Lidocaine Vial Market

Lidocaine Vial Market Size, Share & Trends Analysis Report by Application (Local Anesthesia, Heart Arrhythmia, Dental Procedures and Epilepsy) Forecast Period (2024-2031)

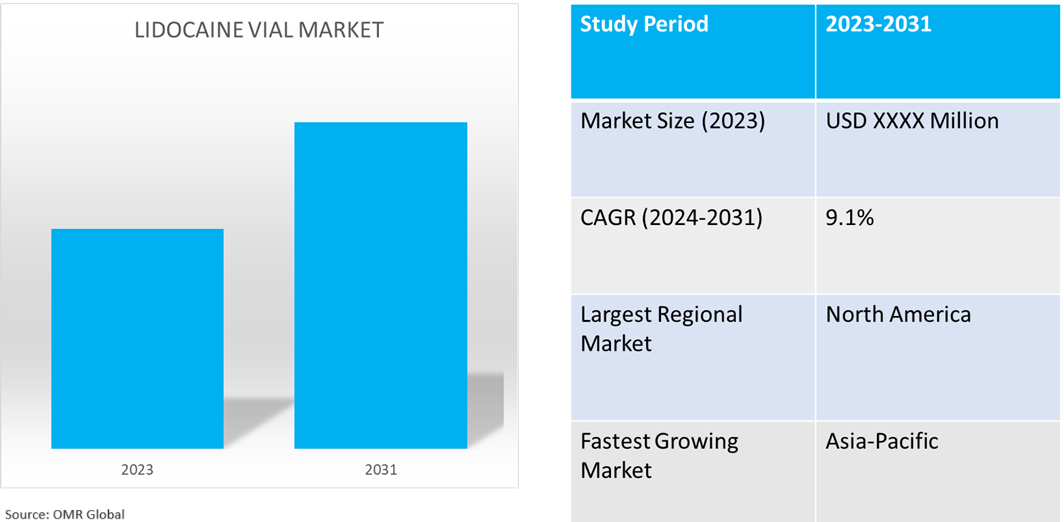

Lidocaine vial market is anticipated to grow at a significant CAGR of 9.1% during the forecast period (2024-2031). The market growth is attributed to the increasing demand for lidocaine injections, driven by an increasing number of dental chronic pain concerns. The global increase in surgical procedures and trauma cases is fueling the market's expansion. The development of innovative formulations and improvements in drug delivery technology are driving market growth. These developments are broadening the range of medical diseases for which lidocaine injections can be used by increasing both its safety and efficacy. According to the National Center for Biotechnology Information (NCBI), in April 2021, in the US and the UK, lidocaine was the most frequently purchased or used dental local anesthetic. Local anesthetics as the most important drugs in dentistry as of their omnipresent use. It has been estimated that more than 300 million local anesthetic cartridges are used annually by dentists in the US.

Market Dynamics

Increasing Demand in Minor Surgeries and Outpatient Procedures

Lidocaine is one of the most commonly used drugs in anesthetics. The mechanism of action of intravenous lidocaine makes it useful in the perioperative setting, alongside its safety profiles and efficacy for different types of surgeries. According to the American Society of Anesthesiologists, Perioperative lidocaine infusion was found to reduce pain scores in patients undergoing major spine surgery and was non-inferior compared with placebo about postoperative opioid consumption. At 1 and 3 months after surgery, patients who had received lidocaine reported significantly improved quality of life, as measured by the Acute Short-Form 12 Health Survey. Based on the results that show both short- and long-term benefits, perioperative lidocaine infusion may provide value for patients undergoing major spine surgery.

Growing Innovation on Combination Products that Include Lidocaine

Combination medicines that combine lidocaine with other medications, such as hydrocortisone, are growing increasingly common as a way to improve efficacy and extend anesthesia. For instance, the combination of lidocaine and hydrocortisone is used to treat conditions such as sunburn, mild burns, insect bites or stings, poison ivy, poison oak, poison sumac, minor wounds, and scratches that cause discomfort and irritation. Intravenous lidocaine injection has been commonly used to attenuate pain on propofol injection. Although many studies have reported that lidocaine was effective in reducing the incidence and severity of pain.

Market Segmentation

- Based on the application, the market is segmented into local anesthesia, heart arrhythmia, dental procedures, and epilepsy.

