Low Earth Orbit (LEO) Satellites Market

Global Low Earth Orbit (LEO) Satellites Market Size, Share & Trends Analysis Report by Satellite type (Small Satellite, Medium Satellite, and Large Satellite), by Application (Communication, Earth Observation and Remote Sensing, and Others), and by End-User (Civil and Commercial, and Military) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global LEO satellites market is anticipated to grow at a significant CAGR of 14.1% during the forecast period. One of the key factors that are boosting the market is the rising commercial applications of a satellite. Factors such as the growing connectivity of electronic devices, the miniaturization of satellites, and the increasing demand for LEO satellite constellations across industries are contributing to the growth of the market.?For instance, in February 2022, SpaceX launched forty-nine Starlink satellites in Florida from NASA's Kennedy Space Center (KSC). These satellites are expected to expand the existing constellation of more than 1700 LEO satellites to offer faster satellite internet.

Impact of COVID-19 Pandemic on Global Low Earth Orbit (LEO) Satellites Market

The COVID-19 pandemic had a significant impact on the financial investments of countries across the globe. It also restricted the manufacturing of subsystems, satellites, and components owing to the lockdown across the globe which dented the supply chain, material availability, transportation, and limited workforce. Although satellite systems are critically important the disruptions delays the scheduled launches. However, as the situation got normalized, the market boosted with multiple satellite launches.

Segmental Outlook

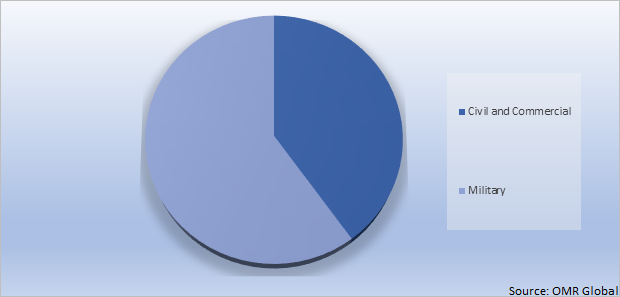

The global LEO satellites market is segmented based on the satellite type, application, and end-user. Based on the satellite type, the market is segmented into small satellites, medium satellites, and large satellites. Based on the application, the market is segmented into communication, earth observation, remote sensing, and others. Other application includes science and technology. Based on the end-user, the market is sub-segmented into the civil and commercial, and military. The above-mentioned segments can be customized as per the requirements. Based on the end-user, the military segment is anticipated to hold a prominent share in the market while based on the application, the communication segment is projected to grow significantly during the forecast period.

Global Low Earth Orbit (LEO) Satellites Market Share by End-User, 2021 (%)

The Military Segment Expected to Hold the Prominent Share in the Global Low Earth Orbit (LEO) Satellites Market

The military segment is anticipated to hold a prominent share in the market during the forecast period owing to the multiple applications of LEO satellites in defense. The perception of using hundreds of small satellites across LEO for the military to perform missile warning, communications, and other military missions has been discussed and dismissed for years owing to the immense launch cost projections. However, with the rapid technological advancement over the past few years with rising defense budgets in nations across the globe, the military sector is now considering launching satellites in LEO. Countries such as the US, the UK, India, South Korea, Russia, France, Japan, and China are all expressively investing in military satellites importantly on LEO for several applications. For instance, in April 2020, Darpa partnered with Lockheed Martin for the 1st stage of satellite integration for project blackjack, a military low earth orbit (LEO) satellite constellation. Lockheed Martin managed interfacing between Blackjack’s payload, bus, and Pit Boss in the build-up to the launch of a demonstration constellation in 2021-22.

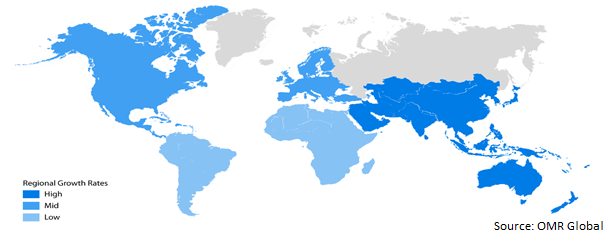

Regional Outlooks

The global LEO satellites market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, North America is anticipated to hold a prominent share in the market while the Asia-Pacific is anticipated to grow at the fastest rate during the forecast period.

