Light Tower Market

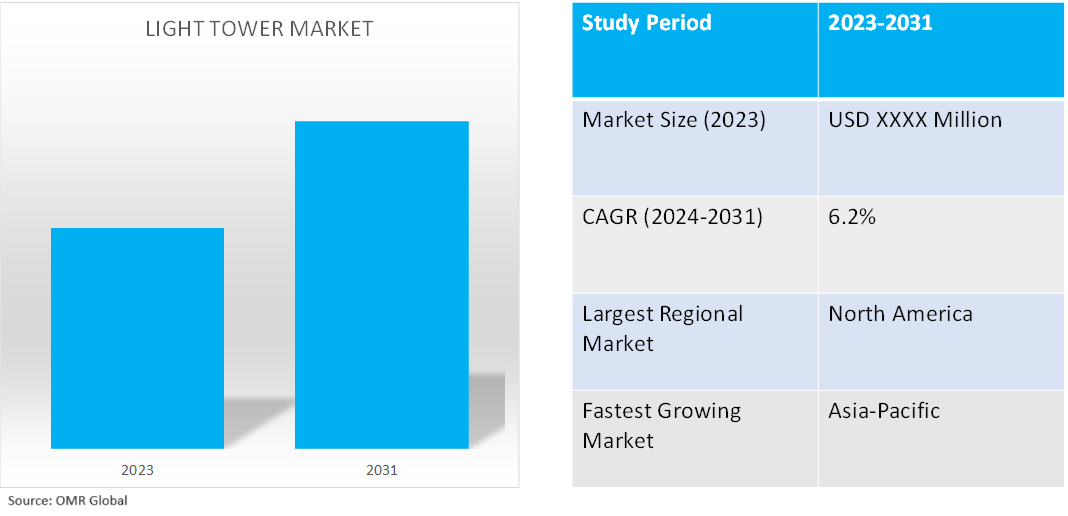

Light Tower Market Size, Share & Trends Analysis Report by Type (LED Towers, and Metal Halid Light Towers), by Power Source (Solar-Powered, Diesel-Powered, Hydrogen-Powered, and Directly Powered), and by End-User (Construction, Oil & Gas, Mining, Industrial, and Others) Forecast Period (2024-2031)

Light tower market is anticipated to grow at a significant CAGR of 6.2% during the forecast period (2024-2031). The growing demand for light towers across the end-use sector is a key factor driving the growth of the global market. The rapid infrastructural development and favorable government initiatives for better lighting systems in the construction industry and other hazardous conditions further driving the global market. The introduction of new products of minimum cost and less power consumption by market players can bring new growth opportunities.

Market Dynamics

Rising Demand from End-User Industry

The increased demand for more rugged and durable light towers from end-user industries such as mining and oil & gas has promoted significant manufacturers to launch newer heavy-duty versions of tower lights for harsher deployment. For instance, in September 2023, Atlas Copco launched the HiLight V5+ LED Light tower which offers fuel savings of up to 65.0%. These light towers are ideal for challenging site conditions such as remote construction sites, outdoor events, infrastructure, road construction, mining, and temporary public lighting installations. The HiLight V5+ includes a HardHat canopy as standard, which ensures maximum protection of internal parts. This range of light towers is perfect for multiple drop applications and provides a robust easy-to-transport set of lighting options that match any site's requirements.

Stringent Regulatory Requirements in the Construction Industry

The construction industry's increased focus on following safety rules and guidelines increases the use of high-tech tools and construction techniques, which is driving the light towers market. According to the US Department of the Treasury’s Office of Economic Policy, since the end of 2021, real manufacturing construction spending has doubled. The Biden Administration is pursuing an economic approach based on “modern supply-side economics” which seeks to expand the productive capacity of the economy by investing in things like infrastructure, high-tech manufacturing, and workers. The growing construction industry globally is a key factor driving the global market growth.

Market Segmentation

- Based on the type, the market is segmented into LED towers, and metal halide light towers.

- Based on the power source, the market is segmented into solar-powered, diesel-powered, hydrogen-powered, and directly powered.

- Based on the end-user, the market is segmented into construction, oil & gas, mining, industrial, and others (sports industry).

LED Towers Holds Major Share Based on Type

The high adoption of LED towers owing to their benefits such as high fuel efficiency is a key factor contributing to the high share of this market segment. LEDs can save up to 40.0% of energy compared to traditional lighting options. Under optimal conditions, such lamps reach up to 80.0% efficiency with an average of 60.0-70.0%. By comparison, metal halide units average roughly 50.0% energy efficiency during electrical power conversion to light. Additionally, LEDs possess several eco-friendly benefits for businesses due to their ability to cut down energy costs. The fixtures do not use toxic chemicals, such as mercury and lead to produce light which makes these lights easy to recycle without any sensitive handling during disposal.