Dental Procedures is Projected to Hold the Largest Segment

The primary factors supporting the growth include increased advancement in pharmaceutical manufacturing methods, the growing frequency of medical operations needing local anesthesia, and the increased demand for dental pain management options. According to the NCBI, in August 2021, a variety of dental anesthetic drugs are available for dental purposes. Lidocaine is among these agents. Lidocaine is an amide anesthetic drug routinely used in dentistry. This agent is metabolized in the liver by multipurpose microsomal oxidase enzymes to monoethyl glycine and its derivatives. Its excretion from the body is via the kidneys. Less than 10.0% of the drug is excreted unchanged and more than 80.0% is excreted as different metabolites. For instance, in May 2024, Rapid Dose Therapeutics introduced QuickStrip™ Dental Products in the Canadian Market. QuickStrip™ Xylitol and Lidocaine will offer consumers needle-free options for dental procedures. LQS™, a Lidocaine thin film will be used professionally as a topical anesthetic application to provide pain-free dental treatment and assist in allowing pain-free local anesthetic where the injection is required.

Regional Outlook

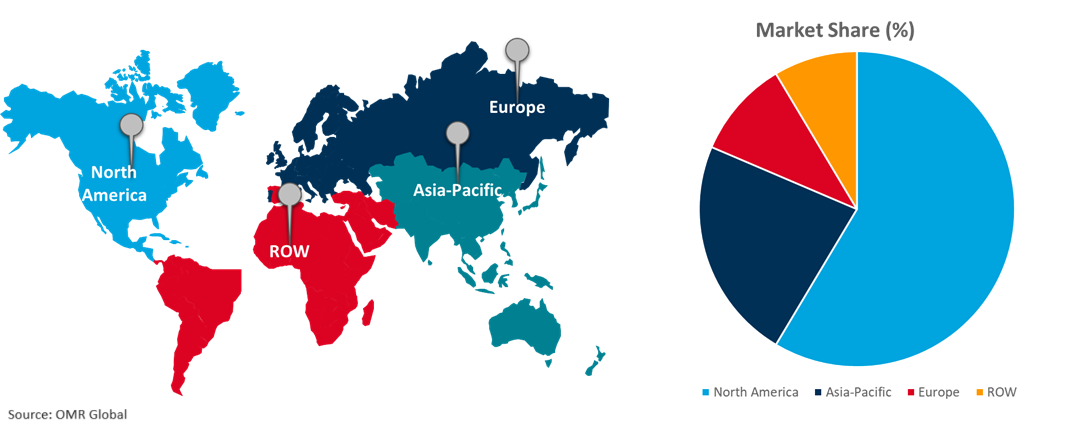

Global lidocaine vial market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Lidocaine Vials in Asia-Pacific

The regional growth is attributed to the growing incidence of chronic pain issues, increasing demand for minimally invasive procedures, and advancements in medication delivery systems driving the growth of the market. According to the NCBI, in July 2022, five billion people globally did not have access to surgical and anesthetic care, when needed. In particular, surgical procedures are precluded to 97.0% of the population in Southern Asia.

Global Lidocaine Vial Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of lidocaine vial offering companies such as Amphastar Pharmaceuticals, Inc., Pfizer Inc. Viatris Inc., and others. The market growth is attributed to the increasing prevalence of chronic ailments, increased funding for pharmaceutical manufacture from the public and private sectors, and increased R&D activities to formulate these medications. According to the Texas Society of Anesthesiologists, it is estimated that nearly 40 million anesthetics are administered each year in the US. Anesthesiologists provide or participate in more than 90.0% of these anesthetics. Market players are introducing lidocaine vials administered intravenously or intramuscularly, which are specifically used in the acute management of ventricular arrhythmias such as those occurring during acute myocardial infarction, or cardiac manipulation, such as cardiac surgery. For instance, in October 2023, Hospira, Inc. issued a voluntary nationwide recall for 4.2% sodium bicarbonate injection, USP, and 1.0% and 2.0% Lidocaine HCl Injection, USP owing to the potential for the presence of glass particulate matter. Lidocaine Hydrochloride Injection (HCI), US Pharmacopeia (USP) is a sterile, nonpyrogenic solution of an antiarrhythmic agent administered intravenously by either direct injection or continuous infusion. It is available in various concentrations.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the lidocaine vial market include Amphastar Pharmaceuticals, Inc., Fresenius SE & Co. KGa, AHikma Pharmaceuticals, Pfizer Inc., and Viatris Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In March 2024, Sintetica US introduced Lidocaine Hydrochloride Injection, USP 1.0%, 2.0% and 4.0%. The product supports healthcare professionals who are facing a difficult situation due to the critical shortage of this product.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global lidocaine vial market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Fresenius SE & Co. KGaA

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hikma Pharmaceuticals

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Pfizer Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Viatris Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Lidocaine Vial Market by Application

4.1.1. Local Anesthesia

4.1.2. Heart Arrhythmia

4.1.3. Dental Procedures

4.1.4. Epilepsy

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Actiza Pharmaceutical Pvt. Ltd.

