Life Science Instrumentation Market

Global Life Science Instrumentation Market Size, Share & Trends Analysis Report by Technology (Chromatography, Spectroscopy, Polymerase Chain Reaction (PCR), Clinical Chemistry Analyzers, Immunoassays, Next Generation Sequencing (NGS), Flow Cytometry, Microscopy, and Others), By End-User(Pharmaceutical & Biotechnology Companies, Research Institutes, and Hospitals &Laboratories) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global life science Instrumentation market is projected to have a considerable CAGR during the forecast period. The market growth mainly backed by the growing various chronic diseases such as cancer, CVD coupled with increasing pharmaceutical R&D, increasing investment in the life science research, and others. The increasing popularity of cell culture in drug discovery, cancer treatment, and vaccine production has promoted the funding of cell-based research. Cell collection and separation instrument in cell harvesting procedure are used in the cell isolation process and in the collection of cells and tissues from the body. Some of the components included in the cell collection kit are cord blood collection bag, cord tissue container, vacuum-insulated panels, temperature indicator, phase-change gel packs, and a range of vials for the collection of blood. Therefore growing research in life-science further projected to be the major factor that contribute in the market growth.

Segmental Outlook

The global life science Instrumentation market is segmented on the technology and End-User. Based on the technology, the market is further classified into chromatography, spectroscopy, polymerase chain reaction (pcr), clinical chemistry analyzers, immunoassays, next generation sequencing (NGS), flow cytometry, microscopy, and others( centrifuges, electrophoresis). The NGS segment is projected to have considerable growth owing to the growing technological advancement in NGS technology encourage the demand of NGS in microbiome sequencing. NGS technologies have transformed microbiome researches that result in the generation of the high volume of microbiome data. Hence, there is a requirement for advanced informatics. According to the Thermo Fisher, with the release of the Axiom Microbiome Array, an orthogonal approach to elucidation of diverse microbiota is possible. The array which incorporates sequences for more than 12,500 species facilitates simultaneous detection of viruses and protozoa and provides ease of analysis.

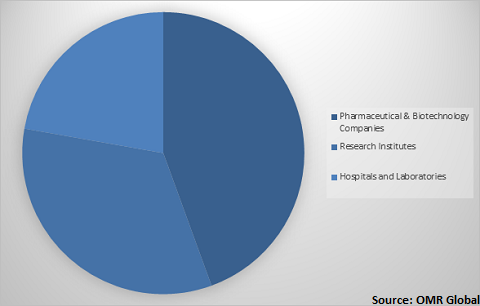

Global life science Instrumentation Market Share by End-User, 2018(%)

Global life science Instrumentation Market to be driven by Pharmaceutical & Biotechnology Companies End-User

The pharmaceutical & biotechnology companies segment held a considerable share in the market. everal pharmaceutical and biotechnology companies, such as Second Genome, Abbvie, Seres Therapeutics, OpenBiome, Vedanta Biosciences, and Enterome SA are engaged in the development drugs and diagnotics test. With the evolution of sequencing technology, these companies turned their attention to obtain information regarding the genomic profiles of microbes that surrounding the human gut. The biotech and pharma companies are using sequencing technology in order to sequence microbial samples that enable to build its capabilities to become a developer of the drug of its own. Moeorver, Cell harvesting equipment are being extensively used by the biotechnology and biopharmaceutical companies in the production of biosimilars such as monoclonal antibodies, regenerative medicine, vaccine production, and drug development, among others. Cell culture techniques are used in biotechnological companies to study the effects of new drugs, cosmetics and chemicals on survival and growth in a diverse variety of cell types, including liver and kidney-derived cell cultures.

