LED Lighting Market

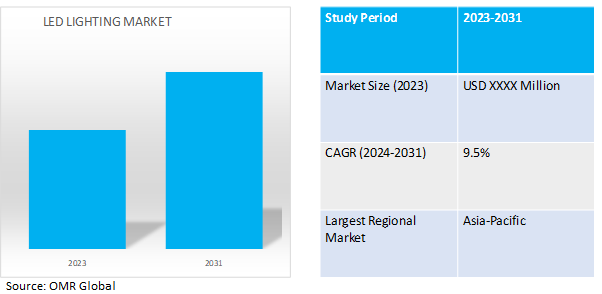

LED Lighting Market Size, Share & Trends Analysis Report by Product (LED Lamps and LED Fixtures), by End-User (Commercial, Residential, Industrial, and Others), by Applications (Indoor Lighting and Outdoor Lighting), and by Sales Channel (Direct, Retail, and E-commerce) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

LED Lighting Market is anticipated to grow at a considerable CAGR of 9.5% during the forecast period (2024-2031). LED is a highly energy-efficient lighting technology. Residential LEDs -- especially ENERGY STAR rated products -- use at least 75.0% less energy, and last up to 25 times longer, than incandescent lighting. The growing energy demand globally is a key factor supporting the adoption of LED lightings; thereby aiding to the market growth.

Market Dynamics

Lighting Landscape Transformation: The Growing Adoption of Energy-Saving Technologies

One of the most prominent factor propelling the global LED lighting market is the undeniable shift towards energy-saving lighting solutions. A growing focus on environmental sustainability and resource conservation has spurred a significant demand for lighting technologies that offer superior energy efficiency. Compared to traditional incandescent bulbs, LEDs boast a remarkable ability to deliver the same level of illumination while consuming a fraction of the energy. According to US Department of Energy, LED lighting technology is incredibly energy-efficient and has the power to drastically alter lighting in the US going forward. It is projected that most lighting installations will be LED-powered by 2035, and the yearly energy savings from LED lighting might surpass 569 TWh, which is the equivalent of more than 92 1,000 MW power plants.This translates to substantial cost savings on electricity bills for consumers and businesses alike. Furthermore, government’s regulations to phase out outdated, less efficient lighting options, further accelerate the shift towards LED lighting.

Evolution Beyond Efficiency: Advancements Shaping the Future of LED Technology

The LED technology extends beyond its core energy-saving nature. Material science breakthroughs have led to the development of LEDs with a broader color spectrum, enabling precise control over the emitted light. This translates to superior color rendering, making objects appear more natural under LED illumination. Furthermore, ongoing refinements in LED chip design and phosphor conversion have yielded significant gains in light output and conversion efficiency. Brighter LEDs that consume even less energy are the result, further bolstering their economic and environmental credentials. For instance, in April 2023, Philips launched a new LED lighting solution. These lights consume only 4.5 watts of electricity, which is almost half that of some of the more well-liked LED bulbs on the market today.

Market Segmentation

Our in-depth analysis of the global LED lighting Market includes the following segments by type, by end-user, by application, and by sales channel:

- Based on product, the market is sub-segmented LED Lamps and LED Fixtures.

- Based on end-user, the market is sub-segmented into commercial, residential, industrial, and others (transportation, agriculture, outdoor applications).

- Based on applications, the market is sub-segmented into indoor lighting and outdoor lighting.

- Based on sales channel, the market is sub-segmented into direct, retail, and e-commerce.

Indoor Lighting: Shining Bright in the LED Market

The indoor lighting segment reigns supreme within the LED market and is poised for continued rapid growth. This dominance stems from several key factors. Firstly, the indoor segment boasts a vast installed base of traditional lighting, presenting a significant opportunity to upgrade to energy-efficient LEDs. Secondly, the commercial sector, a major driver of LED adoption, heavily utilizes indoor lighting. Government regulations and a focus on faster return on investment incentivize businesses to switch to LEDs, propelling the indoor segment forward. For instance in January 2024, Philips Hue has unveiled the Dymera, an intelligent outdoor and interior wall light. The new device has two independently controllable light sources that shine either colored or white light from the top and bottom. The Philips Hue app, which offers a variety of smart home ecosystem connectors, can be used to control the item.

E-commerce to Exhibit the Highest CAGR

E-commerce has ignited a revolution in how consumers purchase LED lighting for their homes. This surge in popularity stems from several key factors. Firstly, e-commerce platforms offer unmatched convenience and price transparency. Through this sales channel, consumers can research, compare, and purchase LED lighting options from a vast array of vendors in the comfort of their homes. This transparency in pricing fuels competition among sellers, potentially leading to lower overall costs for LED lighting. Secondly, e-commerce platforms boast a much wider product selection compared to traditional stores. Consumers have access to a vast array of LED lighting products, including innovative and niche options that cater to diverse needs and preferences. From energy-efficient bulbs to smart lighting solutions and decorative fixtures, e-commerce offers a one-stop shop for all residential LED lighting needs. Additionally, online platforms leverage targeted marketing campaigns based on browsing history and demographics. This allows manufacturers and retailers to reach their target audience more effectively and offer personalized promotions that incentivize online purchases.

