Laboratory Mixer Market

Laboratory Mixer Market Size, Share & Trends Analysis Report by Product (Shakers, Magnetic Stirrers, Vortex Mixers, Conical Mixers, Overhead Stirrers, and Accessories), by Platform (Digital Devices, and Analog Devices), by Operability (Gyratory Movement, Linear Movement, Rocking/Tilting Movement, and Orbital Movement), and by End-User (Pharmaceutical & Biotechnology Companies, Research Laboratories & Institutes, Clinical Research Organizations, Environmental Testing Laboratories, Food Testing Laboratories, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Laboratory mixer market is anticipated to grow at a significant CAGR of 5.1% during the forecast period. The key factors contributing to the market growth include decreasing the burden of increase in several life-threatening diseases, and the pharmaceutical and biotechnology companies focusing on developing effective treatments. These companies are majorly focusing on research and in turn, there is growth in the number of research activities and R&D spending. Owing to it there is an increase in demand for laboratory equipment such as mixers as they are essential equipment in research laboratories. For instance, in April 2021, the data provided by Congressional Budget Office stated that in the US in 2019, the pharmaceutical industry spent 83 billion dollars on R&D, which is up from $5 billion in 1980 and $38 billion in 2000.

Segmental Outlook

The global laboratory mixer market is segmented based on the product, platform, operability, and end-user. On the basis of product, the market is segmented into shakers, magnetic stirrers, vortex mixers, conical mixers, overhead stirrers, and accessories. Based on the platform, the market is segmented into digital devices and analog devices. Based on the operability, the market is segmented into gyratory movement, linear movement, rocking/tilting movement, and orbital movement. Based on the end-user, the market is subdivided into pharmaceutical & biotechnology companies, research laboratories & institutes, clinical research organizations, environmental testing laboratories, food testing laboratories, and, others. Among the end-user segment, the Pharmaceutical & Biotechnology Companies segment is anticipated to hold a prominent share in the market owing to a large number of companies across the globe, increasing investment for further research and development are such factors that drive segmental growth in the market.

Among platform segments, the digital devices segment is estimated to hold a prominent share in the market owing to the increasing use of electronic sound transmission to operate this device are also easier to connect with a greater number of external devices, and new technology-based development by companies operating in the market are prominent factors driving the market growth. For instance, in October 2021, Silverson Machines, Inc., launched three new Laboratory scale mixers that include a Laboratory scale version of the Silverson Flashmix Powder/Liquid mixer with the new manufacturing technology. The company under this development has a range is the FMX5, and three of them can be supplied with a Vessel Package, comprising of a 20-liter stainless steel vessel, vessel stand, valve, and pipework. Moreover, due to widely used by large pharmaceutical companies coupled with the advantages offered by these devices are another factor driving segmental growth. Wit in comparison to analog devices, digital lab mixers have preprogramming functions and also give results accurately and in less time.

Regional Outlooks

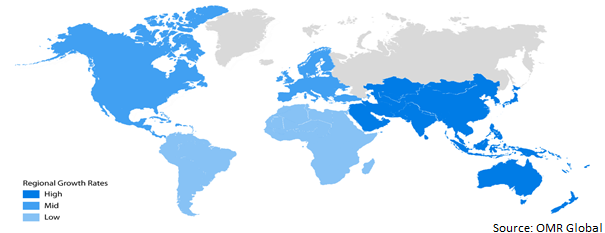

The global laboratory mixer market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. The North America region is estimated to hold a prominent share owing to its well-established healthcare infrastructure, and the presence of prominent players is driving market growth further in the region.

Global Laboratory Mixer Market Growth, by Region 2022-2028

The Asia-Pacific Region is Fastest Growing in the Global Laboratory Mixer Market

The region is estimated to witness the fastest growth in the market owing to the growing expansion of biopharmaceutical and health care players, and the high growth of the life science industry in emerging countries such as India, China, and Malaysia, among others, are such factors driving market growth further. For instance, in July 2022, SPX FLOW, Inc., expanded its Innovation Center in Xidu, China to better serve customers in the Asia-Pacific region with a focus on the mixing process. This new expansion leads to providing more local, technical support for SPX FLOW's mixing solutions brands, which include Lightnin, Plenty, Philadelphia, Stelzer, and Uutechnic. Thus, attributed to expansion, and new investment in biotechnology fields the demand for laboratory mixers is increasing in the market. Moreover, a high number of hospitals & diagnostic laboratories, growing medical tourism, and increasing R&D expenditure in the region are other factors driving market growth in the region.

Market Players Outlook

The major companies serving the global laboratory mixer market include BioAgile Therapeutics Pvt Ltd., Bio-Rad Laboratories, Inc., Corning Inc., Eppendorf SE, Parexel International GmbH, REMI Group, Thermo Fisher Scientific, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in November 2021, Hauschild Engineering launched a new generation of laboratory dual-asymmetric centrifugal (DAC) mixers that comprises craftsmanship and expertise with SMART innovations like real-time temperature control, vacuum-robotic, sensor integration, variable counter rotation, and IoT among others. This is an updated version that is developed to be virtually maintenance-free, indestructible, and to raise the bar on performance.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global laboratory mixer market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. ByRegion

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bio-Rad Laboratories, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Corning Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Eppendorf SE

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. REMI Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Thermo Fisher Scientific

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Laboratory Mixer Market by Product