Regional Outlook

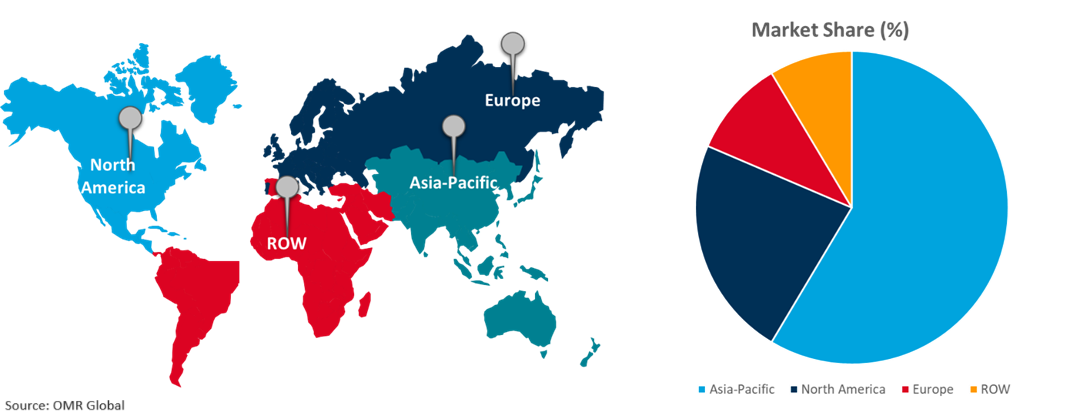

The global light tower market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Light Tower Market Growth by Region 2024-2031

North America Holds Major Market Share

North America is projected to hold a prominent share during the forecast period owing to the presence of major companies in the US and their key focus on environmental safety with the development of low-emission and energy-efficient light towers. These companies are investing heavily in the adoption of innovative and modern light tower technologies rather than traditional light. For instance, in December 2023, Atlas Copco launched the HiLight BI+ 4, its first light tower in the hybrid range. The HiLight BI+ 4 integrates lithium-ion batteries with a low-consumption Stage V diesel engine and can draw power from mains electricity, lithium-ion batteries, the diesel engine, or a hybrid setting. The surface mount devices (SMD) LED lights are said to be 20.0% more efficient than alternative Chip-on-Board (COB) LED lights, with each light tower coming with four floodlights that provide 150W power to cover 4,000m2.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the light tower market include Atlas Copco AB, Terex Corp., Generac Power Systems Inc., and Doosan Portable Power among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In March 2024, Axiom Equipment Group, an industrial equipment solutions provider launched the Metrolite SLT-490 Solar LED Light Tower. With its advanced features and robust design, this solar-powered LED light tower offers unmatched versatility, durability, and performance. With the launch of the Metrolite SLT-490 Solar LED Light Tower, Axiom Equipment Group continues to lead the way in providing innovative solutions to meet the evolving needs of industries globally.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the light tower market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Atlas Copco AB

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Generic Power Systems

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Bobcat Company (Doosan Portable Power)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Light Tower Market by Type

4.1.1. LED Light Tower

4.1.2. Metal Halide Light Tower

4.2. Global Light Tower Market by Power Source

4.2.1. Solar-Powered

4.2.2. Diesel-Powered

4.2.3. Hydrogen Fuel-Powered

4.2.4. Directly Powered

4.3. Global Light Tower Market by End-User

4.3.1. Construction

4.3.2. Oil & Gas

4.3.3. Mining

4.3.4. Industrial

4.3.5. Other (Sports Industry)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Allmand Bros. Inc.

6.2. Aska Equipments Ltd.

6.3. Chicago Pneumatic

6.4. Indus Towers Limited

6.5. JLG Industries, Inc.

6.6. Larson Electronics Inc

6.7. Multiquip Inc.

6.8. Olikara Lighting Towers Pvt. Ltd

6.9. SWT Power

6.10. Terex Corp

6.11. The Will-Burt Co.

6.12. Wacker Neuson Corp

6.13. Wanco Inc.

6.14. Westquip Diesel Sales

6.15. Youngman Richardson

1. Global Light Tower Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global LED Light Tower Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Metal Halide Light Tower Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Light Tower Market Research And Analysis By Power Source, 2023-2031 ($ Million)

