Latin America e-commerce logistics Market

Latin America e-commerce logistics Market Size, Share & Trends Analysis Report By Services (Transportation Services, Warehousing Services, and Other E-Commerce Logistics Services), By Product (Baby Products, Personal Care Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products, and Others), By Location (International, and Domestic) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The Latin American e-commerce market is growing at a CAGR of 6.1% during the forecast period (2021-2027). Major factors that are contributing to the growth of the market include a rise in the number of e-commerce companies, an increase in e-commerce sales, and technological advancements across Latin America. The explosion of mobile internet penetration has also played a vital role as people can search for whatever products they want. For instance, according to the ITU, around 51% of individuals have been used the internet in 2020. The advancement in technology can be implemented to improve control of freight movement and logistics includes drones and optimization of vehicle routing and efficiency, such as platooning of trucks. Countries like Brazil, Argentina, and Chile rely heavily on roadways for the transportation of agricultural products and fertilizers over long distances. Therefore, dependence on the logistics and transportation networks ensures its competitiveness, and continued growth is anticipated to propel the growth of the e-commerce logistics market in the Latin American region.

However, inconsistency in ease and speed customs clearance, poor GPS coverage, lacking quality connectivity of railways and roadways which limits reach and coverage of the logistics company are some of the constraints that challenge the growth of the market in the forecast period. In addition to this, fluctuation in crude oil prices in the region is also a factor that hampers the growth of the market. Conversely, cross-border e-commerce is one of the major opportunities due to the lower density of physical retail space, high penetration of smartphones, limited product availability, and purchase savings throughout the region. For instance, in January 2018, DHL and the Panama Ministry of Commerce and Industry jointly launched a Global Center of Excellence (GCOE) that aims to fulfill the central objectives of the “National Logistics Strategy of Panama by 2030”. Such strategy goals set by the country and the company’s partnership further increase the market share. GCOE has launched increase international investment in Panama in the areas of logistics and transport.

Impact of COVID-19 on the Latin American e-commerce Logistics Market

The Latin American e-commerce logistics market is hardly hit by the outbreak of COVID-19 since December 2019. The outbreak of COVID-19 in these major economies has disrupted the manufacturing and supply of raw materials across the globe which resulted in a low supply of the products in the Latin America region. This was mainly due to the lockdowns imposed by the governments of several countries which affected the transportation of the materials whether international or local. Moreover, flight cancellations, travel bans, and the closure of manufacturing activities affected the e-commerce logistics market.

Segmental Outlook

The market is segmented based on services, products, and location. Based on the services segment, the market is segmented into transportation services, warehousing services, and other e-commerce logistics services. Based on the product segment, the market is segmented into baby products, personal care products, books, home furnishing products, apparel products, electronics products, automotive products, and others. Further, based on the location segment, the market is bifurcated into international and domestic. Further, the domestic is bifurcated into urban, semi-urban, and rural.

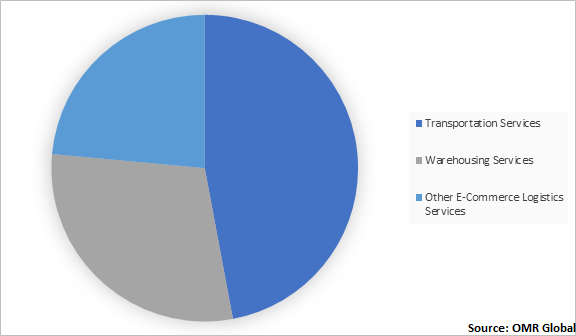

Latin American E-Commerce Logistics Market Share by Services, 2020 (%)

Transportation Segment to Hold a Lucrative Share in the Latin America E-Commerce Logistics market

Amongst the services segment of the Latin America e-commerce logistics market, the transportation segment held one of the largest shares in the services segment in 2020. The transportation services by the logistics companies include shipping containers, aircraft supply, railcars and engines, unit load devices, and transportation through roads. These types of services are comparatively cheap concerning other kinds of services and the customers can also keep records of their shipment details. For instance, in August 2019, FedEx announced to expand its logistics presence in Latin America by acquiring a Colombian freight-forwarding company. However, complex tax structures and government regulations on fuel prices are some of the constraints that can hamper the growth of the market in the transportation services segment.

Regional Outlooks

The Latin American e-commerce logistics market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into Brazil, Costa Rica, Chile, Argentina, Colombia, and the rest of Latin America. Brazil was estimated to be one of the dominating countries in this market. Moreover, Chile & Argentina offers significant potential for cross-border e-commerce logistics growth, with many retailers able to stock centralized inventory in larger markets or cross-border hubs and service multiple markets relatively quickly and at a low cost. Costa Rica is also estimated to have a considerable share. For instance, During 2018, Amazon started shipping directly to Costa Rica, therefore many Costa Ricans are bypassing the Miami-based PO Box services, saving some money and time. Saudi Arabia has well-developed infrastructures along with a broad range of product offerings by manufacturers in the region that are driving the market.

Brazil was estimated to be one of the dominating countries in this market in 2020. As per the World Bank, approximately 30% of the distribution cost structure alone represents the total logistics cost in Brazil. The fields included in this cost are the management, warehousing, inventory, legal requirements, and transportation costs. In addition, Brazil has also become a significant producer and supplier of food on a global scale due to its high agricultural potential in the past decade and the country is also the largest producer of sugar, coffee, orange juice, ethanol, beef, chicken, corn, soy, soybean meal, soybean oil, cotton, and pork across the globe.