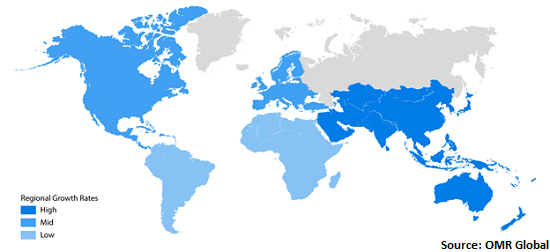

Regional Outlook

Geographically, the global life science Instrumentation market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market mainly driven due to due to the increasing R&D and investments by big pharmaceutical companies in life science research. Asia-Pacific region despite economic slowdown in economies such as in India; the increasing public health care programs including the increasing private wealth is expected to boost the region’s health care spending. According to the India Brand Equity Foundation, an annual average of General Electric Co.spending has increased by 6.6% from 2015 to 2019 thus creating significant contribution in life science instrumentation market

Global life science Instrumentation Market Growth, by Region 2019-2025

North America to hold a considerable share in the global life science Instrumentation market

Geographically, North America is projected to hold a significant market share in the global life science Instrumentation market. Major economies which are anticipated to contribute to the North America genetic testing market are the US and Canada. The factors that are contributing significantly to the growth of the market include R&D investment in the bio-pharmaceutical sector and high healthcare expenditure. Accordingly, the expenditure rate of the US is more than that of Canada, as the US government invests more on R&D activities and there is more business opportunity in the US as compared to Canada. In the US, research on life sciences has increased significantly in the past years. The research areas in which microbiomes play an important role includes agriculture, human, aquatic, laboratory, built environment, terrestrial among various others. The government of the US has invested significantly in these areas so as to promote the research on microbiomes and their impact on the biological processes that further provide ample growth to the market.

Market Players Outlook

The key players in the life science Instrumentation market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Agilent Technologies, Inc., Becton, Dickinson and Co., Bio-Rad Laboratories, Inc., Danaher Corp., Illumina, Inc., Thermo Fisher Scientific, Inc. and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global life science Instrumentation market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Agilent Technologies, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Becton, Dickinson and Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Bio-Rad Laboratories, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Illumina, Inc..

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Thermo Fisher Scientific, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Life Science Instrumentation Market by Technology

5.1.1. Chromatography

5.1.2. Spectroscopy

5.1.3. Polymerase Chain Reaction (PCR)

5.1.4. Clinical Chemistry Analyzers

5.1.5. Immunoassays

5.1.6. Next Generation Sequencing (NGS)

5.1.7. Flow Cytometry

5.1.8. Microscopy

5.1.9. Others( Centrifuges, Electrophoresis)

5.2. Global Life Science Instrumentation Market by End-User

5.2.1. Pharmaceutical & Biotechnology Companies

5.2.2. Research Institutes

5.2.3. Hospitals and Laboratories

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agilent Technologies, Inc.

7.2. Becton, Dickinson and Co.

7.3. Bio-Rad Laboratories, Inc.

7.4. Biomerieux S.A.

7.5. Bruker Corp.

7.6. Carl Zeiss AG

7.7. Danaher Corp.

7.8. Eppendorf AG

7.9. General Electric Co.

7.10. Hitachi High-Tech Corp.

7.11. Illumina, Inc.

7.12. HORIBA, Ltd.

7.13. JEOL Ltd.

7.14. Merck KGaA

7.15. PerkinElmer Inc.

7.16. QIAGEN N.V.

7.17. Shimadzu Corp.

7.18. Thermo Fisher Scientific Inc.

7.19. Tecan Trading AG

7.20. Waters Corp.

1. GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

2. GLOBAL CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL SPECTROSCOPY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL POLYMERASE CHAIN REACTION (PCR) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL CLINICAL CHEMISTRY ANALYZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL NEXT GENERATION SEQUENCING (NGS) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL FLOW CYTOMETRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL MICROSCOPY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

11. GLOBAL LIFE SCIENCE INSTRUMENTATION IN PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL LIFE SCIENCE INSTRUMENTATION IN RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL LIFE SCIENCE INSTRUMENTATION IN HOSPITALS AND LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

18. EUROPEAN LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. EUROPEAN LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

20. EUROPEAN LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

24. REST OF THE WORLD LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

25. REST OF THE WORLD LIFE SCIENCE INSTRUMENTATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

2. GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

6. UK LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD LIFE SCIENCE INSTRUMENTATION MARKET SIZE, 2018-2025 ($ MILLION)