Lignin Market

Lignin Market Size, Share & Trends Analysis Report by Product (Kraft Lignin, Lignosulphonates, Low Purity Lignin, And High Purity Lignin), and by Application (Aromatics, and Macromolecules) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Lignin market is anticipated to grow at a significant CAGR of 5.2% during the forecast period. The rising demand for concrete admixtures is growing the demand for lignin across the globe during the forecast period. As this lignin and its products are used in concrete additives as binders, dust suppressants, and other forms. These products are more safe and economical than petroleum and salt-based products that are typically applied to road surfaces. According to the Observatory of Economic Complexity (OEC), in 2020, cement was the 257th most traded product, with a total trade of $12.4 billion. Further, the top importers of cement in 2021 were the US with $1.3 billion, China with $1.2 billion, Bangladesh with $513 million, and the Philippines with $464 million. Lignin is an organic substance or biodegradable polymer/polymer blend, which is produced naturally by certain woody plants, such as bushes & trees, and algal species such as seaweed & red algae, which acts as a natural binder in plant cellulose fibers and enhances the strength & stiffness of cell walls. Due to its various benefits, it is used in many industries.

Segmental Outlook

The global lignin market is segmented based on product and application. Based on product, the market is segmented into kraft lignin, lignosulphonates, low purity lignin, and high purity lignin. Based on application, the market is sub-segmented into aromatics and macromolecules. Among the application segment, the macromolecules sub-segment is expected to hold a prominent share in the global lignin market. The growing utilization of lightweight carbon fibers in several applications such as automotive and other sectors is the major factor propelling the growth of the market.

Among the product, the low purity lignin is anticipated to grow at the fastest rate as it can be extracted by various methods such as kraft pulping, organosolv pulping, sulfite pulping, soda pulping, and hydrolysis techniques, which offer significant production flexibility, it also can be extracted from wastes produced in various sectors, such as biorefineries, and pulp & paper, which ensure abundant raw material availability and will augment the market growth. Moreover, the Low purity lignin is substantially cheaper than the alternatives of greater purity, aiding end-user manufacturers in reducing their production costs. It is well-suited for the production of plastics and composite materials due to its ability to impart toughness & stiffness. According to Organisation for Economic Co-operation and Development (OECD), Plastic consumption has quadrupled over the past 30 years, driven by growth in emerging markets. Global plastics production doubled from 2000 to 2019 to reach 460 million tonnes.

Regional Outlooks

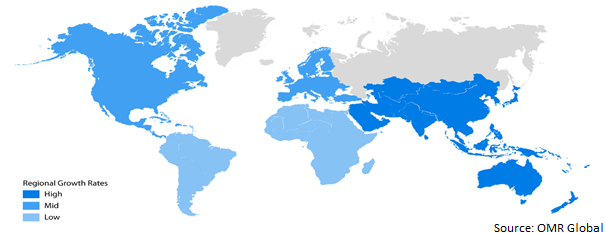

The global lignin market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia-Pacific region is anticipated to grow at the fastest rate owing to the rising trends for the manufacturing of products through bio-based sources is predicted to drive the regional demand over the forecast period. Additionally, the prominent market players in the region are engaged in the production of pulp and paper products, which is anticipated to boost lignin production.

Global Lignin Market Growth, by Region 2022-2028

The Europe is Expected to Hold a Considerable Share in the Global Lignin Market during the Forecast Period

Europe is anticipated to hold a considerable share in the global lignin market during the forecast period. Owing to the growing demand for dyes & pigments primarily from the printing ink, food processing, textile, and wood stain industries will boost the regional market growth. Lignin serves as an effective dispersant, making dyes & pigments more uniform along with improving the ease of application. According to European Commission data published in 2019, there were 160,000 companies in the textile and clothing industry employing 1.5 million people and generating a turnover of around $165.2 billion, with the biggest producers in the industry being Italy, France, Germany, Spain, and Portugal. Together, they account for about three-quarters of EU production. Additionally, the region is registering an increase in lignin usage for niche applications, such as animal feed, vanillin, phenol, cleaning chemicals, and micronutrients, which will propel market growth.

Market Players Outlook

The major companies serving the global lignin market include Domtar Corp., Domsjö Fabriker AB, Stora Enso Oyj, Burgo Group S.p.A., Nippon Paper Industries Co. Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2020, UPM Biochemicals and Domtar Paper Company LLC signed an agreement for UPM to acquire the total annual kraft lignin production of Domtar’s Plymouth Mill in North Carolina, USA as of January 2021. This deal enables UPM to expand its role in the growing lignin business and different application segments. Through this agreement, UPM Biochemicals has also increased its supply of kraft lignin by more than 20,000 metric tonnes annually.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global lignin market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Domtar Corp.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Domsjö Fabriker AB

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Stora Enso Oyj

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Burgo Group S.p.A.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Nippon Paper Industries Co. Ltd.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Lignin Market by Product

4.1.1. Kraft Lignin

4.1.2. Lignosulphonates

4.1.3. Low Purity Lignin

4.1.4. High purity lignin

4.2. Global Lignin Market by Application

4.2.1. Aromatics

4.2.2. Macromolecules

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Borregaard AS

6.2. Ingevity Corp

6.3. LENZING AG

6.4. Lignin Lignin Company LLC

6.5. RYAM (canada)

6.6. Sappi North America

6.7. Sigma-Aldrich Co. (Merck KGaA,)

6.8. West Fraser Timber Co. Ltd.

6.9. WestRock Co.

1. GLOBAL LIGNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL KRAFT LIGNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL LIGNOSULPHONATES LIGNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL LOW PURITY LIGNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL HIGH PURITY LIGNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL LIGNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL LIGNIN FOR AROMATICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL LIGNIN FOR MACROMOLECULES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL LIGNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. NORTH AMERICAN LIGNIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN LIGNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

12. NORTH AMERICAN LIGNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. EUROPEAN LIGNIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN LIGNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

15. EUROPEAN LIGNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC LIGNIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC LIGNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC LIGNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. REST OF THE WORLD LIGNIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD LIGNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

21. REST OF THE WORLD LIGNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL LIGNIN MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL KRAFT LIGNIN MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL LIGNOSULPHONATES MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL LOW PURITY LIGNIN MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL HIGH PURITY LIGNIN MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL LIGNIN MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

7. GLOBAL LIGNIN FOR AROMATICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL LIGNIN FOR MACROMOLECULES MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL LIGNIN MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. US LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

12. UK LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALY LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIA LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

21. SOUTH KOREA LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF ASIA-PACIFIC LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD LIGNIN MARKET SIZE, 2021-2028 ($ MILLION)