Market Player Outlook

Key players of the Latin American e-commerce logistics market include United Parcel Service, Inc., FedEx Corp., Amazon Transportation Services, DB Schenker, DPDgroup, A.P. Moller – Maersk, Bpost, and Deutsche Post DHL, among others. To survive in the market these players adopt different marketing strategies such as a merger, acquisitions, product launch, and geographical expansion so on. For instance, in December 2020, FedEx announced to acquire ShopRunner to expand e-commerce capabilities and is expected to create increased value for brands, merchants, and consumers. Moreover, in April 2020, A.P. Moller – Maersk announced the acquisition of Performance Team, US-based warehousing, and distribution company to strengthen its logistics capabilities by offering end-to-end supply chain solutions to its customers.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the Latin American e-commerce logistics market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Latin America e-Commerce Logistics industry

• Recovery Scenario of Latin America e-Commerce Logistics Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Latin America E-Commerce Logistics Market by Services

5.1.1. Transportation Services

5.1.2. Warehousing Services

5.1.3. Other E-Commerce Logistics Services

5.2. Latin America E-Commerce Logistics Market by Product

5.2.1. Baby Products

5.2.2. Personal Care Products

5.2.3. Books

5.2.4. Home Furnishing Products

5.2.5. Apparel Products

5.2.6. Electronics Products

5.2.7. Automotive Products

5.2.8. Others

5.3. Latin America E-Commerce Logistics Market by Location

5.3.1. International

5.3.2. Domestic

5.3.2.1. Urban

5.3.2.2. Semi-Urban

5.3.2.3. Rural

6. Regional Analysis

6.1. Brazil

6.2. Mexico

6.3. Argentina

6.4. Rest of Latin America

7. Company Profiles

7.1. Asendia Management SAS

7.2. Amazon Transportation Services (Amazon.Com Inc.)

7.3. Aramex, Inc.

7.4. Blue Dart Express

7.5. BRT S.p. A.

7.6. DB Schenker

7.7. DHL International GmbH

7.8. DirectLink

7.9. DPDgroup

7.10. FedEx Corp.

7.11. Jet Box International

7.12. General Logistics Systems B.V.

7.13. Hermes Group

7.14. A.P. Moller – Maersk

7.15. Koninklijke PostNL

7.16. Parcelhub Ltd.

7.17. Pillow Logistics

7.18. Smart Delivery Service Inc.

7.19. Royal Mail Group Ltd.

7.20. United Parcel Service, Inc.

7.21. World Logistics Management Ltd.

1. LATIN AMERICA E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

2. LATIN AMERICA E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

3. LATIN AMERICA TRANSPORTATION SERVICES IN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

4. LATIN AMERICA WAREHOUSING SERVICES IN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

5. LATIN AMERICA OTHER E-COMMERCE LOGISTICS SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

6. LATIN AMERICA E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

7. LATIN AMERICA BABY PRODUCTS FOR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

8. LATIN AMERICA PERSONAL CARE PRODUCTS FOR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

9. LATIN AMERICA BOOKS FOR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. LATIN AMERICA HOME FURNISHING PRODUCTS FOR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

11. LATIN AMERICA APPAREL PRODUCTS FOR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. LATIN AMERICA ELECTRONICS PRODUCTS FOR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. LATIN AMERICA AUTOMOTIVE PRODUCTS FOR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. LATIN AMERICA OTHER PRODUCTS FOR E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. LATIN AMERICA E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

16. LATIN AMERICA E-COMMERCE LOGISTICS IN INTERNATIONAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. LATIN AMERICA E-COMMERCE LOGISTICS IN DOMESTIC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON LATIN AMERICA E-COMMERCE LOGISTICS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON LATIN AMERICA E-COMMERCE LOGISTICS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF LATIN AMERICA E-COMMERCE LOGISTICS MARKET, 2021-2027 (%)

4. LATIN AMERICA E-COMMERCE LOGISTICS MARKET SHARE BY PRODUCT, 2020 VS 2027(%)

5. LATIN AMERICA E-COMMERCE LOGISTICS MARKET SHARE BY SERVICES, 2020 VS 2027(%)

6. LATIN AMERICA E-COMMERCE LOGISTICS MARKET SHARE BY LOCATION, 2020 VS 2027(%)

7. LATIN AMERICA E-COMMERCE LOGISTICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027(%)

8. LATIN AMERICA BABY PRODUCTS FOR E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

9. LATIN AMERICA PERSONAL CARE PRODUCTS FOR E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

10. LATIN AMERICA BOOKS FOR E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

11. LATIN AMERICA HOME FURNISHING PRODUCTS FOR E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

12. LATIN AMERICA APPAREL PRODUCTS FOR E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

13. LATIN AMERICA ELECTRONIC PRODUCTS FOR E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

14. LATIN AMERICA AUTOMOTIVE PRODUCTS FOR E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

15. LATIN AMERICA OTHER PRODUCTS FOR E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

16. LATIN AMERICA E-COMMERCE TRANSPORTATION LOGISTICS SERVICES MARKET SHARE, 2020 VS 2027 (%)

17. LATIN AMERICA E-COMMERCE WAREHOUSE LOGISTICS SERVICES MARKET SHARE, 2020 VS 2027 (%)

18. LATIN AMERICA OTHER E-COMMERCE LOGISTICS SERVICES MARKET SHARE, 2020 VS 2027 (%)

19. LATIN AMERICA INTERNATIONAL E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

20. LATIN AMERICA DOMESTIC E-COMMERCE LOGISTICS MARKET SHARE, 2020 VS 2027 (%)

21. LATIN AMERICA URBAN AREA IN DOMESTIC E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

22. LATIN AMERICA SEMI-URBAN AREA IN DOMESTIC E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

23. LATIN AMERICA RURAL AREA IN DOMESTIC E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

24. BRAZIL E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027($ MILLION)

25. MEXICO E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027($ MILLION)

26. ARGENTINA E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027($ MILLION)

27. REST OF LATIN AMERICA E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027($ MILLION)