Andreas Hettich GmbH & Co. KG

7.3. Beckman Coulter, Inc.

7.4. Bio-Rad Laboratories, Inc.

7.5. Biosan Laboratories, Inc.

7.6. Cole-Parmer Instrument Company, LLC.

7.7. Centurion Scientific Ltd

7.8. Drucker Diagnostics, LLC

7.9. Eppendorf AG

7.10. Kubota Corp.

7.11. HERMLE Labortechnik GmbH

7.12. Labnet International Inc.

7.13. Merck KGaA

7.14. NuAire, Inc.

7.15. PerkinElmer Inc.

7.16. Qiagen NV

7.17. Sartorius AG

7.18. Sigma Laborzentrifugen GmbH

7.19. Thermo Fisher Scientific Inc.

1. GLOBAL LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

2. GLOBAL LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLIONS)

3. GLOBAL DEVICE FOR LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

4. GLOBAL DEVICE FOR LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLIONS)

5. GLOBAL ACCESSORIES FOR LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

6. GLOBAL LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLIONS)

7. GLOBAL LABORATORY CENTRIFUGE IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

8. GLOBAL LABORATORY CENTRIFUGE IN MICROBIOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

9. GLOBAL LABORATORY CENTRIFUGE IN GENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

10. GLOBAL LABORATORY CENTRIFUGE IN PROTEOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

11. GLOBAL LABORATORY CENTRIFUGE IN BLOOD COMPONENT SEPARATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

12. GLOBAL LABORATORY CENTRIFUGE IN OTHERS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

13. GLOBAL LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLIONS)

14. GLOBAL LABORATORY CENTRIFUGE IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

15. GLOBAL LABORATORY CENTRIFUGE IN ACADEMIC & RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

16. GLOBAL LABORATORY CENTRIFUGE IN BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

17. GLOBAL LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLIONS)

18. NORTH AMERICAN LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. NORTH AMERICAN LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

20. NORTH AMERICAN LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. NORTH AMERICAN LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

22. EUROPEAN LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. EUROPEAN LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

24. EUROPEAN LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

25. EUROPEAN LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

30. ROW LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

31. ROW LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

32. ROW LABORATORY CENTRIFUGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL LABORATORY CENTRIFUGE MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL LABORATORY CENTRIFUGE MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL LABORATORY CENTRIFUGE MARKET, 2021-2027 (%)

4. GLOBAL LABORATORY CENTRIFUGE MARKET SHARE BY PRODUCT TYPE, 2020 VS 2027 (%)

5. GLOBAL LABORATORY CENTRIFUGE MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

6. GLOBAL LABORATORY CENTRIFUGE MARKET SHARE BY END-USERS, 2020 VS 2027 (%)

7. GLOBAL LABORATORY CENTRIFUGE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027(%)

8. GLOBAL DEVICE FOR LABORATORY CENTRIFUGE MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL MICROCENTRIFUGE IN DEVICE FOR LABORATORY CENTRIFUGE MARKET SHARE, 2020 VS 2027 (%)

10. GLOBAL MULTIPURPOSE CENTRIFUGE IN DEVICE FOR LABORATORY CENTRIFUGE MARKET SHARE, 2020 VS 2027 (%)

11. GLOBAL FLOOR-BASED CENTRIFUGE IN DEVICE FOR LABORATORY CENTRIFUGE MARKET SHARE, 2020 VS 2027 (%)

12. GLOBAL ULTRACENTRIFUGE IN DEVICE FOR LABORATORY CENTRIFUGE MARKET SHARE, 2020 VS 2027 (%)

13. GLOBAL ACCESSORIES FOR LABORATORY CENTRIFUGE MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL LABORATORY CENTRIFUGE IN DIAGNOSTICS MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL LABORATORY CENTRIFUGE IN MICROBIOLOGY MARKET SHARE BY REGION, 2020 VS 2027 (%)

16. GLOBAL LABORATORY CENTRIFUGE IN GENOMICS MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. GLOBAL LABORATORY CENTRIFUGE IN PROTEOMICS MARKET SHARE BY REGION, 2020 VS 2027 (%)

18. GLOBAL LABORATORY CENTRIFUGE IN BLOOD COMPONENT SEPARATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

19. GLOBAL LABORATORY CENTRIFUGE IN OTHERS APPLICATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

20. GLOBAL LABORATORY CENTRIFUGE IN HOSPITALS MARKET SHARE BY REGION, 2020 VS 2027 (%)

21. GLOBAL LABORATORY CENTRIFUGE IN ACADEMIC & RESEARCH INSTITUTES MARKET SHARE BY REGION, 2020 VS 2027 (%)

22. GLOBAL LABORATORY CENTRIFUGE IN BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

23. US LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

24. CANADA LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

25. UK LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

26. FRANCE LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

27. GERMANY LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

28. ITALY LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

29. SPAIN LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

30. ROE LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

31. INDIA LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

32. CHINA LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

33. JAPAN LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

34. SOUTH KOREA LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

35. REST OF ASIA-PACIFIC LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)

36. ROW LABORATORY CENTRIFUGE MARKET SIZE, 2020-2027 ($ MILLION)