Regional Outlook

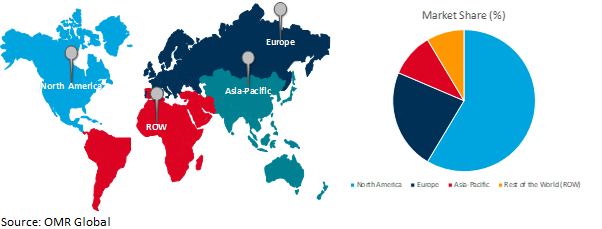

The global LED Lighting Market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Global LED Lighting Market Growth by Region 2024-2031

Asia-Pacific: A Leader in the LED Lighting Market

The dominance of the Asia Pacific region in the LED lighting market stems from a powerful interaction between its established manufacturing base and a growing consumer demand. This region houses many leading LED lighting manufacturers, creating a concentrated production ecosystem. This geographical proximity offers several advantages: reduced costs and streamlined logistics due to shorter supply chains, early access to the latest innovations due to the region's manufacturing hub status, and market-driven production as manufacturers can directly cater to the needs and preferences of a rapidly growing population, particularly in countries like China and India. This convergence, coupled with the continuous expansion in demand for lighting solutions, fuels significant market growth and positions the Asia-Pacific region as the undisputed leader in the global LED lighting market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global LED Lighting Market include Dialight plc, Everlight Electronics Co. Ltd., Koninklijke Philips N.V., Osram Licht AG, Panasonic Industry Co., Ltd., Seoul Semiconductor Co. Ltd.among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2023, Dialight released a brand-new battery-operated variant of their small, multipurpose area light. In challenging industrial settings like petrochemical, water/wastewater, general manufacturing facilities, mining, pulp & paper, recycling, and more, this cutting-edge fixture now provides even more assurance for improved safety.As one of the main causes of accidents at industrial facilities is "poor visibility," it is crucial to make sure there is adequate lighting, especially in locations where power outages may occur.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the globalLED Lighting Market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Dialight plc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Everlight Electronics Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Koninklijke Philips N.V.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Osram Licht AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Panasonic Industry Co., Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Seoul Semiconductor Co. Ltd.

3.7.1. Overview

3.7.2. Financial Analysis

3.7.3. SWOT Analysis

3.7.4. Recent Developments

3.8. Key Strategy Analysis

4. Market Segmentation

4.1. Global LED Lighting Market by Product

4.1.1. LED Lamps

4.1.2. LED Fixtures

4.2. Global LED Lighting Market by End-User

4.2.1. Commercial

4.2.2. Residential

4.2.3. Industrial

4.2.4. Others (Transportation, Agriculture, and Outdoor Applications)

4.3. Global LED Lighting Market by Applications

4.3.1. Indoor Lighting

4.3.2. Outdoor Lighting

4.4. Global LED Lighting Market by Sales channel

4.4.1. Direct

4.4.2. Retail

4.4.3. E-commerce

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Acuity Brands, Inc.

6.2. Cree Lighting USA LLC

6.3. Halonix Technologies Private Ltd.

6.4. Hubbell Inc.

6.5. LSI Industries Inc.

6.6. Lumens Co., Ltd.

6.7. Nanoleaf Canada Ltd.

6.8. Qingdao Yeelink Information Technology Co., Ltd.

6.9. Savant Systems, Inc.

6.10. Siteco GmbH

6.11. Syska Led Lights Pvt Ltd.

6.12. Wipro Consumer Care and Lighting (Wipro Enterprises (P) Ltd.)

6.13. Zumtobel Group AG

1. GLOBAL LED LIGHTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL LED LAMPS LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LED FIXTURES LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL LED LIGHTING MARKET BY END-USER, 2023-2031 ($ MILLION)

5. GLOBAL LED LIGHTING FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LED LIGHTING FOR RESIDENTIALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LED LIGHTING FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LED LIGHTING FOR OTHER END_USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL LED LIGHTING MARKETRESEARCH AND ANALYSIS BY APPLICATIONS, 2023-2031 ($ MILLION)

10. GLOBALINDOOR LED LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OUTDOOR LED LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL LED LIGHTING MARKETRESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

13. GLOBAL LED LIGHTING FOR DIRECT SALES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL LED LIGHTING FOR RETAIL SALES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL LED LIGHTING FOR E-COMMERCE SALES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL LED LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BYPRODUCT 2023-2031 ($ MILLION)

19. NORTH AMERICAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. NORTH AMERICAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2023-2031 ($ MILLION)

21. NORTH AMERICAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

22. EUROPEAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY PRODUCT2023-2031 ($ MILLION)

24. EUROPEAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

25. EUROPEAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2023-2031 ($ MILLION)

26. EUROPEAN LED LIGHTING MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC LED LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA- PACIFIC LED LIGHTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

29. ASIA- PACIFIC LED LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

30. ASIA- PACIFIC LED LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2023-2031 ($ MILLION)

31. ASIA- PACIFIC LED LIGHTING MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

32. REST OF THE WORLD LED LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. REST OF THE WORLD LED LIGHTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

34. REST OF THE WORLD LED LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

35. REST OF THE WORLD LED LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2023-2031 ($ MILLION)

36. REST OF THE WORLD LED LIGHTING MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL LED LIGHTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL LED LAMPS LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL LED FIXTURES LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL LED LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023 VS 2031 (%)

5. GLOBAL LED LIGHTING FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL LED LIGHTING FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL LED LIGHTING FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL LED LIGHTING FOR OTHER END-USERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL LED LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2023 VS 2031 (%)

10. GLOBAL INDOOR LED LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL OUTDOOR LED LIGHTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL LED LIGHTING MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023 VS 2031 (%)

13. GLOBAL LED LIGHTING MARKET FOR DIRECT SALES RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL LED LIGHTING FOR RETAIL SALES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL LED LIGHTING FOR E-COMMERCE SALES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL LED LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. US LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

19. UK LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC LED LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA LED LIGHTING MARKET S031 ($ 2031 ($ MILLION)

31. THE MIDDLE EAST & AFRICA LED LIGHTING MARKET S031 ($ 2031 ($ MILLION)