4.1.1. Shakers

4.1.1.1. Orbital Shakers

4.1.1.2. Rockers

4.1.1.3. Rollers/Rotators

4.1.1.4. Other Shakers

4.1.2. Magnetic Stirrers

4.1.3. Vortex Mixers

4.1.4. Conical Mixers

4.1.5. Overhead Stirrers

4.1.6. Accessories s

4.2. Global Laboratory Mixer Market by Platform

4.2.1. Digital Devices

4.2.2. Analog Devices

4.3. Global Laboratory Mixer Market by Operability

4.3.1. Gyratory Movement

4.3.2. Linear Movement

4.3.3. Rocking/Tilting Movement

4.3.4. Orbital Movement

4.4. Global Laboratory Mixer Market by End-User

4.4.1. Research Laboratories and Institutes

4.4.2. Pharmaceutical and Biotechnology Companies

4.4.3. Clinical Research Organizations

4.4.4. Environmental Testing Laboratories

4.4.5. Food Testing Laboratories

4.4.6. Diagnostic and Pathology Laboratories

4.4.7. Other

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AccuLab Life Sciences

6.2. BioAgile Therapeutics Pvt Ltd.

6.3. Celerion

6.4. Clario

6.5. Dove Quality Solutions Ltd.

6.6. Firma Clinical Research (Firma)

6.7. Frontage Laboratories, Inc.

6.8. Geneticist Inc

6.9. ICON plc

6.10. IQVIA

6.11. Linical Americas

6.12. Medpace, Inc.

6.13. Novo Nordisk A/S

6.14. Novotech

6.15. Parexel International GmbH

6.16. Pepgra

6.17. PSI CRO AG

6.18. SGS

6.19. Syneos Health

6.20. Thermo Fisher Scientific

1. GLOBAL LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL LABORATORY MIXER SHAKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL LABORATORY MAGNETIC STIRRERS MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL LABORATORY OVERHEAD STIRRERS MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL LABORATORY VORTEX MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL LABORATORY CONICAL MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL LABORATORY MIXER ACCESSORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PLATFORMS, 2021-2028 ($ MILLION)

9. GLOBAL Digital Devices LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL Analog Devices LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY OPERABILITY, 2021-2028 ($ MILLION)

12. GLOBAL LABORATORY Gyratory Movement MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL LABORATORY Linear Movement MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL LABORATORY Rocking/Tilting Movement MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL LABORATORY Orbital Movement MIXER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

17. GLOBAL LABORATORY MIXER IN PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL LABORATORY MIXER IN Research Laboratories and Institutes MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL LABORATORY MIXER IN Clinical Research Organizations MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL LABORATORY MIXER IN Environmental Testing Laboratories MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

21. GLOBAL LABORATORY MIXER IN Food Testing Laboratories MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

22. GLOBAL LABORATORY MIXER IN Diagnostic and Pathology Laboratories MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

23. GLOBAL LABORATORY MIXER IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

24. GLOBAL LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

25. NORTH AMERICAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. NORTH AMERICAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

27. NORTH AMERICAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

28. NORTH AMERICAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY OPERABILITY, 2021-2028 ($ MILLION)

29. NORTH AMERICAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

30. EUROPEAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

31. EUROPEAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

32. EUROPEAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

33. EUROPEAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY OPERABILITY, 2021-2028 ($ MILLION)

34. EUROPEAN LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

35. ASIA-PACIFIC LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

36. ASIA-PACIFIC LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

37. ASIA-PACIFIC LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

38. ASIA-PACIFIC LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY OPERABILITY, 2021-2028 ($ MILLION)

39. ASIA-PACIFIC LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

40. REST OF THE WORLD LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

41. REST OF THE WORLD LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

42. REST OF THE WORLD LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2021-2028 ($ MILLION)

43. REST OF THE WORLD LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY OPERABILITY, 2021-2028 ($ MILLION)

44. REST OF THE WORLD LABORATORY MIXER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL LABORATORY MIXER MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL LABORATORY MIXER SHAKERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL LABORATORY MAGNETIC STIRRERS MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL LABORATORY OVERHEAD STIRRERS MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL LABORATORY VORTEX MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL LABORATORY CONICAL MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL LABORATORY OTHERS MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL LABORATORY MIXER MARKET SHARE BY PLATFORM, 2021 VS 2028 (%)

9. GLOBAL DIGITAL DEVICES LABORATORY MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL ANALOG DEVICES LABORATORY MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL LABORATORY MIXER MARKET SHARE BY OPERABILITY, 2021 VS 2028 (%)

12. GLOBAL LABORATORY GYRATORY MOVEMENT MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL LABORATORY LINEAR MOVEMENT MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL LABORATORY ROCKING/TILTING MOVEMENT MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL LABORATORY ORBITAL MOVEMENT MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL LABORATORY MIXER MARKET SHARE BY END-USER, 2021 VS 2028 (%)

17. GLOBAL LABORATORY MIXER IN RESEARCH LABORATORIES AND INSTITUTES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL LABORATORY MIXER IN PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL LABORATORY MIXER IN CLINICAL RESEARCH ORGANIZATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL LABORATORY MIXER IN ENVIRONMENTAL TESTING LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. GLOBAL LABORATORY MIXER IN FOOD TESTING LABORATORIESMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

22. GLOBAL LABORATORY MIXER IN DIAGNOSTIC AND PATHOLOGY LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

23. GLOBAL LABORATORY MIXER IN OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

24. GLOBAL LABORATORY MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

25. GLOBAL LABORATORY MIXER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

26. US LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

27. CANADA LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

28. UK LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

29. FRANCE LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

30. GERMANY LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

31. ITALY LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

32. SPAIN LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

33. REST OF EUROPE LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

34. INDIA LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

35. CHINA LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

36. JAPAN LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

37. SOUTH KOREA LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

38. REST OF ASIA-PACIFIC LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)

39. REST OF THE WORLD LABORATORY MIXER MARKET SIZE, 2021-2028 ($ MILLION)