Laboratory Proficiency Testing Market

Laboratory Proficiency Testing Market Size, Share & Trends Analysis Report by Industry Type (Clinical Diagnostics, Microbiology, Pharmaceuticals, Biologics, and Others), and by Technology (Polymerase Chain Reaction, Immunoassays, Chromatography, Spectrometry, and Others), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Laboratory proficiency testing market is anticipated to grow at a CAGR of 7.4% during the forecast period (2023-2030). The market’s growth is attributed to the demand for quality assurance in the industry across the globe. The quality assurance is prioritized in industries, particularly in food and beverage, to maintain consumer trust and compliance with regulatory standards. The proficiency testing ensures the dependability of laboratory testing procedures. in April 2022,BIPEA is launched a new interlaboratory test (PTS 111) that allowed laboratories to detect Staphylococcal enterotoxins type SEA to SEE in food. It specifies milk matrix for preliminary testing, assessing staphylococcal enterotoxins detection in liquid milk samples.

Segmental Outlook

The global laboratory proficiency testing market is segmented on the industry type, and technology. Based on the industry type, the market is sub-segmented into clinical diagnostics, microbiology, pharmaceuticals, biologics, and others. Furthermore, on the basis of technology, the market is sub-segmented into polymerase chain reaction, immunoassays, chromatography, spectrometry, and others. The clinical diagnostics subcategory is expected to capture a significant portion of the market share within the industry type segment. The growth can be attributed to the development of sophisticated diagnostic tests the need for early diagnosis, and the increased need for precise and reliable testing processes.

The Microbiology Sub-Segment is Anticipated to Hold a Considerable Share of the global Laboratory Proficiency Testing Market

Among the industry type, the microbiology sub-segment is expected to hold a considerable share of the global Laboratory Proficiency Testing market. The segmental growth is attributed to the growing technological advancements in microbiology. The microbiological testing methodologies and technology that enable more accurate and comprehensive identification of microbial contamination of cosmetic formulations boost the proficiency testing industry. For instance, in August 2023, BIPEA launched latest proficiency test, PT 114 the Cosmetic Microbial Challenge test. The purpose of the program is to independently assess a laboratory's the ability to perform a Microbial Challenge test in cosmetic formulations.

Regional Outlook

The global Laboratory Proficiency Testing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, Asia Pacific is anticipated to hold a prominent share of the market across the globe, owing to the rising awareness of healthcare and a growing number of laboratories seeking to obtain international credentials in the region.

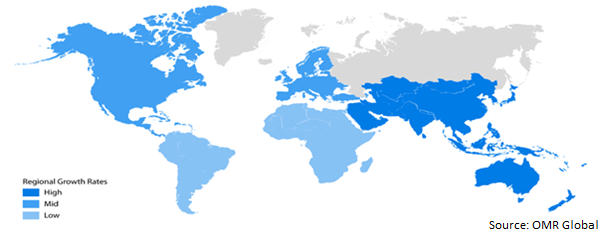

The Global Laboratory Proficiency Testing Market Growth by Region 2023-2030

The North America Region is Expected to Grow at a Significant CAGR in the global Laboratory Proficiency Testing Market

Among all regions, the North America regions is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to the rising demand for enhancing test accuracy and confidence. The proficiency testing programs develop dependence on testing accuracy, that's essential to accurate COVID-19 diagnosis. To improve overall accuracy, the program allows laboratories to analyze the whole operating process, including sample handling and testing procedures. For instance, in April 2020, The College of American Pathologists (CAP), released a new proficiency testing (PT) program for the detection of severe acute respiratory syndrome coronavirus 2 (SARS CoV-2). The Microbiology Committee piloted an innovative project for SARS CoV-2 detection, delivering non-infectious samples and allowing laboratories to examine the complete operation.