Global Low Earth Orbit (LEO) Satellites Market Growth, by Region 2022-2028

The North America Region Anticipated to Hold the Prominent Share in the Global Low Earth Orbit (LEO) Satellites Market

The North American region is expected to hold a prominent share in the market during the forecast period. The US government has been increasingly financing advanced LEO satellite technologies to boost the effectiveness and quality of satellite communication. The increasing financial budget on satellite equipment to improve surveillance and defense capabilities of the armed forces, critical infrastructure, modernization of existing communication in military platforms, and law enforcement agencies using satellite systems, are some of the key factors expected to fuel the LEO satellite market in the region. For instance, in 2021, 28, 0.25U CubeSat SpaceBEE was launched by Swarm Technologies. The CubeSat is observed as one of the smallest, two-way communications, satellites for IoT across the globe.

Market Players Outlook

The major companies serving the global low earth orbit (LEO) satellites market include Blue Canyon Technologies Inc., Northrop Grumman Systems Corp., Planet Labs PBC., Space Exploration Technologies Corp., Surrey Satellite Technology Ltd (Airbus SE), and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2021, ABL Space Systems, of California, a developer of low-cost launch systems and launch vehicles for the small satellite industry, was awarded a contract by Lockheed Martin, for supplying a rocket and associated launch services for the UK vertical satellite launch.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global low earth orbit (LEO) satellites market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Low Earth Orbit (LEO) Satellites Market

• Recovery Scenario of Global Low Earth Orbit (LEO) Satellites Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Blue Canyon Technologies Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Northrop Grumman Systems Corp.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Planet Labs PBC

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Space Exploration Technologies Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Surrey Satellite Technology Ltd (Airbus SE)

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Low Earth Orbit (LEO) Satellites Market by Satellite type

4.1.1. Small satellite

4.1.2. Medium satellite

4.1.3. Large satellite

4.2. Global Low Earth Orbit (LEO) Satellites Market by Application

4.2.1. Communication

4.2.2. Earth Observation and Remote Sensing

4.2.3. Other (Scientific, and Technology)

4.3. Global Low Earth Orbit (LEO) Satellites Market by End-User

4.3.1. Civil and Commercial

4.3.2. Military

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Blue Origin Enterprises, L.P.

6.2. GomSpace Group AB

6.3. Honeywell International Inc.

6.4. L3Harris Technologies, Inc.

6.5. Lockheed Martin Corp.

6.6. Millennium Space Systems Inc. (The Boeing Co.)

6.7. Sierra Nevada Corp.

6.8. Singapore Technologies Engineering Ltd.

6.9. Spire Global, Inc.

6.10. THALES Group

1. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY SATELLITE TYPE, 2021-2028 ($ MILLION)

2. GLOBAL SMALL LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL MEDIUM LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL LARGE LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES FOR COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES FOR EARTH OBSERVATION AND REMOTE SENSING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

10. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES IN CIVIL AND COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES IN MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY SATELLITE TYPE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. NORTH AMERICAN LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

17. EUROPEAN LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY SATELLITE TYPE, 2021-2028 ($ MILLION)

19. EUROPEAN LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

20. EUROPEAN LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY SATELLITE TYPE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

25. REST OF THE WORLD LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. REST OF THE WORLD LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY SATELLITE TYPE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

28. REST OF THE WORLD LOW EARTH ORBIT (LEO) SATELLITES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET, 2022-2028 (%)

4. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET SHARE BY SATELLITE TYPE, 2021 VS 2028 (%)

5. GLOBAL SMALL LOW EARTH ORBIT (LEO) SATELLITES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL MEDIUM LOW EARTH ORBIT (LEO) SATELLITES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL LARGE LOW EARTH ORBIT (LEO) SATELLITES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

9. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES FOR COMMUNICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES FOR EARTH OBSERVATION AND REMOTE SENSING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES FOR OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET SHARE BY END-USER, 2021 VS 2028 (%)

13. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES IN CIVIL AND COMMERCIAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES IN MILITARY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL LOW EARTH ORBIT (LEO) SATELLITES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

18. UK LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD LOW EARTH ORBIT (LEO) SATELLITES MARKET SIZE, 2021-2028 ($ MILLION)