6.2. Afaxys, Inc.

6.3. Amphastar Pharmaceuticals, Inc.

6.4. Aurobindo Pharma Ltd.

6.5. B. Braun Medical Inc.

6.6. Baxter International Inc.

6.7. Dufort & Lavigne Ltd.

6.8. Eugia US LLC (Aurobindo Pharma)

6.9. Fagron Sterile Services US

6.10. Formative Pharma Inc.

6.11. Hilco Vision

6.12. Merit Pharmaceutical

6.13. Nephron Pharmaceuticals Corp.

6.14. NexGen Pharmaceuticals, LLC

6.15. Sagent Pharmaceuticals

6.16. Septodont Holding

6.17. Teligent, Inc.

1. Global Lidocaine Vial Market Research And Analysis By Application, 2023-2031 ($ Million)

2. Global Lidocaine Vial For Local Anesthesia Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Lidocaine Vial For Heart Arrhythmia Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Lidocaine Vial For Dental Procedures Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Lidocaine Vial For Epilepsy Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Lidocaine Vial Market Research And Analysis By Region, 2023-2031 ($ Million)

7. North American Lidocaine Vial Market Research And Analysis By Country, 2023-2031 ($ Million)

8. North American Lidocaine Vial Market Research And Analysis By Application, 2023-2031 ($ Million)

9. European Lidocaine Vial Market Research And Analysis By Country, 2023-2031 ($ Million)

10. European Lidocaine Vial Market Research And Analysis By Application, 2023-2031 ($ Million)

11. Asia-Pacific Lidocaine Vial Market Research And Analysis By Country, 2023-2031 ($ Million)

12. Asia-Pacific Lidocaine Vial Market Research And Analysis By Application, 2023-2031 ($ Million)

13. Rest Of The World Lidocaine Vial Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Rest Of The World Lidocaine Vial Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Lidocaine Vial Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global Lidocaine Vial For Local Anesthesia Market Share By Region, 2023 Vs 2031 (%)

3. Global Lidocaine Vial For Heart Arrhythmia Market Share By Region, 2023 Vs 2031 (%)

4. Global Lidocaine Vial For Dental Procedures Market Share By Region, 2023 Vs 2031 (%)

5. Global Lidocaine Vial For Epilepsy Market Share By Region, 2023 Vs 2031 (%)

6. Global Lidocaine Vial Market Share By Region, 2023 Vs 2031 (%)

7. US Lidocaine Vial Market Size, 2023-2031 ($ Million)

8. Canada Lidocaine Vial Market Size, 2023-2031 ($ Million)

9. UK Lidocaine Vial Market Size, 2023-2031 ($ Million)

10. France Lidocaine Vial Market Size, 2023-2031 ($ Million)

11. Germany Lidocaine Vial Market Size, 2023-2031 ($ Million)

12. Italy Lidocaine Vial Market Size, 2023-2031 ($ Million)

13. Spain Lidocaine Vial Market Size, 2023-2031 ($ Million)

14. Rest Of Europe Lidocaine Vial Market Size, 2023-2031 ($ Million)

15. India Lidocaine Vial Market Size, 2023-2031 ($ Million)

16. China Lidocaine Vial Market Size, 2023-2031 ($ Million)

17. Japan Lidocaine Vial Market Size, 2023-2031 ($ Million)

18. South Korea Lidocaine Vial Market Size, 2023-2031 ($ Million)

19. Rest Of Asia-Pacific Lidocaine Vial Market Size, 2023-2031 ($ Million)

20. Rest Of The World Lidocaine Vial Market Size, 2023-2031 ($ Million)

21. Latin America Lidocaine Vial Market Size, 2023-2031 ($ Million)

22. Middle East And Africa Lidocaine Vial Market Size, 2023-2031 ($ Million)