Market Players Outlook

The major companies serving the Laboratory Proficiency Testing market includes AOAC INTERNATIONAL, Laboratory Corp., LGC Ltd., Merck KGaA, Thermo Fisher Scientific Inc, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2022, Spex CertiPrep, NSI Lab Solutions, and the US Pharmacopeia (USP) partnered to provide a robust proficiency testing (PT) program for laboratories across the globe. The program raises laboratory and analyst performance awareness, supports the requirements for accreditation, enhances quality management systems, promotes industry reliability, and ensures regulator assurance across the product registration and durability.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global laboratory proficiency testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies. Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bio-Rad Laboratories, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. EuroChem Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Intertek Group plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Laboratory Proficiency Testing Market by Industry Type

4.1.1. Clinical Diagnostics

4.1.2. Microbiology

4.1.3. Pharmaceuticals

4.1.4. Biologics

4.1.5. Others (Environmental Testing, Food and Beverage )

4.2. Global Laboratory Proficiency Testing Market by Technology

4.2.1. Polymerase Chain Reaction

4.2.2. Immunoassays

4.2.3. Chromatography

4.2.4. Spectrometry

4.2.5. Other (Cell Culture, Next-Generation Sequencing (NGS))

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AOAC INTERNATIONAL

6.2. BIPEA

6.3. Fera Science Limited (“Fera”)

6.4. Japan Food Research Laboratories

6.5. Laboratory Corp.

6.6. LGC Ltd.

6.7. Merck KGaA

6.8. Neogen Corp.

6.9. NSI Lab Solutions

6.10. QUALITY ASSURANCE AND CONTROL SYSTEMS LTD.

6.11. Randox

6.12. SGS Société Générale de Surveillance SA

6.13. Thermo Fisher Scientific Inc.

6.14. Trilogy Analytical Laboratory, Inc

6.15. WATERS CORP.

1. GLOBAL LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL CLINICAL DIAGNOSTICS LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL MICROBIOLOGY LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

4. GLOBAL PHARMACEUTICALS LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

5. GLOBAL BIOLOGICS LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

6. GLOBAL OTHERS LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

7. GLOBAL LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

8. GLOBAL LABORATORY PROFICIENCY TESTING BY POLYMERASE CHAIN REACTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL LABORATORY PROFICIENCY TESTING BY IMMUNOASSAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL LABORATORY PROFICIENCY TESTING BY CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL LABORATORY PROFICIENCY TESTING BY SPECTROMETRY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL LABORATORY PROFICIENCY TESTING BY OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. NORTH AMERICAN LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2022-2030 ($ MILLION)

16. NORTH AMERICAN LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

17. EUROPEAN LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. EUROPEAN LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2022-2030 ($ MILLION)

19. EUROPEAN LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

20. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

23. REST OF THE WORLD LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

24. REST OF THE WORLD LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2022-2030 ($ MILLION)

25. REST OF THE WORLD LABORATORY PROFICIENCY TESTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

1. GLOBAL LABORATORY PROFICIENCY TESTING MARKET SHARE BY INDUSTRY TYPE, 2022 VS 2030 (%)

2. GLOBAL CLINICAL DIAGNOSTICS LABORATORY PROFICIENCY TESTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL MICROBIOLOGY LABORATORY PROFICIENCY TESTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL PHARMACEUTICALS LABORATORY PROFICIENCY TESTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL BIOLOGICS LABORATORY PROFICIENCY TESTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL OTHERS LABORATORY PROFICIENCY TESTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL LABORATORY PROFICIENCY TESTING MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

8. GLOBAL LABORATORY PROFICIENCY TESTING BY POLYMERASE CHAIN REACTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL LABORATORY PROFICIENCY TESTING BY IMMUNOASSAYS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL LABORATORY PROFICIENCY TESTING BY CHROMATOGRAPHY MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL LABORATORY PROFICIENCY TESTING BY SPECTROMETRY MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL LABORATORY PROFICIENCY TESTING BY OTHERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL LABORATORY PROFICIENCY TESTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. US LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

15. CANADA LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

16. UK LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

17. FRANCE LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

18. GERMANY LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

19. ITALY LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

20. SPAIN LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF EUROPE LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

22. INDIA LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

23. CHINA LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

24. JAPAN LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

25. SOUTH KOREA LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022-2030 ($ MILLION)