5. Global Solar-Powered Light Tower Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Diesel-Powered Light Tower Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Hydrogen Fuel-Powered Light Tower Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Directly Powered Light Tower Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Light Tower Market Research And Analysis By End-User, 2023-2031 ($ Million)

10. Global Light Tower In Construction Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Light Tower In Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Light Tower In Mining Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Light Tower In Industrial Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Light Tower In Other End-Users Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Light Tower Market Research And Analysis By Region, 2023-2031 ($ Million)

16. North American Light Tower Market Research And Analysis By Country, 2023-2031 ($ Million)

17. North American Light Tower Market Research And Analysis By Type, 2023-2031 ($ Million)

18. North American Light Tower Market Research And Analysis By Power Source, 2023-2031 ($ Million)

19. North American Light Tower Market Research And Analysis By End-User, 2023-2031 ($ Million)

20. European Light Tower Market Research And Analysis By Country, 2023-2031 ($ Million)

21. European Light Tower Market Research And Analysis By Type, 2023-2031 ($ Million)

22. European Light Tower Market Research And Analysis By Power Source, 2023-2031 ($ Million)

23. European Light Tower Market Research And Analysis By End-User, 2023-2031 ($ Million)

24. Asia-Pacific Light Tower Market Research And Analysis By Country, 2023-2031 ($ Million)

25. Asia-Pacific Light Tower Market Research And Analysis By Type, 2023-2031 ($ Million)

26. Asia-Pacific Light Tower Market Research And Analysis By Power Source, 2023-2031 ($ Million)

27. Asia-Pacific Light Tower Market Research And Analysis By End-User, 2023-2031 ($ Million)

28. Rest Of The World Light Tower Market Research And Analysis By Region, 2023-2031 ($ Million)

29. Rest Of The World Light Tower Market Research And Analysis By Type, 2023-2031 ($ Million)

30. Rest Of The World Light Tower Market Research And Analysis By Power Source, 2023-2031 ($ Million)

31. Rest Of The World Light Tower Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Light Tower Market Share By Type, 2023 Vs 2031 (%)

2. Global LED Light Tower Market Share By Region, 2023 Vs 2031 (%)

3. Global Metal Halide Light Tower Market Share By Region, 2023 Vs 2031 (%)

4. Global Light Tower Market Share By Power Source, 2023 Vs 2031 (%)

5. Global Solar-Powered Light Tower Market Share By Region, 2023 Vs 2031 (%)

6. Global Diesel-Powered Light Tower Market Share By Region, 2023 Vs 2031 (%)

7. Global Hydrogen Fuel-Powered Light Tower Market Share By Region, 2023 Vs 2031 (%)

8. Global Directly Powered Light Tower Market Share By Region, 2023 Vs 2031 (%)

9. Global Light Tower Market Share By End-User, 2023 Vs 2031 (%)

10. Global Light Tower In Construction Market Share By Region, 2023 Vs 2031 (%)

11. Global Light Tower In Oil & Gas Market Share By Region, 2023 Vs 2031 (%)

12. Global Light Tower In Mining Market Share By Region, 2023 Vs 2031 (%)

13. Global Light Tower In Industrial Market Share By Region, 2023 Vs 2031 (%)

14. Global Light Tower In Other End-Users Market Share By Region, 2023 Vs 2031 (%)

15. Global Light Tower Market Share By Region, 2023 Vs 2031 (%)

16. US Light Tower Market Size, 2023-2031 ($ Million)

17. Canada Light Tower Market Size, 2023-2031 ($ Million)

18. UK Light Tower Market Size, 2023-2031 ($ Million)

19. France Light Tower Market Size, 2023-2031 ($ Million)

20. Germany Light Tower Market Size, 2023-2031 ($ Million)

21. Italy Light Tower Market Size, 2023-2031 ($ Million)

22. Spain Light Tower Market Size, 2023-2031 ($ Million)

23. Rest Of Europe Light Tower Market Size, 2023-2031 ($ Million)

24. India Light Tower Market Size, 2023-2031 ($ Million)

25. China Light Tower Market Size, 2023-2031 ($ Million)

26. Japan Light Tower Market Size, 2023-2031 ($ Million)

27. South Korea Light Tower Market Size, 2023-2031 ($ Million)

28. Rest Of Asia-Pacific Light Tower Market Size, 2023-2031 ($ Million)

29. Rest Of The World Light Tower Market Size, 2023-2031 ($ Million)

30. Latin America Light Tower Market Size, 2023-2031 ($ Million)

31. Middle East And Africa Light Tower Market Size, 2023-2031 ($ Million)